February 28, 2016

NYSE: VZ

VERIZON COMMUNICATIONS INC

BUY

A+

A

A-

HOLD

B+

B

Annual Dividend Rate

$2.26

B-

C+

C

Annual Dividend Yield

4.42%

SELL

C-

D+

D

Beta

0.20

Sector: Telecom

E+

E

E-

F

BUY

Market Capitalization

$208.2 Billion

SMA (50)

RATING SINCE

TARGET PRICE

52-Week Range

$38.06-$51.30

Sub-Industry: Integrated Telecommunication Services

Weekly Price: (US$)

VZ BUSINESS DESCRIPTION

Verizon Communications Inc., through its

subsidiaries, provides communications,

information, and entertainment products and

services to consumers, businesses, and

governmental agencies worldwide.

D-

03/24/2015

$59.03

Price as of 2/25/2016

$51.11

Source: S&P

SMA (100)

1 Year

2 Years

60

TARGET

TARGET

TARGETPRICE

PRICE

PRICE$59.03

$59.03

$59.03

58

55

53

STOCK PERFORMANCE (%)

3 Mo.

Price Change

13.78

1 Yr.

3.88

3 Yr (Ann)

3.78

12 Mo.

3.57

85.75

74.10

3 Yr CAGR

4.35

173.39

141.57

Ind Avg

44.29

28.29

16.82

S&P 500

12.28

14.59

13.97

50

48

GROWTH (%)

Last Qtr

3.19

341.64

344.44

Revenues

Net Income

EPS

43

Rating History

BUY

HOLD

BUY

Volume in Millions

RETURN ON EQUITY (%)

VZ

108.83

78.26

29.60

Q4 2015

Q4 2014

Q4 2013

45

2,000

1,000

2014

2015

0

2016

COMPUSTAT for Price and Volume, TheStreet Ratings, Inc. for Rating History

P/E COMPARISON

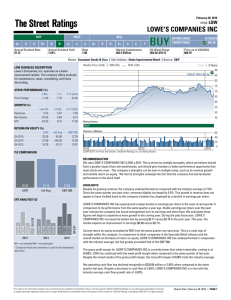

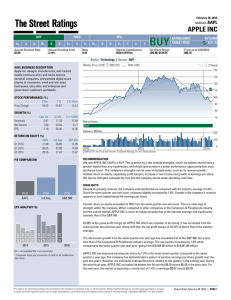

RECOMMENDATION

We rate VERIZON COMMUNICATIONS INC (VZ) a BUY. This is based on the convergence of positive

investment measures, which should help this stock outperform the majority of stocks that we rate. The

company's strengths can be seen in multiple areas, such as its compelling growth in net income, revenue

growth, notable return on equity, expanding profit margins and good cash flow from operations. We feel its

strengths outweigh the fact that the company has had generally high debt management risk by most

measures that we evaluated.

11.70

18.04

21.53

VZ

Ind Avg

S&P 500

HIGHLIGHTS

The net income growth from the same quarter one year ago has significantly exceeded that of the S&P 500

and the Diversified Telecommunication Services industry. The net income increased by 341.6% when

compared to the same quarter one year prior, rising from -$2,231.00 million to $5,391.00 million.

2014

Q4 1.32

Q3 0.99

Q2 1.04

Q1 1.02

VZ's revenue growth trails the industry average of 15.2%. Since the same quarter one year prior, revenues

slightly increased by 3.2%. Growth in the company's revenue appears to have helped boost the earnings per

share.

Q4 -0.54

Q3 0.89

Q2 1.01

Q1 1.15

Q3 0.78

2013

Q4 1.76

Q2 0.78

Q1 0.68

EPS ANALYSIS¹ ($)

2015

NA = not available NM = not meaningful

1 Compustat fiscal year convention is used for all fundamental

data items.

The company's current return on equity greatly increased when compared to its ROE from the same quarter

one year prior. This is a signal of significant strength within the corporation. Compared to other companies in

the Diversified Telecommunication Services industry and the overall market, VERIZON COMMUNICATIONS

INC's return on equity significantly exceeds that of both the industry average and the S&P 500.

The gross profit margin for VERIZON COMMUNICATIONS INC is rather high; currently it is at 57.06%. It has

increased from the same quarter the previous year. Along with this, the net profit margin of 15.73% is above

that of the industry average.

