Learning Outcomes

advertisement

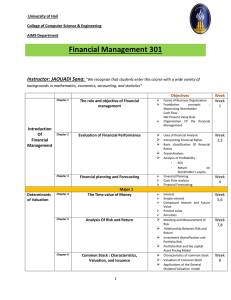

FINC 6141: Financial Policies Learning Outcomes 1. Demonstrate an understanding of the goal of financial management, the existence of agency problems and some methods for resolving agency problems 2. Demonstrate an understanding of Capital Market Efficiency, its different forms and implication for financial management 3. Demonstrate an understanding and analysis of financial statements for financial decision-making 4. Demonstrate an understanding of the time value of money and its implications for financial decision-making 5. Demonstrate an understanding of the risk-return framework of financial decision-making, the difference between stand-alone and market risks, the concept, calculation and application of betas in the Capital Asset and other Asset Pricing Models to make investment decisions 6. Demonstrate an understanding of the valuation of bonds (fixed-rate and zerocoupon), preferred stocks and dividend-paying common stocks with zero, constant and non-constant growth 7. Demonstrate the following competencies regarding capital budgeting decisions: understanding of the Weighted Average Cost of Capital and how to compute and use it in capital budgeting; make capital budgeting decisions (with and without capital rationing) using techniques like Accounting Rate of Return, Payback, Discounted Payback, Net Present value, Internal Rate of Return, Modified Internal Rate of Return and Profitability Index; evaluate risk of capital projects using the Pure Play Method 8. Demonstrate an understanding of alternate models on the effect of capital structure on a firm’s value and how to find the optimum capital structure 9. Demonstrate an understanding of alternate models on the effect of dividend policies on a firm’s value and some practical application of the Residual Dividend Policy Model 10. Demonstrate an understanding of the relevance of working capital in financial management; the close relationship between working capital policies and management and firm valuation; the Cash Conversion Cycle and its application For the management of the various components of working capital 11. Demonstrate an understanding of Mergers and Acquisitions, and their social, economic and ethical consequences