Analysis of financial statements

advertisement

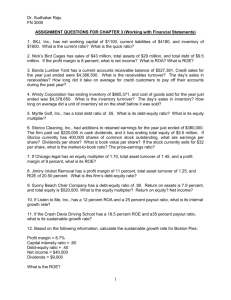

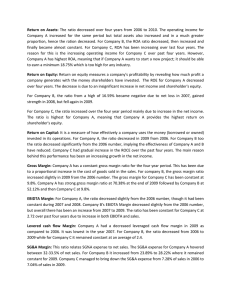

Analysis of financial statements Problem 1. During last year company has achieved following results: Total assets turnover ratio 2 Gross profit margin on sales 12% Debt ratio 40% Quick ratio 1 Current ratio 2 Inventory 10.000 Fixed assets 30.000 Times-interest-earned ratio 3 Tax rate 25% Calculate: a) Return on assets b) Return on equity c) Current asset turnover ratio d) Net Profit margin on sales Problem 2 At the end of the year company’s financial statement where as following: Cash 100.000 Sales Accounts receivable 400.000 Variable costs (75% of sales) Inventory 300.000 Fixed costs * Net plant and equipment 400.000 EBIT Total assets 200.000 Earnings before taxes Debt (16%) 550.000 b) 300.000 c) d) e) Tax (40%) Net income Retained earnings Total liabilities and equity a) Interest Current liabilities Common stock (100.000 a’ 3) 1.800.000 * Depreciation 200.000 * Dividend payout ratio 30% f) Calculate: Debt ratio Quick ratio Earnings per share Days sales outstanding - HW Inventory turnover ratio - HW Fixed assets turnover ratio -HW Problem 3 At the end of the year company’s BDE has following results: Total assets Net profit margin on sales Total assets turnover ratio Variable costs as part of sales 12% debt Tax rate Calculate: a) Basic earning power b) HW – Return on equity c) HW – Times-interest-earned ratio d) HW – Ratio of debt to equity e) HW – Marginal contribution 2.000.000 12% 1,6 60% 1.000.000 40% Problem 4 How many percent will profitability of a company increase if it’s net profit margin on sales and total asset turnover both increase by 15%? Problem 5 What will be the days sales outstanding of a company that has average level of accounts receivable equal to 20% of sales? Problem 6 ABC has $100 million in total assets and its corporate tax rate is 40 percent. The company recently reported that its basic earning power (BEP) ratio was 15 percent and its return on assets (ROA) was 9 percent. What was the company’s interest expense? Homework Problem 7 - HW Financial statements of the company ABC are as shown below: Balance sheet of a company“ABC” Cash Marketable securities Accounts recivable Inventory Current asset Net plant and equipment Total asset 10.000 Accounts payable 0 Accruals Short-term notes 60.000 140.000 110.000 615.000 Total current liabilities Bonds 754.000 1.000.000 Total liabilities Nominal value of common shares (90.000) 90.000 Premium on common shares 80.000 Retained earnings Equity Total liabilities and equity 766.000 P&L of the company ABC Sales 3.000.000 Costs EBIT Interest 88.000 EBT Taxes (40%) Net income * Gross profit margin on sales 9.46% Calculate: a) EPS b) P/E (PPS 23,00) c) Current ratio d) Quick ratio e) Inventory turnover ratio f) AR turnover ratio g) Days sales outstanding h) Fixed asset turnover ratio i) Total asset turover ratio j) Debt ratio k) Times-interest-earned l) Net profit margin on sales m) Basic earnings power n) Return on equity Problem 8 Calculate return on equity of the company with following characteristics: Net profit margin Total asset turnover Days sales outstanding Tax rate Sales Equity 2,7% 2,4 45 days 35% 120.000 40% of assets Problem 9 Calculate Times-interest-earned of the company with the following charasteristics: Net income Annual interest Tax rate 10.500 kn 5.000 kn 30% Problem 10 Company has following characteristics: ABC’ operating income (EBIT) is $40 million. The company’s times interest earned (TIE) ratio is 8.0, its tax rate is 40 percent, and its basic earning power (BEP) ratio is 10 percent. What is the company’s return on assets (ROA)? Problem 11 What is the ROE of the company with the following characteristics: A firm has total assets of $1,000,000 Debt ratio of 30 percent. Currently, it has sales of $2,500,000, total fixed costs of $1,000,000, and EBIT of $50,000. Firm’s before-tax cost of debt is 10 percent Firm’s tax rate is 40 percent Problem 12 Assume ABC is 100 percent equity financed. Calculate the return on equity, given the following information: Earnings before taxes = $1,500 Sales = $5,000 Dividend payout ratio = 60% Total assets turnover = 2.0 Tax rate = 30% Problem 13 A firm has a profit margin of 15 percent on sales of $20,000,000. If the firm has debt of $7,500,000, total assets of $22,500,000, and an after-tax interest cost on total debt of 5 percent, What is the firm’s ROA? Solutions Analysis of financial statement – Solutions of the homework 6. 7. 8. 9. 10. 11. 12. 13. d) 80 e) 6 f) 4,5 a) 1,31 b) 17,56 c) 3,23 d) 1,24 e) 4,88 f) 8 g) 46,84 16,20% 4 23 1,7% 42% 13,3% h) 3 i) 1,5 j) 0,53 k) 3,23 l) 3,92% m) 14,19% n) 12,55%