U.S. Bancorp Piper Jaffray Technology/Communications M&A Weekly

advertisement

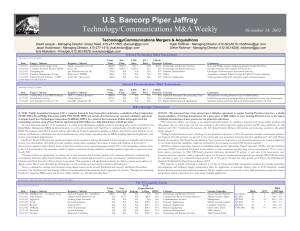

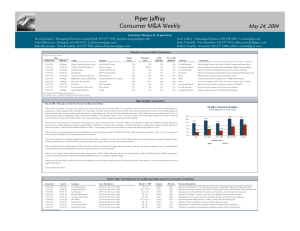

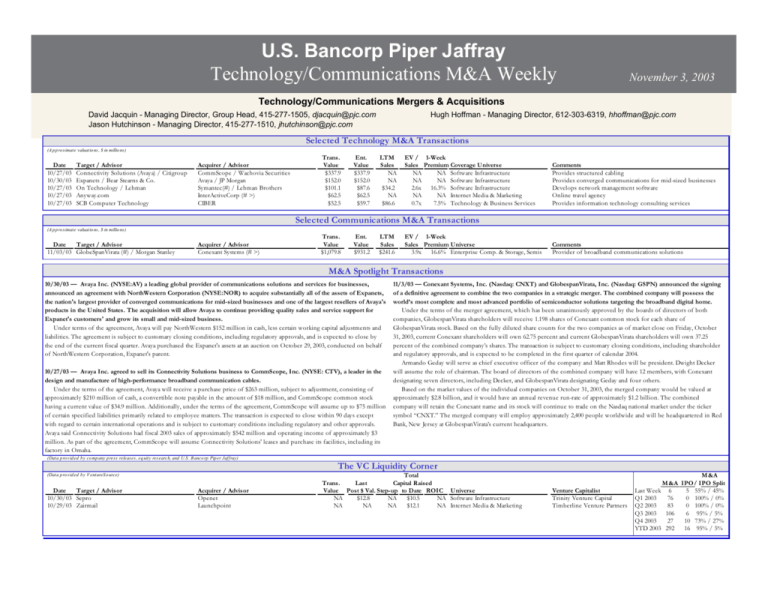

U.S. Bancorp Piper Jaffray Technology/Communications M&A Weekly November 3, 2003 Technology/Communications Mergers & Acquisitions David Jacquin - Managing Director, Group Head, 415-277-1505, djacquin@pjc.com Jason Hutchinson - Managing Director, 415-277-1510, jhutchinson@pjc.com Hugh Hoffman - Managing Director, 612-303-6319, hhoffman@pjc.com Selected Technology M&A M Transactions (A p p ro ximate valuatio ns , $ in millio ns ) Date 10/27/03 10/30/03 10/27/03 10/27/03 10/27/03 Target / Advisor Connectivity Solutions (Avaya) / Citigroup Expanets / Bear Stearns & Co. On Technology / Lehman Anyway.com SCB Computer Technology Acquirer / Advisor CommScope / Wachovia Securities Avaya / JP Morgan Symantec(#) / Lehman Brothers InterActiveCorp (# >) CIBER Trans. Value $337.9 $152.0 $101.1 $62.5 $52.5 Ent. Value $337.9 $152.0 $87.6 $62.5 $59.7 LTM Sales NA NA $34.2 NA $86.6 EV / 1-Week Sales Premium Coverage Universe NA NA Software Infrastructure NA NA Software Infrastructure 2.6x 16.3% Software Infrastructure NA NA Internet Media & Marketing 0.7x 7.5% Technology & Business Services Comments Provides structured cabling Provides converged communications for mid-sized businesses Develops network management software Online travel agency Provides information technology consulting services Selected Communicationss M&A Transactions (A p p ro ximate valuatio ns , $ in millio ns ) Date Target / Advisor 11/03/03 GlobeSpanVirata (#) / Morgan Stanley Acquirer / Advisor Conexant Systems (# >) Trans. Value $1,079.8 Ent. Value $931.2 LTM Sales $241.6 EV / 1-Week Sales Premium Universe 3.9x 16.6% Enterprise Comp. & Storage, Semis Comments Provider of broadband communications solutions M&A Spotlight Trransactions 10/30/03 — Avaya Inc. (NYSE:AV) a leading global provider of communications solutions and services for businesses, announced an agreement with NorthWestern Corporation (NYSE:NOR) to acquire substantially all of the assets of Expanets, the nation's largest provider of converged communications for mid-sized businesses and one of the largest resellers of Avaya's products in the United States. The acquisition will allow Avaya to continue providing quality sales and service support for Expanet's customers' and grow its small and mid-sized business. Under terms of the agreement, Avaya will pay NorthWestern $152 million in cash, less certain working capital adjustments and liabilities. The agreement is subject to customary closing conditions, including regulatory approvals, and is expected to close by the end of the current fiscal quarter. Avaya purchased the Expanet's assets at an auction on October 29, 2003, conducted on behalf of NorthWestern Corporation, Expanet's parent. 10/27/03 — Avaya Inc. agreed to sell its Connectivity Solutions business to CommScope, Inc. (NYSE: CTV), a leader in the design and manufacture of high-performance broadband communication cables. Under the terms of the agreement, Avaya will receive a purchase price of $263 million, subject to adjustment, consisting of approximately $210 million of cash, a convertible note payable in the amount of $18 million, and CommScope common stock having a current value of $34.9 million. Additionally, under the terms of the agreement, CommScope will assume up to $75 million of certain specified liabilities primarily related