Convertible Bonds

advertisement

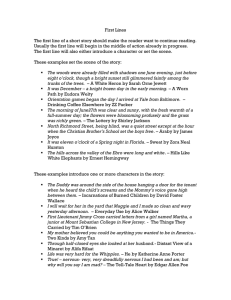

SUCCESS FACTORS RMF INVESTMENT GROUP Asset allocation skills because of the wide divergence between returns of sectors and countries over certain periods State-of-the-art models to keep up with the ever increasing sophistication of the other market participants Credit skills to assess the corporate bond-type credit risk Relationships to investment banks for access to new issues and stock borrowing (CB arbitrage) Market timing skills to protect the capital in extended phases of equity market weakness Risk management skills to avoid unwanted exposure to all types of risk including interest rate and currency risk Proprietary trading experience and mentality to take advantage of the relative value characteristics of the instrument SUMMARY In recent years, the Convertibles market has grown at an accelerated pace. More and more companies are willing to look at the advantages of financing through Convertibles, and they find good demand from various investors such as Hedge Funds, Convertible Bond funds or investment banks. We believe that this trend will continue and that this market will steadily gain significance in the future Convertible Bonds are instruments that are beneficial to both investors and issuers Convertible Bonds are an asset class with risk-return characteristics that are superior to those of pure bonds, pure equities, or a blend of bonds and equities The successful management of Convertible Bond portfolios depends on various factors such as asset allocation, security selection and credit skills, state-of-the-art models as well as good relationships to investment banks for access to new issues RMF commenced activities as an operative Hedge Fund Manager in 1992 with an exclusive mandate for one of the world’s most prestigious Market Neutral Hedge Funds. Over the years, RMF has continued to focus on servicing investors by providing comprehensive products and solutions and is regarded as an innovator in the Alternative Asset Management Industry. In May 2002, RMF was acquired by the Man Group creating the largest independent Alternative Investment Manager in the market, with approximately USD 20 billion under management (excluding Real Estate and Private Equity). As of 30 June 2002 RMF had funds under management of approximately USD 9.5 billion. RMF is a process driven organisation, and one of the few organisations in the financial services industry to have achieved the ISO 9001: 2000 Certification for Quality Management Systems. CONTACT For further information please contact: Client Relations Team RMF Investment Consultants Huobstrasse 16 8808 Pfäffikon/SZ Switzerland Phone +41 (0) 55 415 87 10 Fax +41 (0) 55 415 87 94 www.rmf.ch info@rmf.ch Disclaimer The content of this documentation is for your information purposes only and constitutes neither a request, nor an offer, nor a solicitation, nor a recommendation to buy, sell or make an investment in the described investment instruments or to enter into or conclude other transactions of any kind. The information provided herein is not intended to provide sufficient basis on which to make an investment decision. Potential investors should note that alternative investments can involve significant risks and the value of an investment may go down as well as up. Furthermore, we recommend you consult your bank, or investment and/or tax adviser. Past performance is never an indication or guarantee of future performance. Information contained herein is provided from the RMF database or obtained from sources that RMF considers to be reliable. However, although RMF has taken professional care in gathering and updating this material and information, it does not assume any liability in the case of incorrectly reported or incomplete information, accuracy or correctness. All projections, valuations and statistical analyses are provided to assist the recipient in understanding the basics of alternative investments. Such projections, valuations and analyses may be based on subjective assessments and assumptions and may use one among several alternative methodologies (and other methodologies may produce different results). Accordingly, such projections, valuations and statistical analyses should not be viewed as facts and should not be relied upon as a prediction of future events. The information in this documentation is not intended for persons and organizations subject to U.S. federal, state or local law or to the law of any foreign jurisdiction prohibiting the use or attention of this information whether on the basis of domicile, nationality or for other reasons. This document and all information contained within is proprietary information of RMF and its affiliates and may not be reproduced or otherwise disseminated in whole or in part without prior written consent from RMF. A member of the Man Group An Introduction to the Asset Class Convertible Bonds RMF Investment Group is the leading provider of Alternative Investment Solutions, specialising in Hedge Funds, Leveraged Finance, Private Equity and Convertible Bonds. Focused on the institutional market, RMF’s target clients include pension funds, insurance companies, banks, large corporations and distribution channels. RMF’s headquarters is in Switzerland, however the Company also has physical presence in the major financial centres. 