Executive Summary

advertisement

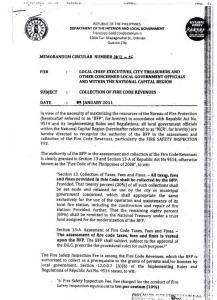

EXECUTIVE SUMMARY A. INRODUCTION The Bureau of Fire Protection (BFP) was created by virtue of Republic Act No. 6975, otherwise known as the “Department of the Interior and Local Government Act of 1990”. It is a line agency under the DILG with a vision of creating a modernized, efficient and responsive national protection agency fully equipped and manned by highly trained officers and men with capability, initiative and foresight in the fulfilment of duty. It is mandated to prevent and suppress all destructive fires on buildings, houses and other structures, forest, land transportation vehicles and equipment, seaports, petroleum industry installations, plane crashes and other similar incidents, as well as the enforcement of the Fire Code of the Philippines and other related laws. It also has the power to investigate all cases of fire incidents, and if necessary file complaints with the proper courts, and assist the Armed Forces of the Philippines in meeting national emergency. In addition to its main task of protecting the communities from destructive fires, the bureau is also mandated to collect fire code fees. As of December 31, 2012, the bureau reported total collections of P 879.522 million an increase of 10.7 percent from previous year’s collection of P 785.734 million. These collections are intended to be used for the modernization of the BFP, including the acquisition and improvement of facilities and purchase of fire trucks, fire fighting equipment, emergency and rescue equipment. The BFP is headed by CSUPT Carlito S. Romero, Officer-in-Charge and concurrent Chief Directorate for Plans and Standards Development. Assisting him are the Deputy Fire Chiefs for Operations, the Chief Directorial Staff (CDS) and Chiefs of Directorates. It has 17 regional offices headed by Regional Director (RD)/Assistant Regional Directors (ARD) and Provincial, City and Municipal Fire Marshal who supervises the provincial, city and municipal fire stations, respectively. For CY 2012, the BFP has a manpower complement of 16,252 composed of 15,782 uniformed personnel and 470 civilian employees. B. FINANCIAL HIGHLIGHT The BFP financial condition, results of operations and sources and applications of funds for CY 2012 with comparative figures for CY 2011 is presented as follows: Group of Accounts Financial Condition Assets 2012 5,786,833,741.60 i 2011 4,927,443,976.18 Increase/Decrease 859,389,765.42 Group of Accounts Liabilities Government Equity 2012 199,496,283.33 5,587,337,458.27 2011 138,105,835.64 4,789,338,140.54 Increase/Decrease 61,390,447.69 797,999,317.73 Results of Operations Income Expenses Net Income 10,650,010,612.12 9,843,946,792.61 806,063,819.51 9,360,949,000.00 8,697,356,000.00 663,593,000.00 1,287,059,170.63 1,144,588,351.12 142,470,819.51 Sources and Applications of Funds Allotment Received Obligation Incurred Unexpended Balance 11,711,773,782.00 10,057,904,286.00 1,653,869,496.00 9,814,898,149.00 8,935,548,247.00 879,349,902.00 1,896,875,633.00 1,122,356,039 774,519,594.00 C. SCOPE OF AUDIT The audit covered the 2012 operations and financial transactions of the Bureau of Fire Protection except PRO4B due to non-submission of report. D. AUDITOR’S REPORT The Auditor rendered a qualified opinion on the fairness of presentation of the consolidated financial statements of the Bureau of Fire and Protection in view of the accounting errors and deficiencies as presented below together with the recommendation and discussed in details under Part II of the Report. 1. The reported balance of Inventory accounts totalling P53,597,158.95 were unreliable due to: (a) purchases of office supplies of P2,451,760.55 directly charged to Office Supplies Expense and Other MOOE accounts; (b) unrecorded issuances of consummated supplies and materials of P1,338,872.45; (c) nonmaintenance/updating and non-reconciliation of Subsidiary Ledger Cards (SLCs) and Stock Cards; (d) failure to conduct physical count of inventory on hand. (Observation No. 8) We recommended that: (a) the Accountant record all regular purchases of supplies and materials in the appropriate inventory account, except those made out of the Petty Cash Fund and to maintain the SLC; (b) the Property Officers prepare monthly RSMIs as a basis for recording issuances and maintain Stock Cards; and (c) the head of the agency to create an inventory committee to undertake the physical