Introduction to Finance

advertisement

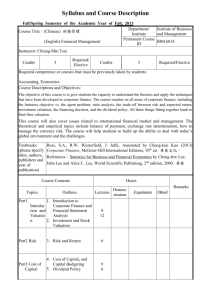

Introduction to Finance Welcome Nisan Langberg nlangberg@uh.edu Office 210E Teaching Assistant PJ Pritzker pjpritzker@gmail.com Goal Equip students with the basic tools necessary for making efficient financial decisions while taking into account future cash flows and their risk. Methodology Students will master the required theoretical tools and apply them to day-to-day decision of individuals (saving/retirement/mortgage…) outline • Logistics • Course schedule Logistics Class Material On our website http://www.bauer.uh.edu/nlangberg/teaching_635.htm Text book I will teach and assign problems using the book Corporate Finance by Jonathan Berk and Peter DeMarzo, Perason Alternative Reading Further/alternative reading is Brealey, Myers and Allen, Principals of Corporate Finance, McGraw-Hill Irwin, 8th edition or higher Buying the book? I do recommend buying the book • The course is built around the text book • Excellent reference book for those to plan to work in the area of corporate finance • Taught in leading B schools around the world Group Assignments • I encourage work in groups • Groups are limited to four students Grade • Homework assignments: 30% • Final exam: 70% Office hours • appointment by email • welcome to stop by my office • Send specific questions by email Course Schedule (tentative) Course schedule Wednesday and Thursday classes August 27/28 September 3/4 Introduction Time value of money (chapters 3.1-3.3 and 4) • Future value • present value • discounting stream of cash flows Time value of money continued • Annuities, perpetuities, growing annuities and growing perpetuities • Saving for retirement • Mortgage Course schedule September 10/11 Review of Time value of money with TA • Review of basic discounting principals • Solution of homework questions in class • Additional advanced practice questions Practice questions CH3,4 due September 17/18 Interest rates (chapter 5) • APR, EAR, Amortizing loans • Nominal and Real interest rates • The Term Structure of Interest Rates Basics of Bond Valuation (chapter 6) • Type of bonds • Structure of bonds • valuation Course schedule September 24/25 Investment Decision Rules (chapter 7) • NPV, Payback period, IRR, EVA • Multiple investment opportunities • Resource constraints, Profitability Index Practice Questions CH5/6 due October 1/2 Stock Valuation (chapter 9) • Investing in stocks • The Constant Dividend Growth model • The dividend and growth tradeoff • Changing growth rates • Application: ebay Practice questions CH7 due Course schedule October 8/9 Pricing Risk (chapter 10) • Risk and return • Expected return, Volatility • Calculating realized returns • Excess returns • Systematic and Idiosyncratic risk • Diversification • CAPM Practice questions CH9 due October 11 Make up class (Saturday) 9:00-12:00 October 15/16 Final 6:00-9:00 Questions before we start?