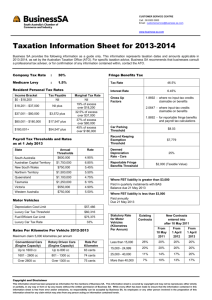

Taxation Information Sheet 2013

advertisement

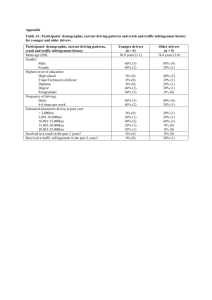

Taxation Information Sheet 2013 Company Tax rate: 30% Payroll Tax 2014 Personal Tax rates - 2013 & Onwards: Income Bracket Tax Payable $0 - $18,200 Nil $18,201 $37,000 Nil plus $37,001 $80,000 $80,000 $180,000 $3,572 plus $180,001 + Marginal Tax Rate Nil 19% over $18,200 $17,547 plus 32.5% over $37,000 37% over $80,000 $54,547 45% over $180,000 Threshold Rate $600,000 4.95% Threshold State South Australia Australian Capital Territory $1,750,000 6.85% $75,000 New South Wales $750,000 5.45% $406,000 Northern Territory Queensland $1,500,000 5.50% $1,100,000 4.75% $1,250,000 6.10% $550,000 4.9% $800,000 5.50% Tasmania Medicare Levy: 1.5% Medicare Levy 2015: 2% Victoria Division 7A 2013 – 7.05% TD 2012/15 Western Australia Medical Expense Tax Offset ATI< $84k singles or $168k families: 20% of net eligible expenses > $2,120 Phased out 1/07/13: Eligible if claimed in prior FY Method Cents per Kilometre 1/3 actual expenses 12% of MV Cost Logbook Private Health Insurance Rebate <$84k 30% 35% 40% $84,001$97,000 20% 25% 30% MV Rates per Kilometre 2013 Convention Rotary Engine Cars Up to 1600cc Up to 800cc 1601 -2600cc 801 – 1300cc Over 2600cc Over 1300cc $97,001$130k 10% 15% 20% Rate per Kilometre 63 cents 74 cents 75 cents Motor Vehicle depreciation cost limit: 2013- $57,466. (Excl GST) 2014 - $59,133 (Excl GST) Non SBE effective life assets: TR 2012/2 $316,000 $600,000 $24,999 $250,000 $300,000 Motor Vehicle ATI> $84k singles or $168k families: 10% of net eligible expenses >$5,000 Single Age <65 65-69 70+ Land Tax 2013 >$130k 0% 0% 0% Requirement Max claim 5,000km > 5,000 business km > 5,000 business km Logbook for 12 continuous weeks 2013 SBE Depreciation Pools Amount < $6,500 excl MV ≤ $5,000 MV Rate Write Off Written Off, then allocated to general pool for remaining balance >$5,000 ≥ $6,500 General Pool 15% first year then 30% every year • 2013 General pool =2012 general and long life pool (No long-life pool in 2013) • Open general pool balance < $6,500 balance can be written off. s328-210. Small Business Entity • Less than $2 million annual Turnover • $6 million net asset test (CGT only) Superannuation tax rate: 15% Individuals with TY > $300,000. 30% tax on concessional superannuation contributions. Div 293 Superannuation Guarantee Contributions Minimum/ Maximum Salary Age Limit 2013 2014 Minimum salary month Maximum salary Amount Superannuation Lump Sum < 70 – Salary sacrifice, concessional member 70-75 – Mandated only < 75 – Salary sacrifice, concessional member 75 & > – Mandated only $450 2013 - $45,750 quarter $183,000 year 2014 - $48,040 quarter $192,160 year SGC Rates Period 1 July 2012 - 30 June 2013 1 July 2013 - 30 June 2014 1 July 2014 - 30 June 2015 1 July 2015 - 30 June 2016 1 July 2016 - 30 June 2017 1 July 2017 - 30 June 2018 1 July 2018 - 30 June 2019 1 July 2019 - 30 June 2020 and onwards Transition to Retirement • Must meet preservation age • Minimum pension 3% • Maximum pension 10% • Pension not rounded to nearest $10 SGC Rate 9% 9.25% 9.5% 10% 10.5% 11% 11.5% 12% Superannuation Contributions Contribution Type Maximum amount Concessional 2013 - $25,000 All ages 2014 - < 60 $25,000 - > 60 $35,000 Non-concessional $150,000 Non concessional $450,000 ≤ 65 yrs. Bring forward rule Minimum pension rate Age Percentage of account balance 2012 & 2013 Onwards Under 65 3% 4% 65 – 74 3.75% 5% 75 – 79 4.5% 6% 80 – 84 5.25% 7% 85 – 89 6.75% 9% 90 – 94 8.25% 11% 95 or older 10.5% 14% • Rounded to the nearest $10 Age 0 - 54 55 – 59 Tax free component Tax Rate Nil Nil Taxable Component Tax Rate 20% Nil for $0 - $175,000 15% for $175,001+ 60 + Nil Nil Preservation Age Date of Birth Before 01/07/1960 01/07/1960 – 30/06/1961 01/07/1961 – 30/06/1962 01/07/1962 – 30/06/1963 01/07/1963 – 30/06/1964 01/07/1964 and later Preservation Age 55 56 57 58 59 60 Fringe Benefits Tax Interest Rate 1/4/13 Gross Up factor Deemed Depreciation rate on MV 6.45% TD2013/8 Type 1: 2.0647 Type 2: 1.8692 25% Motor Vehicle Statutory Rate Distance travelled Before 10/5/11 From 1/4/12 From 1/4/13 From 1/4/14 0– 15,000km 0.26 0.20 0.20 0.20 15,000 – 25,000km 0.20 0.20 0.20 0.20 25,000 – 40,000km 0.11 0.17 0.20 0.20 > 40,000km 0.07 0.13 0.17 0.20 Old rates used for existing commitments

![[Insert DD Month YYYY] [Insert Client Name] [Insert Client Position](http://s3.studylib.net/store/data/008961031_1-9a680caec907673272a1c092ea3671af-300x300.png)