CHAPTER 7 Merchandise Inventory

advertisement

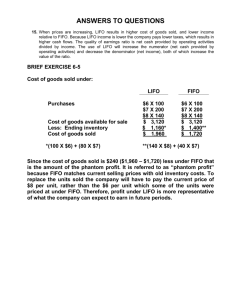

CHAPTER 7 Merchandise Inventory SYNOPSIS In this chapter, the author discusses the economic consequences faced by managers in accounting for inventory. Specifically discussed are the effects of inventory accounting on (1) financial statement users; (2) existing contracts; (3) income taxes; (4) bookkeeping costs; and (5) the usefulness of resulting information. The author also presents the conceptual and practical issues in accounting for inventory, including (1) the acquisition of inventory, covering which units to include as part of inventory and what costs to capitalize as part of inventory; (2) the perpetual method of accounting for inventory; (3) the potential cost flow assumptions for allocating inventory costs to cost of goods sold, FIFO, LIFO, and averaging; and (4) the lowerof-cost-or-market rule, as it applies to inventory. The ethics vignette considers the pressure on auditors to cut hours spent auditing such critical areas such as inventories due to competition. The Internet research exercise explores the inventory policies of Ann Taylor Stores and its competitors. The following key points are emphasized in Chapter 7: 1. Inventory and how it affects the financial statements. 2. Four issues that must be addressed when accounting for inventory. 3. General rules for including items in inventory and attaching costs to these items. 4. The three cost flow assumptions—average, FIFO, and LIFO. 5. The lower-of-cost-or-market rule. TEXT/LECTURE OUTLINE Merchandise inventory. I. Merchandise inventory refers to items held for sale in the ordinary course of business. A. Shareholders, creditors, managers, and auditors are all interested in a company’s inventory. B. The value and marketability of inventory can also provide an indication of a company’s ability to continue as a going concern. II. The relative size of inventories. III. Accounting for inventory: four important issues. A. Acquiring inventory: what costs to capitalize. Chapter 7 1. Items to include in inventory. a) As a general rule, items held for sale and for which the company has complete and unrestricted ownership should be included in inventory. Purchases should be recorded when legal title to the items passes from the seller to the buyer. b) Sometimes it is more difficult to determine the appropriate number of inventory units. (i) Goods on consignment. (a) Items owned by one party (the consignor), but physically held for sale by another party (the consignee). (b) Goods on consignment should be included in the inventory of the consignor, not the consignee, since the consignor retains legal title to the goods. (ii) Goods in transit. (a) Inventory items not in the physical possession of either the buyer of the seller as of a point in time because the goods are in-transit from the seller to the buyer. (b) 2. Ownership is determined by the shipping terms. i) FOB shipping point—legal title to the inventory items passes from the seller to the buyer when the seller delivers the goods to the shipping point. ii) FOB destination—legal title to the inventory items passes from the seller to the buyer when the goods reach their destination. Costs to attach to inventory items. a) As a general rule, all costs associated with manufacturing, acquiring, storing, or preparing inventory items should be capitalized as inventory. b) Cash discounts. c) (1) A discount offered by suppliers for prompt payment on purchases made on account. (2) Cash discounts are accounted for using the gross method. Potential costs that could be capitalized for manufacturing companies. (1) Direct costs (such as direct labor and raw materials) should be capitalized as part of inventory. Chapter 7 (2) B. Overhead (such as indirect materials, indirect labor, utility costs, depreciation, and so forth) must be allocated to inventory. Allocating overhead to inventory is subjective and allows for potential management manipulation of financial statements. Carrying inventory: the perpetual method 1. The inventory account is directly increased for every inflow of inventory. 2. The inventory account is directly decreased for every outflow of inventory. C. Errors in the inventory count. 1. 2. Inventory errors misstate both inventory on the balance sheet and net income on the income statement for the period. a) An overstatement of inventory overstates net income by the same amount; an understatement of inventory understates net income by the same amount. b) Net income for the next period is misstated by the same amount in the opposite direction. Inventory errors are not unusual, often quite significant, and sometimes made intentionally by management to manipulate reported income. D. Selling inventory: which cost flow assumption? 1. 