Net operating cash flow has increased to $10,504.00 million or 40.54% when compared to the same quarter

last year. Despite an increase in cash flow, VERIZON COMMUNICATIONS INC's average is still marginally

south of the industry average growth rate of 45.74%.

This report is for information purposes only and should not be considered a solicitation to buy or sell any security. Neither TheStreet Ratings nor any other party guarantees its accuracy

or makes warranties regarding results from its usage. Redistribution is prohibited without the express written consent of TheStreet Ratings. Copyright(c) 2006-2015. All rights reserved.

Report Date: February 28, 2016

PAGE 1

February 28, 2016

NYSE: VZ

VERIZON COMMUNICATIONS INC

Sector: Telecom Integrated Telecommunication Services Source: S&P

Annual Dividend Rate

$2.26

Annual Dividend Yield

4.42%

PEER GROUP ANALYSIS

AB

OR

TLK

The industry is mature, cyclical, capital intensive, and undergoing consolidation and globalization. The recent

M&A trend, ongoing regulatory liberalization, and privatization have fueled competition in local telephone

services markets and expansion into domestic and cross-border markets. The industry has high entry barriers

due to the dominance of well-established players, strong brand identities, high levels of automation, and

distribution challenges.

15%

CHU

BT

TEF

R

VO

FA

LE

AB

-25%

UN

Revenue Growth (TTM)

NTT

TI.A TI

52.5%

EBITDA Margin (TTM)

Companies with higher EBITDA margins and

revenue growth rates are outperforming companies

with lower EBITDA margins and revenue growth

rates. Companies for this scatter plot have a market

capitalization between $18.3 Billion and $229.9

Billion. Companies with NA or NM values do not

appear.

*EBITDA – Earnings Before Interest, Taxes, Depreciation and

Amortization.

V

FA

15%

T

AB

OR

BCE

CHT

VZ

NTT

CHU

BT

UN

R

VO

FA

TEF

LE

AB

-25%

The US Federal Government, through the Communications Act of 1934, established the Federal

Communications Commission to regulate and retain jurisdiction over use of the radio spectrum, interstate

telecommunications, and international communication that originates or terminates in the US. Deregulation

has occurred since the break-up of AT&T in 1982 and rendered the market more competitive. The industry is

regulated by the US Telecommunications Act of 1996 and 2005, which aims to abolish cross-market barriers

and prohibit dominant players from operating within one communications industry.

LE

TLK

Growth is driven by technological advances and demand for integrated high bandwidth data transmission.

Most companies are seeking new market segments, such as mobile communications, digital data

transmission, and value added services. The changing pace of technology implementation and convergence

of cable network technologies through bundling have redefined the competitive landscape. However, the

recent launch of cable telephony, VoIP, and improved wireless and cellular technologies pose a threat to

traditional wired telecommunication services.

Industry outlook is weak due to a significant drop in subscriber additions, shifting consumer preferences, and

a shift towards wireless connections. The government’s $7.2 billion stimulus package provides $4.7 billion to

establish a Broadband Technology Opportunities Program at NTIA for wireline, wireless, and cable

companies, and provides $2.5 billion for broadband grant, loan, and loan guarantee programs at to be used by

rural wireline telecoms and satellite providers. Service upgrades, which are supported by advanced high-end

3G and 4G networks, introduction of low-cost integrated IP voice and data networks, and the deregulation of

the industry, are likely to revive the industry from its present downturn.

REVENUE GROWTH AND EARNINGS YIELD

Revenue Growth (TTM)

Price as of 2/25/2016

$51.11

LE

VZ

TI TI.A

52-Week Range

$38.06-$51.30

The US diversified telecommunications services industry provides communications and high-density data

transmission through high bandwidth/fiber-optic cable networks. The industry is classified into two

sub-categories, alternative carriers and integrated telecommunication services. There are three parallel

markets, terrestrial networks, cellular networks, and satellite networks, which include major players such as

AT&T (T), Verizon Communications (VZ), and Centurylink (CTL).

