Financial Statement Analysis Basic Approaches Quality of Accounting Numbers 1

advertisement

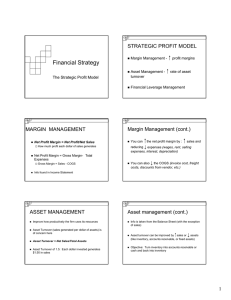

Financial Statement Analysis Basic Approaches ¦Time-series analysis ¦Cross-sectional analysis ¦Benchmark comparison Quality of Accounting Numbers Irrespective of the approach used the analyst must “get behind the numbers.” 1 Two Useful Tools ¦Common size statements ¦Trend statements Return on Assets ROA = NOPAT Average Assets Adjustments to Reported Earnings ¦ Isolate sustainable operating profit ¦ Eliminate after-tax interest expense ¦ Correct distortions related to accounting quality concerns Factors Underlying ROA Margin = NOPAT / Sales Turnover = Sales / Average Assets 2 Factors Underlying ROA NOPAT Sales X ROA = Sales Average Assets NOPAT ROA = Average Assets Controlling ROA A company may increase profitability three ways: • By increasing revenues • By reducing expenses • By reducing assets ¦Strategies • Differentiation • Low-cost leadership Credit Risk ¦Liquidity ¦Solvency 3 Short-Term Liquidity During an operating cycle a company must generate sufficient cash to supply working capital needs and also service debt. Current Assets Current Ratio = Current Liabilities Current Assets - Inventories Quick Ratio = Current Liabilities Activity Ratios ¦Activity Ratios tell the analyst how efficiently a company is using its assets. ¦Activity ratios are especially valuable when analyzed together. Accounts Receivable Turnover Net Credit Sales Average Accounts Receivable 4 Days Receivable Outstanding 3 6 5 Days Accounts Receivable Turnover Inventory Turnover Cost of Goods Sold Average Inventory Days Inventory Held 3 6 5 Days Inventory Turnover 5 Accounts Payable Turnover Inventory Purchases Average Accounts Payable Days Accounts Payable Outstanding 3 6 5 Days Accounts Payable Turnover Long-Term Solvency ¦Debt ratios provide information about the amount of long-term debt in a company’s capital structure. • Long-term debt to assets • Long-term debt to tangible assets 6 Long-Term Solvency ¦Analysts also want to know about the ability of companies to generate inflows sufficient to service their debt. • Interest coverage ratio • Cash flow coverage ratio • Operating cash flow to current liabilities Return on Equity ¦ROCE measures a company’s performance in using capital provided by shareholders to generate earnings. Net Income Available to Common Shareholders ROCE = Average Common Shareholders Equity Return on Equity ¦ROCE can be broken down into three components • ROA • Common earnings leverage • Financial structure leverage ¦The latter two components measure financial leverage---the use of debt to increase a company’s earnings performance. 7 Financial Statement Analysis 8