BF3201

CORPORATE FINANCE AND STRATEGY

_________________________________________________________________________

Course Description and Scope

The first part of the course deals with fundamental issues of corporate finance, including corporate

governance, capital structure, and dividend policies. The second part of the course builds on and

extends the concepts covered in the first part by examining valuation issues in various contexts, such

as capital budgeting, IPO, mergers and acquisitions, corporate restructuring, and risk management.

Course Learning Objective

Acquisition of knowledge:

Students should be able to understand and apply principles of corporate finance.

Teamwork and Interpersonal Skills

Students work as a team on case reports.

Communication skills

Develop skills in analyzing and presenting case studies in class.

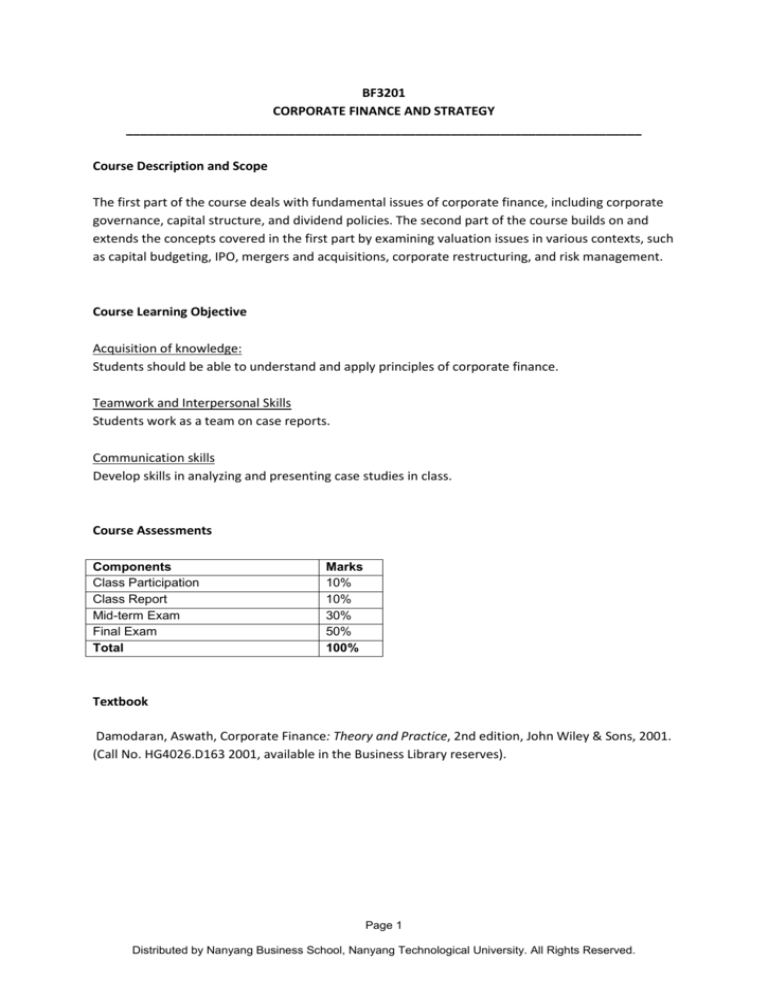

Course Assessments

Components

Class Participation

Class Report

Mid-term Exam

Final Exam

Total

Marks

10%

10%

30%

50%

100%

Textbook

Damodaran, Aswath, Corporate Finance: Theory and Practice, 2nd edition, John Wiley & Sons, 2001.

(Call No. HG4026.D163 2001, available in the Business Library reserves).

Page 1

Distributed by Nanyang Business School, Nanyang Technological University. All Rights Reserved.

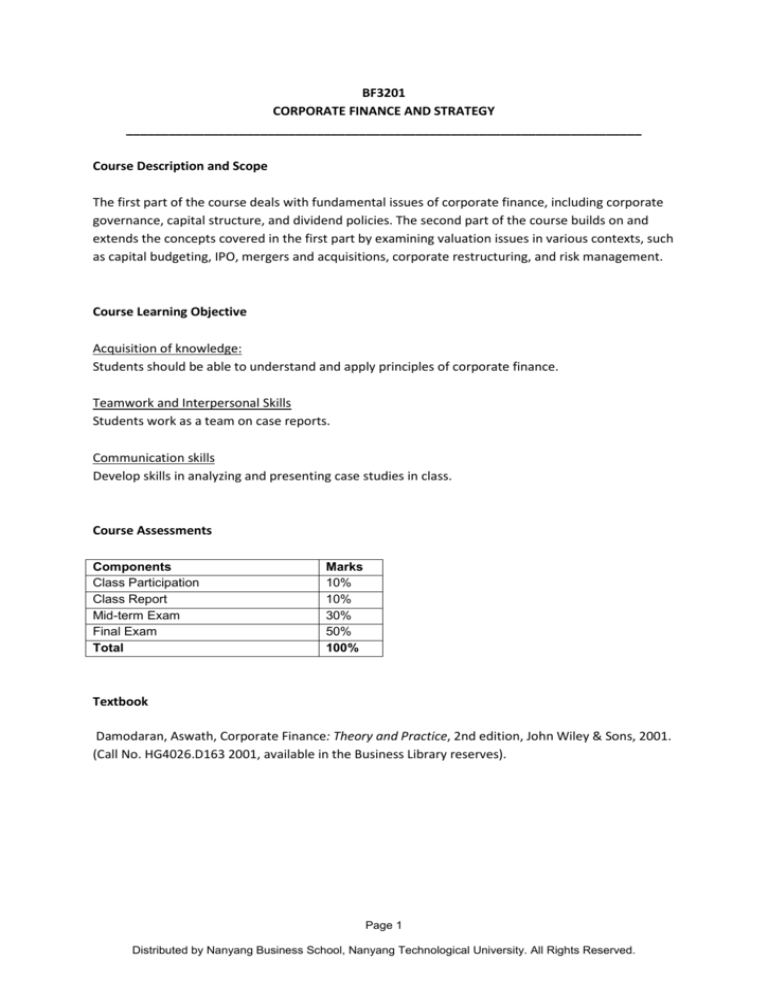

Proposed Weekly Schedule

Week

Topic

1

Corporate governance

2

Risk and hurdle rates

4

Capital structure

5

Capital structure

6

Dividend Policy

7

Mid-term Exam

8

Valuation in Capital budgeting

9

Valuation in Public Offering

10

Valuation in Merger and Acquisition

11

Valuation in Corporate Restructuring

12

Hubris in Valuation

13

Risk Management and Conclustions

Page 2

Distributed by Nanyang Business School, Nanyang Technological University. All Rights Reserved.