Vanguard can help optimize

your practice’s retirement plan

with a full range of expert services

For expert plan consulting,

flexible investments, and

ongoing support for your

fiduciary role, you can rely

on Vanguard

Vanguard offers:

•

Decades of experience in managing plans for hundreds

of medical firms.

•

A full range of investment options, including brokerage.

•

Sound investment management built on time-tested principles.

•

Skilled support for meeting your fiduciary responsibilities.

•

Custom plan consulting and the most current information

on regulatory changes.

•

Personal financial planning and advice services for assets inside

and outside the plan.

•

High-quality, flexible administrative services.

1

Our broad resources and decades

of experience can free you from the

burdens of plan management

If you’re looking for expertise in managing

retirement plans so you can focus on taking

care of your patients, Vanguard can help—

because managing retirement plans is

something we do extremely well. Since our

beginning in 1975, we’ve grown into one of

the world’s largest investment management

companies, with 18 million shareholders

and more than $800 billion in assets under

management (as of June 2005). About half

of those assets are held in retirement plans

and other institutional investments.

When you partner with Vanguard, you get

the best of both worlds—access to the

breadth and depth of our large-company

resources coupled with our extensive

experience in managing retirement plans

of your size and scope, including hundreds

of medical practices like yours.

2

You and your participants are well

served by our corporate structure

Most investment firms are either publicly

traded or privately owned. Vanguard is

different: We’re client-owned. Helping our

investors—your participants—achieve their

goals is literally our sole reason for existence.

This structure is a tremendous benefit, not

just to your participants, but to plan sponsors

like you in your role as a plan fiduciary. With

no other parties to answer to and therefore

no conflicting loyalties, we make every

decision—like keeping investment costs as

low as possible—with only the needs of our

investors in mind.

“We chose Vanguard as our 401(k) plan

provider for their unbeatable combination

of low cost, excellent performance, and

quality service.”

–Dr. John Healey, Radiology Associates of Tarrant County, Fort Worth, Texas

Our skilled analysts provide expert

plan design and ongoing support for

your fiduciary role

When it comes to plan design and support,

Vanguard offers a full range of services. Our

in-house team of investment experts can work

with you to develop a framework for your plan

that fulfills your fiduciary responsibilities and

meets the retirement savings needs of your

staff. Our analysts also can help you develop

an investment policy statement, and can

regularly evaluate your plan to ensure that

its overall investment approach remains

aligned with its objectives.

Our experts in retirement plan law also can

assist you with important concerns, such as

maximizing plan deferrals for key employees

or reducing administrative costs. In fact, our

plan consultants recently helped a medical

firm redesign its plan to save thousands

of dollars in plan costs and maximize benefits

for the firm’s physicians.

You get the investment flexibility

you’re looking for

As one of the world’s leading investment

management firms, we offer your retirement

plan a high level of investment flexibility that

includes not just Vanguard® indexed and

actively managed mutual funds, but a full

range of other fund families and access to the

entire universe of stocks and bonds through a

brokerage option.

For your less experienced participants, we

also provide easy-to-use Target Retirement

Funds. Each of these funds contains a

balanced mix of stock and bond funds and

is automatically managed to become more

conservative as a participant’s retirement

date approaches.

This wide range of investments means

you can create a flexible lineup for your

plan that meets the needs of all your staff

members, whether they are novice or

sophisticated investors.*

In addition, our highly skilled team of plan

consultants is at your disposal, including

attorneys and experienced specialists in

finance and compliance. Whether you need

assistance with document reviews or have a

concern about compliance, we can help you

address the issue properly.

* All investments are subject to risk

3

First in client satisfaction and relationship quality

For six consecutive years, Vanguard has been voted

first in overall client satisfaction in an independent

study conducted by Boston Research Group.

–Boston Research Group Defined Contribution Plan Sponsor Study, 2000–2005

Vanguard consistently strives to keep

investment costs low because we know

low management fees and transaction costs

can provide investors with a head start in

achieving competitive returns. Overall, the

average expense ratio of Vanguard® funds

is far below the average mutual fund expense

ratio.* These lower costs mean you and your

staff receive a higher percentage of your

Vanguard funds’ returns, which can translate

into significant savings over time.

