February 28, 2016

NASDAQ: SBUX

STARBUCKS CORP

BUY

A+

A

A-

HOLD

B+

B

Annual Dividend Rate

$0.80

B-

C+

C

Annual Dividend Yield

1.36%

SELL

C-

D+

D

Beta

0.77

Sector: Consumer Goods & Svcs

SBUX BUSINESS DESCRIPTION

Starbucks Corporation operates as a roaster,

marketer, and retailer of specialty coffee

worldwide. The company operates in four

segments: Americas; Europe, Middle East, and

Africa; China/Asia Pacific; and Channel

Development.

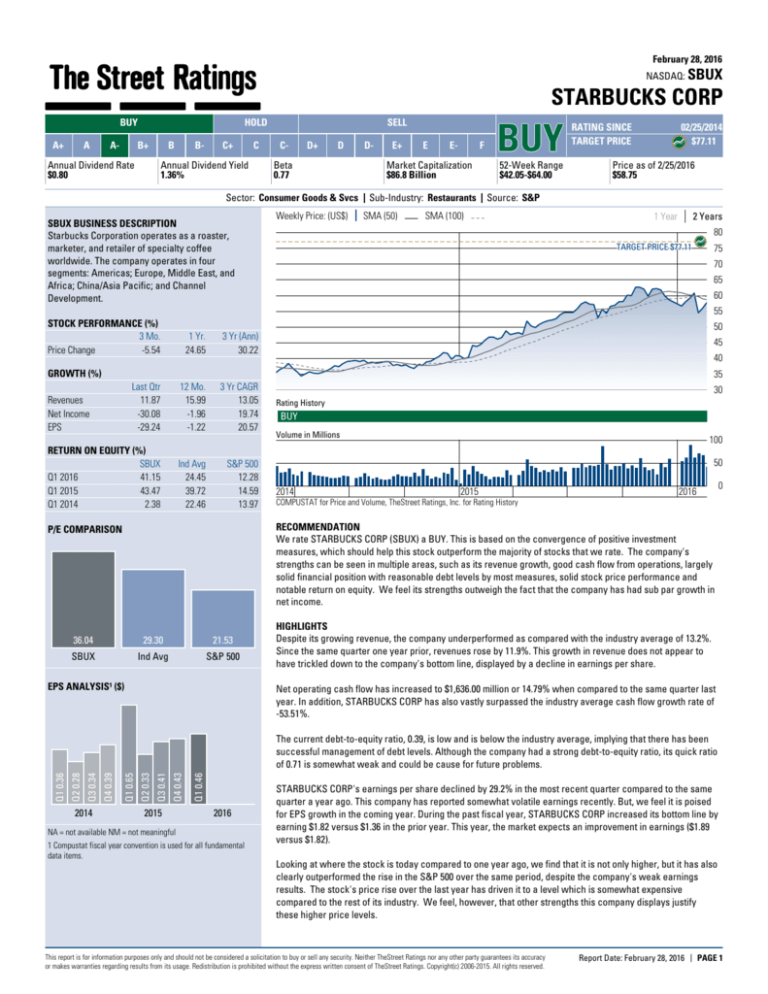

Weekly Price: (US$)

D-

E+

E

E-

F

Market Capitalization

$86.8 Billion

Sub-Industry: Restaurants

SMA (50)

BUY

52-Week Range

$42.05-$64.00

RATING SINCE

TARGET PRICE

02/25/2014

$77.11

Price as of 2/25/2016

$58.75

Source: S&P

SMA (100)

1 Year

2 Years

80

TARGET

TARGET

TARGETPRICE

PRICE$77.11

$77.11

PRICE

$77.11

TARGET

75

70

65

60

55

STOCK PERFORMANCE (%)

3 Mo.

Price Change

-5.54

50

1 Yr.

24.65

3 Yr (Ann)

30.22

12 Mo.

15.99

-1.96

-1.22

3 Yr CAGR

13.05

19.74

20.57

45

40

GROWTH (%)

35

Last Qtr

11.87

-30.08

-29.24

Revenues

Net Income

EPS

RETURN ON EQUITY (%)