V

FA

T

2%

Market Capitalization

$208.2 Billion

INDUSTRY ANALYSIS

REVENUE GROWTH AND EBITDA MARGIN*

27.5%

Beta

0.20

9%

Earnings Yield (TTM)

Companies that exhibit both a high earnings yield

and high revenue growth are generally more

attractive than companies with low revenue growth

and low earnings yield. Companies for this scatter

plot have revenue growth rates between -21.6% and

10.8%. Companies with NA or NM values do not

appear.

PEER GROUP: Diversified Telecommunication Services

Recent

Ticker

Company Name

Price ($)

VZ

VERIZON COMMUNICATIONS I 51.11

NTT

NIPPON TELEGRAPH & TELEPHONE 41.98

BT

BT GROUP PLC

33.86

TEF

TELEFONICA SA

10.44

BCE

BCE INC

43.04

CHU

CHINA UNICOM (HONG KONG) LTD 11.44

TLK

TELEKOMUNIKASI INDONESIA

49.54

CHT

CHUNGHWA TELECOM LTD

31.60

T

AT&T INC

37.37

TI

TELECOM ITALIA SPA

9.96

TI.A

TELECOM ITALIA SPA

8.01

Market

Cap ($M)

208,214

88,007

67,463

51,941

37,247

27,395

24,968

24,514

229,871

18,274

18,274

Price/

Earnings

11.70

15.84

15.75

22.70

14.44

19.07

23.48

18.81

15.83

38.31

30.81

Net Sales

TTM ($M)

131,620.00

94,854.48

25,678.95

52,445.75

21,514.00

44,142.04

7,017.78

7,068.92

146,801.00

22,907.44

22,907.44

Net Income

TTM ($M)

17,879.00

5,587.02

3,620.92

5,142.64

2,676.00

1,509.21

1,032.27

1,305.89

13,345.00

793.84

793.84

The peer group comparison is based on Major Integrated Telecommunication Services companies of comparable size.

This report is for information purposes only and should not be considered a solicitation to buy or sell any security. Neither TheStreet Ratings nor any other party guarantees its accuracy

or makes warranties regarding results from its usage. Redistribution is prohibited without the express written consent of TheStreet Ratings. Copyright(c) 2006-2015. All rights reserved.

Report Date: February 28, 2016

PAGE 2

February 28, 2016

NYSE: VZ

VERIZON COMMUNICATIONS INC

Sector: Telecom Integrated Telecommunication Services Source: S&P

Annual Dividend Rate

$2.26

Annual Dividend Yield

4.42%

Beta

0.20

Market Capitalization

$208.2 Billion

52-Week Range

$38.06-$51.30

Price as of 2/25/2016

$51.11

COMPANY DESCRIPTION

Verizon Communications Inc., through its subsidiaries,

provides communications, information, and

entertainment products and services to consumers,

businesses, and governmental agencies worldwide. The

company's Wireless segment offers wireless voice and

data services; messaging services; service that enables

its customers to access the Internet on smartphones,

basic phones, notebook computers, and tablets;

customers and business-focused multimedia offerings;

location-based services; global data services; LTE

Internet, a high-speed Internet service; and network

access and value added services to support

telemetry-type applications. It also offers

machine-to-machine services that support devices used

in health monitoring, education, manufacturing, utilities,

distribution, and consumer products markets, as well as

offers smartphones and basic phones, tablets, and other

Internet access devices. As of October 12, 2015, it had

109.5 million retail connections. Its Wireline segment

provides high-speed Internet, FiOS Internet, and FiOS

Video services; voice services, such as local exchange,

regional and long distance calling, and voice messaging

services, as well as VOIP services; private Internet

protocol and Ethernet access and optical services; and

Internet protocol, infrastructure and cloud services,

machine-to-machine services, security, and other

communications services. It also offers voice and data

services, such as conferencing and contact center

solutions, and private line and data access networks, as

well as customer premise equipment, installation,

maintenance, and site services; and data, voice, local

dial tone, and broadband services primarily to local, long

distance, and other carriers. The company has a strategic

partnership with AdMobilize. The company was formerly

known as Bell Atlantic Corporation and changed its name

to Verizon Communications Inc. in June 2000. Verizon

Communications Inc. was founded in 1983 and is based

in New York, New York.