2. Specific identification. a) The cost of the actual inventory item sold is allocated to cost of goods sold. b) Only practical for companies that sell large-ticket, easily-tracked items. c) Allows manipulation of net income and inventory. Three inventory cost flow assumptions. a) A cost flow assumption is used to determine the inventory cost allocated to cost of goods sold and inventory. The cost flow assumption does not refer to the physical flow of inventory. b) Averaging assumption: a weighted average cost of all inventory units available is used to allocate inventory costs. c) First-in, First-out (FIFO) assumption: the oldest inventory costs are assumed to be the first inventory costs sold. Chapter 7 d) 3. 4. 5. Last-in, First-out (LIFO) assumption: The most recent inventory costs are assumed to be the first inventory costs sold. Inventory cost flow assumptions: effects on the financial statements. a) Inventory costs increasing. b) Inventory costs decreasing. c) LIFO liquidation boosts profits. Inventory cost flow assumptions: effects on federal income taxes. a) LIFO conformity rule. b) Inventory costs increasing – LIFO minimizes taxes. b) Inventory costs decreasing – FIFO minimizes taxes. c) LIFO liquidation increases taxes because it increases profits. Tradeoffs among the cost flow assumptions. a) b) Income and asset measurement tradeoffs. (1) LIFO matches the most current inventory costs to current revenues, whereas FIFO matches older inventory costs to current revenues. Consequently, LIFO provides "better" matching than FIFO. The averaging assumption falls between LIFO and FIFO. (2) FIFO reports the most current inventory costs as ending inventory, whereas LIFO reports older inventory costs as ending inventory. LIFO can report an inventory balance that is grossly out-of-date. The averaging assumption falls between LIFO and FIFO. Economic tradeoffs. (1) Income taxes and liquidity. (a) LIFO conformity rule. (b) In times of rising prices, LIFO results in lower net income than does FIFO. This lower net income results in lower current taxes. The tax effect has cash flow implications and can also have liquidity implications. (2) Bookkeeping costs: LIFO requires more detailed accounting records so bookkeeping costs are higher under LIFO than FIFO. Chapter 7 (3) LIFO liquidations and purchasing practices: Unexpected increases in sales or unexpected decreases in purchases or production can deplete LIFO inventory layers. LIFO liquidations can give rise to substantially increased taxes (with rising prices) and poor inventory purchasing practices. (4) Debt and compensation contracts: If debt covenants specify a minimum debt/equity ratio or a minimum working capital requirement, management can minimize the probability of violating the covenant by maximizing inventory and net income via FIFO. Further, if management is compensated, at least partially, with a bonus contract, management can maximize the value of its bonus by maximizing net income via FIFO. (5) The capital market: If managers believe that investors cannot "see through" accounting methods but, rather, focus on net income, then managers may prefer to use FIFO to increase income. Research in accounting and finance generally supports the view that investors "see through" accounting methods and value a company on the basis of its underlying cash flows. (6) The LIFO reserve: Financial statements of companies using LIFO include footnote disclosure of "LIFO reserves," which reflect the difference between inventories computed using LIFO and FIFO. This disclosure is helpful to financial statement users in assessing the tax and income effects of using LIFO versus FIFO, and for making more valid comparisons with other companies that use FIFO. IV. Ending inventory: applying the lower-of-cost-or-market rule. V. A. Determine the original cost of the inventory based on the cost flow assumption selected. B. Compare the original cost to market value. 1. If the market value is less than the original cost, adjust the original cost down to the market value, thereby resulting in an unrealized loss. 2. If the market value exceeds the original cost, then no adjustment is necessary. The lower-of-cost-or-market rule and hidden reserves. A. Conceptually, the lower-of-cost-or-market-value (LCM) rule is inconsistent, since decreases, but not increases, in value are recognized. B. Although this inconsistent treatment can create hidden reserves that managers can use to manipulate income, the LCM rule makes economic sense due to conservatism. VI. International perspective: Japanese business and inventory accounting Chapter 7 VII. Review problem VIII. Ethics in the real world. IX. Internet research exercise. LECTURE TIPS 1. Students often have difficulty understanding goods in transit, particularly (1) deciding on in whose books goods in transit should be recorded, and (2) how to adjust the books if they have already been adjusted to the physical count and goods in transit are then detected. End-of-chapter exercise 7–1 is useful to demonstrate how to account for goods in transit. The exercise can be extended to illustrate the correcting entries required and how not correcting the errors affects the current and following period. 