SBUX

Q1 2016

41.15

Q1 2015

43.47

Q1 2014

2.38

Ind Avg

24.45

39.72

22.46

S&P 500

12.28

14.59

13.97

30

Rating History

BUY

Volume in Millions

100

50

2014

2015

0

2016

COMPUSTAT for Price and Volume, TheStreet Ratings, Inc. for Rating History

RECOMMENDATION

We rate STARBUCKS CORP (SBUX) a BUY. This is based on the convergence of positive investment

measures, which should help this stock outperform the majority of stocks that we rate. The company's

strengths can be seen in multiple areas, such as its revenue growth, good cash flow from operations, largely

solid financial position with reasonable debt levels by most measures, solid stock price performance and

notable return on equity. We feel its strengths outweigh the fact that the company has had sub par growth in

net income.

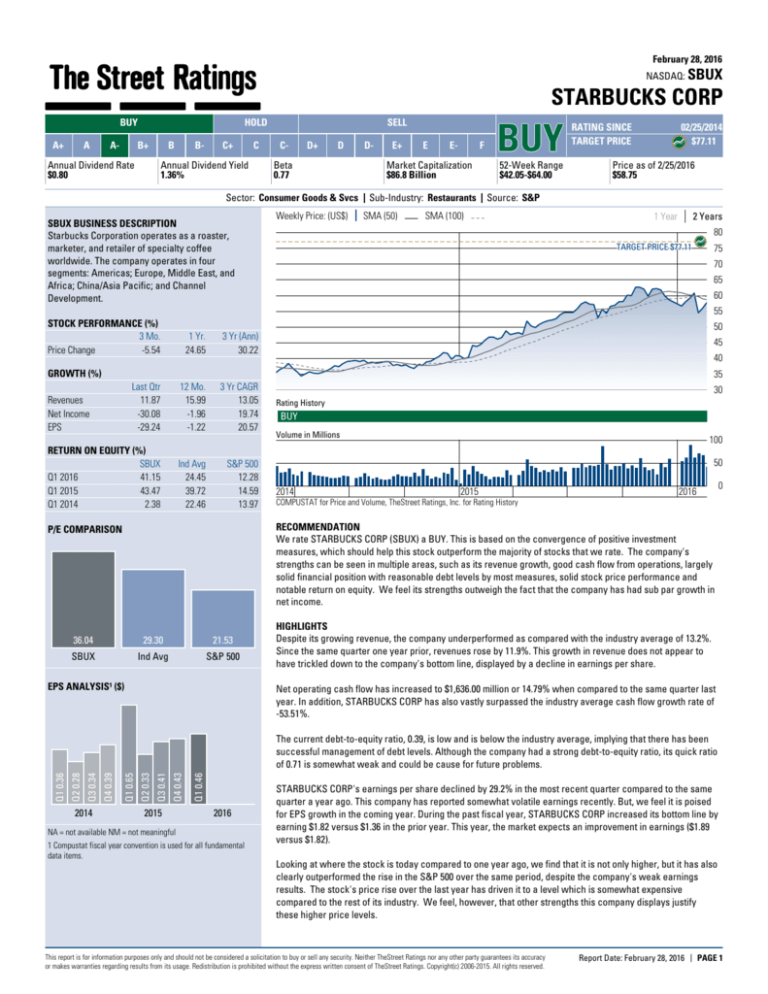

P/E COMPARISON

36.04

29.30

21.53

SBUX

Ind Avg

S&P 500

EPS ANALYSIS¹ ($)

HIGHLIGHTS

Despite its growing revenue, the company underperformed as compared with the industry average of 13.2%.

Since the same quarter one year prior, revenues rose by 11.9%. This growth in revenue does not appear to

have trickled down to the company's bottom line, displayed by a decline in earnings per share.

Net operating cash flow has increased to $1,636.00 million or 14.79% when compared to the same quarter last

year. In addition, STARBUCKS CORP has also vastly surpassed the industry average cash flow growth rate of

-53.51%.

2014

2015

Q1 0.46

Q4 0.43

Q3 0.41

Q2 0.33

Q1 0.65

Q4 0.39

Q3 0.34

Q2 0.28

Q1 0.36

The current debt-to-equity ratio, 0.39, is low and is below the industry average, implying that there has been

successful management of debt levels. Although the company had a strong debt-to-equity ratio, its quick ratio

of 0.71 is somewhat weak and could be cause for future problems.

