CH 13

advertisement

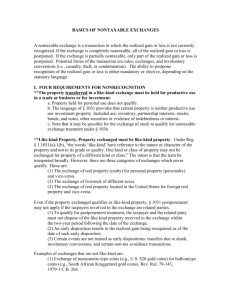

570 Notes, 13-1 CHAPTER 13 PROPERTY TRANSACTIONS – GAIN/LOSS, BASIS, NONTAXABLE EXCHANGES (Subchapter O, §§ 1001- 1092) I. Dispositions - Determining Gain or Loss (§1001) + A. Amount Realized: + cash received + FMV of property received + decrease in seller’s liabilities - costs of sale (e.g., commissions) +/- other items (e.g., property tax adjustments) - B. Adjusted Basis (see Concept Summary 13-2 in text) original basis + capital improvements recoveries (e.g., depreciation “allowed or allowable;” bond premium amortization) = C. Realized Gain or Loss ? D. Recognized Gain or Loss II. 1. May or may not be the realized gain or loss. 2. Not recognized: 3. Postponed Basis and Holding Period A. Why important? 1. Basis 2. Holding Period a. Rule of thumb 570 Notes, 13-2 III. Basis Calculation Formulas (§§1011-1023) Method of acquisition Calculation formula 1. Purchase Cost 2. Taxable exchange 3. Nontaxable exchange Fair market value Basis of qualifying property transferred + Basis of boot transferred + Gain recognized – Loss recognized – Fair market value of boot received or Fair market value of qualifying property received – Postponed gain (i.e., gain not recognized) + Postponed loss (i.e., loss not recognized) Gain or regular basis Donor’s basis + Gift tax paid on the appreciation* 4. Gift 5. Inheritance 2010 Loss basis Lower of: Gain basis or Fair market value at the date of the gift - Step-up (FMV) on $1.3m ($3m add’l for transfers to spouse) - Excess same as gift basis After 2010 6. Converting personal use property to business use Fair market value at the primary (or alternate) valuation date Gain basis Original basis Loss & depreciation basis Lower of: Original basis or Fair market value at the date of conversion 7. Leasehold Improvements made by lessee If in lieu of rent, basis = amount recognized as income in lieu of rent. If not in lieu of rent (not taxable to lessor), basis = 0. Holding Pd Starts 570 Notes, 13-3 IV. Demo Examples of Basis Calculation: 1. Stock Dividends Example: You own 1,000 shares of X stock with a basis of $10,000 and a FMV of $15,000. You receive 100 shares in a stock dividend distribution. - If Nontaxable: - If Taxable: 2. 3. Stock Rights Example: You own 1,000 shares of ABC common stock with a basis of $10,000 and a FMV of $20,000. 1,000 rights, worth $5 each ($5,000 total) allow you to purchase 1,000 shares of stock at $15 per share. - Allocation of a nontaxable stock right received is mandatory only if the right has a FMV 15% of the FMV of the underlying stock. Basic Exchange Examples: Old asset (adjusted basis = $15,000, FMV = $17,000) and $10,000 cash given for new asset worth $27,000. - If Nontaxable: - If Taxable: 4. Gift Example #1 : Donor basis = $30,000, FMV = $50,000. Donor pays $10,000 gift tax. Donee basis = 5. Gift Example #2: Donor basis = $50,000, FMV = $30,000. Donor pays $6,000 gift tax. Donee basis = 570 Notes, 13-4 6. Inherited Property Example: Joe owns property with a basis of $100,000 and a FMV of $150,000 on the date of Joe’s death. The property has a FMV of $140,000 six (6) months after Joe’s death. Ann inherits the property. - Normal valuation date: - Alternate valuation date: - Suppose Ann is Joe’s spouse, the property is jointly-owned, and they live in (use the normal valuation date): - a community property state - a common law state Sooooo, let’s talk about gift vs. inherited property. Which is better from the recipient’s point of view? A note on deathbed gifts (Appreciated property gifted to someone who dies within 1 year of the gift and bequests the property back to the donor.) 7. Personal to Business Conversion Example: Convert personal residence (basis = $80,000, FMV = $70,000) to rental house. 8. Related Party Loss Sale Example: Father sells stock (basis = $20,000) to daughter for $15,000. Daughter later sells stock to unrelated party for – - $22,000 - $16,000 - $13,000 570 Notes, 13-5 V. Like-Kind Exchanges (§1031) A. General Rule. 1. NO GAIN OR LOSS recognized on an exchange of like-kind property EXCEPTION –GAIN recognized if boot is received. 2. Property must be held for investment or for use in a trade or business. The like-kind exchange treatment is mandatory if the transaction meets the statutory requirements. B. Like-Kind Property Defined 1. Exchanged property must be of the same class (i.e. personal property for personal and real property for real). Personal property be within the same General Business Asset Class or within the same Product Class. 2. Certain property (inventory and securities) does not qualify for like-kind exchange treatment. C. Receipt of Boot 1. Gain is recognized to the extent of boot received, limited by the realized gain. No loss is ever recognized on a like-kind exchange. 2. Boot is any kind of non-qualifying property (i.e. cash and relief of mortgage liability, any asset that is not like-kind). 