2. Students struggle with LIFO because the accounting assumptions used in LIFO are the reverse of how goods normally flow through an inventory. Students understand LIFO best when it is presented as a tax savings technique approved by congress via the political process rather than as a system based on logic. Stress that LIFO is a cost flow assumption, not a “goods flow” assumption. ANSWERS TO IN-TEXT DISCUSSION QUESTIONS 291. Where inventories are a material income producing factor, such as for manufacturers and retailers, management must ensure that inventories are manufactured or acquired at reasonable costs. Also, management must be efficient concerning quantities on hand, i.e., the cost of carrying inventory and the risk of obsolescence must be balanced against having enough goods on hand to meet demand. “Uncontrolled inventories” are those where management fails to meet those cost and efficiency goals. 292. Hewlett-Packard sells a tangible product and therefore has substantial inventories. Yahoo is a service provider which does not sell goods, but rather uses its infrastructure to generate revenues. 294. Consignment inventories are those inventories which are physically on the premise of a consignee (receiver) who holds the goods for sale, in this case Saks, but are actually owned by another, the consignor. Ownership, not physical possession, determines the balance sheet upon which consigned inventory is carried. Therefore the inventories belonging to others held by Saks on consignment are not reflected on Saks’ balance sheet. 295. Kellogg’s accounting policy of recognizing sales upon the delivery of its product to customers implies that goods are shipped FOB (free on board) destination, which means that Kellogg is responsible for the goods to the point from which they are delivered to the customer. The buyer has the responsibility for the goods after that point. Revenue is recognized at the point of delivery because the risk of ownership has been passed to the buyer, thereby completing the earnings process. Under the matching principle, the cost of the goods sold is removed from inventory at the point of delivery, and charged to the income statement. Chapter 7 295. Lowe’s costs of assembling light fixtures before displaying them for sale is a cost of getting the inventory ready to be sold and should be capitalized as a cost of inventory. These costs would then be included in the cost of goods sold when the light fixtures are sold. 296. Dell’s incredibly rapid inventory turnover has a positive impact on Dell’s cash flow. Dell doesn’t need to tie up very much cash in order to carry 7.4 days worth of inventory. Dell could very well sell most of its inventory (and collect the cash) before they have even paid their vendors for it. If these are all cash sales, Dell’s operating cycle would revolve every 7.4 days, generating more and more cash. The term “cash cow” comes to mind. 297. Intel Corporation is obviously a manufacturer because it has three categories of inventories: raw materials, work in process, and finished goods. Raw materials represents the acquisition cost of materials to be processed into a finished product through the application of labor and other costs, including overhead. Work in process includes accumulated costs of materials, labor and overhead for those goods in process, but not complete at the balance sheet date. Finished goods includes all costs linked to the production process for those goods which are complete, but not sold as of the balance sheet date. The amount of inventory shown on the balance sheet is the total of all three categories, or $3.7 billion at its year-end 2008. 299. The nature of most retail businesses is that inventory is an important component of their balance sheet. CVS’s investment in inventory at any given time runs into many millions of dollars. Physical control of the inventory is important if losses from spoilage, theft, and obsolescence are to be avoided. Management has a stewardship responsibility for inventory and each store manager spends a great deal of his or her time attending to inventory related tasks. An increase in inventory turnover can help improve profits and management needs accurate and up to date information in order to properly manage the inventory. They need to purchase and stock the right goods and run promotions that make sense. Without accurate information about inventory managers don’t know what is going on and cannot control inventory, sales or cash flow. Keeping track of inventory is a messy and error prone process. Regular counts of inventory are necessary to verify the information being generated by the inventory management system. The counts are useful in the correcting errors that continuously arise in the process of keeping track of inventory. The accuracy of the monthly financial statements that management uses depends on the accuracy of the accounting records for inventory. The accuracy of the annual financial statements are also dependent correct values for inventory. 