count of inventories at least once every six months as of June 30 and December 31 of each year; and to prepare/submit a report thereon. ii 2. The year-end balance of PPE accounts of P5,750,849,327.04 was inaccurate due to: (a) unrecorded donated parcels of land and motor vehicles and PPE found at stations; (b) unreconciled difference of P91,855,465.49 between Accounting and Property reports; (c) inclusion of unserviceable properties totalling P136,021,860.52; and (d) cost of major repairs not capitalized amounting to P12,861,408.18. Moreover, the required PPE Ledger Cards and Property Cards were not maintained, thus, the existence and reliability of PPEs could not be ascertained. (Observation No. 12) We recommended that (a)Management secure titles to all donated lots and cause its appraisal including the building and PPEs found on station for recording in the books of accounts; (b) the Accounting Office and the Property Officer to reconcile the PPE accounts; (c) the Accountant to reclassify the unserviceable PPEs to Other Assets and cause the immediate disposal of unserviceable equipment and to capitalize the cost of upgrading and major repairs of fire trucks; and (d) the Property Officers and the Accountant, to maintain Property Cards and PPE Ledger cards, respectively, and to renew ARE every three years. 3. The validity/correctness of the Deposits on Letters of Credit amounting to P47,127,407.02 or 95.48 percent of the year-end balance of the account could not be ascertained due to the absence of supporting records/documents. The account remained dormant/non-moving for more than five years. (Observation No. 11) We recommended that management exert more effort locating pertinent documents for the eventual liquidation of the dormant account. If warranted, submit request for write off and/or adjustment of the balance in accordance with the provision of COA Circular No. 97-001 dated February 5, 1997. E. OTHER SIGNIFICANT OBSERVATIONS AND RECOMMENDATIONS 1. Income generated from Fire Code fees totaling P2,600,762,771.60 were not utilized during the three-year period; thus, resulted in idle cash. Of this amount, P2,080,610,217.28 or 80 percent were intended for the modernization of the Bureau’s facilities; and the remaining P520,152,554.32 or 20 percent were envisioned for the operation and maintenance of the local fire stations as required under Section 13 of RA 9514. (Observation No. 1) (Observation No. 1) We recommended that management (a) create a Financial and Technical committee to study, plan and manage the 80 per cent of income collected from Fire Code fees and the utilization of the fund for the attainment of the objectives of the program; and (b) make proper coordination with the DBM for the release of the 20 per cent of total collections for remittance to the concerned LGUs as required under Section 13 of RA 9514. iii 2. The allotment released by the DBM for the procurement of 68 fire trucks amounting to P416,319,730 had lapsed on December 31, 2012, while the allotment for the construction of three storey Agham Fire Station, procurement of fire trucks and firefighting gears and equipment totalling P717,406,607.00 remained unobligated at year end as a result of the long procurement process. In the Bureau, procurement of goods and service beyond P7 million needs the approval of the DILG Secretary and is undertaken by the DILG Central BAC. (Observation no. 2) We recommended that management make proper coordination with the DILG to fast track the procurement of fire trucks and firefighting gears and the construction of the 3-storey Aghan Fire Station in order to prevent the lapsing of the allotment. 3. Due to lack of modern fire trucks, fire fighting gears/equipment, and inadequate fire stations/facilities, the BFP’s vision of a modern fire protection agency for a safe and progressive society and its mandate of providing adequate personnel, firefighting gears and equipment and facilities in every province, city and municipality nationwide are far from being realized in the coming years. (Observation No. 3) We recommended that management fast track the procurement process of the modern equipment and fire fighting vehicles as well as construction of fire stations for the benefit of the BFP and the public. 