2016

NA = not available NM = not meaningful

1 Compustat fiscal year convention is used for all fundamental

data items.

STARBUCKS CORP's earnings per share declined by 29.2% in the most recent quarter compared to the same

quarter a year ago. This company has reported somewhat volatile earnings recently. But, we feel it is poised

for EPS growth in the coming year. During the past fiscal year, STARBUCKS CORP increased its bottom line by

earning $1.82 versus $1.36 in the prior year. This year, the market expects an improvement in earnings ($1.89

versus $1.82).

Looking at where the stock is today compared to one year ago, we find that it is not only higher, but it has also

clearly outperformed the rise in the S&P 500 over the same period, despite the company's weak earnings

results. The stock's price rise over the last year has driven it to a level which is somewhat expensive

compared to the rest of its industry. We feel, however, that other strengths this company displays justify

these higher price levels.

This report is for information purposes only and should not be considered a solicitation to buy or sell any security. Neither TheStreet Ratings nor any other party guarantees its accuracy

or makes warranties regarding results from its usage. Redistribution is prohibited without the express written consent of TheStreet Ratings. Copyright(c) 2006-2015. All rights reserved.

Report Date: February 28, 2016

PAGE 1

February 28, 2016

NASDAQ: SBUX

STARBUCKS CORP

Sector: Consumer Goods & Svcs Restaurants Source: S&P

Annual Dividend Rate

$0.80

Annual Dividend Yield

1.36%

PEER GROUP ANALYSIS

250%

QSR

V

FA

AB

OR

-50%

DNKN

LE

AB

Revenue Growth (TTM)

LE

R

VO

FA

SBUX

5%

55%

EBITDA Margin (TTM)

Companies with higher EBITDA margins and

revenue growth rates are outperforming companies

with lower EBITDA margins and revenue growth

rates. Companies for this scatter plot have a market

capitalization between $3.5 Billion and $108.7 Billion.

Companies with NA or NM values do not appear.

*EBITDA – Earnings Before Interest, Taxes, Depreciation and

Amortization.

REVENUE GROWTH AND EARNINGS YIELD

250%

52-Week Range

$42.05-$64.00

Price as of 2/25/2016

$58.75

The foodservice industry employs more than 12 million people, making it America’s second largest employer

after the U.S. government. Not only is the industry huge, it’s growing, as factors - such as a rise in

two-income households - have been leading to increasing levels of dining out. In recent years, restaurant

sales have risen roughly 5% annually according to National Restaurant Association estimates. However,

despite its growth rate, the industry should be seen as mature. Companies within the industry generally earn

thin margins and face stiff competition. As a result, M&A activity is frequent as competitors look to spread

fixed costs across more locations.

UN

ARMK

CMG

PNRA

CBRL

DPZ

YUM

Market Capitalization

$86.8 Billion

INDUSTRY ANALYSIS

The hotels, restaurant, and leisure industry consists of hotels, restaurants, casinos, cruise lines, resorts, and

theme parks. Demand is driven by a fairly consistent group of factors throughout the whole of the industry:

personal income levels, total employment, and consumer confidence. In recent years, catastrophic weather,

fear of terrorism, and health epidemics directly impacted the industry in a material way. The industry is

capital, marketing, personnel, energy, maintenance, and technology intensive. Major players include

Intercontinental Hotels Group (IHG), Marriott International Inc. (MAR), Las Vegas Sands (LVS), MGM Resorts

International (MGM), McDonald’s (MCD), and Yum! Brands (YUM).

REVENUE GROWTH AND EBITDA MARGIN*

DRI

Beta

0.77

QSR

Both tourism and business travel remain vital to the industry, and as a result, U.S. GDP growth, consumer

confidence, and corporate earnings remain vital to the industry’s success. The expansion in capital spending

has been in response to projected demand. However, overdevelopment in certain areas is a concern. Looking

forward, any prolonged low occupancy rates could threaten hotels that are heavily leveraged. As for metrics,

occupancy, average daily room rate, and revenue per available room should be considered when analyzing

the industry or a player within the industry.