to employee matters. The transaction is expected to close within 90 days except with regard to certain international operations and is subject to customary conditions including regulatory and other approvals. Avaya said Connectivity Solutions had fiscal 2003 sales of approximately $542 million and operating income of approximately $3 million. As part of the agreement, CommScope will assume Connectivity Solutions' leases and purchase its facilities, including its factory in Omaha. (Data p ro vid ed b y co mp any p res s releas es , eq uity res earch, and U.S . B anco rp Pip er Jaffray) (Data p ro vid ed b y V entureS o urce) Date Target / Advisor 10/30/03 Sepro 10/29/03 Zairmail Acquirer / Advisor Openet Launchpoint 11/ /3/03 — Conexant Systems, Inc. (Nasdaq: CNXT) and GlobespanVirata, Inc. (Nasdaq: GSPN) announced the signing off a definitive agreement to combine the two companies in a strategic merger. The combined company will possess the wo orld’s most complete and most advanced portfolio of semiconductor solutions targeting the broadband digital home. Under the terms of the merger agreement, which has been unanimously approved by the boards of directors of both ompanies, GlobespanVirata shareholders will receive 1.198 shares of Conexant common stock for each share of co GllobespanVirata stock. Based on the fully diluted share counts for the two companies as of market close on Friday, October 31, 2003, current Conexant shareholders will own 62.75 percent and current GlobespanVirata shareholders will own 37.25 peercent of the combined company’s shares. The transaction is subject to customary closing conditions, including shareholder an nd regulatory approvals, and is expected to be completed in the first quarter of calendar 2004. Armando Geday will serve as chief executive officer of the company and Matt Rhodes will be president. Dwight Decker wiill assume the role of chairman. The board of directors of the combined company will have 12 members, with Conexant deesignating seven directors, including Decker, and GlobespanVirata designating Geday and four others. Based on the market values of the individual companies on October 31, 2003, the merged company would be valued at pproximately $2.8 billion, and it would have an annual revenue run-rate of approximately $1.2 billion. The combined ap co ompany will retain the Conexant name and its stock will continue to trade on the Nasdaq national market under the ticker symbol “CNXT.” The merged company will employ approximately 2,400 people worldwide and will be headquartered in Red Baank, New Jersey at GlobespanVirata’s current headquarters. The VC Liquidiity Corner Total Trans. Last Caapital Raised Value Post $ Val. Step-up to Date ROIC Universe NA $12.8 NA $10.5 NA Software Infrastructure NA NA NA $12.1 NA Internet Media & Marketing Venture Capitalist Trinity Venture Capital Timberline Venture Partners M&A M&A IPO/ IPO Split 5 55% / 45% Last Week 6 Q1 2003 76 0 100% / 0% Q2 2003 83 0 100% / 0% Q3 2003 106 6 95% / 5% Q4 2003 27 10 73% / 27% YTD 2003 292 16 95% / 5% U.S. Bancorp Piper Jaffray Technology/Communications M&A Weekly November 3, 2003 Technology/Communications Mergers & Acquisitions David Jacquin - Managing Director, Group Head, 415-277-1505, djacquin@pjc.com Jason Hutchinson - Managing Director, 415-277-1510, jhutchinson@pjc.com Hugh Hoffman - Managing Director, 612-303-6319, hhoffman@pjc.com Private Equity/LBO Analysis Spread (LIBOR) For Leveraged Buyouts Senior Bank Loans (By Deal Size) $70 350 250 