200/Q2_02 The following factors are critical for the success of a Convertible Bond investor: CHARACTERISTICS (CONT.) Investment Categories Efficient Frontier Convertibles are fascinating hybrid securities. On the one hand, they have the benefits of debt instruments that pay fixed coupons and will be redeemed at maturity at a pre-specified price. On the other hand, the embedded conversion option provides the investor with a participation in the upside potential of the underlying equity. Hybrid instrument (at-the-money) Convertible Bonds where the underlying share price trades close to the conversion price are considered balanced Convertibles because of their asymmetric payoff profile. They have a medium sensitivity to changes in the underlying equity. These bonds are affected by the share price performance and volatility movements as well as changes in interest rates and the issuer’s credit profile. The majority of new issues are launched as balanced Convertibles. The conversion right provides the bond holder with a better-of-two-choices option. At maturity, the Convertible Bonds are worth the higher of (a) their redemption value (the price at which the issuer had agreed to buy the bonds back) or (b) the market value of the underlying shares. Equity alternative (deep-in-the-money) Convertible Bonds where the underlying share price trades significantly above the conversion price are highly sensitive to changes in the equity, whereas their sensitivity to changes in interest rates and/or credit spreads is low. These bonds trade at an insignificant premium or even a small discount to parity. Deep-in-the-money Convertibles will almost certainly be converted into the underlying shares at maturity. In other words, a Convertible Bond is a straight bond with an embedded equity call option. Due to this call option, the Convertible will participate in any increase of the underlying equity, while the fixed income portion provides capital protection, should the share price fall. CHARACTERISTICS Payoff profile Yield Instrument Hybrid Instrument Equity Alternative Price Behaviour of Convertibles ity Par rice rtible P Conve Premium Yield instrument (out-of-the-money) Convertible Bonds where the underlying share price trades significantly below the conversion price have low equity sensitivity and behave like fixed income securities. The main price factors are the interest rate level and the issuer’s credit spread. Bond Floor Old Price 130 New Price 162.5 Capital Gain/ Loss 32.5 Cashflow 1.5 Total Return 0.3 Convertible Bond 135 164.0 29.0 4.4 0.2 Share Price unchanged Equity 130 130.0 0.0 1.5 0.0 Convertible Bond 135 135.0 0.0 4.4 0.0 Share Price - 25% Equity 130 97.5 -32.5 1.5 -0.2 Convertible Bond 135 120.0 -15.0 4.4 -0.1 Share Price + 25% Equity Convertible price Similarly to straight debt, a Convertible contains the risk of the issuer not being able to repay the principal at maturity. This credit risk is expressed in the graph as the steep fall of the bond floor as well as the bond price on the left-hand side. The best risk-return profile is located in the red area where the Convertible’s potential upside is the greatest while the downside risk is relatively low. RMF focuses on Convertible Bonds priced in that area. 100% CB s, 0% B o nds 14% 12% 100% E quity , 0% B onds 10% 100% B onds 8% 4% 9% 14% Annualised Volatility 19% Source: RMF Research MARKET Global Overview The Convertible Bonds market has been growing over the last decade. The data indicate this trend will continue in the future as both companies and investors become more aware of the benefits of Convertible Bonds. The following map depicts the capitalisation of outstanding Convertible Bonds divided by geographic region (as of December 2001). 162.5 135 130 120 Europe USD 137 bn Asia (ex Japan) USD 29 bn Japan USD 91 bn North America USD 213 bn Share Price Source: RMF Research In the long run, Convertible Bonds can outperform pure equity and/or pure bond portfolios. The studies further show that CBs can replicate the upside movements of the share prices without the corresponding volatility. Value Index 150 ML-G300 Global Convertibles MSCI Global Equities JPM Global Bonds 100 Jun 02 Jun 01 Dec 01 Dec 00 Jun 00 Dec 99 Jun 99 Jun 98 Dec 98 Jun 97 Dec 97 Jun 96 Dec 96 Dec 95 Jun 95 Dec 94 50 Source: Bloomberg Correlation Matrix for Convertibles and other major Asset Classes 16% 97.5 200 The x-axis displays the underlying share price while the y-axis represents the price of the Convertible Bond. The dotted diagonal expresses the intrinsic value called parity. Parity represents the value that the investor would receive upon conversion of the bond. Parity is a lower boundary for the price of the Convertible. The yellow line outlines the Convertible‘s fair value. If the share price increases, the fair value of the Convertible Bond rises as well. As the share price increases, the relationship between shares and bonds becomes more direct until the bond price behaviour and risk profile resemble characteristics of the underlying equity. On the other hand, if the share price falls, the bond‘s sensitivity to its underlying share price will decrease and the bond will not decline to the same extent as the equity. The level which will prevent the Convertible from falling further down is shown in the above graph as the bond floor (grey) which is also a lower boundary for the price of the Convertible. 