glenhurst corporation pty ltd - Wholistic Financial Solutions

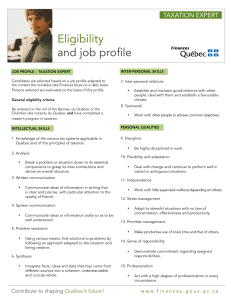

advertisement

“Navigating your financial future” Welcome Book Australian Taxation Professionals Suite 1, 53 Dundas Court PHILLIP ACT 2606 Tel: (02) 6290 1496 Fax: (02) 6290 2371 E-Mail: office@atp.net.au Australian Taxation Professionals Suite 1, 53 Dundas Court PHILLIP ACT 2606 Tel: (02) 6290 1496 Fax: (02) 6290 2371 E-Mail: office@atp.net.au Our Mission Please allow us to share our aim and philosophy with you. We hope that you enjoy your pursuits as much as we enjoy ours. You may find our aim and philosophy somewhat different than the conventional. However, knowing our aim and philosophy will help you to better understand the way we do things, and whether you will enjoy and benefit from the services we have to offer. Australian Taxation Professional’s objectives are: To provide a unique and exceptional service to our clients, beyond standard tax return lodgement. Analyse your personal and/or business needs and prepare financial planning strategies to solve your needs and financial objectives. Continually enhance our industry knowledge so that we may impart this knowledge to you, our clients, where appropriate. To provide a plan of action to “Chart” you through the financial maze with minimum of effort or pain on your behalf. In essence, Australian Taxation Professionals, engineers financial solutions for our clients to address their financial goals or objectives without sacrificing lifestyle goals. Australian Taxation Professionals was created by looking through the eyes of the Consumer and translating your requirements into consolidated, accurate and easily understandable financial plans. Our consolidated financial reports provide an accurate translation of your Adviser’s vision and recommendations for you to help guide you towards achieving your individual financial goals and objectives. Development of Australian Taxation Professionals was influenced by international research which showed that the most desirable customers are those with a high need for advice and above average income. A key factor is that this segment, more than any other, requires high efficiency in customer service and complete mastery of the complex regulatory requirements. Delivery of a highly valued service rather than products is the key to a success financial planning business in this day of advanced technology and information. Most important of all, our specialist advisers are dedicated to working with you every step of the way in “Charting” your course to financial success! Please note, Australian Taxation Professionals is not a Licensed Securities Dealer, however, within our practice we have an adviser authorised as a representative of Wealthsure Pty Ltd, Licensed Securities Dealer, as well as life broker representatives of a Registered Life Insurance Broker. Australian Taxation Professionals Pty Ltd Suite 1, 53 Dundas Court PHILLIP ACT 2606 Tel: (02) 6290 1496 Fax: (02) 6290 2371 E-Mail: office@atp.com.au Our Company Australian Taxation Professionals has over 100 years of collective experience and knowledge in the provision of excellence in financial and taxation services to individuals, corporate and business people and professionals. We are good communicators. One of our greatest strengths is the ability to listen to our clients, to their plans and financial concerns, and to their dreams. By asking them the questions to help them define their needs, we help our clients discover the solutions to protecting their finances today, and in the future. We will help them stay on track and see the job through. The staff and associates of Australian Taxation Professionals have developed a proud reputation for quality and professionalism in the areas of: Taxation Planning, Preparation and Lodgment Portfolio Design and Management Financial Planning Superannuation Planning and Advice Insurance and Risk Management Investment Portfolio Reviews Centrelink and Retirement Planning Remuneration Packaging Finance Mortgage Reduction and Cash flow Management Property Management including Sales and Lease Negotiations Real Estate Agency Services We pride ourselves on our people skills and our strong client relationships. This is demonstrated by the fact that referrals from our clients and professional advisors make up over more than 90% of our new business. “Put not your trust in money, put your money in trust…” Oliver Wendell Holmes Australian Taxation Professionals Pty Ltd Suite 1, 53 Dundas Court PHILLIP ACT 2606 Tel: (02) 6290 1496 Fax: (02) 6290 2371 E-Mail: office@atp.com.au Our People Wayne Lucerne Principal - Australian Taxation Professionals Wayne Lucerne is an independent financial planner, authorised representative and Premier Adviser of Wealthsure Financial Planning Pty Ltd, Licensed Dealer in Securities. He has a broad client base and advises on all financial planning issues. These include salary packaging, savings and investment strategies, retirement planning, superannuation, insurance, estate planning and