STOCK-AT-A-GLANCE

Below is a summary of the major fundamental and technical factors we consider when determining our

overall recommendation of VZ shares. It is provided in order to give you a deeper understanding of our rating

methodology as well as to paint a more complete picture of a stock's strengths and weaknesses. It is

important to note, however, that these factors only tell part of the story. To gain an even more comprehensive

understanding of our stance on the stock, these factors must be assessed in combination with the stock’s

valuation. Please refer to our Valuation section on page 5 for further information.

VERIZON COMMUNICATIONS INC

1095 Avenue of the Americas

New York, NY 10036

USA

Phone: 212-395-1000

http://www.verizon.com

THESTREET RATINGS RESEARCH METHODOLOGY

FACTOR

SCORE

5.0

Growth

out of 5 stars

weak

Measures the growth of both the company's income statement and

cash flow. On this factor, VZ has a growth score better than 90% of the

stocks we rate.

strong

5.0

Total Return

out of 5 stars

weak

Measures the historical price movement of the stock. The stock

performance of this company has beaten 90% of the companies we

cover.

strong

5.0

Efficiency

out of 5 stars

weak

Measures the strength and historic growth of a company's return on

invested capital. The company has generated more income per dollar of

capital than 90% of the companies we review.

strong

4.5

Price volatility

out of 5 stars

weak

Measures the volatility of the company's stock price historically. The

stock is less volatile than 80% of the stocks we monitor.

strong

5.0

Solvency

out of 5 stars

weak

Measures the solvency of the company based on several ratios. The

company is more solvent than 90% of the companies we analyze.

strong

4.5

Income

out of 5 stars

weak

Measures dividend yield and payouts to shareholders. The company's

dividend is higher than 80% of the companies we track.

strong

TheStreet Ratings' stock model projects a stock's total return potential over a 12-month period including both

price appreciation and dividends. Our Buy, Hold or Sell ratings designate how we expect these stocks to

perform against a general benchmark of the equities market and interest rates. While our model is

quantitative, it utilizes both subjective and objective elements. For instance, subjective elements include

expected equities market returns, future interest rates, implied industry outlook and forecasted company

earnings. Objective elements include volatility of past operating revenues, financial strength, and company

cash flows.

Our model gauges the relationship between risk and reward in several ways, including: the pricing drawdown

as compared to potential profit volatility, i.e.how much one is willing to risk in order to earn profits; the level of

acceptable volatility for highly performing stocks; the current valuation as compared to projected earnings

growth; and the financial strength of the underlying company as compared to its stock's valuation as

compared to projected earnings growth; and the financial strength of the underlying company as compared

to its stock's performance. These and many more derived observations are then combined, ranked, weighted,

and scenario-tested to create a more complete analysis. The result is a systematic and disciplined method of

selecting stocks.

This report is for information purposes only and should not be considered a solicitation to buy or sell any security. Neither TheStreet Ratings nor any other party guarantees its accuracy

or makes warranties regarding results from its usage. Redistribution is prohibited without the express written consent of TheStreet Ratings. Copyright(c) 2006-2015. All rights reserved.

Report Date: February 28, 2016

PAGE 3

February 28, 2016

NYSE: VZ

VERIZON COMMUNICATIONS INC

Sector: Telecom Integrated Telecommunication Services Source: S&P

Annual Dividend Rate

$2.26

Annual Dividend Yield

4.42%

Consensus EPS Estimates² ($)

IBES consensus estimates are provided by Thomson Financial

1.06

3.99 E

4.10 E

Q1 FY16

2016(E)

2017(E)

Market Capitalization

$208.2 Billion

52-Week Range

$38.06-$51.30

Price as of 2/25/2016

$51.11

FINANCIAL ANALYSIS

VERIZON COMMUNICATIONS INC's gross profit margin for the fourth quarter of its fiscal year 2015 is

essentially unchanged when compared to the same period a year ago. The company has grown sales and net

income during the past quarter when compared with the same quarter a year ago, however, it was unable to

keep up with the growth of the average competitor within its industry. VERIZON COMMUNICATIONS INC has

weak liquidity. Currently, the Quick Ratio is 0.53 which shows a lack of ability to cover short-term cash needs.

The company's liquidity has decreased from the same period last year.