Casinos generate roughly $68 billion in revenues annually, and typically, 50% of a casino hotel’s revenues

come from gaming, 20% from hotel rooms, 15% from food and beverages, and 15% from retail stores, shows,

and other entertainment offerings. Expansion and consolidation have been recent trends of note. In 2005

alone, MGM Resorts International purchased Mandalay Resort Group for close to $8 billion and Harrah’s

bought Caesars for over $9 billion. Recent years have also seen a good amount of new casino construction in

the $700 million range as competitors jockey to attract visitors by providing more elaborate offerings. Looking

ahead, further capacity expansion may threaten margins. Meanwhile, most of the industry’s top-line growth

has come from Native American casinos, which at present generate roughly $16 billion in revenues annually.

V

FA

AB

OR

PEER GROUP: Hotels, Restaurants & Leisure

LE

AB

-50%

R

VO

FA

Revenue Growth (TTM)

LE

UN

CMG

DPZ DNKNSBUX

PNRA ARMK

1%

DRI

CBRL

YUM

MCD

5%

Earnings Yield (TTM)

Companies that exhibit both a high earnings yield

and high revenue growth are generally more

attractive than companies with low revenue growth

and low earnings yield. Companies for this scatter

plot have revenue growth rates between -7.4% and

238.4%. Companies with NA or NM values do not

appear.

Ticker

SBUX

DRI

ARMK

QSR

DPZ

PNRA

DNKN

CBRL

YUM

CMG

MCD

Recent

Company Name

Price ($)

STARBUCKS CORP

58.75

DARDEN RESTAURANTS INC

63.74

ARAMARK

31.53

RESTAURANT BRANDS INTL INC 33.67

DOMINO'S PIZZA INC

132.90

PANERA BREAD CO

205.02

DUNKIN' BRANDS GROUP INC

46.19

CRACKER BARREL OLD CTRY STO 147.90

YUM BRANDS INC

70.96

CHIPOTLE MEXICAN GRILL INC

505.33

MCDONALD'S CORP

118.37

Market

Cap ($M)

86,838

8,174

7,627

7,601

6,626

4,714

4,234

3,541

29,002

15,182

108,691

Price/

Earnings

36.04

22.85

31.85

67.34

42.32

35.29

43.17

20.69

24.30

33.49

24.61

Net Sales

TTM ($M)

19,732.90

6,905.00

14,337.06

4,052.20

2,118.30

2,681.58

810.93

2,869.52

13,105.00

4,501.22

25,413.00

Net Income

TTM ($M)

2,461.60

368.70

243.79

375.10

178.06

149.34

105.23

171.82

1,293.00

475.60

4,529.30

The peer group comparison is based on Major Restaurants companies of comparable size.

This report is for information purposes only and should not be considered a solicitation to buy or sell any security. Neither TheStreet Ratings nor any other party guarantees its accuracy

or makes warranties regarding results from its usage. Redistribution is prohibited without the express written consent of TheStreet Ratings. Copyright(c) 2006-2015. All rights reserved.

Report Date: February 28, 2016

PAGE 2

February 28, 2016

NASDAQ: SBUX

STARBUCKS CORP

Sector: Consumer Goods & Svcs Restaurants Source: S&P

Annual Dividend Rate

$0.80

Annual Dividend Yield

1.36%

COMPANY DESCRIPTION

Starbucks Corporation operates as a roaster, marketer,

and retailer of specialty coffee worldwide. The company

operates in four segments: Americas; Europe, Middle

East, and Africa; China/Asia Pacific; and Channel

Development. Its stores offer coffee and tea beverages,

packaged roasted whole bean and ground coffees,

single-serve and ready-to-drink coffee and tea products,

juices, and bottled water. The company's stores also

provide fresh food and snack offerings; and various food

products, such as pastries, and breakfast sandwiches

and lunch items, as well as serve ware, beverage-making

equipment, and accessories. In addition, it licenses its

trademarks through licensed stores, and grocery and

national foodservice accounts. The company offers its

products under the Starbucks, Teavana, Tazo, Seattle's

Best Coffee, Evolution Fresh, La Boulange, Ethos,

Starbucks VIA, Seattle's Best Coffee, Frappuccino,

Starbucks Doubleshot, Starbucks Refreshers, and

Starbucks Discoveries Iced Cafe Favorites brand names.

