Ch 17 futures contract

advertisement

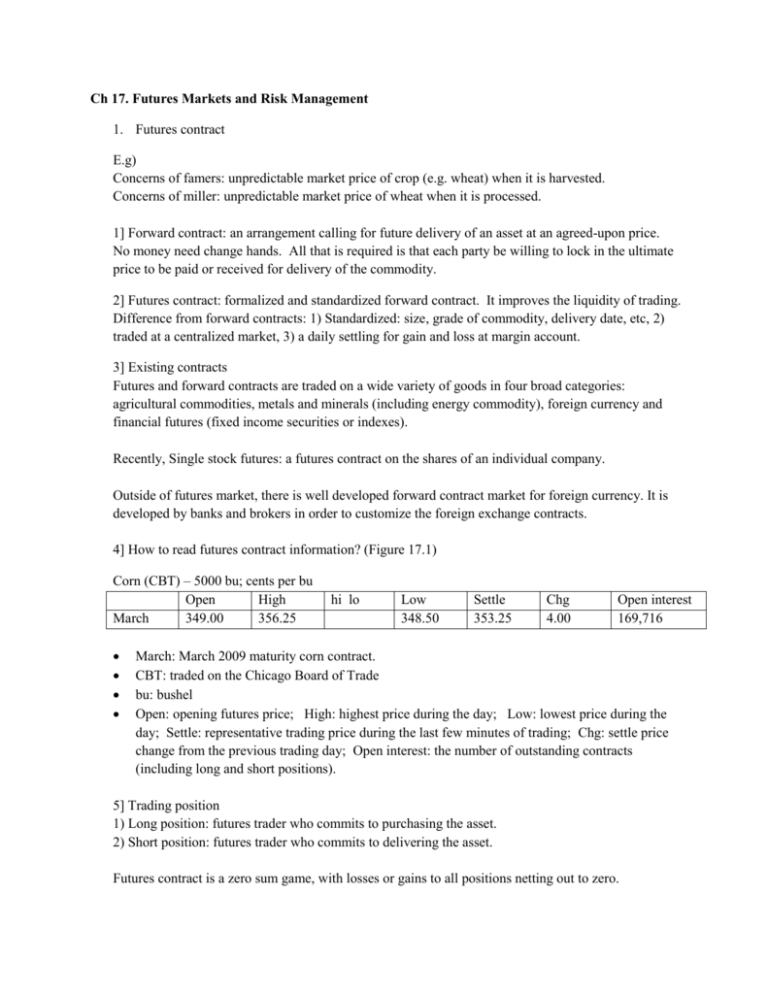

Ch 17. Futures Markets and Risk Management 1. Futures contract E.g) Concerns of famers: unpredictable market price of crop (e.g. wheat) when it is harvested. Concerns of miller: unpredictable market price of wheat when it is processed. 1] Forward contract: an arrangement calling for future delivery of an asset at an agreed-upon price. No money need change hands. All that is required is that each party be willing to lock in the ultimate price to be paid or received for delivery of the commodity. 2] Futures contract: formalized and standardized forward contract. It improves the liquidity of trading. Difference from forward contracts: 1) Standardized: size, grade of commodity, delivery date, etc, 2) traded at a centralized market, 3) a daily settling for gain and loss at margin account. 3] Existing contracts Futures and forward contracts are traded on a wide variety of goods in four broad categories: agricultural commodities, metals and minerals (including energy commodity), foreign currency and financial futures (fixed income securities or indexes). Recently, Single stock futures: a futures contract on the shares of an individual company. Outside of futures market, there is well developed forward contract market for foreign currency. It is developed by banks and brokers in order to customize the foreign exchange contracts. 4] How to read futures contract information? (Figure 17.1) Corn (CBT) – 5000 bu; cents per bu Open High March 349.00 356.25 hi lo Low 348.50 Settle 353.25 Chg 4.00 Open interest 169,716 March: March 2009 maturity corn contract. CBT: traded on the Chicago Board of Trade bu: bushel Open: opening futures price; High: highest price during the day; Low: lowest price during the day; Settle: representative trading price during the last few minutes of trading; Chg: settle price change from the previous trading day; Open interest: the number of outstanding contracts (including long and short positions). 5] Trading position 1) Long position: futures trader who commits to purchasing the asset. 2) Short position: futures trader who commits to delivering the asset. Futures contract is a zero sum game, with losses or gains to all positions netting out to zero. Profit to long position = spot price at maturity – original futures price Profit to short position = original futures price – spot price at maturity Figure 17.2: payoffs of futures. There is no limit in downside risk compared to call option. 2. Mechanics of Trading in Futures Markets 1] Clearinghouse 1) CME Globex: electronic trading (exchange) system combing CBOT and Globex. 2) Clearinghouse is established by exchanges to facilitate trading. The clearinghouse becomes the seller of the contract for the long position and the buyer of the contract for the short position. Its position nets to zero. It is only the party that can be hurt by the failure of any trader to observe the obligations of futures contracts. 3) Reversing trade means undoing (or closing) your long or short position by taking the opposite position. 4) Futures contracts rarely result in actual delivery of the underlying asset. Before the maturity, many futures contracts tend to be reversed for cash settlement. In unusual case of actual delivery, however, it occurs via regular channels of supply, via warehouse receipts. 2] Marking to market and the margin account. Each futures trader initially sets up a margin account which requires cash or near-cash securities as a margin (security account). The initial margin is between 5% and 15% of the total value of the contracts. This margin account marks to market, calculating daily loss and gain. If the balance of the margin account is below maintenance margin, there will be a margin call. 1) Marking to market: daily settlement of obligations on futures position, calculating daily gains or losses. 2) Maintenance margin: established value below which a trader’s margin may not fall. 3) Margin call: a request to increase the margin account up to the maintenance margin. Positions are closed out before the margin account is exhausted. 