Piper Jaffray Consumer M&A Weekly

advertisement

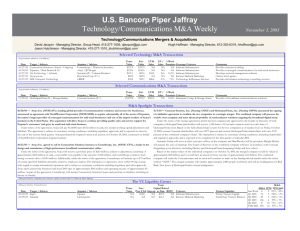

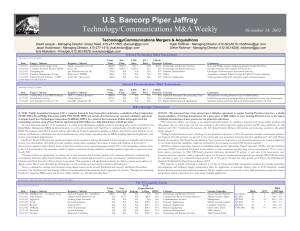

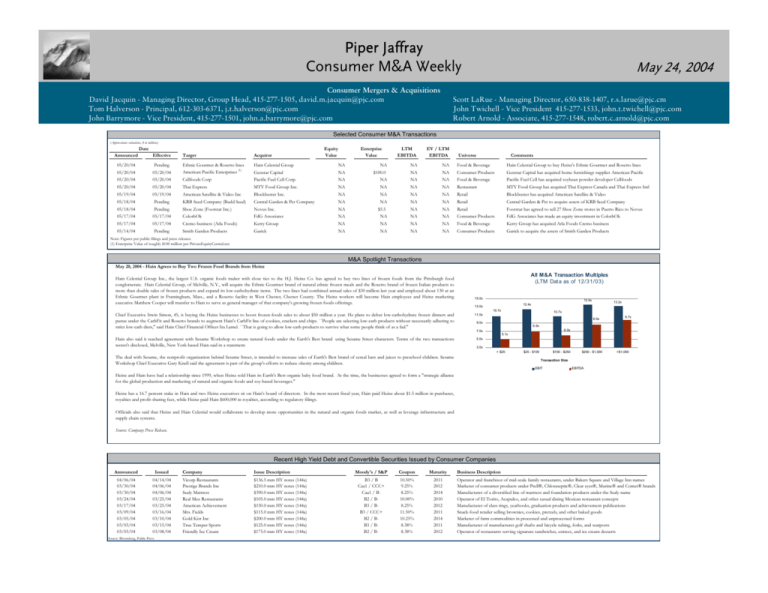

Piper Jaffray Consumer M&A Weekly Consumer Mergers & Acquisitions David Jacquin - Managing Director, Group Head, 415-277-1505, david.m.jacquin@pjc.com Tom Halverson - Principal, 612-303-6371, j.t.halverson@pjc.com John Barrymore - Vice President, 415-277-1501, john.a.barrymore@pjc.com May 24, 2004 Scott LaRue - Managing Director, 650-838-1407, r.s.larue@pjc.cm John Twichell - Vice President 415-277-1533, john.t.twichell@pjc.com Robert Arnold - Associate, 415-277-1548, robert.c.arnold@pjc.com Selected Consumer M&A Transactions (Approximate valuations, $ in millions) Date Equity Value Announced Effective Target Acquiror 05/20/04 Pending Ethnic Gourmet & Rosetto lines Hain Celestial Group 05/20/04 05/20/04 American Pacific Enterprises 05/20/04 05/20/04 Cellfoods Corp 05/20/04 05/20/04 Thai Express 05/19/04 05/19/04 American Satellite & Video Inc 05/18/04 Pending KRB Seed Company (Budd Seed) 05/18/04 Pending Shoe Zone (Footstar Inc.) 05/17/04 05/17/04 05/17/04 05/17/04 05/14/04 Pending Enterprise Value LTM EBITDA EV / LTM EBITDA NA NA NA NA Genstar Capital NA $100.0 NA Pacific Fuel Cell Corp. NA NA NA MTY Food Group Inc. NA NA NA Blockbuster Inc. NA NA Central Garden & Pet Company NA NA Novus Inc. NA ColorbOk FdG Associates Cremo business (Arla Foods) Smith Garden Products (1) Universe Comments Food & Beverage Hain Celestial Group to buy Heinz's Ethnic Gourmet and Rosetto lines NA Consumer Products Genstar Capital has acquired home furnishings supplier American Pacific NA Food & Beverage Pacific Fuel Cell has acquired soybean powder developer Cellfoods NA Restaurant MTY Food Group has acquired Thai Express Canada and Thai Express Intl NA NA Retail Blockbuster has acquired American Satellite & Video NA NA Retail Central Garden & Pet to acquire assets of KRB Seed Company $5.5 NA NA Retail Footstar has agreed to sell 27 Shoe Zone stores in Puerto Rico to Novus NA NA NA NA Consumer Products FdG Associates has made an equity investment in ColorbOk Kerry Group NA NA NA NA Food & Beverage Kerry Group has acquired Arla Foods Cremo business Garick NA NA NA NA Consumer Products Garick to acquire the assets of Smith Garden Products Note: Figures per public filings and press releases. (1) Enterprise Value of roughly $100 million per PrivateEquityCentral.net M&A Spotlight Transactions May 20, 2004 - Hain Agrees to Buy Two Frozen Food Brands from Heinz Hain Celestial Group Inc., the largest U.S. organic foods maker with close ties to the H.J. Heinz Co. has agreed to buy two lines of frozen foods from the Pittsburgh food conglomerate. Hain Celestial Group, of Melville, N.Y., will acquire the Ethnic Gourmet brand of natural ethnic frozen meals and the Rosetto brand of frozen Italian products to more than double sales of frozen products and expand its low-carbohydrate items. The two lines had combined annual sales of $30 million last year and employed about 130 at an Ethnic Gourmet plant in Framingham, Mass., and a Rosetto facility in West Chester, Chester County. The Heinz workers will become Hain employees and Heinz marketing executive Matthew Cooper will transfer to Hain to serve as general manager of that company's growing frozen foods offerings. All M&A Transaction Multiples (LTM Data as of 12/31/03) 15.0x 13.5x 10.7x Chief Executive Irwin Simon, 45, is buying the Heinz businesses to boost frozen-foods sales to about $50 million a year. He plans to debut low-carbohydrate frozen dinners and pastas under the CarbFit