18% 250 Global Performance across Asset Classes Source: RMF Research The payoff of Convertible Bonds surpasses the returns achieved by either pure bonds or equities. 164 Source: RMF Research Stock price Market data indicate the advantage of investing in CBs as compared to fixed income instruments and/or equities. The chart depicts the efficient frontier analysis of investing in bonds, equities and Convertible Bonds. Annualised Return Convertible Bonds (CBs) are fixed income instruments that can be converted into a fixed number of shares of the issuer at the option of the investor. Bonds that are convertible into shares other than the issuer’s are called exchangeable bonds. CHARACTERISTICS (CONT.) Convertible Bond DESCRIPTION Convertible Large-Cap Small-Cap Bonds Stocks Stocks Convertible Bonds Large-Capitalisation Stocks Small-Capitalisation Stocks Long-Term Treasury Bonds Intermediate-Term Treasury Bonds Treasury Bills Long-Term Corporate Bonds Intermediate-Term Corporate Bonds Mortgage-Backed Securities Real Estate 1.00 0.83 0.80 0.36 0.32 -0.01 0.51 0.52 0.42 -0.02 1.00 0.79 0.36 0.28 -0.09 0.51 0.48 0.35 -0.23 1.00 0.12 0.07 0.02 0.30 0.33 0.10 0.34 Long-Term Treasury Bonds 1.00 0.93 0.00 0.92 0.90 0.87 0.04 Intermediat e-Term Treasury Bonds 1.00 0.25 0.91 0.94 0.91 0.09 Treasury Bills 1.00 -0.01 0.19 0.14 0.25 IntermediateLong-Term MortgageTerm Corporate Backed Real Estate Corporate Bonds Securities Bonds 1.00 0.97 0.95 0.07 1.00 0.93 0.16 1.00 -0.01 1.00 Source: Ibbotson Associates and Goldman Sachs Correlations above are generally calculated using monthly total returns over the period 19732000. The exceptions are Mortgage Backed Securities, which use the period 1976-2000, and Real Estate which uses quarterly returns for the period March 1978-September 2000. The Convertible Bonds Market: USD 470 bn Market Participants Source: Merrill Lynch Long-only investors including dedicated CB Funds The strategy is to generate above average returns via capital gains and interest income while enjoying downside protection and lower volatility. Studies show that Convertible Bond portfolios have outperformed traditional portfolios (50% bonds and 50% equities) on a global basis from 1993 to 2000. During this period, they even outperformed pure equity portfolios (CBs returned 9.92% p.a., while equities returned 9.07% p.a.) (study by Jefferies). Hedge Funds CB arbitrage is a typical Hedge Fund strategy. The arbitrageur is long a Convertible and short the underlying shares according to the CB‘s sensitivity to its underlying (delta), in order to extract the Convertible‘s ‘cheapness’. If the share price falls, the CB becomes more bond-like and declines less than the share price, so the trader buys back some shares. Similarly, if the share price rises, the Convertible becomes more equity-like and the trader sells more shares. If it is possible to repeat this operation on several occasions, the trader will always be buying low and selling high. Equity investors As equity investors need or want full upside exposure, their strategy would be to buy deep-in-themoney CBs. They could often generate an income advantage as the coupon yield is typically higher than the dividend yield. Furthermore, they enjoy the benefit of the embedded call option on the underlying equity as well as free downside protection, although that may be rather far away. The investors could also take advantage of in-the-money CBs trading at a discount to parity. Fixed income investors Fixed income investors tend to buy out-of-the-money CBs that are trading with yields close to their corporate bond equivalents but contain the added bonus of upside participation of the underlying share price. CHARACTERISTICS (CONT.) Investment Categories Efficient Frontier Convertibles are fascinating hybrid securities. On the one hand, they have the benefits of debt instruments that pay fixed coupons and will be redeemed at maturity at a pre-specified price. On the other hand, the embedded conversion option provides the investor with a participation in the upside potential of the underlying equity. Hybrid instrument (at-the-money) Convertible Bonds where the underlying share price trades close to the conversion price are considered balanced Convertibles because of their asymmetric payoff profile. They have a medium sensitivity to changes in the underlying equity. These bonds are affected by the share price performance and volatility movements as well as changes in interest rates and the issuer’s credit profile. The majority of new issues are launched as balanced Convertibles. The conversion right provides the bond holder with a better-of-two-choices option. At maturity, the Convertible Bonds are worth the higher of (a) their redemption value (the price at which the issuer had agreed to buy the bonds back) or (b) the market value of the underlying shares. Equity alternative (deep-in-the-money) Convertible Bonds where the underlying share price trades significantly above the conversion price are highly sensitive to changes in the equity, whereas their sensitivity to changes in interest rates and/or credit spreads is low. These bonds trade at an insignificant premium or even a small discount to parity. Deep-in-the-money Convertibles will almost certainly be converted into the underlying shares at maturity. In other words, a Convertible Bond is a straight bond with an embedded equity call option. Due to this call option, the Convertible