*Lipper Inc., as of 12/31/04

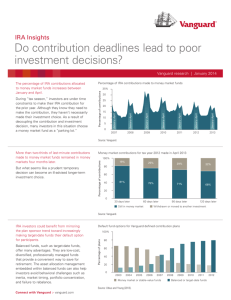

> Lower investment costs mean you

keep more of your funds’ returns

$1.8 million

$1,483,503

Low expense ratio

$314,023 Difference

$1,169,480

High expense ratio

Portfolio value

Our low-cost investments help you

keep more of what you earn

A

B

0

10

20

Years

30

40

Low costs can have a dramatic impact on retirement savings.

This chart shows the result of 40 years of compounding

on two investments with different expense ratios. Fund A

carries an expense ratio of 0.30%. Fund B charges 1.40%.

After 40 years of compounding, the lower-cost option delivers

$314,023 more than the higher-cost option.*

*Assumptions: A 25-year-old participant has a starting salary of

$30,000, receives a 5% raise annually, and puts 10% of that

salary into a 401(k) plan each year with average annual returns

of 8% before costs. The example does not take into account

any taxes at distribution. This hypothetical example does not

represent the return on any particular investment.

4

Vanguard also ranked first in overall client relationship

quality for eight consecutive years in a study conducted

by Greenwich Associates.

–Greenwich Associates 401(k) Plan Study, 1997–2004

> Percentage of Vanguard active funds

topping their Lipper averages

100%

81%

85%

88%

91%

> Expense ratios: Vanguard versus industry

1.5%

1.35%

Mutual Fund Industry

1.2%

0.9%

0.6%

The Vanguard Group

1 Year

3 Years

5 Years

10 Years

0.23%

0.3%

Periods ended June 30, 2005.

Source: Lipper Inc.

The comparisons for the one-, three-, five-, and ten-year

performance as of June 30, 2005, included 12,245; 10,006;

7,641; and 3,118 funds in Lipper Inc. stock, taxable and

municipal bond, balanced, and money market categories.

Comparison does not include index funds. Results may vary for

other time periods. Only funds with a minimum one-, three-, five-,

or ten-year history respectively were included in the comparison.

0.0%

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

Note that the competitive performance data shown

represent past performance, which is not a guarantee of

future results, and that all investments are subject to risk.

While costs for just about everything are skyrocketing, the

cost of investing in Vanguard mutual funds has fallen 39%

since 1990.

Sources: The Vanguard Group and Lipper Inc.

5

Personal financial planning and

advice help you manage your entire

financial picture

As your assets grow, you and your staff can

rely on Vanguard’s personal financial planning

and advice services to help manage all your

financial resources, both inside and outside

the plan. Select from our wide array of

services, from comprehensive one-time

financial planning to lifelong advisory and

trust services, all customized to your individual

needs. Whichever services you prefer to use,

you can be confident that they are backed

by our reputation for consistency, objectivity,

and integrity—a reputation that is second

to none in the financial services industry.

As a Vanguard investor with a more complex

portfolio, you can choose from services

that include:

Flagship™ Service: When you invest more than

$1 million with Vanguard, you'll be assigned a

specially trained, highly experienced Vanguard

representative who is familiar with your financial

situation, can help you address a wide range of

investment issues, and takes responsibility for

your satisfaction with Vanguard.

6

Voyager Service®: With an investment of

$250,000 to $1 million with Vanguard, you'll

have access to a special team of Vanguard

associates who can offer you guidance on

managing your portfolio, help identify your

investment and financial needs, and provide

solutions through Vanguard's array of products

and services.

Asset Management Services: If you’re ready

for ongoing, personal investment management

and trust services, entrust your assets of

$500,000 or more to Vanguard Asset

Management Services.

Personal Financial Planning: Get personalized

and practical advice by consulting with a

Vanguard financial planning professional, who

can help you with issues such as selecting

investments, saving for future education

expenses, or developing an estate plan.

“We really felt like part of the ownership model

Vanguard talks about. Most companies lower

prices only if they are at risk of losing a client or

to stay competitive. But with Vanguard, the cost

of investing is really based on cost, not profit.”

