Ambassador Financial Group, Inc., advises Farmers & Merchants

advertisement

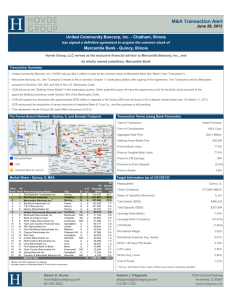

Ambassador Financial Group, Inc., advises Farmers & Merchants Bancorp of Western Pennsylvania, Inc., on its merger with NexTier Inc. Allentown, PA, June 3, 2014 – Ambassador Financial Group, Inc., is pleased to announce that it has acted as financial advisor to the special committee of Farmers & Merchants Bancorp of Western Pennsylvania, Inc., in regard to its agreement to merge with NexTier Inc. in an all-stock transaction. The transaction is expected to close in the fourth quarter of 2014, subject to customary closing conditions. Farmers & Merchants Bancorp of Western Pennsylvania, Inc., is headquartered in Kittanning, Pennsylvania. Its primary subsidiary, Farmers & Merchants Bank of Western Pennsylvania, had assets of $434 million as of March 31, 2014. Farmers & Merchants Bank of Western Pennsylvania operates eight banking offices in Armstrong County. NexTier Inc. is headquartered in Butler, Pennsylvania and had assets of $527 million as of March 31, 2014. Its primary subsidiary, NexTier Bank, operates 16 full-service banking offices in Allegheny, Armstrong, and Butler counties. This is Ambassador Financial Group’s 12th transaction announced since 2011. These transactions include whole bank acquisitions, branch sales, and acquisitions of fee businesses: • • • • • • • • • • • • First Choice Bank’s (NJ) acquisition of Vantage Point Bank (PA) ESSA Bancorp’s (PA) branch acquisition from First National Community Bancorp (PA) Franklin Security Bancorp’s (PA) $15.7 million sale to ESSA Bancorp (PA) Haven Bancorp’s (NJ) $27 million acquisition of Hilltop Community Bancorp (NJ) Riverview Financial Corporation’s (PA) consolidation of Union Bank and Trust Company (PA) MVB Financial Corp’s (WV) $30 million purchase and assumption agreement with CFG Community Bank (MD) Old Line Bancshares’ (MD) $49 million acquisition of WSB Holdings (MD) NBT Bancorp’s (NY) $233 million acquisition of Alliance Financial Corporation (NY) MVB Financial Corp’s (WV) $19 million acquisition of Potomac Mortgage Group (VA) ESSA Bancorp’s (PA) $24 million acquisition of First Star Bancorp (PA) Capital Bank’s (MD) branch sale to DNB First (PA) Canandaigua National Corporation’s (NY) acquisition of OBS Holdings (NY) Ambassador’s M&A expertise can assist financial institutions seeking to acquire, identify an exit strategy, or find a strategic partner. For acquirers, we identify candidates, determine an appropriate deal structure, create pro-forma models, and lead negotiations. For those considering an exit, we identify potential acquirers and determine their level of interest, ability to pay, and ability to close. We also prepare an information memorandum, contact those who have the greatest potential, and negotiate on behalf of our clients. For those seeking a strategic partner, we employ our experience to develop solutions to social, management, and corporate culture issues to facilitate a mutually beneficial, value-enhancing combination. At Ambassador, we are dedicated to assisting clients achieve their strategic goals. We do this by offering personalized service along with a comprehensive suite of capital market services that encompass balance sheet management, investment banking, and investor relations. Contacts: David Danielson 240.242.4083 Mike Rasmussen 610.351.1633 John Putman 240.242.4083 Chris Donahue 240.242.4083