will participate in any increase of the underlying equity, while the fixed income portion provides capital protection, should the share price fall. CHARACTERISTICS Payoff profile Yield Instrument Hybrid Instrument Equity Alternative Price Behaviour of Convertibles ity Par rice rtible P Conve Premium Yield instrument (out-of-the-money) Convertible Bonds where the underlying share price trades significantly below the conversion price have low equity sensitivity and behave like fixed income securities. The main price factors are the interest rate level and the issuer’s credit spread. Bond Floor Old Price 130 New Price 162.5 Capital Gain/ Loss 32.5 Cashflow 1.5 Total Return 0.3 Convertible Bond 135 164.0 29.0 4.4 0.2 Share Price unchanged Equity 130 130.0 0.0 1.5 0.0 Convertible Bond 135 135.0 0.0 4.4 0.0 Share Price - 25% Equity 130 97.5 -32.5 1.5 -0.2 Convertible Bond 135 120.0 -15.0 4.4 -0.1 Share Price + 25% Equity Convertible price Similarly to straight debt, a Convertible contains the risk of the issuer not being able to repay the principal at maturity. This credit risk is expressed in the graph as the steep fall of the bond floor as well as the bond price on the left-hand side. The best risk-return profile is located in the red area where the Convertible’s potential upside is the greatest while the downside risk is relatively low. RMF focuses on Convertible Bonds priced in that area. 100% CB s, 0% B o nds 14% 12% 100% E quity , 0% B onds 10% 100% B onds 8% 4% 9% 14% Annualised Volatility 19% Source: RMF Research MARKET Global Overview The Convertible Bonds market has been growing over the last decade. The data indicate this trend will continue in the future as both companies and investors become more aware of the benefits of Convertible Bonds. The following map depicts the capitalisation of outstanding Convertible Bonds divided by geographic region (as of December 2001). 162.5 135 130 120 Europe USD 137 bn Asia (ex Japan) USD 29 bn Japan USD 91 bn North America USD 213 bn Share Price Source: RMF Research In the long run, Convertible Bonds can outperform pure equity and/or pure bond portfolios. The studies further show that CBs can replicate the upside movements of the share prices without the corresponding volatility. Value Index 150 ML-G300 Global Convertibles MSCI Global Equities JPM Global Bonds 100 Jun 02 Jun 01 Dec 01 Dec 00 Jun 00 Dec 99 Jun 99 Jun 98 Dec 98 Jun 97 Dec 97 Jun 96 Dec 96 Dec 95 Jun 95 Dec 94 50 Source: Bloomberg Correlation Matrix for Convertibles and other major Asset Classes 16% 97.5 200 The x-axis displays the underlying share price while the y-axis represents the price of the Convertible Bond. The dotted diagonal expresses the intrinsic value called parity. Parity represents the value that the investor would receive upon conversion of the bond. Parity is a lower boundary for the price of the Convertible. The yellow line outlines the Convertible‘s fair value. If the share price increases, the fair value of the Convertible Bond rises as well. As the share price increases, the relationship between shares and bonds becomes more direct until the bond price behaviour and risk profile resemble characteristics of the underlying equity. On the other hand, if the share price falls, the bond‘s sensitivity to its underlying share price will decrease and the bond will not decline to the same extent as the equity. The level which will prevent the Convertible from falling further down is shown in the above graph as the bond floor (grey) which is also a lower boundary for the price of the Convertible. 18% 250 Global Performance across Asset Classes Source: RMF Research The payoff of Convertible Bonds surpasses the returns achieved by either pure bonds or equities. 164 Source: RMF Research Stock price Market data indicate the advantage of investing in CBs as compared to fixed income instruments and/or equities. The chart depicts the efficient frontier analysis of investing in bonds, equities and Convertible Bonds. Annualised Return Convertible Bonds (CBs) are fixed income instruments that can be converted into a fixed number of shares of the issuer at the option of the investor. Bonds that are convertible into shares other than the issuer’s are called exchangeable bonds. CHARACTERISTICS (CONT.) Convertible Bond DESCRIPTION Convertible Large-Cap Small-Cap Bonds Stocks Stocks Convertible Bonds Large-Capitalisation Stocks Small-Capitalisation Stocks Long-Term Treasury Bonds Intermediate-Term Treasury Bonds Treasury Bills Long-Term Corporate Bonds Intermediate-Term Corporate Bonds Mortgage-Backed Securities Real Estate 1.00 0.83 0.80 0.36 0.32 -0.01 0.51 0.52 0.42 -0.02 1.00 0.79 0.36 0.28 -0.09 0.51 0.48 0.35 -0.23 1.00 0.12 0.07 0.02 0.30 0.33 0.10 0.34 Long-Term Treasury Bonds 1.00 0.93 0.00 0.92 0.90 0.87 0.04 Intermediat e-Term Treasury Bonds 1.00 0.25 0.91 0.94 0.91 0.09 Treasury Bills 1.00 -0.01 0.19 0.14 0.25 IntermediateLong-Term MortgageTerm Corporate Backed Real Estate Corporate Bonds Securities Bonds 1.00 0.97 0.95 0.07 1.00 0.93 0.16 1.00 -0.01 1.00 Source: Ibbotson Associates and Goldman Sachs Correlations above are generally calculated using monthly total returns over the period 19732000. The exceptions are Mortgage Backed Securities, which use the period 1976-2000, and Real Estate which uses quarterly returns for the period March 1978-September 2000. The Convertible Bonds Market: USD 470 bn Market Participants