4) Convergence property: the convergence of futures prices and spot prices at the maturity of the futures contract. Otherwise arbitrage opportunity will occur. e.g) Assume that the current futures price for silver for delivery five days from today is $12.10 per ounce. Suppose that next five days futures price evolve as follows: Day Futures price 0 (today) $12.10 1 12.20 2 12.25 3 12.18 4 12.18 5 12.21 The daily mark-to-market settlements for each contact held by the long position will be as follow: Day Profit (loss) per ounce ×5000 ounce / contract 1 2 3 4 5 $12.20 - 12.10 = 0.1 12.25 - 12.20 = 0.05 12.18 - 12.25 = -0.07 12.18 – 12.18 = 0 12.21 – 12.18 = 0.03 $500 250 -350 0 150 Sum = $550 (F1-F0)×5000 + (F2-F1) ×5000+ (F3- F2) ×5000+ (F4-F3) ×5000+ (F5-F4) ×5000 = (F5-F0) ×5000 (12.21 – 12.10) × 5000 = 550 = sum (above). Thus daily settlement (mark to market) generates Ft-F0. Under convergence property, Ft = St. Then it will generate St-F0. If the initially required margin is 10%, the trader must post $6,050 (=0.1×5000× 12.10) per contract for the margin account. The margin account of the long position will have $6050 + $550 on the 5th day. 3] Regulation and tax Futures markets are regulated by the Commodity Futures Trading Commission (CFTC). The CFTC sets capital requirements for member firms of the futures exchanges, authorize trading in contracts, and oversees maintenance of daily trading records. Futures exchanges set the price limits on the amount by which futures prices may change from one day to the next. Taxes are paid at year-end on cumulated profits or losses regardless of whether the position has been closed. 3. Futures Market Strategies 1] Speculation and hedging A speculator uses a futures contract to profit from movements of price whereas a hedger wants to be protected against the price movement. 1) Why a speculator wants to use futures contract? Smaller transaction costs and smaller margin than actual value of underlying assets for trading. 2) How a hedger can use futures in order to isolate themselves? e.g) Short hedge: Assume that an oil distributor plans to sell 100,000 barrels of oil in March in order to hedge against possible decline in oil price. Because each contract calls for delivery of 1,000 barrels, it would sell contracts. The current futures price for delivery in March is $39.48. Total revenue in March; Oil price in March (PT) $37.48 Revenue from Oil sale: $3,748,000 $39.48 $3,948,000 $41.48 $4,148,000 100000× PT + Profit on futures: 100,000×(F0-FT) = 100,000×(F0-PT) under convergence property Total Revenue $200,000 0 $ - 200,000 $3,948,000 $3,948,000 $3,948,000 Total revenue = 100000× PT + 100,000×(F0-FT) = 100,000× PT + 100,000×(F0-PT) under convergence property = 100,000×F0 e.g) long hedge: Assume that an oil distributor plans to buy 100,000 barrels of oil in March in order to hedge against possible increase in oil price. Because each contract calls for delivery of 1,000 barrels, it would sell contracts. The current futures price for delivery in March is $39.48. Total cost in March; Oil price in March (PT) Cost from Oil Purchase: 100000× PT + loss on futures: 100,000×(F0-FT) = 100,000×(F0-PT) under convergence property Total cost $37.48 $3,748,000 $39.48 $3,948,000 $41.48 $4,148,000 $200,000 0 $ - 200,000 $3,948,000 $3,948,000 $3,948,000 Total cost = 100000× PT + 100,000×(F0-FT) = 100000× PT + 100,000×(F0-PT) under convergence property = 100,000×F0 Note: (1) This hedging can be achieved When PT= FT. Basis: difference between futures price (FT) and the spot price (PT) = FT-PT. Basis risk: risk attributable to uncertain movement in basis. (2) Exact hedging for some goods/portfolios is impossible because the necessary futures contracts are not traded. In this case, a hedger tries to use or take a short position on index futures if an underlying index is highly correlated to the return movement of goods/portfolio. It is called “cross hedging.” 