300. If The Gap had incorrectly reported ending inventory at $1,700 million, the overstatement of inventory would be $194 million ($1,700 million inventory versus the correct amount of $1,506 million). The overstatement of ending inventory would have caused an understatement of cost of goods sold, and an overstatement of gross profit and net income by a like amount ($194 million). 2008 net income would have been erroneously reported at $1,161 million. 302. Specific identification is difficult to use where there are a significant number of items being sold. The difficulties of using this method create additional record-keeping costs which become more and more burdensome as volume increases. The benefit of using this method is the ability of management to manipulate gross profit by selling the least costly item (or the most costly item where profits are not desired) when inventory Chapter 7 includes identical items that were acquired at varying costs. In the early days, the ability to manipulate income may have been important to Amazon. However, as the company grew and matured, the costs of using this method of accounting would have increased, while at the same time the ability to manipulate income probably became less important. 305. As prices rise, the difference between the book value of an inventory under FIFO compared to the book value of that same inventory under LIFO will increase. Assuming there are no liquidations of LIFO layers, the difference will continue to grow every year as long as prices are rising. Since prices usually rise every year, companies that have been in business for a long time will see a large disparity between the LIFO cost of their inventory compared to its cost computed under FIFO. This is not the case in industries where prices are declining, such as computers. For a chain of drug stores, however, with inventories that include expensive prescription drugs, the costs of which are skyrocketing, one would expect there to be a significant LIFO reserve 306. At a 30% income tax rate, and a $1.2 billion LIFO reserve, Walgreen’s tax savings from using LIFO would be $360 million. Theoretically, this savings is only a deferral of taxes because eventually all the inventory will be sold and all the profits recognized. In reality however, if Walgreen’s continues to be a successful business indefinitely, these taxes are deferred indefinitely. 307. In a period of rising prices, LIFO produces a lower income number than FIFO. It results in a more realistic matching of income and costs because it assigns the most recent, higher costs to the income statement. FIFO matches older, lower costs against income, thereby creating so-called paper profits on which taxes have to be paid. The lower income under LIFO would result in lower cash payments required for income taxes, thus improving liquidity for companies with cash flow problems. 308. It looks like the reduction in LIFO inventory caused a liquidation of LIFO layers. This happens when LIFO is used and inventory levels decline from one year to the next. The liquidation of a LIFO layer has an affect on the cost of goods sold - the costs of the goods sold corresponding to the inventory reduction are understated. The costs are understated because the inventory cost associated with last year’s LIFO layer is lower than the current year’s inventory cost. This understatement of cost of goods sold results in an overstatement of income. Analysts will find this of interest because the portion of the income reported for the year that is attributable to the reduction of LIFO layers would not be expected to recur. This type of income does not generate any cash flow; it actually generates negative cash flow because income taxes have to be paid on this “phantom income”. The adverse tax and cash flow consequences associated with liquidation of LIFO layers is one of the disadvantages of using LIFO. 309. The “LIFO allowance”, otherwise known as the “LIFO reserve” is the difference between the value of inventory under FIFO and the value of inventory under LIFO. Under LIFO, inventories are carried on the books at artificially low costs. These artificial costs correspond with the market costs of the inventory prevailing at the time that the inventory level was increased. This works fine as long as the business grows and inventory levels grow annually. For a year where the inventory level decreases, however, the inventories that have been carried at artificially low costs are sold. This causes cost of goods sold to be understated and gross profits to be overstated. Chapter 7 312. The weak market caused a decline in steel prices and a reduction in the value of the inventory. Although the inventory write down is an expense, it doesn’t affect cash. Consequently, the write down is a non-cash expense (like depreciation and amortization) that is added back to net income in the operating section of the statement of cash flows.