International equities: The market for active

management?

Elizabeth Tammaro: “Are foreign equities more amenable to active management given the

breadth of that market?” So now let’s talk a little bit about international equities. What do

you guys think?

Walter Lenhard: Well I get that question a lot when I talk about where should you index

and where should you go active. And how I answer that question is, for the U.S. large

cap, the distribution of most fund returns is fairly narrow. So you don’t get a lot of reward

for taking an active bet in U.S. large cap. So some people will say I index my U.S. largecap asset allocation or the exposure there, and then if I’m going to go active, I’m going to

go active in international or small cap because you’ve got a higher probability of finding a

manager who might outperform there.

But the flip side is, because the return distribution is wider in international and small cap

than it is in large cap. So there is the potential to outperform down there, but the zero

sum game argument that Scott outlined still holds for all those different asset classes

and half the managers are going to outperform before cost, half the managers are going

to underperform, but then if you take the costs out—and cost can actually be higher in

international and small cap—that whole distribution shifts to the left even more than it does

for U.S. large cap.

So while the potential to find an active manager is there, you’ve got to be certain. If you’re

just rolling the dice, you shouldn’t roll the dice in those markets because costs are going to

really hurt you there. But if you can find an active manager that’s going to outperform, and

you believe they’re going to outperform in the next cycle, that’s where you could take a bet

on active management.

Scott Donaldson: Right. And I always hear, too, on this concept, and I mentioned in

the long-term numbers earlier about the 70% of active underperforming over 15 or 20

years. That’s in every segment. That’s in international, that’s emerging market, that’s

high yield bond, it’s real estate. You name the subsegment that people think are the less

efficient markets and the indexing still works. But people get confused with informational

inefficiency, like people don’t know a lot about those markets and so forth, versus

transactional efficiency.

So some of these other markets are, as Walter put it, much more higher cost to trade

in. So even if you have some known information that you think is valuable from an

outperformance, the minute that you go try to implement that in a less liquid, less traded

market, it’s very, very hard to realize the full benefit of that on an after-cost basis.

(continued on next page)

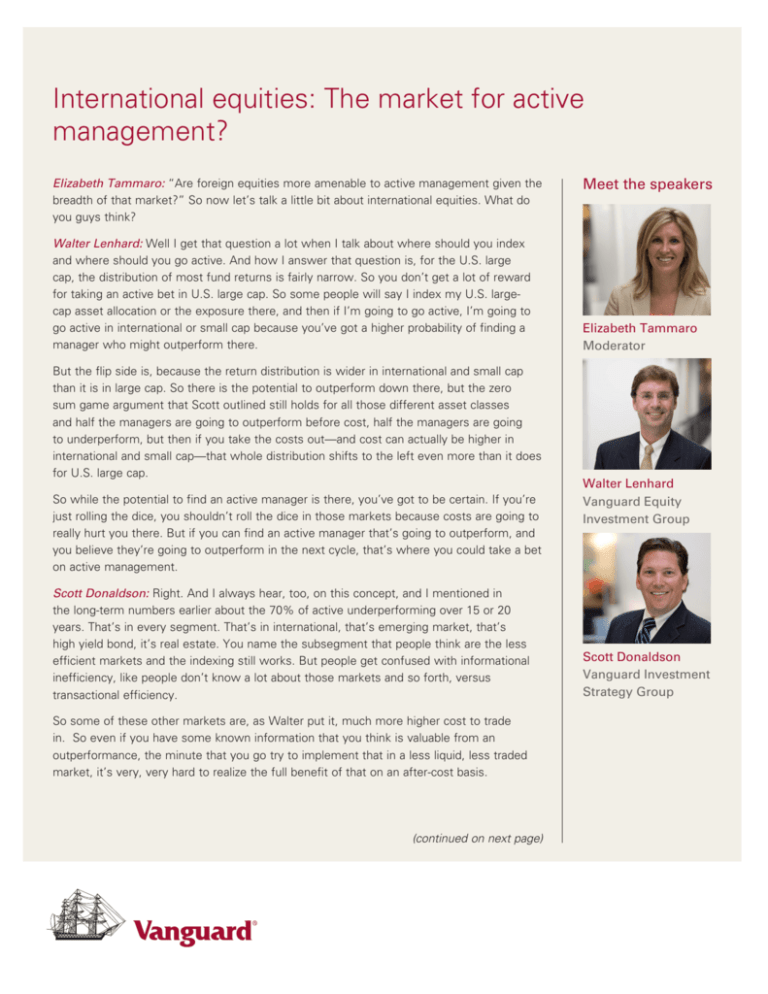

Meet the speakers

Elizabeth Tammaro

Moderator

Walter Lenhard

Vanguard Equity

Investment Group

Scott Donaldson

Vanguard Investment

Strategy Group

Elizabeth Tammaro: Okay.

Walter Lenhard: And that’s an interesting point that the costs are more than just expense

ratios. Normally, people think about the expense ratio of a mutual fund, but even in emerging

markets or small cap you’ve got the spread costs, you’ve got commissions, etc. So the total

costs are higher than just your expense ratio.

Vanguard Financial

Advisor Services™

For more information on Vanguard funds and Vanguard ETF Shares, visit

advisors.vanguard.com or call 800-997-2798 to obtain a prospectus. Investment

objectives, risks, charges, expenses, and other important information are contained

in the prospectus; read and consider it carefully before investing.

All investing is subject to risk, including possible loss of principal.

Past performance is no guarantee of future returns. The performance of an index is not an exact representation

of any particular investment, as you cannot invest directly in an index.

P.O. Box 2900

Valley Forge, PA 19482-2900

© 2014 The Vanguard Group, Inc.

All rights reserved.

Vanguard Marketing Corporation, Distributor.

INDXIN4BTR 122014