Calculating total return -

advertisement

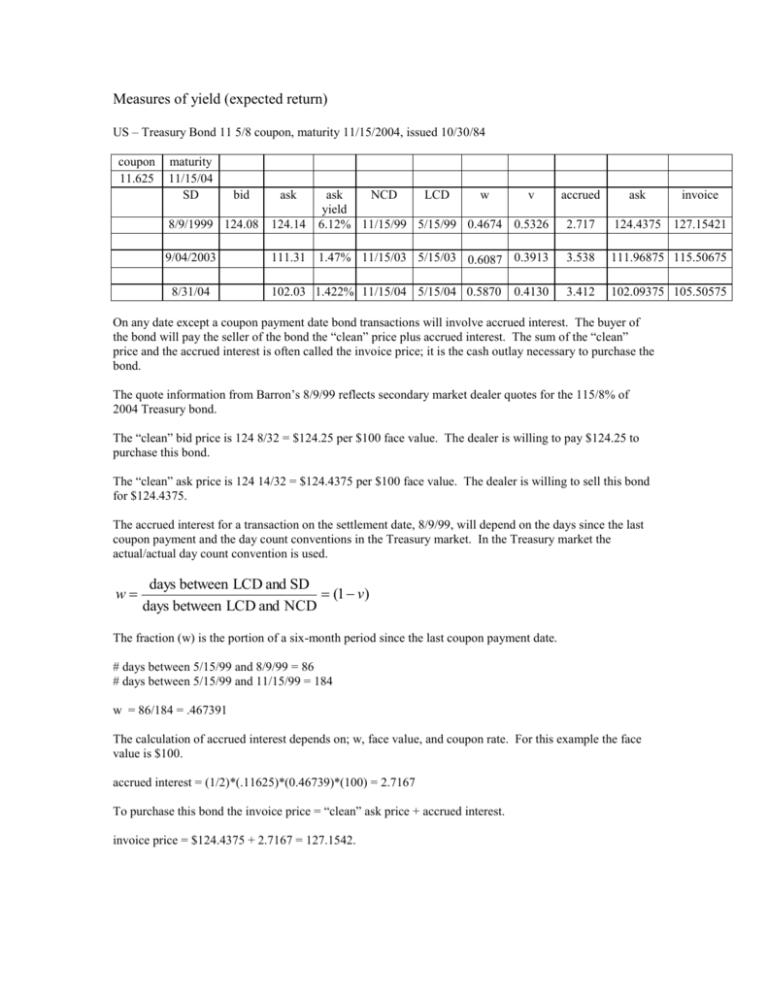

Measures of yield (expected return) US – Treasury Bond 11 5/8 coupon, maturity 11/15/2004, issued 10/30/84 coupon 11.625 maturity 11/15/04 SD 8/9/1999 124.08 124.14 ask NCD LCD w v yield 6.12% 11/15/99 5/15/99 0.4674 0.5326 9/04/2003 111.31 1.47% 11/15/03 5/15/03 0.6087 0.3913 8/31/04 bid ask 102.03 1.422% 11/15/04 5/15/04 0.5870 0.4130 accrued ask 2.717 124.4375 127.15421 3.538 111.96875 115.50675 3.412 102.09375 105.50575 On any date except a coupon payment date bond transactions will involve accrued interest. The buyer of the bond will pay the seller of the bond the “clean” price plus accrued interest. The sum of the “clean” price and the accrued interest is often called the invoice price; it is the cash outlay necessary to purchase the bond. The quote information from Barron’s 8/9/99 reflects secondary market dealer quotes for the 115/8% of 2004 Treasury bond. The “clean” bid price is 124 8/32 = $124.25 per $100 face value. The dealer is willing to pay $124.25 to purchase this bond. The “clean” ask price is 124 14/32 = $124.4375 per $100 face value. The dealer is willing to sell this bond for $124.4375. The accrued interest for a transaction on the settlement date, 8/9/99, will depend on the days since the last coupon payment and the day count conventions in the Treasury market. In the Treasury market the actual/actual day count convention is used. w days between LCD and SD (1 v) days between LCD and NCD The fraction (w) is the portion of a six-month period since the last coupon payment date. # days between 5/15/99 and 8/9/99 = 86 # days between 5/15/99 and 11/15/99 = 184 w = 86/184 = .467391 The calculation of accrued interest depends on; w, face value, and coupon rate. For this example the face value is $100. accrued interest = (1/2)*(.11625)*(0.46739)*(100) = 2.7167 To purchase this bond the invoice price = “clean” ask price + accrued interest. invoice price = $124.4375 + 2.7167 = 127.1542. invoice Potential sources of a bond’s dollar return 1. The coupon payments 2. Capital gain/loss at maturity/call date/sale date 3. Reinvestment income Current yield: Considers only promised coupon payments ignores capital gain/loss and reinvestment income. Current yield (8/9/1999) = 100*($11.625 / 127.1542) = 9.14% “The yield (to maturity, to call, to put) on any investment is the interest rate that will make the present value of the cash flows from the investment equal to the full price (invoice) of the investment.” Yield-to-maturity (internal rate of return) Yield-to-call Yield-to-put Yield-to-worst Yield-to-maturity, Yield-to-call, Yield-to-put are