and Rosetto brands to augment Hain's CarbFit line of cookies, crackers and chips. ``People are selecting low-carb products without necessarily adhering to strict low-carb diets,'' said Hain Chief Financial Officer Ira Lamel. ``That is going to allow low-carb products to survive what some people think of as a fad.'' 11.0x Hain also said it reached agreement with Sesame Workshop to create natural foods under the Earth's Best brand using Sesame Street characters. Terms of the two transactions weren't disclosed, Melville, New York-based Hain said in a statement. 5.0x 13.2x 12.4x 13.0x 10.7x 8.6x 9.0x 9.7x 6.9x 6.0x 7.0x 5.1x 3.0x < $25 The deal with Sesame, the nonprofit organization behind Sesame Street, is intended to increase sales of Earth's Best brand of cereal bars and juices to preschool children. Sesame Workshop Chief Executive Gary Knell said the agreement is part of the group's efforts to reduce obesity among children. $25 - $100 $100 - $250 $250 - $1,000 >$1,000 Transaction Size EBIT EBITDA Heinz and Hain have had a relationship since 1999, when Heinz sold Hain its Earth's Best organic baby food brand. At the time, the businesses agreed to form a "strategic alliance for the global production and marketing of natural and organic foods and soy-based beverages." Heinz has a 16.7 percent stake in Hain and two Heinz executives sit on Hain's board of directors. In the most recent fiscal year, Hain paid Heinz about $1.5 million in purchases, royalties and profit-sharing fees, while Heinz paid Hain $600,000 in royalties, according to regulatory filings. Officials also said that Heinz and Hain Celestial would collaborate to develop more opportunities in the natural and organic foods market, as well as leverage infrastructure and supply chain systems. Source: Company Press Release. Recent High Yield Debt and Convertible Securities Issued by Consumer Companies Announced Issued 04/06/04 03/30/04 03/30/04 03/24/04 03/17/04 03/09/04 03/05/04 03/03/04 03/03/04 04/14/04 04/06/04 04/06/04 03/25/04 03/25/04 03/16/04 03/10/04 03/15/04 03/08/04 Source: Bloomberg, Public Press Company Issue Description Vicorp Restaurants Prestige Brands Inc Sealy Mattress Real Mex Restaurants American Achievement Mrs. Fields Gold Kist Inc True Temper Sports Friendly Ice Cream $136.5 mm HY notes (144a) $210.0 mm HY notes (144a) $390.0 mm HY notes (144a) $105.0 mm HY notes (144a) $150.0 mm HY notes (144a) $115.0 mm HY notes (144a) $200.0 mm HY notes (144a) $125.0 mm HY notes (144a) $175.0 mm HY notes (144a) Moody's / S&P Coupon Maturity B3 / B Caa1 / CCC+ Caa1 / BB2 / BB3 / BB3 / CCC+ B2 / BB3 / BB2 / B- 10.50% 9.25% 8.25% 10.00% 8.25% 11.50% 10.25% 8.38% 8.38% 2011 2012 2014 2010 2012 2011 2014 2011 2012 Business Description Operator and franchisor of mid-scale family restaurants, under Bakers Square and Village Inn names Marketer of consumer products under Prell®, Chloraseptic®, Clear eyes®, Murine® and Comet® brands Manufacturer of a diversified line of mattress and foundation products under the Sealy name Operator of El Torito, Acapulco, and other casual dining Mexican restaurant concepts Manufacturer of class rings, yearbooks, graduation products and achievement publications Snack-food retailer selling brownies, cookies, pretzels, and other baked goods Marketer of farm commodities in processed and unprocessed forms Manufacturer of manufactures golf shafts and bicycle tubing, forks, and seatposts Operator of restaurants serving signature sandwiches, entrees, and ice cream desserts Piper Jaffray Consumer M&A Weekly Consumer Mergers & Acquisitions David Jacquin - Managing Director, Group Head, 