200 277 251 1996 306 257 264 344 316 353 334 309 1998 1999 2000 2001 2002 $63.3 $55.4 $60 396 353 238 242 1997 294 363 ($ in Billions) 400 300 Buyout Funds Raised $ in Billions 450 LTM 6/30/03 $50 $34.5 $40 $30 $23.2 $18.4 $20 $10 $5.3 $6.0 1992 1993 $36.9 $34.5 $17.0 $11.7 $4.1 $0 Less than $100 Million (Data Per U.S . B anco rp Pip er Jaffray) $100 Million to $250 Million 1994 1995 1996 1997 1998 1999 2000 2001 2002 1H 2003 Key M&A Valuation Statistics No te: M ultip les have b een chang ed to med ian values . Technology Transactions 4 .0 x 2 .0 x 10 0 % 4 .0 x 80% 3 .0 x 1.8 x 2 .2 x 1.4 x 1.2 x 1.6 x 1.9 x 1.9 x 1.1x 1.0 x 60% 1.6 x 1.4 x 20% 0 .0 x 0% Q1 0 1 Q2 0 1 Q3 0 1 Q4 0 1 Q1 0 2 Q2 0 2 10 0 % 75% Q3 0 2 Q4 0 2 71% Q1 0 3 70 % Q2 0 3 1.3 x 1.3 x 1.0 x 1.3 x 1.2 x Q3 0 2 Q4 0 2 Q1 0 3 40% 0% Q3 0 1 Q4 0 1 Q1 0 2 22% Q2 0 2 Q2 0 3 Q3 0 3 12 5 Venture Backed Tech/Comm M&A 46% 60% 20% Q2 0 1 52 % 52 % 52 % 52 % 3 5% 10 0 75 50 2 5% 25 0% (Data Per U.S . B anco rp Pip er Jaffray) 1.2 x 80% 2 .1x 0 .0 x Q1 0 1 52 % 10 0 % 2 .3 x 2 .3 x 0 .7x Q3 0 3 54 % 50 % 1.7x 2 .0 x 40% 1.0 x Communications Transactions 2 .6 x 3 .0 x 0 Q1 0 1 Q2 0 1 Q3 0 1 Q4 0 1 Q1 0 2 Q2 0 2 Q3 0 2 Q4 0 2 Q1 0 3 Q2 0 3 Q3 0 3 Market Overview Equity Capital Markets Activity: There were 24 transactions completed in the equity capital markets last week raising a combined $4.1 billion. DealNasdaq activity consisted of 5 IPOs, 14 follow-on offerings and 5 convertible transactions. Last week, 4 of the 5 IPOs priced within their filing range with 1DJIA pricing above the range. In the aftermarket, IPOs gained 15% on their first day and finished the week up 23% from offer price. Three of the 5 IPOsS&P were500 for biotechnology issuers, 2000 each pricing at the bottom of the range. Follow-on activity consisted of 11 shelf takedowns and 3 conventional Russell marketed offerings. On average, follow-ons traded down 5% in registration, but finished the week up 3% from offer price. Broader Market Activity: Brian Belski, U.S. Bancorp Piper Jaffray's Fundamental Market Strategist, made the following comments on the broader market: - Own Growth: While performance continues to surprisingly favor value, we believe growth multiples remain more attractive. - Increase Large-Cap Exposure, Small-Cap Net Outperformance Likely To Proceed: Small-cap relative performance continues to contract, even though longer-term outperformance trends remain intact. Small-cap multiples trading at a premium relative to large-cap stocks (SPX) - Unemployment Peak Is Becoming Increasingly Likely: We believe both near-term (weekly claims) and longer-term unemployment data (duration of unemployment) is showing decided improvement Close as of Weekly YTD LTM 10/31/03 % Change % Chang % Change 1,932 3.6 44.7 45.3 9,801 2.3 17.5 16.7 1,051 2.1 19.4 18.6 528 4.3 37.9 41.4 497 8.4 71.7 68.2 (0.1) 12.1 10.2 432 192 6.1 62.5 81.8 NASDAQ DJIA S&P 500 Russell 2000 Philadelphia Semiconductor Index S&P Software Index S&P Comm Equipment Index 12 25 10 00 7 75 5 50 225 0 12 /3 1/0 1 3 /0 4 /0 2 5/0 2 /0 2 7/0 2 /0 2 NASDAQ Rus s ell 2 0 0 0 S&P Co mm Eq uip ment Ind ex 8 /3 0 /0 2 10 /3 0 /0 2 12 /3 1/0 2 3 /0 4 /0 3 5/0 2 /0 3 DJ IA Philad elp hia Semico nd ucto r Ind ex 7/0 2 /0 3 9 /0 2 /0 3 10 10/3 /301/0 / 3 S&P 50 0 S&P So ftware Ind ex U.S. Bancorp Piper Jaffray Technology/Communications M&A Weekly November 3, 2003 Technology/Communications Mergers & Acquisitions David Jacquin - Managing Director, Group Head, 415-277-1505, djacquin@pjc.com