Hedging Strategy

Hedging Strategies Using

Derivatives

1. Basic Principles

• Goal: to neutralize the risk as far as possible.

I. Derivatives

A. Option: contract that gives its holder the right to buy (or sell) an asset at a predetermined price within a specified period of time.

•

• A-1) Call option: option to buy an underlying asset at a certain price within a specific period

• A-2) Put option: option to sell an underlying asset at a certain price within a specific period

Call

Put

PN ( d

1

)

PN (

d

1

)

Xe

rt

N ( d

2

)

Xe

rt

N (

d

2

) d

1

(ln( P / X )

( r

2

/ 2 )

t ) /(

d

2

d

1

t

t )

• call put

• Underlying asset + -

• Exercise price +

• Time to expiration + +

• Risk free rate + -

• Variance of return + +

• B. Forward Contracts:

- agreements where one party agree to buy a commodity at a specific price on a specific future date and other party agrees to sell.

- Physical delivery occurs

• C. Future contracts:

• - similar to forward contracts

• - marked to market on a daily basis

• (margin account with minimum requirement, reducing default risk)

• - settled with cash

• - standardized

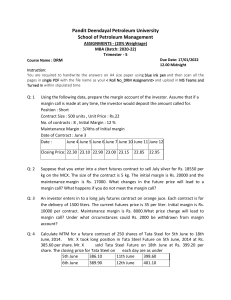

• Ex) marking to market

• Setting up a margin account for futures contract with initial margin – e.g)$4000

• Rebalanced daily to reflect investors’ gains or losses, using daily futures prices.

• If the balance below maintenance margin, there will be a margin call.

• The investor is entitled to withdraw any balance in the margin account in excess of the initial margin.

• D. Swap: two parties agree to exchange obligations to make specified payment streams.

• Ex) Floating rate bond & Fixed rate bond

• E. Structured notes: a debt obligation derived from another debt obligation

• Ex) Stripping long term debts (30 years) to create a series of zero coupon bonds

• Ex) CMO with mortgages loans

F. Inverse Floaters

• A note in which the interest paid moves counter to market rates

Ex) note at prime plus 1%

II. Hedging with futures

• Short hedge: a hedge that involves a short position in futures contract. Here the hedger owns an asset and expects to sell it in the future.

• Ex-1) suppose that an oil producer sell a

August 15 futures contract at $18.75 per barrel. Now it is April.

• Suppose that the spot price on August 15 prove to be $17.50. And August 15 futures price will be close to $17.50.

• gain = Sales of oil + difference of futures price = 17.50

+(18.7517.50

) = 18.75

• If the spot price goes up to $19, gain =

19 + (18.75 19 ) =18.75

• Long hedges: hedges taking a long position in a futures contract. Here hedgers want to purchase a certain assets

• Ex) A copper fabricator buys a May futures contract at 120 cents per pound. He or she needs 10,000 pound in May. Now, It is January.

• If spot price goes up to 125 cents, costs =

10000* 1.25

- ( 1.25

-1.20)*10000=120000

• If spot price goes down to 105 cents, costs =

10000* 1.05

+(1.201.05

)*10000=120000

1) Basis Risk

As shown in the previous examples, to achieve hedging, spot price and future contract prices should converge around the expiration date. If not,……

• Basis = spot price of asset to be hedged

– futures price of contract used.

• Reasons of basis:

- the asset for hedging is not the same as the asset underlying the futures contract

- uncertain date when the asset will be bought or sold

- closed out before its expiration date

• Strengthening of the basis: increasing basis

• Weakening of the basis: decreasing basis

• 2) Minimum variance hedge ratio

• Ratio that minimize the variance of the hedger’s position h

*

F s

S

F

: change

: change in in spot price futures during price the during

: S tan dard s

F

: S tan dard

: correlatio n deviation deviation of between

S of

S

F and

F life the of life hedge of hedge

• 3) Optimal Number of Contracts

• N: optimal number of contracts

• N

A

: Size of position hedged

• Q

F

: Size of one contract

N

h

*

N

A

Q

F