Starbucks Corporation

advertisement

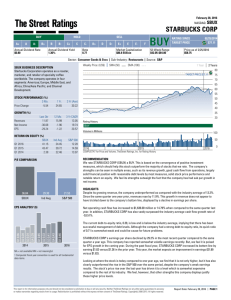

Starbucks Corporation a) Company name: Starbucks b) Brief description of the company: Starting its business in 1971, Starbucks used to a roaster and retailer of whole bean and ground coffee, tea and spices with a single store in Seattle’s Pike Place Market Now Starbucks expanded its business in 65 countries. It connects millions of customers with more than 20,000 retail stores. The name “ Starbucks” is named after the first mate in Herman Melville’s Moby Dick. The world-famous logo is inspired by the sea-featured a twin-tailed siren from Greek mythology.1 The mission of Starbucks is to inspired and nurture the human spirit- one person, onecup and one neighbor at a time. The products of Starbucks are more than coffee, it also provides handcrafted beverages, merchandise, fresh food, and other consumer products, such as coffee and Tea product and Ready-to- Drink (RTD) products. The object of the company is to maintain its position as one of the most recognized and respected brands in the world. In order to achieve this old, the company-wide strategy is to continue the disciplined expansion of their global store based. 2 Starbucks went public on June 26, 1992, when the price per share was $17, or $0.53 per share, adjusted for subsequent stock splits and closed training that first date at $ 21.50 per share c) Stock Price, market capitalization: Formed in 185, Starbucks common stock trades on the NASDAQ Global Select Market ( “ NADAQ”) under the symbol “ SBUX Market capitalization is a measurement of business value based on share rice and number of shares outstanding. It generally represents market’s view of a company’s stock value and is a determining factor in stock valuation 2. The formula is Market Capitalization= Number of Shares Outstanding * Price. I used the WRDS as a source and came up with common shares traded according to annual calendar and also close stock price for each year from 2004 to 2013 and go the company’s market capitalization with $ 92,346,169,294.08 d) Geographic breakdown of operations, sales, employees, etc: Total stores: 20,519 (as of March 30, 2014), the geographic breakdowns are all over the world, it can be mainly broken down to four operating segments: 1) Americas, inclusive of the US, Canada, and Latin America; 2) Europe, Middle East, and Africa ( “ EMEA”); 3) China/ Asian Pacific ( “ CAP”); 4) Channel Development. Segment revenues as a percentage of total revenues for fiscal year 2013 is Americans (74%), EMEA ( 8%), CAP ( 6%), Channel Development ( 9%), and all other segments (3%).The Americans, EMEA, and CAP segments include both company-operated and licensed stores, among them the Americans segments is the most mature market and achieved significant scale. By consulting the 10-K report of Starbucks from the SEC website, I found the sales of Starbucks can be divided by four categories: beverages, food, packaged and single serve coffees and coffee-making equipment and other merchandise. The retail sales mix by product type for company-operated stores by the September 29, 2013 is 74% for beverages, 20% for food, 3% packaged and single serve coffees and 3% for coffee-making equipment and other merchandise. e) Estimated cost of equity: Formula: Cost of Equity = Risk-free Rate + Beta ( Mature Market Premium + Country Risk Premium) Risk-free rates: usually use government security rates ( adjusted for default risk) = US 10-year bond ( Actual) = 2.56 % 3 . I chose 10-year US government rate as the riskfree rate is because US is a country with very low default risk and the government bond is also at a very low risk, so I just used the 10-year US government bond rate as my security rate and default rate as zero. Beta: usually estimated by regressing stock return against market returns = 0.95 4.IIt took quite long to find out the Beta of the Starbucks, so I just used the value from the yahoo finance. The weakness of using this value is that it is just a simplified number and has limited reliance. Mature Market Premium: US s typical considered a mature market; ne careful relying on historical premiums = 6.85% 5. I checked the Historical Risk Premia for the United States from used the arithmetic method and used the number 6.85% ( 1994-2003). This is a 10- year stocks –treasury bond premium rate and smooth come of the fluctuations during the period Country risk Premium: additional premium ( beyond the mature market ) added for country-specific Spread) = 7.52% . As the Starbucks has nearly all over the world, I calculated the country risk premium by calculating the average of all the counties and get the final number as 7.52%. The Cost of Equity: E(Return)= 2.56% + 0.95 ( 6.85% + 7.52%) = 16.21% f) Estimated cost of debt: Formula: Cost of Debt = Pre-tax Cost of Debt * ( 1- marginal tax rate) Current cost of Debt for Starbucks is 3.85% . This is the number that can be found on the 10K report that on the SEC website. The resource is reliable, so I think the number is valid for the calculation here Marginal tax rate: amount of tax paid on additional dollar of income ( do not simply rely on effective tax rates) = 34.5% . This is also a number that can be found on the 10 K report from the company. The cost of debt should be = 3.85% * ( 1- 34.5%) = 2.52 Reference 1. http://globalassets.starbucks.com/assets/233b9b746b384f8ca57882614f6cebdb.pd f 2. http://www.sec.gov/Archives/edgar/data/829224/000082922413000044/sbux3. 4. 5. 6. 9292013x10k.htm http://www.tradingeconomics.com/bonds https://finance.yahoo.com/q/ks?s=SBUX+Key+Statistics http://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/ctryprem.h tml http://www.sec.gov/Archives/edgar/data/829224/000082922413000044/sbux9292013x10k.htm