3. If both properties are encumbered with debt, the mortgages are offset to determine if there is net boot. D. EXAMPLES 1. A and B exchange like-kind property. A's has a FMV of $240,000 and a basis of $500,000; B's has a FMV of $440,000, a basis of $300,000, and is subject to a debt of $200,000, which A assumes. A B Rec’d: (FMV) Gave: (Basis) G(L) Realized: G(L) Recognized: Basis of new property: 570 Notes, 13-6 2. A and B exchange like-kind property. A's has a FMV of $220,000, a basis of $135,000, and is subject to a $160,000 debt; B's has a FMV of $180,000, a basis of $300,000, and is subject to a $120,000 debt. An even swap is made, subject to the debts. A B Rec’d: (FMV) Gave: (Basis) G(L) Realized: G(L) Recognized: Basis of new property: 3. A and B exchange real property. A gives up a building with a FMV of $160,000 and a basis of $54,000. B gives up a building with a FMV of $140,000 and a basis of $128,000. B also gives up stock with a FMV of $20,000 and a basis of $12,000. A Rec’d: (FMV) Gave: (Basis) G(L) Realized: G(L) Recognized: Basis of new property: B 570 Notes, 13-7 VI. Involuntary Conversions (§1033) A. General Rule. 1. Gains from involuntary conversions are deferred if the full amount of the proceeds is invested in qualifying replacement property within a certain period and an election is made to defer the gain. 2. Losses on involuntary conversions are fully recognized. B. Involuntary Conversion Defined 1. Involuntary conversions include theft, seizure, requisition, condemnation, or destruction of property. C. Determination of Gain and Basis 1. Recognized Gain (limited to realized gain) = Proceeds (insurance recovery or government condemnation proceeds) > Cost of replacement property 2. EXAMPLE: A taxpayer receives $500,000 of insurance proceeds from an involuntary conversion; basis in the property was $300,000. Replacement property was purchased for $450,000. D. Replacement Property 1. Generally, replacement property is required to be similar or related in service or use to the converted property. 2. If real property used in a trade or business or held for investment is condemned, it may be replaced under the less restrictive like-kind standard. E. Time Requirements for Replacement 1. The normal replacement period is two years after the end of the tax year in which the involuntary conversion gain is realized. 2. Condemned real property can be replaced within three years after the end of the tax year in which the involuntary conversion gain is realized. 570 Notes, 13-8 VII. Sale of Principal Residence by Individuals - Exclusion of Gain (§121) A. Exclusion of gain up to $250,000 ($500,000 for married, joint returns). B. Requirements: 1. Must have owned and used the property as a principal residence for at least 2 years during the 5-year period ending on the date of sale. 2. Exclusion allowed on each sale, but no more than once every 2 years. 3. Exception to the use and limit of once every 2 years: Prorated exclusion allowed if either of the 2-year requirements not met if caused by reason of a change in place of employment, health, or other unforeseen circumstances. Exclusion Ratio = Shorter of: (1) Actual ownership & use; or (2) time since most recent excluded sale 2 years Example: Mr. and Ms. Jones purchased and occupied a principal residence in 2010. Exactly one year later, Ms. Jones is transferred by her employer to another city and the Jones move. The sell their home at a $200,000 gain. What is their exclusion? 4. Exception for “nonqualified use,” defined as any period of time after 2008 that the house is not used as the principal residence. Example: Bob buys a second home January 1, 2005, then moves into it as his principal residence on January 1, 2011, and sells it on January 1, 2013. He meets the 2-out-of-5 year requirement, but 2 years of ownership (2009 and 2010) is not qualified use, so twoeighths of any gain is not eligible for the exclusion. 4. Rules for married individuals: a. MFJ taxpayers can exclude up to $500,000 if (1) either meets the ownership test; (2) both meet the use test; and (3) neither is ineligible because of a prior sale within 2 years. b. On the other hand, each spouse can exclude $250,000. Thus, if H marries W, who sold her home in the prior year, H could still get a $250,000 exclusion. 5. Depreciation recapture occurs for any business use of the home for periods after 5/6/97. 570 Notes, 13-9 SUMMARY SHEET – NONRECOGNITION TRANSACTIONS Transaction Sales of Personal Assets Do Not Recognize Losses When It Applies A person sells personal-use property at a loss, such as a house or jewelry. Wash Sales Losses A person acquires stock within 30 days of selling the same stock at a loss. Sales to a Related Party Losses A person sells property at a loss to a related party, which includes: Parent, grandparent, child, grandchild, spouse, or sibling Majority-owned corporation Majority-owned partnership Like-Kind Exchanges A person exchanges business real property for other business real property, or business personal property for other business personal property in the same product class. Involuntary Conversions Gain is recognized only A person who lost property due to a to the extent that a casualty, theft, or condemnation, if: person reinvests less in A similar replacement property is a replacement property purchased within 2 years from the end than the proceeds of the year in which the casualty or received from the theft occurred (3 years if original property. condemnation) An appropriate election to not report the gain is filed. Installment Sales A portion of the overall gain is recognized only as a person collects cash each year, as follows: Losses Gain is recognized only to the extent that “boot” is received A person sells property for periodic installment payments Gain x Cash Collected Total Sales Price Sale of a Principal Residence Up to $250,000 or reportable gain is not recognized ($500,000 on a joint return) Lived in the home for at least 2 of the prior 5 years