Source: Merrill Lynch Long-only investors including dedicated CB Funds The strategy is to generate above average returns via capital gains and interest income while enjoying downside protection and lower volatility. Studies show that Convertible Bond portfolios have outperformed traditional portfolios (50% bonds and 50% equities) on a global basis from 1993 to 2000. During this period, they even outperformed pure equity portfolios (CBs returned 9.92% p.a., while equities returned 9.07% p.a.) (study by Jefferies). Hedge Funds CB arbitrage is a typical Hedge Fund strategy. The arbitrageur is long a Convertible and short the underlying shares according to the CB‘s sensitivity to its underlying (delta), in order to extract the Convertible‘s ‘cheapness’. If the share price falls, the CB becomes more bond-like and declines less than the share price, so the trader buys back some shares. Similarly, if the share price rises, the Convertible becomes more equity-like and the trader sells more shares. If it is possible to repeat this operation on several occasions, the trader will always be buying low and selling high. Equity investors As equity investors need or want full upside exposure, their strategy would be to buy deep-in-themoney CBs. They could often generate an income advantage as the coupon yield is typically higher than the dividend yield. Furthermore, they enjoy the benefit of the embedded call option on the underlying equity as well as free downside protection, although that may be rather far away. The investors could also take advantage of in-the-money CBs trading at a discount to parity. Fixed income investors Fixed income investors tend to buy out-of-the-money CBs that are trading with yields close to their corporate bond equivalents but contain the added bonus of upside participation of the underlying share price. CHARACTERISTICS (CONT.) Investment Categories Efficient Frontier Convertibles are fascinating hybrid securities. On the one hand, they have the benefits of debt instruments that pay fixed coupons and will be redeemed at maturity at a pre-specified price. On the other hand, the embedded conversion option provides the investor with a participation in the upside potential of the underlying equity. Hybrid instrument (at-the-money) Convertible Bonds where the underlying share price trades close to the conversion price are considered balanced Convertibles because of their asymmetric payoff profile. They have a medium sensitivity to changes in the underlying equity. These bonds are affected by the share price performance and volatility movements as well as changes in interest rates and the issuer’s credit profile. The majority of new issues are launched as balanced Convertibles. The conversion right provides the bond holder with a better-of-two-choices option. At maturity, the Convertible Bonds are worth the higher of (a) their redemption value (the price at which the issuer had agreed to buy the bonds back) or (b) the market value of the underlying shares. Equity alternative (deep-in-the-money) Convertible Bonds where the underlying share price trades significantly above the conversion price are highly sensitive to changes in the equity, whereas their sensitivity to changes in interest rates and/or credit spreads is low. These bonds trade at an insignificant premium or even a small discount to parity. Deep-in-the-money Convertibles will almost certainly be converted into the underlying shares at maturity. In other words, a Convertible Bond is a straight bond with an embedded equity call option. Due to this call option, the Convertible will participate in any increase of the underlying equity, while the fixed income portion provides capital protection, should the share price fall. CHARACTERISTICS Payoff profile Yield Instrument Hybrid Instrument Equity Alternative Price Behaviour of Convertibles ity Par rice rtible P Conve Premium Yield instrument (out-of-the-money) Convertible Bonds where the underlying share price trades significantly below the conversion price have low equity sensitivity and behave like fixed income securities. The main price factors are the interest rate level and the issuer’s credit spread. Bond Floor Old Price 130 New Price 162.5 Capital Gain/ Loss 32.5 Cashflow 1.5 Total Return 0.3 Convertible Bond 135 164.0 29.0 4.4 0.2 Share Price unchanged Equity 130 130.0 0.0 1.5 0.0 Convertible Bond 135 135.0 0.0 4.4 0.0 Share Price - 25% Equity 130 97.5 -32.5 1.5 -0.2 Convertible Bond 135 120.0 -15.0 4.4 -0.1 Share Price + 25% Equity Convertible price Similarly to straight debt, a Convertible contains the risk of the issuer not being able to repay the principal at maturity. This credit risk is expressed in the graph as the steep fall of the bond floor as well as the bond price on the left-hand side. The best risk-return profile is located in the red area where the Convertible’s potential upside is the greatest while the downside risk is relatively low. RMF focuses on Convertible Bonds priced in that area. 100% CB s, 0% B o nds 14% 12% 100% E quity , 0% B onds 10% 100% B onds 8% 4% 9% 14% Annualised Volatility 19% Source: RMF Research MARKET Global Overview The Convertible Bonds market has been growing over the last decade. The data indicate this trend will continue in the future as both companies and investors become more aware of the benefits of Convertible Bonds. The following map depicts the capitalisation of outstanding Convertible Bonds divided by geographic region (as of December 2001). 