small business planning and tax effective investment. Wayne also provides specialised financial planning services to clients of accountants, solicitors, real estate agents and mortgage consultants, working together with them to provide a complete financial solution for their clients. Wayne is a Practitioner Member of the Financial Planning Association of Australia Limited and as such abides by their Code of Ethics and Rules of Professional Conduct. He holds a Bachelor of Arts/Economics at the Australian National University and is in his final unit of the Diploma of Financial Planning through Deakin University and the Financial Planning Association of Australia prior to receiving the status of Certified Financial Planner (CFP). Wayne was previously employed as a policy analyst, ministerial speechwriter and protocol officer within the Commonwealth Public Service for over 15 years and since commencing in the financial services industry in 1989, has been self-employed running and advising in his own financial planning practice and has a depth of experience in small business having established many businesses including among others a real estate agency and an internet start-up company. Wayne also has unique and valuable experience in business planning, venture capital raising and has acted as corporate adviser for many companies. Atif Iqbal Principal – Australian Taxation Professionals Taxation & Business Consultant Atif Iqbal is Managing Director of Australian Taxation Professionals Pty Ltd. Atif specializes in accounting, taxation and business advice and planning. Atif is an associated member of the Society of Certified Practicing Accountants of Australia, and is working towards the full status of CPA. Atif is also a fellow of National Tax and Accountants Associations and as such abide by their code of ethics and rules of professional conduct. This enables him to practice as a public accountant. Atif is highly qualified in advising on business and taxation affairs. He has achieved all of his academic qualification locally in Canberra. He holds an Advance Diploma of Business in Accounting from the Canberra Institute of Technology (CIT) and a Bachelor of Commerce in Accounting from the University of Canberra (UC). Australian Taxation Professionals Pty Ltd Suite 1, 53 Dundas Court PHILLIP ACT 2606 Tel: (02) 6290 1496 Fax: (02) 6290 2371 E-Mail: office@atp.com.au Atif spent over five years working for different accounting firms in Canberra. In his last appointment, he was serving as the senior accountant for the practice, dealing with a large variety of clients, include small to medium local businesses. In Australian Taxation Professionals, he is the registered Nominee Taxation Agent and Practice Manager. He manages the provision of services like preparation of tax return, preparation of BAS/IAS, preparation of accounts, providing clients with taxation and business advice and business planning. In his personal life he is married to his university class fellow and has three children. Michaele D’Onofrio CPA, Master Law, Bach Law& Acct, Dip Project Management, Principal – Australian Taxation Professionals Taxation & Business Consultant, Finance and Home Loans, Property Management, Project Development and Management Michaele Dónofrio was previously a proper authority holder with Lifespan Financial Planning Pty Ltd. This enabled him to provide financial advice to his clients as an authorized representative. With the amalgamation of the taxation practice with the financial planning practice, Michaele now provides technical and specialized taxation and superannuation advise as an additional service to the financial planning services offered from Wayne Lucerne. Michaele specialilises in taxation, superannuation and investment planning. Michael DÓnofrio is a certified practicing accountant and has more than thirty years of experience in taxation and accounting advice. Michaele is a member of the Society of Certified Practicing Accountants of Australia, and as such abides by their Code of Ethics and Rules of Professional Conduct. Michaele is highly qualified in advising on Taxation law, together with an extensive background in taxation, business management and the construction industry. He holds a Masters of Taxation, a double degree in Law and Accounting, and is qualified to provide financial planning advice under the new requirements of the Securities and Investment Commission. He was a guest lecturer and tutor in the subjects of financial and management accounting, and taxation law at the University of Canberra, Australian National University and the University of New South Wales. He was a founding lecturer and tutor for the ATAX scheme, which was a program within the Australian Taxation Office to upgrade the technical skills of their staff. Michaele spent over 15 years working for the Australian Taxation Office as a senior taxation specialist in areas such as the Top 100 Review of the largest companies operating in Australia. He has been a personal financial adviser to the Prime Minister of Western