Introduction to Taxation 2

Introduction to Taxation

John V. Balanquit

Objectives

After the presentation, students should be able to:

• Identify and distinguish the objects of taxation

• Explain the doctrines of taxation

• Explain the “situs of taxation”

Objectives (continued)

• Identify the nature of taxes and explain the characteristics of taxes

• Determine the classification of taxes

• Distinguish taxes from other fees

Objects of Taxation

• Persons (natural or juridical)

• Properties (tangible or intangible, real or personal)

• Excise objects (transactions, privilege, rights or interests)

Doctrines of Taxation

• Prospectivity of tax laws

• Imprescriptibility of taxes

• Double taxation (indirect and direct)

• Escape from taxation (tax evasion vs tax avoidance)

• Equitable recoupment

Doctrines of Taxation

• Set-off of taxes

• Taxpayer suit

• Compromise

• Power to build and destroy

Situs of Taxation

It is the “place” of taxation. It may be based on the:

• Nature of tax

• Citizenship and residence of taxpayer

• Source of income

• Place of the item subject to tax

Nature of Taxes

Taxes are:

• Obligations created by law

• Generally personal to the taxpayer

Essential Characteristics of Taxes

• Enforced contributions

• Imposed by the legislative body

• Proportionate in character

• Payable in the form of money

• Imposed for the purpose of raising revenue

• Used for public purpose

Essential Characteristics of Taxes

• Enforced on persons, properties or rights

• Commonly required to be paid in regular intervals

• Imposed by the sovereign state within its jurisdiction

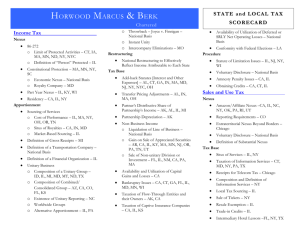

Classifications of Taxes

As to Purpose

• Revenue/Fiscal

• Regulatory/Sumptuary

Classifications of Taxes

As to Object

• Personal/ Poll/ Capitation

• Property

• Excise

Classifications of Taxes

As to Determination of Amount

• Ad Valorem

• Specific

Classifications of Taxes

As to Who Bears the Burden

• Direct

• Indirect

Classifications of Taxes

As to Authority or Scope

• National (transfer taxes, income taxes, VAT, percentage taxes, excise taxes, documentary stamp tax)

• Local (Community tax, municipal license tax, professional tax, real estate tax)

Classifications of Taxes

As to Rate or Graduation

• Proportionate/ Flat Rate

• Progressive/ Graduated

• Mixed

Other Fees

• Penalty

• Revenue

• Debt

• Toll

• License fee

• Customs duties

Other Fees

• Subsidy

• Tariff

• Margin fee

• Special assessment

End of Lecture.

Thank You!