Jason Hutchinson - Managing Director, 415-277-1510, jhutchinson@pjc.com Hugh Hoffman - Managing Director, 612-303-6319, hhoffman@pjc.com The following disclosures apply to stocks mentioned in this report if and as indicated: (#) U.S. Bancorp Piper Jaffray (USBPJ) was making a market in the Company’s securities at the time this research report was published. USBPJ may buy and sell the Company’s securities on a principal basis. (^) A USBPJ analyst who follows this Company or a member of the analyst’s household has a financial interest (a long equity position) in the Company’s securities. (@) Within the past 12 months, USBPJ was a managing underwriter of an offering of, or dealer manager of a tender offer for, the Company’s securities or the securities of an affiliate. (>) USBPJ has either received compensation for investment banking services from the Company within the past 12 months or expects to receive or intends to seek compensation within the next three months for investment banking services. (~) A USBPJ analyst who follows this Company, a member of the analyst’s household, a USBPJ officer, director, or other USBPJ employee is a director and/or officer of the Company. (+) USBPJ and its affiliates, in aggregate, beneficially own 1% or more of a class of common equity securities of the subject Company. (=) One or more affiliates of U.S. Bancorp, the ultimate parent company of USBPJ, provided commercial banking services (including, without limitation, loans) to the Company at the time this research report was published. Nondeposit investment products are not insured by the FDIC, are not deposits or other obligations of or guaranteed by U.S. Bank National Association or its affiliates, and involve investment risks, including possible loss of the principal amount invested. This material is based on data obtained from sources we deem to be reliable; it is not guaranteed as to accuracy and does not purport to be complete. This information is not intended to be used as the primary basis of investment decisions. Because of individual client requirements, it should not be construed as advice designed to meet the particular investment needs of any investor. It is not a representation by us or an offer or the solicitation of an offer to sell or buy any security. Further, a security described in this release may not be eligible for solicitation in the states in which the client resides. Affiliates of U.S. Bancorp Piper Jaffray, including U.S. Bancorp and their respective officers or employees, or members of their families, may have a beneficial interest in the Company's securities and may purchase or sell such positions in the open market or otherwise. Notice to customers in the United Kingdom: This report is a communication made in the United Kingdom by U.S. Bancorp Piper Jaffray to market counterparties or intermediate customers and is exclusively directed at such persons; it is not directed at private customers and any investment or services to which the communication may relate will not be available to private customers. In the United Kingdom, no persons other than a market counterparty or an intermediate customer should read or rely on any of the information in this communication. Securities products and services offered through U.S. Bancorp Piper Jaffray, member SIPC and NYSE, Inc., a subsidiary of U.S. Bancorp. Additional information is available upon request. © 2003 U.S. Bancorp Piper Jaffray, 800 Nicollet Mall, Suite 800, Minneapolis, Minnesota 55402-7020