doc - Knowledge

advertisement

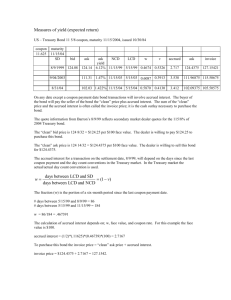

CORRECTION QUIZZ 3’’ 1. 6-month Treasury bill : 360/180 (100 – Y) = 2 Y = 99 1/99 = 0.06383 = 1.01% for 6 months 1.01% x 2 = 2.02% compounded semi annually. We need to compound it continuously 2Ln (1+ 0.020/2) = 2.01% is the 6-month zero rate 1 year treasury Bill : 360/360 ( 100 - Y) = 2.5 Y=97.5 2.5/97.5 = 2.56% for 1 year. We need to compounded continuously that is 1Ln(1+ 0.0256/1) = 2.53% is the 1year zero rate 2. 110-16 means the bond is priced at 110 16/32 that is 110.50 that is $1105.00 To calculate the accrued interest we must determine : amount of days since last coupon payment , that is since July 27th as this bond pays only once a year. The count for corporate bonds is 30/360 that is one month = 30 days even if it has 31 days and the year has 360 days even if it has 365 days. So the amount of days between July 27th and October 24th is : 3 + 30 + 30 + 24 = 87 DAYS amount of days between each coupon payment that is 360 days as this bond pays only once a year So the accrued interest on this corporate bond is : (87/360) x $120 = $29 By adding the accrued interest ($29) to the dollar cash price (($1105), we get $1134 3. The quoted price of the 6-month Treasury bill is simply 1.67 as stated on the Bloomberg sheet. Te question did not ask you to calculate the cash price of the Bill. The 5 year Treasury note has a coupon of 3.25% and pays every six month on Aug 15th and Feb15th. Today is October 22nd. The accrued interest is calculated the following way (actual/actual) : number of days since last coupon / days in between the two coupon payments) x $32.25/2 That is : (Number of days between Aug 15th and October 22nd ) / 184 (68 / 183) x (32.25/2)= 5.99 or (68 / 365) x $32.25 = $6.00 By adding the accrued interest ($6) to the price of the bond (100-06 = 100 + 6/32 = $1001.875), we get : $1007.875 4. The duration of a 10 year zero coupon bond is 10 years as the present value of its discounted cash flow (zero) is equal to 10. 5. Duration is defined as the time needed for an investor to get his initial investment back from the present value of the cash flows that is the present value of the accumulated coupons. Duration is also defined as a sensitivity measure to a change in interest rate. 6. If a bond portfolio manager expects interest rate to increase, he should decrease the duration or volatility of his, portfolio by shortening its maturity and swapping his low coupon bonds for high coupon bonds. He could also short interest rate futures contracts in relation to his portfolio size. 7. The duration of the portfolio is calculated by taking into account the weighing of each bond and its duration within the portfolio. (16 X 3) + (17 X 9) + ( 35 X 5) + ( 20 X 11) / portfolio size 596 MILLIONS / 88 MILLION = 6.77 If interest rates decrease by 50 Basis Points that is 0.50%, the portfolio will increase by 0.50 X 6.77 = 3.385% The value of the portfolio is now therefore 88 x 1.03385 = $90.978 million 8. What I most like about this class is seeing you guys participate and “getting it” !!