2006 Facts & Figures

advertisement

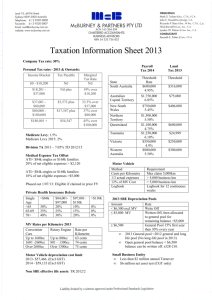

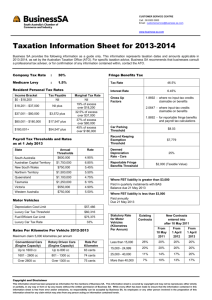

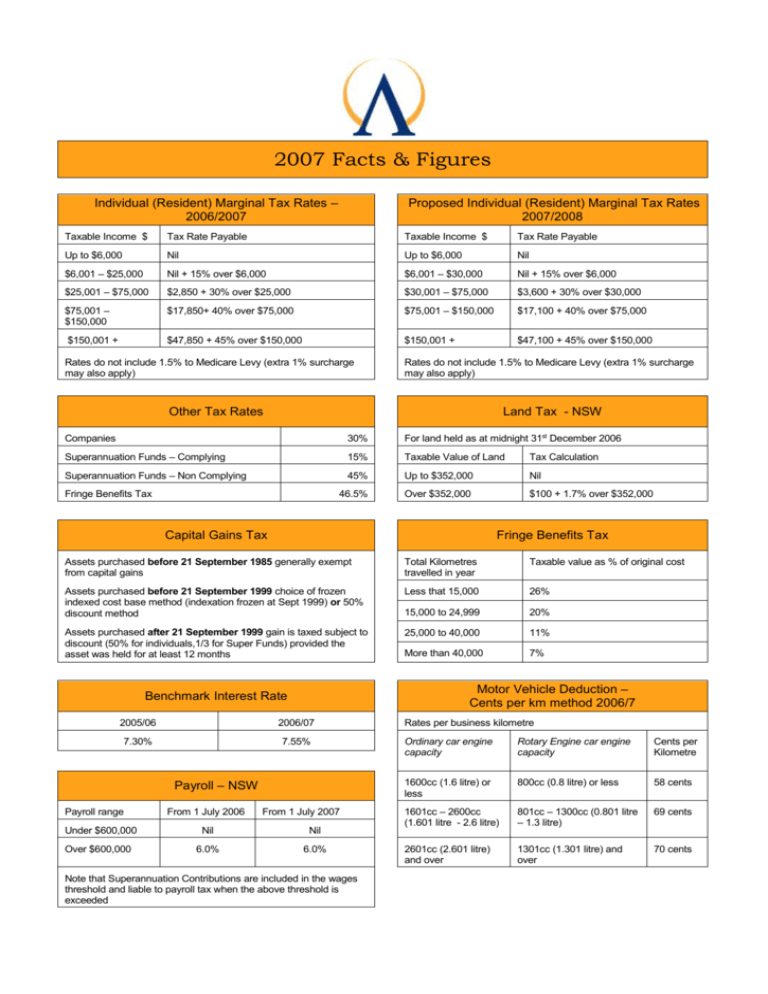

2007 Facts & Figures Individual (Resident) Marginal Tax Rates – 2006/2007 Proposed Individual (Resident) Marginal Tax Rates 2007/2008 Taxable Income $ Tax Rate Payable Taxable Income $ Tax Rate Payable Up to $6,000 Nil Up to $6,000 Nil $6,001 – $25,000 Nil + 15% over $6,000 $6,001 – $30,000 Nil + 15% over $6,000 $25,001 – $75,000 $2,850 + 30% over $25,000 $30,001 – $75,000 $3,600 + 30% over $30,000 $75,001 – $150,000 $17,850+ 40% over $75,000 $75,001 – $150,000 $17,100 + 40% over $75,000 $150,001 + $47,850 + 45% over $150,000 $150,001 + $47,100 + 45% over $150,000 Rates do not include 1.5% to Medicare Levy (extra 1% surcharge may also apply) Rates do not include 1.5% to Medicare Levy (extra 1% surcharge may also apply) Other Tax Rates Land Tax - NSW Companies 30% For land held as at midnight 31st December 2006 Superannuation Funds – Complying 15% Taxable Value of Land Tax Calculation Superannuation Funds – Non Complying 45% Up to $352,000 Nil 46.5% Over $352,000 $100 + 1.7% over $352,000 Fringe Benefits Tax Capital Gains Tax Fringe Benefits Tax Assets purchased before 21 September 1985 generally exempt from capital gains Total Kilometres travelled in year Taxable value as % of original cost Assets purchased before 21 September 1999 choice of frozen indexed cost base method (indexation frozen at Sept 1999) or 50% discount method Less that 15,000 26% 15,000 to 24,999 20% Assets purchased after 21 September 1999 gain is taxed subject to discount (50% for individuals,1/3 for Super Funds) provided the asset was held for at least 12 months 25,000 to 40,000 11% More than 40,000 7% Motor Vehicle Deduction – Cents per km method 2006/7 Benchmark Interest Rate 2005/06 2006/07 7.30% 7.55% Payroll – NSW Payroll range From 1 July 2006 From 1 July 2007 Under $600,000 Nil Nil Over $600,000 6.0% 6.0% Note that Superannuation Contributions are included in the wages threshold and liable to payroll tax when the above threshold is exceeded Rates per business kilometre Ordinary car engine capacity Rotary Engine car engine capacity Cents per Kilometre 1600cc (1.6 litre) or less 800cc (0.8 litre) or less 58 cents 1601cc – 2600cc (1.601 litre - 2.6 litre) 801cc – 1300cc (0.801 litre – 1.3 litre) 69 cents 2601cc (2.601 litre) and over 1301cc (1.301 litre) and over 70 cents Maximum Deductible Superannuation Contributions Superannuation Guarantee Year 2005/06 2006/07 Minimum rate 9% 9% Maximum rate $33,720 $35,240 No Superannuation Guarantee payable if earnings are less that $450 in a month Employed Age of Member 2006/07 Self Employed $5,000 + 75% Rule 100% claimable 2007/08 2006/07 2006/07 Under 35 $ 15,260 $ 50,000 $ 18,680 $ 50,000 35 to 49 $ 42,385 $ 50,000 $ 54,846 $ 50,000 50 & over $ 105,113 $ 100,000 $ 138,484 $ 100,000 Minimum Pension Factors Age Government Co-Contribution 2007/08 55-64 4% 65-74 5% 75-79 6% Assessable Income and Reportable Fringe Benefits (AI) Co-Contribution 2006/07 Less than or equal to $28,000 Lesser of: eligible personal contributions x 150% and $1500 More than $28,000 but less than $58,000 Lesser of: eligible personal contributions x 150% or $1,500 reduced by 5c per $1 of AI over $28,000 80-84 7% 85-89 9% 90-94 11% $58,000 or more 95 or greater 14% Thresholds will be indexed annually in line with AWOTE from 1 July 2007 That is: $1,500-[(AI-$28,000) x 5%] No maximum amount for 2007/8 Nil From 1/7/2007 Self employed people may be able to receive the Co-Contribution Other conditions include that the contributor: Reasonable Benefit Limit (need to check) 2005/06 Min 10% employment or self employment income Make the contribution to a complying superannuation fund or RSA Be less than age 75 at the end of the income year Not hold an eligible temporary residents visa at any time during the year 2006/07 Lump Sum RBL Pension RBL $648,946 $678,149 $1,297,886 $1,356,291 Bona-fide Redundancy & Approved Early Retirement Scheme Tax Free Amount Eligible Termination Payment Lump Sum Rates 2006/07 2005/6 2006/07 Undeducted Contributions Exempt Base Amount $6,491 $6783 Post 1/7/94 Invalidity component Exempt Additional amount for each year $3,246 $3392 Concessional Component 5% at Marginal Tax Rate Pre 1/7/83 Component 5% at Marginal Tax Rate Age Amount Taxed Element Untaxed Element Up to a Deceased’s Pension RBL Under 55 All 20% 30% Paid to a Dependent Post 83 Component: 55 & Over Excessive Component Death Benefits Superannuation Payments 2006/07 45% First $135,590 Over $135,590 0% 15% 15% 30% Tax Rate plus 1.5% Medicare Levy Nil Paid to a Non-Dependent Pre 01/07/1983 component 5% at Marginal Tax Rate Post 30/06/1983 – ‘taxed’ 15% Post 30/06/1983 – ‘untaxed’ 30% Excess benefits above Pension RBL 45%