As of September 27, 2015, it operated 23,043 stores.

Starbucks Corporation was founded in 1985 and is based

in Seattle, Washington.

STARBUCKS CORP

2401 Utah Avenue South

Seattle, WA 98134

USA

Phone: 206-447-1575

http://www.starbucks.com

Beta

0.77

Market Capitalization

$86.8 Billion

52-Week Range

$42.05-$64.00

Price as of 2/25/2016

$58.75

STOCK-AT-A-GLANCE

Below is a summary of the major fundamental and technical factors we consider when determining our

overall recommendation of SBUX shares. It is provided in order to give you a deeper understanding of our

rating methodology as well as to paint a more complete picture of a stock's strengths and weaknesses. It is

important to note, however, that these factors only tell part of the story. To gain an even more comprehensive

understanding of our stance on the stock, these factors must be assessed in combination with the stock’s

valuation. Please refer to our Valuation section on page 5 for further information.

FACTOR

SCORE

5.0

Growth

out of 5 stars

weak

Measures the growth of both the company's income statement and

cash flow. On this factor, SBUX has a growth score better than 90% of

the stocks we rate.

strong

4.5

Total Return

out of 5 stars

weak

Measures the historical price movement of the stock. The stock

performance of this company has beaten 80% of the companies we

cover.

strong

5.0

Efficiency

out of 5 stars

weak

Measures the strength and historic growth of a company's return on

invested capital. The company has generated more income per dollar of

capital than 90% of the companies we review.

strong

5.0

Price volatility

out of 5 stars

weak

Measures the volatility of the company's stock price historically. The

stock is less volatile than 90% of the stocks we monitor.

strong

5.0

Solvency

out of 5 stars

weak

Measures the solvency of the company based on several ratios. The

company is more solvent than 90% of the companies we analyze.

strong

3.0

Income

out of 5 stars

weak

Measures dividend yield and payouts to shareholders. The company's

dividend is higher than 50% of the companies we track.

strong

THESTREET RATINGS RESEARCH METHODOLOGY

TheStreet Ratings' stock model projects a stock's total return potential over a 12-month period including both

price appreciation and dividends. Our Buy, Hold or Sell ratings designate how we expect these stocks to

perform against a general benchmark of the equities market and interest rates. While our model is

quantitative, it utilizes both subjective and objective elements. For instance, subjective elements include

expected equities market returns, future interest rates, implied industry outlook and forecasted company

earnings. Objective elements include volatility of past operating revenues, financial strength, and company

cash flows.

Our model gauges the relationship between risk and reward in several ways, including: the pricing drawdown

as compared to potential profit volatility, i.e.how much one is willing to risk in order to earn profits; the level of

acceptable volatility for highly performing stocks; the current valuation as compared to projected earnings

growth; and the financial strength of the underlying company as compared to its stock's valuation as

compared to projected earnings growth; and the financial strength of the underlying company as compared

to its stock's performance. These and many more derived observations are then combined, ranked, weighted,

and scenario-tested to create a more complete analysis. The result is a systematic and disciplined method of

selecting stocks.

This report is for information purposes only and should not be considered a solicitation to buy or sell any security. Neither TheStreet Ratings nor any other party guarantees its accuracy

or makes warranties regarding results from its usage. Redistribution is prohibited without the express written consent of TheStreet Ratings. Copyright(c) 2006-2015. All rights reserved.

Report Date: February 28, 2016

PAGE 3

February 28, 2016

NASDAQ: SBUX

STARBUCKS CORP

Sector: Consumer Goods & Svcs Restaurants Source: S&P

Annual Dividend Rate

$0.80

Annual Dividend Yield

1.36%

Consensus EPS Estimates² ($)

IBES consensus estimates are provided by Thomson Financial

Beta

0.77

Market Capitalization

$86.8 Billion

52-Week Range

$42.05-$64.00

Price as of 2/25/2016

$58.75

FINANCIAL ANALYSIS

STARBUCKS CORP's gross profit margin for the first quarter of its fiscal year 2016 is essentially unchanged

when compared to the same period a year ago. Even though sales increased, the net income has decreased.

STARBUCKS CORP has weak liquidity. Currently, the Quick Ratio is 0.71 which shows a lack of ability to cover

short-term cash needs. The company's liquidity has decreased from the same period last year.

