Nontaxable Exchanges

advertisement

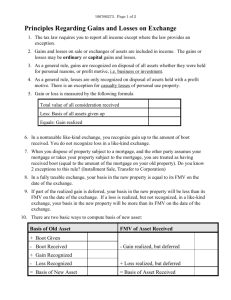

Nontaxable Exchanges An exchange of property involves the disposition of an asset and acquisition of another (non-cash) asset An exchange of property is nontaxable only if a specific statutory provision requires deferral of gain or loss. Otherwise, the disposition is taxable, and the acquisition is capitalized with tax basis equal to purchase price 8-1 Characteristics of a Generic Nontaxable Exchange Taxpayers exchange ‘qualifying property’ Value-for-value presumption Gain/loss realized is not recognized currently, but is deferred until taxable disposition of property received Substituted basis rule leads to deferral of gain/loss 8-2 Tax basis of the qualifying property received = Tax basis of qualifying property surrendered - FMV of boot received + FMV of boot paid + gain recognized = FMV of qualifying property - deferred gain + deferred loss Generic Exchange continued Treatment of ‘Boot’ Definition: any cash or non-qualifying property included in a nontaxable exchange Effect of boot: Taxpayer receiving boot recognizes gain (not loss) equal to the lesser of: – realized gain on the exchange – FMV of the boot received Basis of boot received equals its FMV Taxpayer giving boot recognizes gain or loss only if the FMV of the boot differs from its adjusted basis 8-3 Specific Nontaxable Exchange Provisions Sec. 1031 - Like-kind exchanges Sec. 1033 - Involuntary conversions Sec. 351 - Corporate formations Sec. 721 - Partnership formations Sec. 1091 - wash sales 8-4 Like-kind Exchanges No gain or loss recognized by a taxpayer who exchanges business or investment property for other business or investment property of a like-kind Does not apply to: Exchanges of inventory Exchanges of corporate stock or partnership interests Personal use assets 8-5 Like-kind Exchanges continued Determination of like-kind status: Real property - virtually all types of business and investment real property are considered like-kind Examples: land for office building, apartment building for shopping center Personal property - exchangeability depends on IRS classification system Examples: office furniture and copier are likekind, copier and personal computer are not 8-6 In-Class Problem: Like-kind Exchange Matt owns an office building with $70,000 adjusted basis and $200,000 FMV. Phil owns land held for investment with $180,000 adjusted basis and $170,000 FMV. If Matt and Phil wish to exchange assets, how much boot must be given, and by whom, in order for this exchange to be economically rational? 8-7 In-Class Problem continued Assuming that boot is given as determined above, how much gain or loss is realized by Matt and Phil on the exchange? How much gain or loss is recognized? Determine the adjusted basis of the assets received by Matt and Phil. 8-8 Debt and Like-kind Exchanges When property is transferred subject to a mortgage, such debt relief is included in the amount realized on disposition and is considered boot received by the party relieved of debt and boot given by the party assuming the debt When both parties assume debt, only the net amount is considered boot given and received 8-9 In-Class Problem: Like-kind Exchange with Debt Thomas owns an apartment complex with $300,000 adjusted basis, $450,000 FMV, subject to a mortgage of $200,000. Angela owns an office building with $480,000 adjusted basis, $500,000 FMV, subject to a mortgage of $250,000. Thomas and Angela agree to exchange these assets, subject to the related debt. 8-10 In-Class Problem continued Are Thomas and Angela each receiving equal value in the exchange? How much gain or loss is realized by Thomas and Angela on the exchange? How much gain or loss is recognized? Determine the adjusted basis of the assets received by Thomas and Angela. 8-11 Involuntary Conversions Include loss of property due to theft, natural disaster, or condemnation A gain will result from involuntary conversion when insurance or condemnation proceeds exceed the adjusted basis of the property A taxpayer may elect to defer gain on involuntary conversion if the amount realized is reinvested in property that is similar or related in service or use within 2 years 8-12 Corporate Formations Sec. 351 defers recognition of gain or loss if: property is transferred to a corporation solely in exchange for that corporation’s stock and the transferors are in control of the corporation immediately after the transfer Property includes tangible and intangible assets and cash, but not services Control requires ownership of at least 80% of the corporation’s outstanding stock 8-13 Corporate Formations continued Any money or property received by the transferors other than stock of the controlled corporation is considered boot Transferee corporation recognizes no gain or loss when exchanging its stock for property or services Tax basis of property received equals transferors’ adjusted tax basis plus any gain recognized by the transferors 8-14 In-Class Problem: Corporate Formation Ira has been operating a business as a sole proprietorship. He wishes to expand, and has approached Rochelle, owner of a building in a good location, regarding a joint venture. For legal reasons, they have decided to incorporate the new business. Ira transfers assets worth $100,000 ($40,000 tax basis) to a newly formed corporation, IRA Inc., in exchange for 500 shares of common stock. Rochelle transfers the building, worth $300,000 ($100,000 tax basis) in exchange for 1,500 shares. Rochelle also receives 100 shares in exchange for her services in coordinating the corporate formation. 8-15 In-Class Problem continued How much gain or loss have Ira and Rochelle each realized in this exchange? Does the exchange qualify for nonrecognition treatment under Sec. 351? What are Ira and Rochelle’s tax bases in the stock of IRA Inc.? What is the corporation’s tax basis in the assets received? 8-16 Partnership Formations Sec. 721 - No gain or loss is generally recognized by a partnership or any partner when property is contributed in exchange for a partnership interest Sec. 721 has no ‘control’ requirement similar to that of Sec. 351 8-17 Wash Sales Sec. 1091 disallows recognition of losses realized on wash sales of marketable securities A wash sale occurs when an investor realizes a loss on sale of a security and reacquires substantially the same investment within 30 days before or after the date of sale 8-18 Update to Book/Tax Difference List Temporary Differences • Deferral of gain/loss on nontaxable exchanges 8-19 Permanent Differences