415-277-1505, david.m.jacquin@pjc.com Tom Halverson - Principal, 612-303-6371, j.t.halverson@pjc.com John Barrymore - Vice President, 415-277-1501, john.a.barrymore@pjc.com May 24, 2004 Scott LaRue - Managing Director, 650-838-1407, r.s.larue@pjc.cm John Twichell - Vice President 415-277-1533, john.t.twichell@pjc.com Robert Arnold - Associate, 415-277-1548, robert.c.arnold@pjc.com The Private Equity/ LBO Sponsor Corner Date 05/20/04 05/17/04 05/11/04 05/05/04 05/03/04 04/30/04 04/23/04 04/21/04 04/15/04 04/14/04 04/02/04 04/01/04 04/01/04 Target Financial Sponsor Summary of Transaction American Pacific Enterprises ColorbOk Gift Bag Unit (Jeanmarie Creations) MD Beauty Caribbean Restaurants Core-Mark International Loehmann's Holdings Leiner Health Products Fuze Beverages Hartselle Frozen Foods & Meat Bear Creek Corp Sunny Delight & Punica juice brands Nonni's Food Co. Genstar Capital FdG Associates Management Buyout Group Berkshire Partners & JH Partners Castle Harlan Investor Group Crescent Capital Golden Gate Capital & North Castle Partners Castanea Partners Private Investor Group Wasserstein & Co J.W. Childs Wind Point Partners Genstar Capital has acquired American Pacific, a designer and marketer of specialty bedding products, bath accessories and window coverings FdG Associates has made an equity investment in ColorbOk, a manufacturer and distributor of scrapbooking, toy, stationery and gift products A private group led by management of Jeanmarie Creations has agreed to acquire the decorative gift bag and gift tag business of Jeanmarie Creations Berkshire Partners and JH Partners have agreed to recapitalize MD Beauty, a specialty cosmetics company which sells its cosmetics and skin care products Castle Harlan to acquire Caribbean Restaurants, operator of 165 Burger King restaurants in Puerto Rico, from Oak Hill Capital and American Securities Capital An investor group comprised of Texas executives has offered to purchase Core-Mark International, the nation's second largest wholesale distribution company Crescent Capital has agreed to take discount clothing retailer Loehmann's Holdings private Golden Gate Capital and North Castle Partners have announced a recapitalization of Leiner Health Products Fuze Beverages, manufacturer of Smart Age functional beverages, has received a significant equity investment form Castanea Partners A private investor group led by Jerry Smith has acquired Hartselle Frozen Foods & Meat from Samie and Billy Wiley Wasserstein & Co has agreed to acquire Bear Creek Corp, the largest direct marketer of fruit and food gifts in the U.S., from Yamanouchi Pharmaceutical J.W. Childs Associates has agreed to acquire Sunny Delight and Punica juice brands from Procter & Gamble Wind Point Partners has acquired Nonni's Food, a leading manufacturer of biscotti and bagel chips from Swander Pace Private Equity/LBO Analytics SPREAD (LIBOR) FOR LEVERAGED BUYOUTS SENIOR BANK LOANS By Deal Size BUYOUT FUNDS RAISED $ in Billions Basis Points $70 450 400 409 363 350 300 277 250 264 251 200 1996 316 306 242 1997 257 309 294 344 334 357 353 406 328 $50 $34.5 $40 $30 238 1998 $63.3 $55.4 $60 $18.4 $20 1999 2000 Less than $100 Million 2001 2002 2003 Q1 04 $10 $5.3 $6.0 1992 1993 $36.9 $34.5 $24.0 $23.2 $17.0 $11.7 $5.8 $0 $100 Million to $250 Million 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 Q1 2004 Market Overview Equity Capital Markets Activity: NASDAQ DJIA S&P 500 Russell 2000 S&P Food Index S&P Retail Index S&P Apparel Index S&P Rest. Index Last Week’s Activity There were 14 transactions completed in the equity capital markets last week raising a combined $3.3 