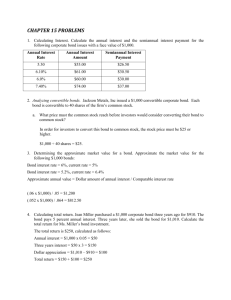

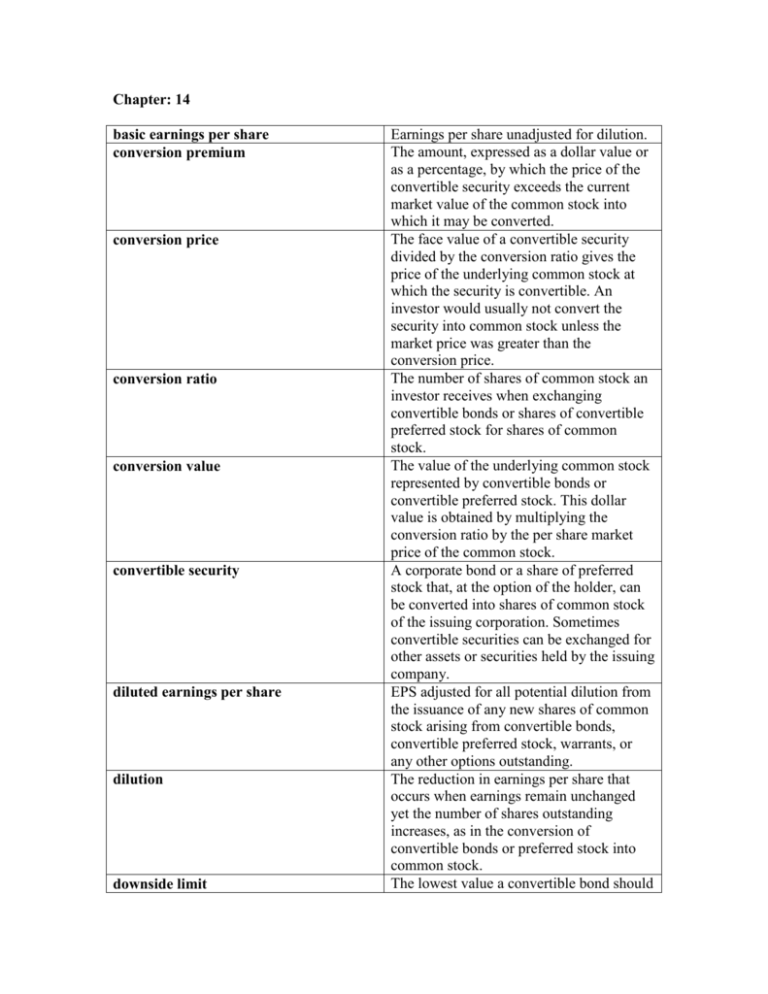

Chapter: 14

advertisement

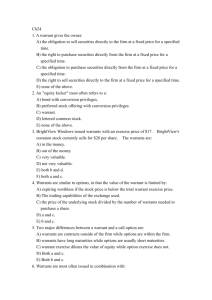

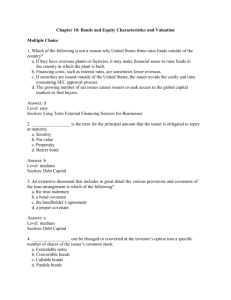

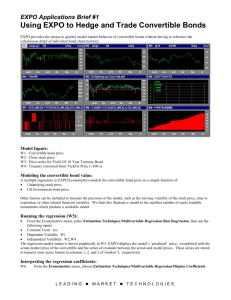

Chapter: 14 basic earnings per share conversion premium conversion price conversion ratio conversion value convertible security diluted earnings per share dilution downside limit Earnings per share unadjusted for dilution. The amount, expressed as a dollar value or as a percentage, by which the price of the convertible security exceeds the current market value of the common stock into which it may be converted. The face value of a convertible security divided by the conversion ratio gives the price of the underlying common stock at which the security is convertible. An investor would usually not convert the security into common stock unless the market price was greater than the conversion price. The number of shares of common stock an investor receives when exchanging convertible bonds or shares of convertible preferred stock for shares of common stock. The value of the underlying common stock represented by convertible bonds or convertible preferred stock. This dollar value is obtained by multiplying the conversion ratio by the per share market price of the common stock. A corporate bond or a share of preferred stock that, at the option of the holder, can be converted into shares of common stock of the issuing corporation. Sometimes convertible securities can be exchanged for other assets or securities held by the issuing company. EPS adjusted for all potential dilution from the issuance of any new shares of common stock arising from convertible bonds, convertible preferred stock, warrants, or any other options outstanding. The reduction in earnings per share that occurs when earnings remain unchanged yet the number of shares outstanding increases, as in the conversion of convertible bonds or preferred stock into common stock. The lowest value a convertible bond should exercise price (warrant) floor value forced conversion intrinsic value option price parity price pure bond value speculative premium warrant fall to based on its pure bond value (and an assumption that interest rates stay constant). The price at which the stock can be bought using the warrant. A value that an income-producing security will not fall below because of the fundamental value attributable to its assured income stream. When the company calls the convertible security knowing that the owners will take the stock and thus convert the debt to equity. Value of a warrant or option equal to market price minus the strike (exercise) price. The specified price at which the holder of a warrant may buy the shares to which the warrant entitles purchase. The price to compensate for inflation exposure. The fundamental value of a bond that represents a floor price below which the bond's value should not fall. The pure bond value is computed as the present value of all future interest payments added to the present value of the bond principal. The difference between an option or warrant's price and its intrinsic value. That an investor would pay something in excess of the intrinsic value indicates a speculative desire to hold the security in anticipation of future increases in the price of the underlying stock. A right or option to buy a stated number of shares of stock at a specified price over a given period. It is usually of longer duration than a call option.