job profile of tax experts

TaxaTion ExpErT

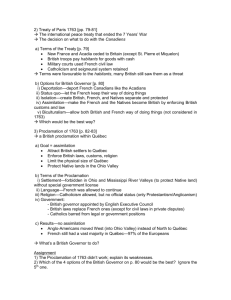

Eligibility and job profile

JOB PROFILE – TaxaTIOn ExPERT

Candidates are selected based on a job profile adapted to the context the ministère des Finances faces on a daily basis.

Persons selected are evaluated on the basis of this profile.

General eligibility criteria:

Be entered on the roll of the Barreau du Québec or the

Chambre des notaires du Québec and have completed a master’s program in taxation.

InTELLECTUaL SKILLS

1. Knowledge of the various tax systems applicable in

Québec and of the principles of taxation.

2. Analysis

• Break a problem or situation down to its essential components to grasp its inter-connections and derive an overall structure.

3. Written communication

• Communicate ideas of information in writing that is clear and precise, with particular attention to the quality of French.

4. Spoken communication

• Communicate ideas or information orally so as to be well understood.

5. Problem resolution

• Using various means, find solutions to problems by following an approach adapted to the situation and being creative.

6. Synthesis

• Integrate facts, ideas and data that may come from different sources into a coherent, understandable and concise whole.

Contribute to shaping Québec’s future !

InTER-PERSOnaL SKILLS

7. Inter-personal relations

• Establish and maintain good relations with other people; deal with them and establish a favourable climate.

8. Teamwork

• Work with other people to achieve common objectives.

PERSOnaL QUaLITIES

9. Discipline

• Be highly disciplined in work.

10. Flexibility and adaptation

• Deal with change and continue to perform well in varied or ambiguous situations.

11. Independence

• Work with little supervision without depending on others.

12. Stress management

• Adapt to stressful situations with no loss of concentration, effectiveness and productivity.

13. Priorities management

• Make productive use of one’s time and that of others.

14. Sense of responsibility

• Demonstrate commitment regarding assigned respons ibilities.

15. Professionalism

• Act with a high degree of professionalism in every circumstance.

w w w . f i n a n c e s . g o u v . q c . c a