3) Two trading strategies related to basis or spread (1) A long spot and short futures position. It will generate profits when basis narrows. At maturity, total revenue = Q× PT + Q×(F0-FT). Here, basis = FT-PT. FT = basis+ PT. Thus, total revenue = Q× PT + Q×[F0- (basis +PT)]. As basis narrows, total revenue improves. (2) Spread: a long position in a futures contract of one maturity and a short position in a futures contract of a different maturity, both on the same commodity. As (FLT-FST) increases, total revenue improves. At maturity, total revenue (not cost) = Q×(FLT-FL0) + Q×(FS0-FST) = Q×(FLT-FST) - Q×(FS0+FL0) 4. Determination of Futures Prices There are two ways to obtain an asset at some day in the future. 1) to buy it now and store it until the target date and 2) a long futures position that calls for purchase of the asset on the date in question. e.g) Gold case Strategy A: buy the gold at the current spot price (S0) and hold it until time T, when its spot price will be ST. Strategy B: a long futures contract (F0) and invest now in order to pay the futures price (F0) when the contract matures. Strategy A Strategy B Action Buy gold Long futures position Invest F0/(1+rF)T Total for Strategy B Initial Cash Flow - S0 0 - F0/(1+rF)T - F0/(1+rF)T Cash Flow at time T ST ST-F0 F0 ST Two strategies come up with same cash flow at time T. The initial investments for two strategies are supposed to be the same. F0/(1+rF)T = S0 F0 = S0 × (1+rF)T Her rF = T-bill rate or cost of carrying. This equation shows spot-futures parity theorem or cost-of-carry relationship. If this equation does not work, investors can earn arbitrage profits. e.g) gold currently sells for $900 an ounce. If the risk-free interest rate is 0.5% per month, the six month maturity futures contract should have a future price of F0 = 900(1.005)6 = 927.34 Suppose that the market price of 6 month maturity futures is $928, rather than $927.34. An investor can (1) borrow enough to have a long position in gold and (2) short a futures contract. Action Borrow $900, repay with interest at time T Buy gold for $900 Initial cash flow + 900 -900 Cash flow at Time T (6 month) -900(1.005)6 = -927.34 ST Enter short futures position (F0=928) Total Generalization Action 1. Borrow S0 2. Buy gold for S0 3. Enter short futures position Total 0 928- ST 0 0.66 Initial Cash Flow + S0 - S0 0 0 Cash Flow at Time T -S0(1+rf)T ST F0-S0 F0-S0(1+rf)T In the case of index futures, the underlying stocks pay dividend to investors Thus spot-futures parity is revised a little bit: 0 = F0 - S0 × (1+rF - d)T here d : dividend yield. Net cost of carry = rF – d. F0 = S0 × (1+rF - d)T Basing on the equation, it is found that maturity is positively related to futures price. 5. Financial Futures 1) Stock index futures Unlike futures contracts on commodities, futures contracts on financial assets settle in cash. The amount equal to the index difference between an initial contract index and final index at maturity times a multiplier that scales the size of contract. Table 17.2 lists some contracts on major indices. e.g) An S&P 500 contract with an initial futures price of 800 and final index value of 810 would result in a profit for a long position of 250 ×(810-800). Here 250 is a multiplier for S&P500 index. Broad stock market indices are highly correlated each other – more than 80% correlation. 2) Creating synthetic trading position. Index futures allow investors to participate in broad market movement without actually buying and selling large number of stocks. Futures contracts on indices represent “synthetic” holding of the market position. Market timers who speculate market movement are large players in stock index futures. Market timers tend to investing in Treasury bills and hold varying amounts of market index futures contracts, depending on their speculation. 