Up and away: refrigerant prices soar

advertisement

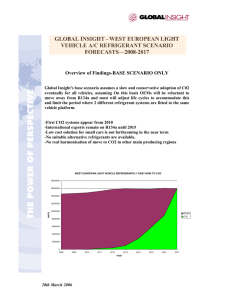

COVER STORY Up and away: refrigerant prices soar Since mid 2010, refrigerant prices have skyrocketed – the result of a perfect storm of increased demand, limited supply, high raw material costs and the phase-out of R22. Although volatile, Sean McGowan reports that the market may be softening. Arkema’s Changshu production facility in China. Source: Arkema, Antoine Icard. The Montreal Protocol has been ratified by 187 signatories since it was first introduced in 1987 as a way of protecting the ozone layer. The protocol stipulates phasing out the production of ozonedepleting substances, a number of refrigerants included. enormous stress on the supply of R410A, R22’s new generation, non-ozone-depleting replacement. Perhaps the most common refrigerant to have been recently affected by the treaty is HCFC-22, commonly known as R22. R410A, along with the other 4 and 5 Series blend of refrigerants, are dependent on R125, a fluorocarbon essential in the manufacture of this range of nonozone-depleting HFC refrigerants. Ironically, it was once used as a replacement for the highly ozone-depleting CFC-11 and CFC-12 due to its comparatively low-ozone-depleting potential. However, it is now suffering the same fate as its predecessors, as it is phased out across the globe, country by country. The phase-out is on in earnest in the US, with the country’s EPA ruling a reduction in the production and importation of R22 by over 150 million pounds last year, and 10-13 per cent per year through to 2014. The European F-Gas regulation has also now banned the use of virgin R22 for new equipment and service in Europe. Naturally, this has resulted in a significant shortfall compared to the market demand and placed And herein lies the first factor behind the refrigerant price hikes we’ve seen recently: supply and demand. But unfortunately, the news only gets worse. And you guessed it – there is a global shortage of R125 too. It is indeed the perfect storm. According to Kylie Farrelley, product manager for global refrigerant manufacturer Arkema in Australia, supply and demand is just part of the story. Raw material shortages (most notably the mineral fluorspar used in the production of HFCs), the volatility of commodity prices and the set-up of the world’s largest manufacturing plants have all impacted on refrigerant prices. “With the raw materials, there have been some regulation changes in mining in China, including government restrictions and quotas,” explains Farrelley. “Also over the last 12 months we’ve seen adverse weather and the earthquake in Japan, which has made it difficult to either mine or to transport the raw materials.” Another factor she points to is that most of the world’s refrigerant plants are multi-purpose and can produce other products including PCE (perchloroethylene) used as a dry cleaning solvent, PTFE (polytetrafluoroethylene) commonly known as Teflon, and a host of other products. “If the price of PCE or PTFE is greater than the market price for R125, then they produce whatever they can to make the most of the plant,” Farrelley says. Other global refrigerant manufacturers also operate swing plants that are able to make either R125 or R134a. As global demand for R134a has increased as a result of major conversion from HCFCs in insulating foams across the globe, again in response to obligations under the Montreal Protocol, further pressure has been placed on the existing capacity of these plants. “There are a lot of these influencing factors, rather than just one thing, which are impacting on refrigerant pricing,” Farrelley says. www.hvacrnation.com.au n August 2011 n HVAC&R Nation n 19 COVER STORY Arkema’s Changshu production facility in China. Source: Arkema, Antoine Icard. While acknowledging the significance of the price increases, Farrelley says Australia has been lucky to avoid the shortages that have plagued other countries, including limits on allocations and supplier decisions on who would receive supply. “Fortunately it didn’t come to that in Australia,” she says. “But it was a real threat.” Closer to home Although the Australian HVAC&R industry escaped the worst of the global supply issues, we have not been immune to significant price hikes. Local wholesalers have had their suppliers force large price increases on them in response to the global situation, and these have naturally flowed on to their customers. “We saw increases come through from our supplier network towards the end of last year and early this year, but there has been a patch of stability in recent times,” explains Gavin Tory, director of marketing – Australia and New Zealand, for Heatcraft. “The best way to describe it is that it’s volatile but there are some signs of softening.” A number of refrigerants have seen incremental price increases of around 10 per cent. However, others like R404A have risen substantially more. The price of R134a, for instance, has increased by up to 80 per cent in the last six months. Supply, too, has become tight and challenging to manage. increase competition in the marketplace and place downward pressure on prices. “It got to the stage, at the start of this year, where things were looking very tight in the supply pipeline from Asia,” Tory says. “Thankfully we didn’t get to the point where the market was short on product.” However, this is likely to be countered by the limitation on imports of R22 from next year, which may put even greater pressure on supply in Australia. “We work very closely with our suppliers to ensure we’ve got good forecasts in place and understand where the demand is going to be and cater accordingly. But it has been more challenging than has historically been the case.” Tory says the evolving landscape of refrigerants will create further challenges to the supply chain in the future, particularly as demand for new refrigerant types grows. Already moves to new blends overseas are placing extra uncertainty on the market, with new technology refrigerants like HFO (hydrofluoro olefin) 1234yf now being legislated in Europe for use in vehicle air conditioning, replacing the use of R134a. “This is just starting to flow through, and there is still growing demand for the R134a. But you’ve got this threat now of other types of refrigerants that will supercede R134a. “It means companies aren’t willing to invest in further capacity because they’re not quite sure if there’s going to be a long-term demand for the product.” The good news is that patents on some of the 4 Series refrigerants are soon to end, which will likely 20 n HVAC&R Nation n August 2011 n www.hvacrnation.com.au It is for this reason that Heatcraft and its competitors are actively informing customers about the phaseout of R22 and the alternatives available to manage this change. Heatcraft last month completed a series of roadshows around Australia and New Zealand where customers were advised of the trends in the marketplace, including the phase-out of R22 and future developments such as the implications of a carbon tax and a quota on HFCs, which is being discussed globally. In the short term, however, the advice from both Heatcraft and Arkema is to remain in close contact with your supplier; to plan ahead, particularly for large jobs; and take heed of the information being made available. “It’s always good to speak to your supplier,” suggests Farrelley. “But the only advice I could offer is to only buy what you need at the moment and not stockpile.” With signs that price relief may start to flow through from August, perhaps there is light at the end of the tunnel; however, with so many factors at play the situation is likely to remain volatile for some time to come. n