billion. Deal activity consisted of 2 IPOs, 10 follow-ons and 2 convertibles. Follow-on activity consisted of 6 shelf takedowns and 3 conventional marketed transactions. On average, follow-on offerings traded flat in registration, but finished the week up 2% in the aftermarket. The Week Ahead There are 20 deals expected to price this week including 8 IPOs, 11 follow-on offerings and 1 convertible. Issuers look to raise a combined $5.4 billion. Broader Market Activity The major market indices were mixed for the week. The Dow Jones decreased 46 pts, or 0.5%, and closed at 9,967. The Nasdaq increased 8 points, or 0.4%, and closed at 1,912. The S&P 500 fell 2 points, or 0.2%, and closed at 1,094. The Russell 2000 increased 2 points, or 0.4%, finishing at 546. Close as of Weekly YTD LTM 5/21/2004 1,912 9,967 1,094 546 231 366 209 233 % Change (1) 0.4 (0.5) (0.2) 0.4 (1.1) 1.6 (0.5) (1.7) % Change (4.6) (4.7) (1.7) (2.0) 7.0 1.1 1.6 1.5 % Change 28.3 17.0 18.4 32.9 22.8 29.5 33.1 35.0 160 150 140 130 120 110 100 90 80 5/23/03 7/08/03 8/19/03 10/01/03 NASDAQ (1) Based on Friday closing prices. 11/12/03 DJIA 12/26/03 2/10/04 S&P 500 3/24/04 5/06/04 Piper Jaffray Consumer M&A Weekly Consumer Mergers & Acquisitions David Jacquin - Managing Director, Group Head, 415-277-1505, david.m.jacquin@pjc.com Tom Halverson - Principal, 612-303-6371, j.t.halverson@pjc.com John Barrymore - Vice President, 415-277-1501, john.a.barrymore@pjc.com May 24, 2004 Scott LaRue - Managing Director, 650-838-1407, r.s.larue@pjc.cm John Twichell - Vice President 415-277-1533, john.t.twichell@pjc.com Robert Arnold - Associate, 415-277-1548, robert.c.arnold@pjc.com This report is published by the Mergers & Acquisitions Group within the Investment Banking Department of Piper Jaffray. Information contained in this publication is based on data obtained from sources we deem to be reliable, however, it is not guaranteed as to accuracy and does not purport to be complete. Nothing contained in this publication is intended to be a recommendation of a specific security or company nor is any of the information contained herein intended to constitute an analysis of any company or security reasonably sufficient to form the basis for any investment decision. Nothing contained in this publication constitutes an offer to buy or sell or the solicitation of an offer to buy or sell any security. Officers or employees of affiliates of Piper Jaffray & Co., or members of their families, may have a beneficial interest in the securities of a specific company mentioned in this publication and may purchase or sell such securities in the open market or otherwise. Notice to customers in the United Kingdom: This publication is a communication made in the United Kingdom by Piper Jaffray & Co. to market counterparties or intermediate customers and is exclusively directed at such persons; it is not directed at private customers and any investment or services to which the communication may relate will not be available to private customers. In the United Kingdom, no persons other than a market counterparty or an intermediate customer should read or rely on any of the information in this communication. Piper Jaffray & Co. Since 1895. Member SIPC and NYSE. Securities products and services are offered in the United States through Piper Jaffray & Co. and in the United Kingdom through its affiliated company, Piper Jaffray Limited., which is authorized and regulated by the Financial Services Authority. Additional information is available upon request. www.piperjaffray.com © 2004 Piper Jaffray & Co., 800 Nicollet Mall, Minneapolis, Minnesota 55402-7020