global insight - west european light vehicle a/c refrigerant scenario

advertisement

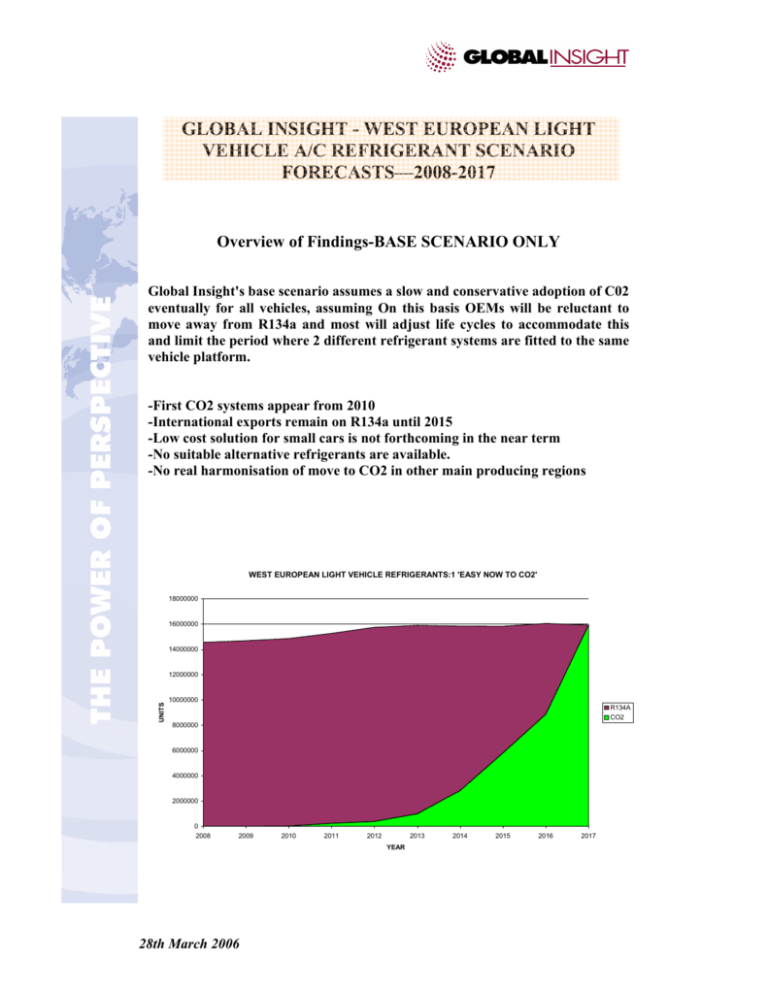

GLOBAL INSIGHT - WEST EUROPEAN LIGHT VEHICLE A/C REFRIGERANT SCENARIO FORECASTS—2008-2017 Overview of Findings-BASE SCENARIO ONLY Global Insight's base scenario assumes a slow and conservative adoption of C02 eventually for all vehicles, assuming On this basis OEMs will be reluctant to move away from R134a and most will adjust life cycles to accommodate this and limit the period where 2 different refrigerant systems are fitted to the same vehicle platform. -First CO2 systems appear from 2010 -International exports remain on R134a until 2015 -Low cost solution for small cars is not forthcoming in the near term -No suitable alternative refrigerants are available. -No real harmonisation of move to CO2 in other main producing regions WEST EUROPEAN LIGHT VEHICLE REFRIGERANTS:1 'EASY NOW TO CO2' 18000000 16000000 14000000 12000000 UNITS 10000000 R134A CO2 8000000 6000000 4000000 2000000 0 2008 2009 2010 2011 2012 2013 YEAR 28th March 2006 2014 2015 2016 2017 Background Even when R12 began to be replaced by R134a in the early-mid 1990s, the industry knew that this was unlikely to be the final solution. The European Commission's recently passed regulation on MAC refrigerants ultimately mandates the phase out of R134a beginning 2011 and concluding by 2017 for all light vehicles. (2011 European Union environmental standards require the phase out of (HFC) R-134a beginning in 2011 for all new vehicles, 2017 for all vehicles). Global Insight was involved in the original stakeholder conference that considered the implications and need for further regulation to protect the environment from the release of hydroflurocarbons to the atmosphere. Many in the industry still question the need for and question the fundamental basis of this regulation, not least because Europe acts in isolation from the rest of the world. Global Insight would be pleased to discuss the background for this significant industry change with clients. Certainly the MAC regulation is just one of many additional burdens the European industry must bear in terms of increased complexity and additional costs. New Refrigerants After some discussion the European MAC regulation permits from 2017 refrigerants with a Global Warming Impact of less than 150.The main contenders as the replacement refrigerants in Europe have been carbon dioxide(R744),GWP=1 and R152a, GWP =148. The German industry has led the argument for the switch to CO2 refrigerant systems, particularly citing efficiency/performance gains and potential in heat pump vehicle applications. Others, particularly of US origin have cited the suitability of R152a as a potential replacement not least since it is likely to be an easier 'drop in' to existing R134a systems. However flammability concerns of R152a are such that now it is not considered as a viable replacement in Europe. While CO2 is attractive from an environmental perspective, components and systems operate at very high pressures, require some additional components and to some extent require new manufacturing investment. It is also not a 'drop in' system for R134a. 28th March 2006 The industry has assumed that the costs of CO2 systems would be neutral with R134a systems and were thus relaxed about the outcome. As we have moved closer to its use, vehicle OEMs now commonly cite additional and unacceptable costs in the range of 100-250 euros. Additional costs and complexity of operating vehicle platforms with multi refrigerant systems and service implications also adds to the concern. The situation for the mass market of small cars is exacerbated further. While some German luxury car buyers may be able to afford to be green by selecting more environmentally friendly climate control, this does not apply for small