At the same time, stockholders' equity ("net worth") has remained virtually unchanged only increasing by

3.56% from the same quarter last year. Overall, the key liquidity measurements indicate that the company is in

a position in which financial difficulties could develop in the future.

0.39

1.89 E

2.18 E

Q2 FY16

2016(E)

2017(E)

STOCKS TO BUY: TheStreet Quant Ratings has identified a handful of stocks that can potentially TRIPLE in the

next 12-months. To learn more visit www.TheStreetRatings.com.

INCOME STATEMENT

Net Sales ($mil)

EBITDA ($mil)

EBIT ($mil)

Net Income ($mil)

Q1 FY16

5,373.50

1,229.40

993.90

687.60

Q1 FY15

4,803.30

1,079.80

873.80

983.40

Q1 FY16

2,379.90

12,943.50

2,347.70

5,981.50

Q1 FY15

1,953.10

12,351.10

2,048.40

5,775.40

Q1 FY16

28.56%

22.87%

18.50%

1.52

19.01%

41.15%

Q1 FY15

28.46%

22.48%

18.19%

1.38

20.32%

43.47%

Q1 FY16

1.07

0.28

16.50

60.24

Q1 FY15

1.28

0.26

16.30

53.61

Q1 FY16

1,486

0.20

0.46

4.03

NA

10,770,952

Q1 FY15

1,501

0.16

0.65

3.85

NA

8,281,083

BALANCE SHEET

Cash & Equiv. ($mil)

Total Assets ($mil)

Total Debt ($mil)

Equity ($mil)

PROFITABILITY

Gross Profit Margin

EBITDA Margin

Operating Margin

Sales Turnover

Return on Assets

Return on Equity

DEBT

Current Ratio

Debt/Capital

Interest Expense

Interest Coverage

SHARE DATA

Shares outstanding (mil)

Div / share

EPS

Book value / share

Institutional Own %

Avg Daily Volume

2 Sum of quarterly figures may not match annual estimates due to

use of median consensus estimates.

This report is for information purposes only and should not be considered a solicitation to buy or sell any security. Neither TheStreet Ratings nor any other party guarantees its accuracy

or makes warranties regarding results from its usage. Redistribution is prohibited without the express written consent of TheStreet Ratings. Copyright(c) 2006-2015. All rights reserved.

Report Date: February 28, 2016

PAGE 4

February 28, 2016

NASDAQ: SBUX

STARBUCKS CORP

Sector: Consumer Goods & Svcs Restaurants Source: S&P

Annual Dividend Rate

$0.80

Annual Dividend Yield

1.36%

RATINGS HISTORY

Our rating for STARBUCKS CORP has not changed

since 2/25/2014. As of 2/25/2016, the stock was

trading at a price of $58.75 which is 8.2% below its

52-week high of $64.00 and 39.7% above its 52-week

low of $42.05.

BUY: $35.28

2 Year Chart

Beta

0.77

Market Capitalization

$86.8 Billion

$70

$60

Price/Earnings

$50

$40

2015

MOST RECENT RATINGS CHANGES

Date

Price

Action

2/25/14

$35.28 No Change

From

Buy

To

Buy

Price reflects the closing price as of the date listed, if available

RATINGS DEFINITIONS &

DISTRIBUTION OF THESTREET RATINGS

(as of 2/25/2016)

1

2

3

35.29% Hold - We do not believe this stock offers

conclusive evidence to warrant the purchase or sale of

shares at this time and that its likelihood of positive total

return is roughly in balance with the risk of loss.

Price/Projected Earnings

Research Contact: 212-321-5381

Sales Contact: 866-321-8726

5

1

2

3

4

5

2

3

premium

4

5

1

2

premium

3

4

5

Price to Earnings/Growth

4

5

discount

1

2

3

premium

4

5

discount

SBUX 9.39

Peers 2.95

• Premium. The PEG ratio is the stock’s P/E divided by

the consensus estimate of long-term earnings

growth. Faster growth can justify higher price

multiples.

• SBUX trades at a significant premium to its peers.

Earnings Growth

1

2

3

4

lower

5

higher

SBUX -1.22

Peers 22.69

• Lower. Elevated earnings growth rates can lead to

capital appreciation and justify higher

price-to-earnings ratios.