3) Index arbitrage Strategy that exploits divergences between actual futures prices and their theoretically correct parity values to make a riskless profit. e.g) if the futures price is too high (low), short (long) the futures contract and buy (short) the stocks in the index. But it is difficult to buy stocks in the index. Program trading, which refers to coordinated buy or sell orders of entire portfolio through computer, is used. 4) Foreign exchange futures Forward market in foreign currency is informal. It is a simply network of banks and brokers that allows customers to enter forward contract to purchase or sell currency in the future at a currently agreed-upon rate of exchange. Not standardized and negotiated. Forward quotations always apply to rolling over delivery in 30, 60, 90 days. There is a standardized futures market on currency, established by CME, London International Financial Futures and others. 5) Interest rate futures Major interest rate contracts are traded on Eurodollars, T-Bills, T-Bond and T-notes. Treasury contracts call for delivery of a T-bond, bill and notes. A short position on interest rate contracts will profit when an interest rate increase and the price of underlying bill, notes or bonds decreases. Also they are used to hedge interest rate risk. e.g) suppose that a manager has $ 10 million bond portfolio with modified duration of 9 years. If market interest rates increase and the bond portfolio’s yield also rises by 10 basis point (0.1%), the fund will suffer a capital loss by D*×Δy = (9×0.1%) = 0.9% or $90,000. The sensitivity of unprotected value of bond portfolio to changes in market yields is $9,000 per 1 basis point change in the yield is $90,000/10 basis point = $9000/1 basis point. Price value of a basis point = PVBP = change in portfolio value / predicted change in yield = $90,000/10 basis point One way to hedge this risk is to take an offsetting short position in an interest rate futures contract. Assume that the bond ($100,000 par value T-bond with 6% coupon rate and 20 year maturity) to be delivered on the contract already is known and has a modified duration of 10 years. Currently futures price is $90 per $100 par value. The futures requires delivery of $100,000 par value of bonds, the contract multiplier is $1,000. If the yield increases by 10 basis points, then bond price will decrease by D*×Δy = (10×0.1%) = 1%. The futures price will decrease by 1% ( from $90 to $89.1). Due to 1000 multiplier, the gain on the short position is 1000 × (90-89.1) = 900. PVBP for one futures = 900/10 = 90/1 H (hedge ratio) = PVBP of portfolio / PVBP of hedge vehicle = [90000/10]/[900/10] = 100 contracts. Major issue in application of hedging is to find securities or contracts moving in perfectly in unison. It is not easy. Practically the most hedging activity is cross-hedging, meaning the hedge vehicle is a different asset from the one to be hedged. 6) Swaps Swaps: multiperiod extensions of forward contracts. Foreign exchange swap: an agreement to exchange a sequence of payments denominated in one currency for payments in another currency at an exchange rate agreed to today. e.g) parties might exchange $1.8 million for 1 million pounds in each of several future dates. Interest rate swap: contracts between two parties to trade cash flows corresponding to different interest rates. e.g) Assume that an interest rate would increase. Bond portfolio managers are worry about decreasing capital gains and they are looking for an alternative to rebalance their positions. A swap dealer is willing to exchange or swap a cash flow based on the six-month LIBOR rate (synthetic floating rate debts) for one based on fixed rate of 7%. The bond portfolio manager enters into a swap contract with a swap dealer to pay 7% on notional principal of $100 million and receive payment of the LIBOR rate on that amount of notional principal. The manager’s net cash flow is (LIBOR-7%) × $100 million. Why a dealer is willing to take on the opposite side of the swap?? neutralization Setting up swap contracts exchange floating rate for fixed rate and setting and setting up another swap contracts exchanging fixed rate for floating rate.