file:

advertisement

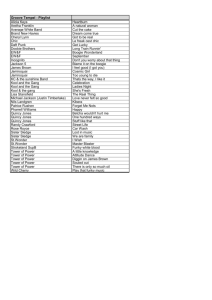

M&A Transaction Alert June 28, 2013 United Community Bancorp, Inc. - Chatham, Illinois has signed a definitive agreement to acquire the common stock of Mercantile Bank - Quincy, Illinois Hovde Group, LLC served as the exclusive financial advisor to Mercantile Bancorp, Inc., and its wholly owned subsidiary, Mercantile Bank Transaction Summary • United Community Bancorp, Inc. ("UCB") will pay $22.3 million in cash for the common stock of Mercantile Bank (the "Bank") (the "Transaction"). • Mercantile Bancorp, Inc. (the "Company") intends to file a voluntary Chapter 11 bankruptcy petition after signing of the Agreement. The Transaction will be effectuated pursuant to Sections 105, 363, and 365 of the U.S. Bankruptcy Code. • UCB will act as the "Stalking Horse Bidder" in the bankruptcy auction. Other potential buyers will have the opportunity to bid for the Bank stock pursuant to the approved bidding procedures under Section 363 of the Bankruptcy Code. • UCB will acquire four branches with approximately $338 million in deposits in the Quincy MSA and will jump to #2 in deposit market share rank. On March 11, 2013, UCB announced the acquisition of seven branches of Heartland Bank & Trust Co., and the purchase is still pending. • This represents Hovde Group's 6th bank M&A transaction of 2013. Pro Forma Branch Network - Quincy, IL and Broader Footprint Transaction Terms (using Bank Financials) Type of Transaction Asset Purchase Form of Consideration 100% Cash Aggregate Deal Price $22.3 Million Stalking Horse Bidder Fee 2 77.6% Price-to-Tangible Book Value 77.6% Price-to-LTM Earnings UCB Premium-to-Core Deposits Heartland Bank & Trust Co. Price-to-Assets 2012 PF Rank Rank Parent Company Name 1 1 First Bankers Trustshares Inc. 2 Pro Forma Company 2 Mercantile Bancorp Inc. 1 3 3 Backlund Investment Co. 4 4 T & C Bancorp Inc. 5 5 Quincy Bancshares Inc. 6 United Community Bancorp, Inc. 2 7 6 Monticello Bancshares Inc. 8 7 Bank of America Corp. 9 8 River Valley Bancshares Inc. 10 9 Town and Country Financial Corp. 11 10 FBL Bancshares Inc. 12 11 First Mid-Illinois Bancshares Inc. 13 12 Clayton Bancshares Inc. 14 13 Illini Corp. 15 14 Canton Bancshares Inc. 16 15 North Adams Bancshares Inc. 17 16 Lima Bancshares Inc. 18 17 First National Bank of Barry 19 18 Clark County Bancshares Inc. 20 19 Spring Bancorp Inc. 21 20 Farmers & Merchants Bancorp Inc. Market Total 1 Price-to-Book Value Mercantile Bank Market Share - Quincy, IL MSA 250,000 NM (2.0%) 5.8% Target Information (as of 3/31/2013)* City Quincy Chatham Quincy Peoria Quincy Quincy Chatham Monticello Charlotte Lewistown Springfield Liberty Mattoon Pleasant Hill Springfield Hannibal Ursa Lima Barry Wyaconda Springfield Hannibal # of ST Loc IL 5 IL 7 IL 4 IL 4 IL 5 IL 2 IL 3 MO 2 NC 2 MO 2 IL 1 IL 3 IL 2 IL 2 IL 1 MO 1 IL 2 IL 1 IL 1 MO 1 IL 1 MO 1 47 Utilizes 3/31/2013 deposits for analysis Includes impact of Heartland Bank & Trust branch acquisition PF Deposits ($000) 513,100 421,863 337,884 153,039 131,535 93,572 83,979 71,192 63,987 61,606 60,177 59,642 53,024 47,588 40,678 30,252 29,586 26,387 13,960 13,244 11,503 4,743 1,998,930 PF Market Share (%) 25.7 26.0 21.8 7.7 6.6 4.7 4.2 3.6 3.2 3.1 3.0 3.0 2.7 2.4 2.0 1.5 1.5 1.3 0.7 0.7 0.6 0.2 100.0 Headquarters Quincy, IL Ticker (Company) OTCQB: MBCR States of Operation (Branches) IL (4) Total Assets ($000) $386,343 Total Deposits ($000) $337,884 Leverage Ratio (Bank) 7.43% Leverage Ratio (Company) (10.91%) LTM ROAA (1.68%) Net Interest Margin 2.52% Noninterest Expense/ Avg. Assets 3.81% NPAs + 90 Days PD/ Assets 3.16% LLR/ Loans 2.80% NCOs/ Avg. Loans 2.26% Cost of Funds 1.21% * Source: Call Report Data; Data at Bank-level unless otherwise specified Steven D. Hovde shovde@hovdegroup.com 847.991.6622 Andrew J. Fitzgerald afitzgerald@hovdegroup.com 312.361.3153 1629 Colonial Parkway Inverness, IL 60067 www.hovdegroup.com