all measures of the internal rate of return from investment in a fixed income security. The invoice price (clean + accrued interest) is analogous to the initial investment in a capital budgeting decision. The promised cashflows (coupon payments, maturity value, call price, put price) and invoice price are used to find the discount rate (y) that equates the present value of the promised payments with the invoice price. n P C t 1 (1 0.5 * y ) t M * (1 0.5 * y) n P = invoice price y = yield M = maturity value or call price or put price Bond description: Semi-annual pay Current date = settlement date = coupon payment date Coupon rate = c = 5% M = $1,000 B0 = invoice amount = $1,050 Time to maturity = 10 years Time to first call = 4 years, first call price = 102 Time to first put = 5 years, first put price = 100 Scheduled cash flows to maturity 1 2 ($1,050) $25 $25 ........ 20 $1025 Scheduled cash flows to first call 1 2 ($1,050) $25 $25 ........ 8 $1045 Scheduled cash flows to first put 1 2 ($1,050) $25 $25 ........ 10 $1025 Semi-annual pay, Settlement date = coupon payment date, Coupon rate = c = 5%, M = $1,000, B0 = $1,050 ytm 4.3772% ytc 4.0973% ytp 3.8899% ytw 3.8899% Yield-to-maturity, yield-to-call, yield-to-put are measures of the expected return from owning a fixed income investment. These measures indicate the return per dollar invested for a specific scenario. Yield-to-maturity scenario – All promised cash flows through the bond’s maturity date inclusive of coupons and maturity value are received as promised. All cash flows received prior to maturity date are reinvested at the yield-tomaturity till the maturity date. Total return – A measure of expected return that incorporates a specific user defined scenario specifying the reinvestment rate(s), and terminal security value for the investment horizon. Bond-equivalent TR semi-annual compounding accumulation 1 / h TR 1 2 B0 accumulation – Sum of coupons, reinvestment income, and horizon value of security on the horizon date. Bond and scenario description – Semi-annual pay Current date = settlement date = coupon payment date Time-to-maturity = 7.5 years Coupon rate = c = 4.5% M = $5,000 ytm = 6% B0 = invoice amount = $4,552.33 h = investment horizon = 5 years g = reinvestment rate = 3% yh = yield-to-maturity on horizon date = 6% Using future value of annuity to find the accumulation of coupons and reinvestment income on the horizon date. 1 0.01510 1 $112.50 * $1,204.06 0.015 Using bond valuation rule to find horizon value of bond 1 1 0.03 5 5 Bh $112.50 * $5,000 * (1.03) $4,828.26 0 . 03 accumulation = $1,204.06 + $4,828.26 = $6,032.32 $6,032.17 1 / 10 TR 2 * 1 5.71% $4,552.33