• However, SBUX is expected to significantly trail its

peers on the basis of its earnings growth rate.

Sales Growth

discount

SBUX 4.42

Peers 2.96

• Premium. In the absence of P/E and P/B multiples,

the price-to-sales ratio can display the value

investors are placing on each dollar of sales.

• SBUX is trading at a significant premium to its

industry.

3

SBUX 21.95

Peers 14.94

• Premium. The P/CF ratio, a stock’s price divided by

the company's cash flow from operations, is useful

for comparing companies with different capital

requirements or financing structures.

• SBUX is trading at a significant premium to its

peers.

discount

SBUX 14.59

Peers 12.45

• Premium. A higher price-to-book ratio makes a

stock less attractive to investors seeking stocks

with lower market values per dollar of equity on the

balance sheet.

• SBUX is trading at a premium to its peers.

2

premium

discount

SBUX 26.95

Peers 24.01

• Premium. A higher price-to-projected earnings ratio

than its peers can signify a more expensive stock

or higher future growth expectations.

• SBUX is trading at a significant premium to its

peers.

1

1

Price/CashFlow

discount

premium

Price/Sales

32.52% Sell - We believe that this stock is likely to

decline by more than 10% over the next 12 months, with

the risk involved too great to compensate for any

possible returns.

4

SBUX 36.04

Peers 29.30

• Premium. A higher P/E ratio than its peers can

signify a more expensive stock or higher growth

expectations.

• SBUX is trading at a premium to its peers.

Price/Book

32.19% Buy - We believe that this stock has the

opportunity to appreciate and produce a total return of

more than 10% over the next 12 months.

TheStreet Ratings

14 Wall Street, 15th Floor

New York, NY 10005

www.thestreet.com

Price as of 2/25/2016

$58.75

VALUATION

BUY. This stock's P/E ratio indicates a premium compared to an average of 29.30 for the Hotels, Restaurants

& Leisure industry and a significant premium compared to the S&P 500 average of 21.53. For additional

comparison, its price-to-book ratio of 14.59 indicates a significant premium versus the S&P 500 average of

2.56 and a significant premium versus the industry average of 12.45. The price-to-sales ratio is well above

both the S&P 500 average and the industry average, indicating a premium. Upon assessment of these and

other key valuation criteria, STARBUCKS CORP proves to trade at a premium to investment alternatives within

the industry.

premium

2014

52-Week Range

$42.05-$64.00

1

2

3

lower

4

5

higher

SBUX 15.99

Peers 7.04

• Higher. A sales growth rate that exceeds the

industry implies that a company is gaining market

share.

• SBUX has a sales growth rate that significantly

exceeds its peers.

DISCLAIMER:

The opinions and information contained herein have been obtained or derived from sources believed to be reliable, but

TheStreet Ratings cannot guarantee its accuracy and completeness, and that of the opinions based thereon. Data is provided

via the COMPUSTAT® Xpressfeed product from Standard &Poor's, a division of The McGraw-Hill Companies, Inc., as well as

other third-party data providers.

TheStreet Ratings is a division of TheStreet, Inc., which is a publisher. This research report contains opinions and is provided

for informational purposes only. You should not rely solely upon the research herein for purposes of transacting securities or

other investments, and you are encouraged to conduct your own research and due diligence, and to seek the advice of a

qualified securities professional, before you make any investment. None of the information contained in this report constitutes,

or is intended to constitute a recommendation by TheStreet Ratings of any particular security or trading strategy or a

determination by TheStreet Ratings that any security or trading strategy is suitable for any specific person. To the extent any of

the information contained herein may be deemed to be investment advice, such information is impersonal and not tailored to the

investment needs of any specific person. Your use of this report is governed by TheStreet, Inc.'s Terms of Use found at

http://www.thestreet.com/static/about/terms-of-use.html.

This report is for information purposes only and should not be considered a solicitation to buy or sell any security. Neither TheStreet Ratings nor any other party guarantees its accuracy

or makes warranties regarding results from its usage. Redistribution is prohibited without the express written consent of TheStreet Ratings. Copyright(c) 2006-2015. All rights reserved.

Report Date: February 28, 2016

PAGE 5