cars. Small car buyers mainly buy small cars for 'small 'prices'. Thus the industry has more recently concentrated on optimising CO2 systems for small cars by trading off performance advantages for lower costs. Such has been the unknown that most next generation vehicles are designed to accommodate either R134a or CO2 within the same package envelope. Vehicle OEMs face a period of utilising multiple refrigerant systems across a single vehicle platform for at least one vehicle life cycle – an average 6-7 years. The lack of international consensus of the next refrigerant is also an important feature, with the prospect of CO systems fitted perhaps on European sales but not some exports. Yet the industry looked to be sliding inevitably towards, for many, a begrudging acceptance that CO2 was the only solution. Yet refrigerant makers have suggested for some time that, it would be unwise to dismiss the possibility of a new synthetic refrigerant being developed that might compete with CO2. The most recent announcements from Dupont and Honeywell confirm the potential for such an alternative or indeed a range of alternatives that would meet the GWP limit of 150. Moreover, the announcements suggest the prospect of a system with neutral costs; that would be 'compatible with conventional hydrofluorocarbon (HFC) 134a automotive air conditioning systems with the potential for only minor modifications'. If these new refrigerants can be commercialized within five years this would meet the 2011 European Union environmental standards mandating the phase out of R-134a beginning in 2011 for all new vehicles. For many in the industry, the arrival of new alternatives is attractive even if testing will take some time. For others CO2 may still be the preferred route. 28th March 2006 GLOBAL INSIGHT SERVICE CREDENTIALS Global Insight's automotive team has specialised for nearly two decades in forecasting of OE, Retrofit and Aftermarket for vehicle heating and air conditioning systems. Most tier 1, tier 2 and tier 3 component and system manufacturers rely on Global Insight's detailed documentation and forecasts of penetration, component technology, suppliers and manufacturer origins for all major components. Global Insight is pleased to announce the availability of the first detailed vehicle model/platform forecasts of competing refrigerants for light vehicle a/c systems. These forecasts are driven by four different scenarios based on different assumptions of refrigerant availability, applications, system costs and performance. In addition to the availability of forecasts by vehicle model and platform, for each refrigerant type, Global Insight offers more summarised analysis of the outcomes at a total market, segment and ,OEM level. Service Characteristics Global Insight's forecast service now considers all of the above to provide the first recognised alternative refrigerant forecast service. The forecasts take into account at a vehicle model/platform level -OE a/c penetration rate -Vehicle replacement cycles, new and facelift launches to 2017 -European versus International sales mix -OEM propensity for new refrigerants -OEM market and brand position This service utilises four alternative scenarios for refrigerant change in West European light vehicles,: 1. 'Easy Now to CO2'-conservative move to carbon dioxide…. 2. 'Two why Not Three'-new alternative refrigerants, but later arrival….. 3. 'Simple Divide'- carbon dioxide preferred by luxury cars, but alternative refrigerant on time………….. 4. 'Full Ahead to CO2'-rapid move to carbon dioxide, single refrigerant vehicle platforms, no real alternatives…. Each of the above are defined with detailed assumptions For further information on this service, please contact: David Smith-Tilley Director Auto Consulting, London Tel: 44 7941 989 606 Em: david.smith-tilley@globalinsight.com 28th March 2006