At the same time, stockholders' equity ("net worth") has greatly increased by 33.58% from the same quarter

last year. Overall, the key liquidity measurements indicate that the company is in a position in which financial

difficulties could develop in the future.

STOCKS TO BUY: TheStreet Quant Ratings has identified a handful of stocks that can potentially TRIPLE in the

next 12-months. To learn more visit www.TheStreetRatings.com.

INCOME STATEMENT

Net Sales ($mil)

EBITDA ($mil)

EBIT ($mil)

Net Income ($mil)

Beta

0.20

Q4 FY15

34,254.00

13,783.00

9,744.00

5,391.00

Q4 FY14

33,192.00

1,932.00

-2,136.00

-2,231.00

Q4 FY15

5,070.00

244,640.00

110,194.00

16,428.00

Q4 FY14

11,153.00

232,708.00

113,271.00

12,298.00

Q4 FY15

57.06%

40.23%

28.45%

0.54

7.30%

108.83%

Q4 FY14

56.61%

5.82%

-6.44%

0.55

4.13%

78.26%

Q4 FY15

0.64

0.87

1,357.00

7.18

Q4 FY14

1.06

0.90

1,334.00

-1.60

Q4 FY15

4,073

0.57

1.32

4.03

NA

17,744,808

Q4 FY14

4,155

0.55

-0.54

2.96

NA

13,664,092

BALANCE SHEET

Cash & Equiv. ($mil)

Total Assets ($mil)

Total Debt ($mil)

Equity ($mil)

PROFITABILITY

Gross Profit Margin

EBITDA Margin

Operating Margin

Sales Turnover

Return on Assets

Return on Equity

DEBT

Current Ratio

Debt/Capital

Interest Expense

Interest Coverage

SHARE DATA

Shares outstanding (mil)

Div / share

EPS

Book value / share

Institutional Own %

Avg Daily Volume

2 Sum of quarterly figures may not match annual estimates due to

use of median consensus estimates.

This report is for information purposes only and should not be considered a solicitation to buy or sell any security. Neither TheStreet Ratings nor any other party guarantees its accuracy

or makes warranties regarding results from its usage. Redistribution is prohibited without the express written consent of TheStreet Ratings. Copyright(c) 2006-2015. All rights reserved.

Report Date: February 28, 2016

PAGE 4

February 28, 2016

NYSE: VZ

VERIZON COMMUNICATIONS INC

Sector: Telecom Integrated Telecommunication Services Source: S&P

Annual Dividend Rate

$2.26

Annual Dividend Yield

4.42%

RATINGS HISTORY

Our rating for VERIZON COMMUNICATIONS INC

has not changed since 3/24/2015. As of 2/25/2016,

the stock was trading at a price of $51.11 which is

.4% below its 52-week high of $51.30 and 34.3%

above its 52-week low of $38.06.

BUY: $49.41

HOLD: $47.15

BUY: $46.29

2 Year Chart

Market Capitalization

$208.2 Billion

$50

Price/Earnings

$48

2015

1

2

3

5

1

2

3

4

5

Price reflects the closing price as of the date listed, if available

RATINGS DEFINITIONS &

DISTRIBUTION OF THESTREET RATINGS

Price/Book

(as of 2/25/2016)

32.19% Buy - We believe that this stock has the

opportunity to appreciate and produce a total return of

more than 10% over the next 12 months.

35.29% Hold - We do not believe this stock offers

conclusive evidence to warrant the purchase or sale of

shares at this time and that its likelihood of positive total

return is roughly in balance with the risk of loss.

32.52% Sell - We believe that this stock is likely to

decline by more than 10% over the next 12 months, with

the risk involved too great to compensate for any

possible returns.

TheStreet Ratings

14 Wall Street, 15th Floor

New York, NY 10005

www.thestreet.com

Research Contact: 212-321-5381

Sales Contact: 866-321-8726

2

3

premium

4

5

Price/Sales

1

2

premium

3

4

5

Price to Earnings/Growth

4

5

discount

1

2

3

premium

4

5

discount

VZ NM

Peers 0.78

• Neutral. The PEG ratio is the stock’s P/E divided by

the consensus estimate of long-term earnings

growth. Faster growth can justify higher price

multiples.

• VZ's negative PEG ratio makes this valuation

measure meaningless.

