Chapter 5 Instructor`s Manual

advertisement

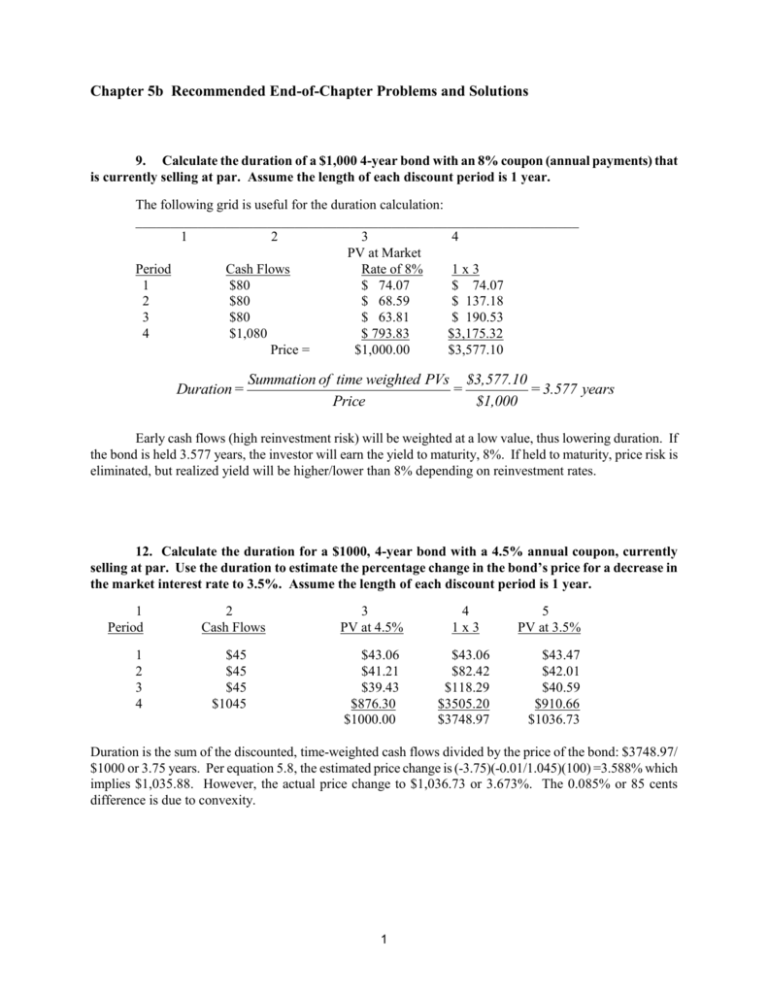

Chapter 5b Recommended End-of-Chapter Problems and Solutions 9. Calculate the duration of a $1,000 4-year bond with an 8% coupon (annual payments) that is currently selling at par. Assume the length of each discount period is 1 year. The following grid is useful for the duration calculation: ________________________________________________________________ 1 2 3 4 PV at Market Period Cash Flows Rate of 8% 1x3 1 $80 $ 74.07 $ 74.07 2 $80 $ 68.59 $ 137.18 3 $80 $ 63.81 $ 190.53 4 $1,080 $ 793.83 $3,175.32 Price = $1,000.00 $3,577.10 Duration = Summation of time weighted PVs $3,577.10 = = 3.577 years Price $1,000 Early cash flows (high reinvestment risk) will be weighted at a low value, thus lowering duration. If the bond is held 3.577 years, the investor will earn the yield to maturity, 8%. If held to maturity, price risk is eliminated, but realized yield will be higher/lower than 8% depending on reinvestment rates. 12. Calculate the duration for a $1000, 4-year bond with a 4.5% annual coupon, currently selling at par. Use the duration to estimate the percentage change in the bond’s price for a decrease in the market interest rate to 3.5%. Assume the length of each discount period is 1 year. 1 Period 1 2 3 4 2 Cash Flows $45 $45 $45 $1045 3 PV at 4.5% 4 1x3 $43.06 $41.21 $39.43 $876.30 $1000.00 $43.06 $82.42 $118.29 $3505.20 $3748.97 5 PV at 3.5% $43.47 $42.01 $40.59 $910.66 $1036.73 Duration is the sum of the discounted, time-weighted cash flows divided by the price of the bond: $3748.97/ $1000 or 3.75 years. Per equation 5.8, the estimated price change is (-3.75)(-0.01/1.045)(100) =3.588% which implies $1,035.88. However, the actual price change to $1,036.73 or 3.673%. The 0.085% or 85 cents difference is due to convexity. 1 a. Suppose a 6% $10,000 bond (whose last semi-annual coupon occurred 42 days ago) is quoted on the web at 96.4578. How much would 4000 of them cost assuming 181 days in the current coupon period? 42(300) Cost 4000 9645.78 181 38,861,573.04 What would be the error if in our calculations we were off by one day in our count since the last coupon payment? 4000*1*300/181 = $6,629.83 b. Assume a 4.5% bond (next semi-annual coupon payment in 52 days) whose Full Price is $412.34772. What is the bond’s Clean Price assuming 183 days in the current coupon period? 131(22.50) 183 396.2411 (or in the media 39.62411) Clean Price 412.34772 c. What is the duration of a 6% bond (semi-annual coupon payments) that matures 27 months for now whose required yield is 7%? Just succinctly set up the math and load with parameter values. Assume that the length of each discount period is 0.5 year. Use D time-weighted PV of each cash flow PB Then .25(30) .75(30) 1.25(30) 1.75(30) 2.25(1030) .5 (1.035) (1.035)1.5 (1.035) 2.5 (1.035)3.5 (1.035) 4.5 D PB 2 d. This exercise is about the versatility of the ordinary annuity formula. What is the monthly payment on a 4%, 15-year, $160,000 mortgage? Solve the ordinary annuity formula for A, then load. 1 (1 r ) n PV A r A A r PV 1 (1 r ) n .04 12 (160000) 1 (1 .04 12) (15*12) ans. $1,183.50 e. Consider a $100,000 bond portfolio, $20,000 of which is in D = 4 bonds, $50,000 of which is in D = 6 bonds, and $30,000 of which is in D = 7 bonds. What is the portfolio’s duration? To raise the portfolio’s duration to 6.4, how much of D = 4 bonds should be sold to buy D = 7 bonds? Portfolio D = .2(4) + .5(6) + .3(7) = 5.9 years 6.4 = (.2 –x)(4) + .5(6) + (.3 + x)(7) = .8 -4x + 3.0 + 2.1 +7x 0.5 = 3x x = .5/3 = .16667 or $16,667 3