Corporate Finance

advertisement

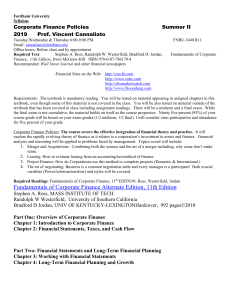

Corporate Finance Course for the Master’s Level Course description The syllabus for the Corporate Finance course is prepared specifically for the students of the Master Program in Economics Department of NSU in order to equip them with a framework and basic tools and techniques necessary to understand and make financial and investment decisions. This course examines important issues in corporate finance from the perspective of financial managers who are responsible for making financial and investment decisions. The course develops theoretical framework for understanding and analyzing major financial problems of modern company in market environment. Topics of the course are as follows: Corporate and Financial Manager; Financial Statements; The Time Value of Money; Bond Valuation; Stock Valuation; Risk and Return; Capital Structure and Cost of Capital; Dividends and Dividend Policy; Corporate Control, Mergers & Acquisitions. Course objectives To develop the knowledge of a theoretical framework in corporate finance in the modern economy. To teach the fundamental methods and skills of finance vital for understanding valuation of any asset, personal or corporate. To prepare students to make sound personal and professional decisions. To create capacity to understand the theory and apply the techniques developed in corporate finance in real situations. To provide students with a better understanding of the role of finance in discussions on corporate and public policy. Assessment The student’s performance in the Corporate Finance course will be evaluated on the basis of the following: Written homework (30%). Participation in lectures and practice sessions including answers to questions, short presentations of homework exercises or reading assignments (30%). Final examination (40%). Main reading 1. Ross S., Westerfield R., Jordan B. Essentials of Corporate Finance, 2008. 2. Richard A. Brealey, Steward C. Meyers, Franklin Allen. Principles of Corporate Finance. 10th Edition, 2011.