162.5 135 130 120 Europe USD 137 bn Asia (ex Japan) USD 29 bn Japan USD 91 bn North America USD 213 bn Share Price Source: RMF Research In the long run, Convertible Bonds can outperform pure equity and/or pure bond portfolios. The studies further show that CBs can replicate the upside movements of the share prices without the corresponding volatility. Value Index 150 ML-G300 Global Convertibles MSCI Global Equities JPM Global Bonds 100 Jun 02 Jun 01 Dec 01 Dec 00 Jun 00 Dec 99 Jun 99 Jun 98 Dec 98 Jun 97 Dec 97 Jun 96 Dec 96 Dec 95 Jun 95 Dec 94 50 Source: Bloomberg Correlation Matrix for Convertibles and other major Asset Classes 16% 97.5 200 The x-axis displays the underlying share price while the y-axis represents the price of the Convertible Bond. The dotted diagonal expresses the intrinsic value called parity. Parity represents the value that the investor would receive upon conversion of the bond. Parity is a lower boundary for the price of the Convertible. The yellow line outlines the Convertible‘s fair value. If the share price increases, the fair value of the Convertible Bond rises as well. As the share price increases, the relationship between shares and bonds becomes more direct until the bond price behaviour and risk profile resemble characteristics of the underlying equity. On the other hand, if the share price falls, the bond‘s sensitivity to its underlying share price will decrease and the bond will not decline to the same extent as the equity. The level which will prevent the Convertible from falling further down is shown in the above graph as the bond floor (grey) which is also a lower boundary for the price of the Convertible. 18% 250 Global Performance across Asset Classes Source: RMF Research The payoff of Convertible Bonds surpasses the returns achieved by either pure bonds or equities. 164 Source: RMF Research Stock price Market data indicate the advantage of investing in CBs as compared to fixed income instruments and/or equities. The chart depicts the efficient frontier analysis of investing in bonds, equities and Convertible Bonds. Annualised Return Convertible Bonds (CBs) are fixed income instruments that can be converted into a fixed number of shares of the issuer at the option of the investor. Bonds that are convertible into shares other than the issuer’s are called exchangeable bonds. CHARACTERISTICS (CONT.) Convertible Bond DESCRIPTION Convertible Large-Cap Small-Cap Bonds Stocks Stocks Convertible Bonds Large-Capitalisation Stocks Small-Capitalisation Stocks Long-Term Treasury Bonds Intermediate-Term Treasury Bonds Treasury Bills Long-Term Corporate Bonds Intermediate-Term Corporate Bonds Mortgage-Backed Securities Real Estate 1.00 0.83 0.80 0.36 0.32 -0.01 0.51 0.52 0.42 -0.02 1.00 0.79 0.36 0.28 -0.09 0.51 0.48 0.35 -0.23 1.00 0.12 0.07 0.02 0.30 0.33 0.10 0.34 Long-Term Treasury Bonds 1.00 0.93 0.00 0.92 0.90 0.87 0.04 Intermediat e-Term Treasury Bonds 1.00 0.25 0.91 0.94 0.91 0.09 Treasury Bills 1.00 -0.01 0.19 0.14 0.25 IntermediateLong-Term MortgageTerm Corporate Backed Real Estate Corporate Bonds Securities Bonds 1.00 0.97 0.95 0.07 1.00 0.93 0.16 1.00 -0.01 1.00 Source: Ibbotson Associates and Goldman Sachs Correlations above are generally calculated using monthly total returns over the period 19732000. The exceptions are Mortgage Backed Securities, which use the period 1976-2000, and Real Estate which uses quarterly returns for the period March 1978-September 2000. The Convertible Bonds Market: USD 470 bn Market Participants Source: Merrill Lynch Long-only investors including dedicated CB Funds The strategy is to generate above average returns via capital gains and interest income while enjoying downside protection and lower volatility. Studies show that Convertible Bond portfolios have outperformed traditional portfolios (50% bonds and 50% equities) on a global basis from 1993 to 2000. During this period, they even outperformed pure equity portfolios (CBs returned 9.92% p.a., while equities returned 9.07% p.a.) (study by Jefferies). Hedge Funds CB arbitrage is a typical Hedge Fund strategy. The arbitrageur is long a Convertible and short the underlying shares according to the CB‘s sensitivity to its underlying (delta), in order to extract the Convertible‘s ‘cheapness’. If the share price falls, the CB becomes more bond-like and declines less than the share price, so the trader buys back some shares. Similarly, if the share price rises, the Convertible becomes more equity-like and the trader sells more shares. If it is possible to repeat this operation on several occasions, the trader will always be buying low and selling high. Equity investors As equity investors need or want full upside exposure, their strategy would be to buy deep-in-themoney CBs. They could often generate an income advantage as the coupon yield is typically higher than the dividend yield. Furthermore, they enjoy the benefit of the embedded call option on the underlying equity as well as free downside protection, although that may be rather far away. The investors could also take advantage of in-the-money CBs trading at a discount to parity. Fixed income investors Fixed income investors tend to buy out-of-the-money CBs that are trading with yields close to their corporate bond equivalents but contain the added bonus of upside participation