Samoa, the Minister for Finance and Minister for Economic Development. He has provided advice on taxation matters to the previous Commissioner of Taxation. As well as providing high level taxation advice, Michaele is an active equity trader who undertakes considerable research on the share-markets and the performance of listed stock. Michaele also provided consultancy services to Australia’s largest ethical investment and superannuation trust, Australian Ethical Investments Limited. On the personal side, Michaele has been very active in the community where his family has fostered numerous children from Dr Barnardoes Homes. In 1993, Michaele received an Australia Day Medal for services within the Australian Taxation Office and the community, primarily in the area of relating to and helping homeless children. Australian Taxation Professionals Pty Ltd Suite 1, 53 Dundas Court PHILLIP ACT 2606 Tel: (02) 6290 1496 Fax: (02) 6290 2371 E-Mail: office@atp.com.au Catherine Smith Principal - Wholistic Financial Solutions Catherine has had over 18 years experience in Taxation. She holds a Masters degree in Taxation and has been recognized by the Certified Practitioners of Australia (CPA) Society as a 'Specialist in Taxation'. She spent 11 years with the Australian Taxation Office as a senior Audit manager and a Fraud Investigator. After leaving the ATO Catherine established an Accounting practice in Ulladulla in 2002 and then relocated the practice to Canberra in 2006. She was born and bred in Canberra and intends to remain in Canberra until retirement. Catherine has a degree in Accounting and a Masters degree in Taxation as well as a diploma in Financial Planning. Catherine is a registered Tax Agent, a CPA, a Public Practicing Accountant of the CPA and NTAA societies, a Justice of Peace, an accredited and experienced mortgage and finance consultant, a SMSF specialist and Director of Wholistic Financial Solutions, Australian Financial Porfessionals and owner of the Investor Finance Canberra Branch. She maintains the required Continuing Professional Development status by maintaining her high level of knowledge in a rapidly changing and complex legal areas of taxation and finance. Our Commitment As an Australian Taxation Professionals client, we want you to know you have the right to expect the following standards from us: You will receive friendly, courteous, awesome service. You will be respected and not taken for granted. We will act with integrity, honesty and openness in everything we do for you, and with you. As your financial planners, we will communicate with you frequently, making recommendations to help you improve your personal and/or business financial position and build a win-win relationship with you. Your feedback is critical to our continuing to innovate and improve. We are always looking forward to your ideas, comments and your suggestions. Whenever you entrust us with your work, we will carefully research everything that needs to be done, therefore whenever we make recommendations they are not based on a whim, but are carefully researched facts. We will constantly question the way things are, and never, ever rest on our laurels (today’s laurels are tomorrow’s compost). We will always dot the i’s and cross the t’s, and in general, never forget that the devil is in the details. Australian Taxation Professionals Pty Ltd Suite 1, 53 Dundas Court PHILLIP ACT 2606 Tel: (02) 6290 1496 Fax: (02) 6290 2371 E-Mail: office@atp.com.au We will always be there to help, at any time, as remember, we are your financial planners. Our Services Portfolio Design and Management Correct and accurate assessment of your risk profile and corresponding strategic asset allocation of your investment portfolio is critical to set you on the path to efficient and safe wealth creation over the medium to long term. Diversification is a key factor in reducing the overall risk factor of your portfolio, not only through the different asset classes, but also as importantly through different Fund Managers and different management style funds. Any good plan or strategy has a limited shelf life and ongoing management of your portfolio and strategy is an integral component of ensuring your success in wealth creation. Financial Planning Financial planning should provide a blueprint to meet both current and future financial objectives. At Australian Taxation Professionals, our experience and expertise allows us to develop solid financial strategies for our clients so that they can obtain the greatest possible benefit from their resources. To reach a new destination you have to plan how to get there. Similarly, the best way to meet your future financial needs is through financial planning. Good financial planning requires more than making a few investments. To create a comprehensive plan a professional adviser examines your needs now and in the future, your assets and liabilities, attitude to risk, family objectives, personal goals, tax situation and ways to protect your income and wealth. The financial plan…a combination of flexible strategies and products that is developed from this process…is not a static blueprint. It has to evolve as your needs and objectives in life change. It should be able to take advantage of any appropriate new products that may be created, and to adapt to changes in legislation. The financial plan lays down a path…you have to contribute the willingness and commitment to make the plan succeed. Some of the aspects we are skilled in examining in this planning process with you are: Objectives Income Wealth creation Expenses Retirement Considerations Fund access Portability Cash flow Time horizons Risk/reward Strategies Superannuation Taxation Social security Insurance Insurances Income Life Assets Health General Australian Taxation Professionals Pty Ltd Suite 1, 53 Dundas Court PHILLIP ACT 2606 Tel: (02) 6290 1496 Fax: (02) 6290 2371 E-Mail: office@atp.com.au Recommendation Asset allocation Investment Fund selection Our Services Superannuation Planning and Advice Superannuation is a powerful wealth building and asset protection tool for business people and professionals. As with all other facets of your business and your Estate however, where there are legal and tax considerations, you need to get expert advice. Do you know that you can pass on accumulated superannuation taxation benefits to your beneficiaries? Did you know that you could bind the discretionary power of the Superannuation Trustee and ensure that your wishes are carried out – to the letter? With a range of master trusts and self-managed superannuation facilities in conjunction with our depth of expertise in this area, we are in an ideal position to provide superannuation advice and services to all clients, whether self employed, employers, employees or retirees. Insurance and Risk Management We have solutions for all client risk management needs. We have the capacity to analyse your attitude to risk and to recommend appropriate products and courses of action for your specific purpose, to protect you and your family, your business and your overall financial plans from being adversely affected by unforseen circumstances. Investment Portfolio Reviews We have access to a comprehensive range of well researched managed investments giving us the advantage to design a portfolio to match the risk profile and needs of our clients as well as reviewing that portfolio on an ongoing basis. Through our use of state of the art technology, we are in a position to provide clients with comprehensive portfolio reviews and ongoing automated management services that alert them to any potential areas of concern in respect to their individual investment portfolios. Centrelink and Retirement Planning Through the use of software technology, we are able to provide our retiree clients with accurate and innovative financial structures to maximise Centrelink pensions and benefits. Personalised income streams are paramount to retiree’s quality of life and it is with this underlying requirement in mind that we can personalise your retirement structure to ensure your continued quality of life in retirement. Australian Taxation Professionals Pty Ltd Suite 1, 53 Dundas Court PHILLIP ACT 2606 Tel: (02) 6290 1496 Fax: (02) 6290 2371 E-Mail: office@atp.com.au Our Services Finance Correct financing arrangements are often the key to implementing your financial plan efficiently. Our consultants are accredited to write finance for you through 45 different lending institutions via various national finance service groups. Let us do the research into what institution and facility will suit your individual situation. This service will not cost you any more than if you were to approach a bank directly as we do not charge a fee for the provision of finance services. We are actually paid by the lending institutions. Mortgage Reduction and Cash flow Management Financial planning can be defined as: “The management of what you earn compared to what you spend, and what you own compared to what you owe.” Cash flow management is essential to the success of any financial plan and repayment of non taxdeductible debt must be a major concern for all clients. We offer to our clients an exceptional service in this area through the use of efficient finance arrangements and innovative software packages that show you what is achievable initially, and more importantly, what can be achieved over the longer term through the provision of a monitoring tool for your use that shows budgeting data, mortgage terms and investment growth if applicable. The Next Step Your Critical Path to Wealth Creation Vision Management And Service Programme Initial Consultation Needs/Wants Analysis Designing Extensive Market Research Loop Presenting Implementation Client Agreement Australian Taxation Professionals Pty Ltd Suite 1, 53 Dundas Court PHILLIP ACT 2606 Tel: (02) 6290 1496 Fax: (02) 6290 2371 E-Mail: office@atp.com.au Without Losing Sight Of Your Vision 1. 2. 3. 4. 5. 6. 7. 8. Initial Consultation Getting to know each other, understanding your hopes, dreams and aspirations. Needs/Wants Analysis We carefully assess your current Financial and Estate position, what you want and what needs to be done to achieve your aims. Extensive Market Research We put all the solutions available under the microscope to determine which will work best for your situation. Designing For A Secure Future We design and plan your financial future while building in flexibility to move with market changes in your business and your environment. Presenting Presenting is just that. Presenting you with our report and findings. Giving you the facts and the alternatives and our recommendations. Client Agreement Some breathing space for you to carefully read and digest everything in our financial design plan and decide which way you want to go. Implementation We put your plan into action ensuring all your needs are met to provide the financial freedom you’re looking for. Management and Service Programme You’re always guaranteed of our continuing support and interest. In fact, we’ll come back to you on a regular basis to let you know how your plan is doing and recommend any changes necessary. A Logical Process We’ll help you organise and review your existing arrangements and will prepare clear financial statements to show your current and future cash flow. You need to know where you are now before deciding what needs to be done to achieve your objectives. We’ll help you define and cost your desired lifestyle and will create a computer model of your arrangements so that alternative courses of action can be explored and a plan developed which will enable your objectives to be achieved. Personal and business planning may need to be coordinated. Often, the principal challenge is how to increase cash flow. Australian Taxation Professionals Pty Ltd Suite 1, 53 Dundas Court PHILLIP ACT 2606 Tel: (02) 6290 1496 Fax: (02) 6290 2371 E-Mail: office@atp.com.au How much time will we need to look after you? As an individual you may need as little as one meeting each year whereas a corporate client may need a meeting once a month or once a quarter. Most people spend more time each year planning their annual holidays than they spend throughout their lifetime planning their financial future! Organising Your Affairs We help our clients organise their affairs, create and protect capital and achieve their desired lifestyle. Our advice is proactive and objective. How would our service benefit you? By helping you add to the quality of your life through better planning of your investments and of your business, financial and tax arrangements. Some people feel their lives have become unbalanced and that they are not enjoying the quality of life they desire. They have assets but insufficient cash. The fun has gone out of much of what they do and they feel a need to develop their lives in a slightly different way. That’s where we can help. Who do we advise? An extremely broad spectrum – from young people buying their first home to people entering retirement and requiring advice on setting themselves up for the rest of their lives. Most plan to be financially independent and want to minimise their tax liabilities. Australian Taxation Professionals Pty Ltd Suite 1, 53 Dundas Court PHILLIP ACT 2606 Tel: (02) 6290 1496 Fax: (02) 6290 2371 E-Mail: office@atp.com.au A Brighter Future Many people now expect to live to a greater age than their parents or grandparents and to enjoy a standard of living undreamed of in earlier times. In practice, this will be possible only if they have arranged their affairs so that they will be financially independent and able to afford not only their desired lifestyle but also the cost of suitable care if health problems arise. By working closely with us to minimise tax and enhance investment returns some clients are able to achieve financial independence by their early fifties. Money management and investment is now a full time occupation and financial planning has become essential for anyone who is serious about achieving financial independence. A Financial Planner doesn’t replace your solicitor, accountant or stockbroker. That’s why our practice incorporates and works with solicitors to achieve your goals. We are registered to prepare your tax returns and help you plan the best overall tax strategy and take the initiative to bring to your attention ideas, which help you achieve your financial objectives. We don’t write your will but we will work with your solicitor to help protect your estate from Capital Gains Tax and ensure financial security for your dependents. We don’t deal on the stock market but we can liaise with your stockbroker to maximise the return on your capital. The help of a professional Financial Planner can make all the difference. Thank You We hope you have enjoyed reading about us at Australian Taxation Professionals. We look forward to developing a lasting and mutually rewarding relationship. Welcome to the Australian Taxation Professionals team… Australian Taxation Professionals Pty Ltd Suite 1, 53 Dundas Court PHILLIP ACT 2606 Tel: (02) 6290 1496 Fax: (02) 6290 2371 E-Mail: office@atp.com.au