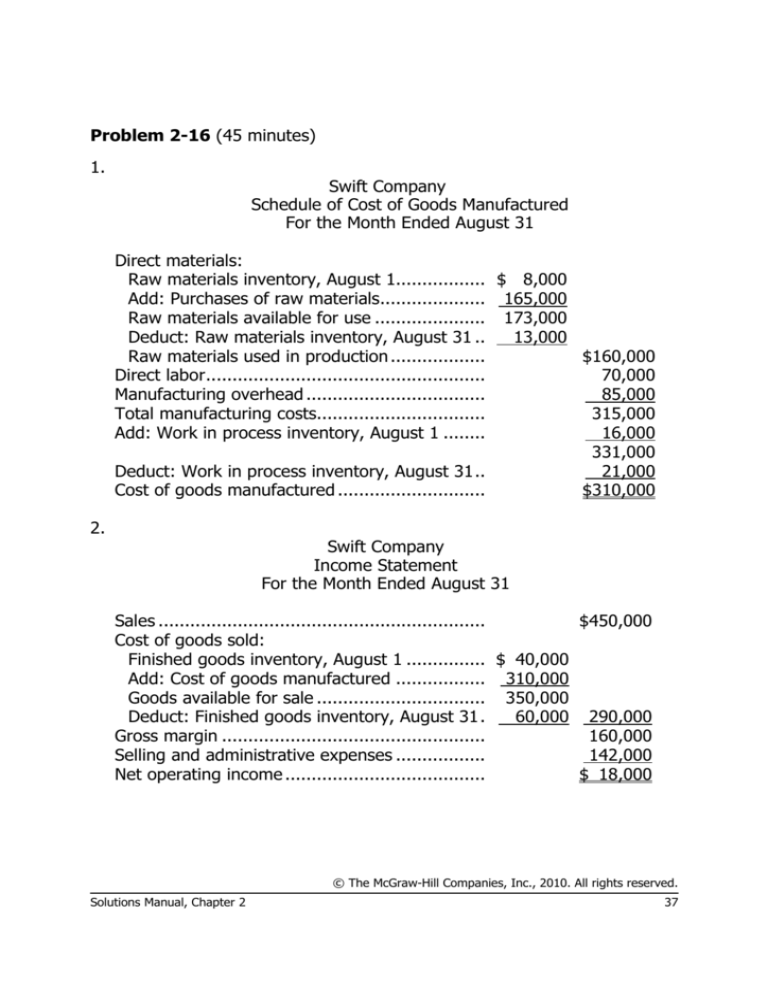

Problem 2-16 (45 minutes)

1.

Swift Company

Schedule of Cost of Goods Manufactured

For the Month Ended August 31

Direct materials:

Raw materials inventory, August 1................. $ 8,000

Add: Purchases of raw materials.................... 165,000

Raw materials available for use ..................... 173,000

Deduct: Raw materials inventory, August 31 ..

13,000

Raw materials used in production ..................

$160,000

Direct labor.....................................................

70,000

Manufacturing overhead ..................................

85,000

Total manufacturing costs................................

315,000

Add: Work in process inventory, August 1 ........

16,000

331,000

Deduct: Work in process inventory, August 31..

21,000

Cost of goods manufactured ............................

$310,000

2.

Swift Company

Income Statement

For the Month Ended August 31

Sales ..............................................................

$450,000

Cost of goods sold:

Finished goods inventory, August 1 ............... $ 40,000

Add: Cost of goods manufactured ................. 310,000

Goods available for sale ................................ 350,000

Deduct: Finished goods inventory, August 31.

60,000 290,000

Gross margin ..................................................

160,000

Selling and administrative expenses .................

142,000

Net operating income ......................................

$ 18,000

© The McGraw-Hill Companies, Inc., 2010. All rights reserved.

Solutions Manual, Chapter 2

37

Problem 2-16 (continued)

3. In preparing the income statement for August, Sam failed to distinguish

between product costs and period costs, and he also failed to recognize

the changes in inventories between the beginning and end of the

month. Once these errors have been corrected, the financial condition

of the company looks much better and selling the company may not be

advisable.

© The McGraw-Hill Companies, Inc., 2010. All rights reserved.

38

Managerial Accounting, 13th Edition