of the underlying share price. SUCCESS FACTORS RMF INVESTMENT GROUP Asset allocation skills because of the wide divergence between returns of sectors and countries over certain periods State-of-the-art models to keep up with the ever increasing sophistication of the other market participants Credit skills to assess the corporate bond-type credit risk Relationships to investment banks for access to new issues and stock borrowing (CB arbitrage) Market timing skills to protect the capital in extended phases of equity market weakness Risk management skills to avoid unwanted exposure to all types of risk including interest rate and currency risk Proprietary trading experience and mentality to take advantage of the relative value characteristics of the instrument SUMMARY In recent years, the Convertibles market has grown at an accelerated pace. More and more companies are willing to look at the advantages of financing through Convertibles, and they find good demand from various investors such as Hedge Funds, Convertible Bond funds or investment banks. We believe that this trend will continue and that this market will steadily gain significance in the future Convertible Bonds are instruments that are beneficial to both investors and issuers Convertible Bonds are an asset class with risk-return characteristics that are superior to those of pure bonds, pure equities, or a blend of bonds and equities The successful management of Convertible Bond portfolios depends on various factors such as asset allocation, security selection and credit skills, state-of-the-art models as well as good relationships to investment banks for access to new issues RMF commenced activities as an operative Hedge Fund Manager in 1992 with an exclusive mandate for one of the world’s most prestigious Market Neutral Hedge Funds. Over the years, RMF has continued to focus on servicing investors by providing comprehensive products and solutions and is regarded as an innovator in the Alternative Asset Management Industry. In May 2002, RMF was acquired by the Man Group creating the largest independent Alternative Investment Manager in the market, with approximately USD 20 billion under management (excluding Real Estate and Private Equity). As of 30 June 2002 RMF had funds under management of approximately USD 9.5 billion. RMF is a process driven organisation, and one of the few organisations in the financial services industry to have achieved the ISO 9001: 2000 Certification for Quality Management Systems. CONTACT For further information please contact: Client Relations Team RMF Investment Consultants Huobstrasse 16 8808 Pfäffikon/SZ Switzerland Phone +41 (0) 55 415 87 10 Fax +41 (0) 55 415 87 94 www.rmf.ch info@rmf.ch Disclaimer The content of this documentation is for your information purposes only and constitutes neither a request, nor an offer, nor a solicitation, nor a recommendation to buy, sell or make an investment in the described investment instruments or to enter into or conclude other transactions of any kind. The information provided herein is not intended to provide sufficient basis on which to make an investment decision. Potential investors should note that alternative investments can involve significant risks and the value of an investment may go down as well as up. Furthermore, we recommend you consult your bank, or investment and/or tax adviser. Past performance is never an indication or guarantee of future performance. Information contained herein is provided from the RMF database or obtained from sources that RMF considers to be reliable. However, although RMF has taken professional care in gathering and updating this material and information, it does not assume any liability in the case of incorrectly reported or incomplete information, accuracy or correctness. All projections, valuations and statistical analyses are provided to assist the recipient in understanding the basics of alternative investments. Such projections, valuations and analyses may be based on subjective assessments and assumptions and may use one among several alternative methodologies (and other methodologies may produce different results). Accordingly, such projections, valuations and statistical analyses should not be viewed as facts and should not be relied upon as a prediction of future events. The information in this documentation is not intended for persons and organizations subject to U.S. federal, state or local law or to the law of any foreign jurisdiction prohibiting the use or attention of this information whether on the basis of domicile, nationality or for other reasons. This document and all information contained within is proprietary information of RMF and its affiliates and may not be reproduced or otherwise disseminated in whole or in part without prior written consent from RMF. A member of the Man Group An Introduction to the Asset Class Convertible Bonds RMF Investment Group is the leading provider of Alternative Investment Solutions, specialising in Hedge Funds, Leveraged Finance, Private Equity and Convertible Bonds. Focused on the institutional market, RMF’s target clients include pension funds, insurance companies, banks, large corporations and distribution channels. RMF’s headquarters is in Switzerland, however the Company also has physical presence in the major financial centres. 