4. Allotment for capital outlay in 2010, 2011 and 2012 amounting to P242,825,829.00, P119,167,048.00 and P24,000,000.00 respectively, were obligated in favor of PS-DBM to avoid lapsing of allotment. (Observation No. 4) We recommended that Management improve/streamline the procurement process to preclude the transfer of funds to PS-DBM to avoid the lapsing of funds. 5. Unused cash balances, dormant and idle cash deposits totalling P13,692,440.61 were not remitted to the Bureau of Treasury (BTr) contrary to Executive Order No. 338 and depriving the national government of the much needed funds in the implementation of its various programs and activities.( Observation No. 5) We recommended that management remit all unused cash balances to the Bureau of Treasury pursuant to EO 338. 6. Of the P94,120,813.45 funds transferred to PS-DBM for the procurement of office equipment, fire fighting equipment and commonly used office supplies the amount of P37,917,171.70 have been outstanding from one to three years. Despite these unserved requisitions, the Bureau still transferred P54,560,792.00 iv during the year for the procurement of eight units fire trucks with 1,500 gallons capacity. (Observation No.6) We recommended that Management (a) demand from the PS-DBM the immediate delivery of the office equipment, personal protective equipment and eight units of fire trucks; (b) require the PS-DBM for the refund of excess/ balance of transferred funds; and (c) refrain from transferring funds to PS-DBM for the procurement of goods other than the common use supplies. 7. Cash advances granted to disbursing officers, officials and employees amounting to P13,116,530.43 remained unliquidated as of year-end which is not in accordance with COA Circular No. 97-002 dated February 10, 1997. (Observation No. 7) We recommended that management require the officials and employees to strictly comply with the rules and regulations on the granting and liquidation of the cash advances. If not liquidated within the prescribed period, deduct from their salaries the unsettled amount. 8. Advance Deposit amounting to P6,025,168.29 for the lease of various offices at the Union Square Condominium remained uncollected due to the failure of the management to demand from the Marfi Realty the refund of the deposit made after more than a year from termination of the contract. (Observation No. 9) We recommended that management exert more effort to demand the refund of the aforesaid deposit. 9. The Bureau procured P2,006,020 worth of tools and equipment but were not utilized and kept idle in the storage area for two years, thereby exposing these equipment to obsolescence and deterioration and the risk of wastage of government funds. (Observation No. 13) We recommended that management: (a) utilize the aforementioned tools and equipment for the emergency repairs of BFP motor vehicles; (b) for the NCR, make representation with the BFP National Headquarters for the release of additional funds for the establishment of motor pool and to look for a place where the motor pool could be constructed in order that procured tools will not deteriorate. 10. Plant, Property and Equipment totalling P358,012,935.93 were not insured with the GSIS General Insurance Fund and the Property Replacement Fund contrary to COA Circular No. 92-390, thereby exposing the government to the risk of not being indemnified or compensated for any damage to, or loss of its property due to fire, or other force majeure. (Observation No. 14) v We recommended that management insure all insurable physical assets with GSIS under the General Insurance Fund and the Property Replacement Fund pursuant to COA Circular No. 92-390. 11. Of the total disallowances of P190,272,698.71 only P1,728,759.03 or 0.9 percent was settled during the year, while audit suspensions of P1,500,113.52 only P589,126.85 or 39.27 percent was settled. (Observation No. 22) We recommended that management (a) enforce immediate settlement of audit suspensions and disallowances; and (b) ensure that the government auditing rules and regulations are strictly complied with to minimize audit suspensions and disallowances. The above findings and recommendations contained in the report were discussed with the concerned officials of the agency in an exit conference held on May 23, 2013. Management views and reactions were considered in the report where appropriate. F. IMPLEMENTATION OF PRIOR YEAR’S AUDIT RECOMMENDATIONS Out of 21 audit recommendations embodied in the CY 2011 Consolidated Annual Audit Report, eight were fully implemented, 12 were partially implemented and one was not implemented. vi