–Jay Burghart, CFO, The Doctor’s Clinic, Seattle, Washington

Effective education and advice

programs aim to improve

participants’ savings

We can take on the administrative

tasks and reduce your plan-related

workload

To be financially prepared for retirement, your

participants need to learn how to make sound

investment decisions that can help them build

assets in the plan. To meet this need, Vanguard

can deliver effective investment education

programs—in print, online, on video, or in

person—all communicated in the clear, candid

“plain talk” style that is one of our hallmarks.

Our education programs and tools are based

on our proprietary research in behavioral

finance and are proven through our decades

of experience in managing retirement plans.

Your focus should be on caring for your

patients, as well as building and maintaining

your practice, not administering your plan. Our

broad experience in administering retirement

plans—including plans for hundreds of medical

firms like yours—can help. We can take the

burden of administration off your shoulders,

reducing the amount of time you need to

spend on plan issues.

In addition to ongoing investment education,

we also offer a variety of personal financial

planning options for your participants, ranging

from comprehensive, do-it-yourself, online

portfolio management through Financial Engines

to simple, diversified Target Retirement Funds

that automatically become more conservative

over time.

7

98% of Vanguard clients

Rate Vanguard’s overall quality as excellent, very

good, or good.

• Are likely to continue using Vanguard.

• Are likely to recommend Vanguard to a colleague.

•

–Vanguard 2005 Client Loyalty Study

Your Vanguard team collaborates with

you to create efficiencies and value

You and your participants can contact

Vanguard through multiple channels

We strive for lifelong relationships with all our

clients and are committed to excellence in

everything we do. We think you’ll appreciate

the dedication of our people, who will quickly

become your most valued resource.

When you and your participants have investment and retirement questions, Vanguard

provides several different ways to get answers.

You can log on to Vanguard.com®, one of the

most comprehensive websites in the industry,

to manage your account, learn about investing,

and research funds. Participants can also call

our automated telephone account service 24

hours a day, or speak directly to a licensed

associate during business hours.

Your single point of contact is your relationship

manager, who serves as your partner, listening

to your needs, brainstorming strategic solutions,

and bringing in other Vanguard experts as needed.

Plan C

rsion

nve s

Com onsu

o

e

pli a lti

n C ervic

nc

S

p

i

h

M

s

n

ana

t io

a

g

l

e

ng

/

e

er

Re d

A

ew

Your Medical

Practice

co

m i rdke

n i s eping/

tra t

ion

8

E ducation/

Advice

P articipa nt

Services

R

Pl a

> Your Vanguard team collaborates

with you

i

ev

oR p

i

l

o

f

Port G r o u

As a plan sponsor, you also have access to the

Vanguard Plan Sponsor Bridge®, where you can

log on directly to current plan-level data and

activity, as well as participant-level information.

The Bridge also helps you stay up-to-date on

the latest developments at Vanguard and in the

financial industry at large.

Vanguard Institutional

Investor Group

P.O. Box 2900

Valley Forge, PA 19482-2900

Connect with Vanguard™ > www.vanguard.com > 800-523-1036

For more information, visit www.vanguard.com,

or call 800-523-1036 for Vanguard funds and

800-992-8327 for non-Vanguard funds offered

through Vanguard Brokerage Services®, to obtain

a prospectus. Investment objectives, risks,

charges, expenses, and other important

information are contained in the prospectus;

read and consider it carefully before investing.

Vanguard, Flagship, Voyager Service, Vanguard.com, Plan Sponsor

Bridge, Vanguard Brokerage Services, Connect with Vanguard, and

the ship logo are trademarks of The Vanguard Group, Inc.

Vanguard Personal Financial Planning Service is provided by

Vanguard Advisers, Inc., a registered investment adviser. Vanguard

Asset Management Services are provided by Vanguard National

Trust Company, which is a federally chartered trust company

operated under the supervision of the Office of the Comptroller

of the Currency.

Financial Engines is a trademark of Financial Engines, Inc.

Financial Engines Advisors LLC, a federally registered investment

advisor and wholly owned subsidiary of Financial Engines, Inc.,

provides all advisory services.

All other marks are the exclusive property of their

respective owners.

© 2005 The Vanguard Group, Inc.

All rights reserved.

Vanguard Marketing Corporation, Distributor.

MPBRO 092005