Earnings Growth

1

2

3

4

lower

5

higher

VZ 74.10

Peers 42.47

• Higher. Elevated earnings growth rates can lead to

capital appreciation and justify higher

price-to-earnings ratios.

• VZ is expected to have an earnings growth rate that

significantly exceeds its peers.

Sales Growth

discount

VZ 1.58

Peers 1.67

• Average. In the absence of P/E and P/B multiples,

the price-to-sales ratio can display the value

investors are placing on each dollar of sales.

• VZ is trading at a valuation on par with its industry

on this measurement.

3

VZ 5.35

Peers 5.97

• Discount. The P/CF ratio, a stock’s price divided by

the company's cash flow from operations, is useful

for comparing companies with different capital

requirements or financing structures.

• VZ is trading at a discount to its peers.

discount

VZ 12.67

Peers 7.82

• Premium. A higher price-to-book ratio makes a

stock less attractive to investors seeking stocks

with lower market values per dollar of equity on the

balance sheet.

• VZ is trading at a significant premium to its peers.

2

premium

discount

VZ 12.47

Peers 16.72

• Discount. A lower price-to-projected earnings ratio

than its peers can signify a less expensive stock or

lower future growth expectations.

• VZ is trading at a discount to its peers.

1

1

Price/CashFlow

discount

premium

To

Buy

Hold

Buy

4

VZ 11.70

Peers 18.04

• Discount. A lower P/E ratio than its peers can

signify a less expensive stock or lower growth

expectations.

• VZ is trading at a significant discount to its peers.

Price/Projected Earnings

From

Hold

Buy

Buy

Price as of 2/25/2016

$51.11

$53

premium

MOST RECENT RATINGS CHANGES

Date

Price

Action

3/24/15

$49.41

Upgrade

1/23/15

$47.15 Downgrade

2/25/14

$46.29 No Change

52-Week Range

$38.06-$51.30

VALUATION

BUY. This stock's P/E ratio indicates a discount compared to an average of 18.04 for the Diversified

Telecommunication Services industry and a discount compared to the S&P 500 average of 21.53. For

additional comparison, its price-to-book ratio of 12.67 indicates a significant premium versus the S&P 500

average of 2.56 and a significant premium versus the industry average of 7.82. The price-to-sales ratio is

below both the S&P 500 average and the industry average, indicating a discount. The valuation analysis

reveals that, VERIZON COMMUNICATIONS INC seems to be trading at a discount to investment alternatives

within the industry.

$45

2014

Beta

0.20

1

2

3

lower

4

5

higher

VZ 3.57

Peers 1.43

• Higher. A sales growth rate that exceeds the

industry implies that a company is gaining market

share.

• VZ has a sales growth rate that significantly

exceeds its peers.

DISCLAIMER:

The opinions and information contained herein have been obtained or derived from sources believed to be reliable, but

TheStreet Ratings cannot guarantee its accuracy and completeness, and that of the opinions based thereon. Data is provided

via the COMPUSTAT® Xpressfeed product from Standard &Poor's, a division of The McGraw-Hill Companies, Inc., as well as

other third-party data providers.

TheStreet Ratings is a division of TheStreet, Inc., which is a publisher. This research report contains opinions and is provided

for informational purposes only. You should not rely solely upon the research herein for purposes of transacting securities or

other investments, and you are encouraged to conduct your own research and due diligence, and to seek the advice of a

qualified securities professional, before you make any investment. None of the information contained in this report constitutes,

or is intended to constitute a recommendation by TheStreet Ratings of any particular security or trading strategy or a

determination by TheStreet Ratings that any security or trading strategy is suitable for any specific person. To the extent any of

the information contained herein may be deemed to be investment advice, such information is impersonal and not tailored to the

investment needs of any specific person. Your use of this report is governed by TheStreet, Inc.'s Terms of Use found at

http://www.thestreet.com/static/about/terms-of-use.html.

This report is for information purposes only and should not be considered a solicitation to buy or sell any security. Neither TheStreet Ratings nor any other party guarantees its accuracy

or makes warranties regarding results from its usage. Redistribution is prohibited without the express written consent of TheStreet Ratings. Copyright(c) 2006-2015. All rights reserved.

Report Date: February 28, 2016

PAGE 5