200/Q2_02 The following factors are critical for the success of a Convertible Bond investor: SUCCESS FACTORS RMF INVESTMENT GROUP Asset allocation skills because of the wide divergence between returns of sectors and countries over certain periods State-of-the-art models to keep up with the ever increasing sophistication of the other market participants Credit skills to assess the corporate bond-type credit risk Relationships to investment banks for access to new issues and stock borrowing (CB arbitrage) Market timing skills to protect the capital in extended phases of equity market weakness Risk management skills to avoid unwanted exposure to all types of risk including interest rate and currency risk Proprietary trading experience and mentality to take advantage of the relative value characteristics of the instrument SUMMARY In recent years, the Convertibles market has grown at an accelerated pace. More and more companies are willing to look at the advantages of financing through Convertibles, and they find good demand from various investors such as Hedge Funds, Convertible Bond funds or investment banks. We believe that this trend will continue and that this market will steadily gain significance in the future Convertible Bonds are instruments that are beneficial to both investors and issuers Convertible Bonds are an asset class with risk-return characteristics that are superior to those of pure bonds, pure equities, or a blend of bonds and equities The successful management of Convertible Bond portfolios depends on various factors such as asset allocation, security selection and credit skills, state-of-the-art models as well as good relationships to investment banks for access to new issues RMF commenced activities as an operative Hedge Fund Manager in 1992 with an exclusive mandate for one of the world’s most prestigious Market Neutral Hedge Funds. Over the years, RMF has continued to focus on servicing investors by providing comprehensive products and solutions and is regarded as an innovator in the Alternative Asset Management Industry. In May 2002, RMF was acquired by the Man Group creating the largest independent Alternative Investment Manager in the market, with approximately USD 20 billion under management (excluding Real Estate and Private Equity). As of 30 June 2002 RMF had funds under management of approximately USD 9.5 billion. RMF is a process driven organisation, and one of the few organisations in the financial services industry to have achieved the ISO 9001: 2000 Certification for Quality Management Systems. CONTACT For further information please contact: Client Relations Team RMF Investment Consultants Huobstrasse 16 8808 Pfäffikon/SZ Switzerland Phone +41 (0) 55 415 87 10 Fax +41 (0) 55 415 87 94 www.rmf.ch info@rmf.ch Disclaimer The content of this documentation is for your information purposes only and constitutes neither a request, nor an offer, nor a solicitation, nor a recommendation to buy, sell or make an investment in the described investment instruments or to enter into or conclude other transactions of any kind. The information provided herein is not intended to provide sufficient basis on which to make an investment decision. Potential investors should note that alternative investments can involve significant risks and the value of an investment may go down as well as up. Furthermore, we recommend you consult your bank, or investment and/or tax adviser. Past performance is never an indication or guarantee of future performance. Information contained herein is provided from the RMF database or obtained from sources that RMF considers to be reliable. However, although RMF has taken professional care in gathering and updating this material and information, it does not assume any liability in the case of incorrectly reported or incomplete information, accuracy or correctness. All projections, valuations and statistical analyses are provided to assist the recipient in understanding the basics of alternative investments. Such projections, valuations and analyses may be based on subjective assessments and assumptions and may use one among several alternative methodologies (and other methodologies may produce different results). Accordingly, such projections, valuations and statistical analyses should not be viewed as facts and should not be relied upon as a prediction of future events. The information in this documentation is not intended for persons and organizations subject to U.S. federal, state or local law or to the law of any foreign jurisdiction prohibiting the use or attention of this information whether on the basis of domicile, nationality or for other reasons. This document and all information contained within is proprietary information of RMF and its affiliates and may not be reproduced or otherwise disseminated in whole or in part without prior written consent from RMF. A member of the Man Group An Introduction to the Asset Class Convertible Bonds RMF Investment Group is the leading provider of Alternative Investment Solutions, specialising in Hedge Funds, Leveraged Finance, Private Equity and Convertible Bonds. Focused on the institutional market, RMF’s target clients include pension funds, insurance companies, banks, large corporations and distribution channels. RMF’s headquarters is in Switzerland, however the Company also has physical presence in the major financial centres. 200/Q2_02 The following factors are critical for the success of a Convertible Bond investor: