Financial Statement Analysis: Colmar Ltd Case Study

advertisement

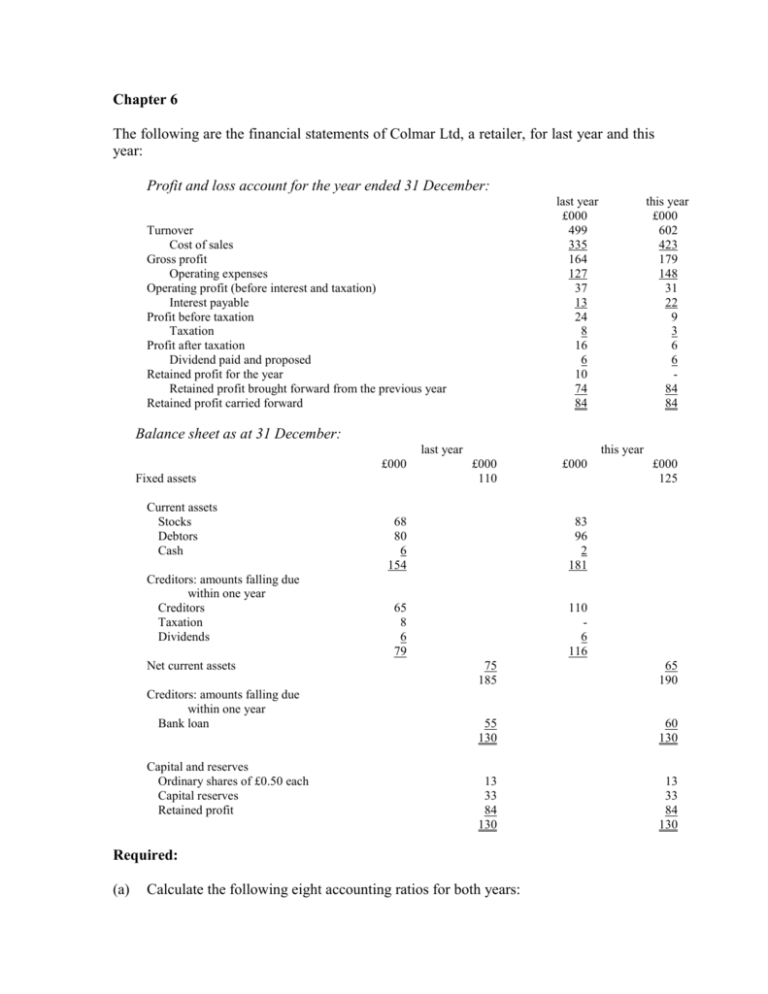

Chapter 6 The following are the financial statements of Colmar Ltd, a retailer, for last year and this year: Profit and loss account for the year ended 31 December: last year £000 499 335 164 127 37 13 24 8 16 6 10 74 84 Turnover Cost of sales Gross profit Operating expenses Operating profit (before interest and taxation) Interest payable Profit before taxation Taxation Profit after taxation Dividend paid and proposed Retained profit for the year Retained profit brought forward from the previous year Retained profit carried forward this year £000 602 423 179 148 31 22 9 3 6 6 84 84 Balance sheet as at 31 December: last year £000 Fixed assets Current assets Stocks Debtors Cash Creditors: amounts falling due within one year Creditors Taxation Dividends Net current assets Creditors: amounts falling due within one year Bank loan Capital and reserves Ordinary shares of £0.50 each Capital reserves Retained profit this year £000 110 68 80 6 154 83 96 2 181 65 8 6 79 110 6 116 £000 125 75 185 65 190 55 130 60 130 13 33 84 130 13 33 84 130 Required: (a) £000 Calculate the following eight accounting ratios for both years: (b) return on capital employed return on ordinary shareholders’ funds gross profit margin net profit margin current acid test average stock turnover period Discuss, on the basis of your answers to part (a), differences between the two years regarding the business’s performance and position.