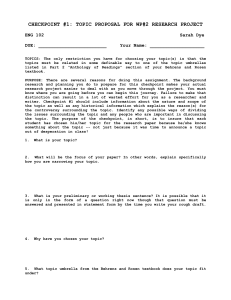

View Complaint

advertisement

UNITED STATES DISTRICT COURT DISTRICT OF NEW JERSEY PLAINTIFF, Individually and On Behalf of All Others Similarly Situated, Plaintiff, v. No. ___________________________ CLASS ACTION COMPLAINT FOR VIOLATIONS OF THE FEDERAL SECURITIES LAWS JURY TRIAL DEMANDED CHECKPOINT SYSTEMS, INC., GEORGE BABICH, JR., JEFFERY O. RICHARD AND JAMES M. LUCANIA, Defendants. INTRODUCTION 1. Plaintiff, ___________, (“Plaintiff”) residing at __________________ ________, __ _____, by his undersigned attorneys, alleges as follows upon personal knowledge as to his own acts, and upon information and belief as to all other matters, based on the investigation conducted by and through Plaintiff’s counsel, which included, among other things, a review of Defendants’ public documents, filings made with the United States Securities and Exchange Commission (the “SEC”), announcements issued by Checkpoint Systems, Inc. (“Checkpoint” or the “Company”), wire and press releases published by and regarding the Company and other information readily obtainable in the public domain. I. 2. NATURE OF THE ACTION This is a securities class action on behalf of all investors who purchased or otherwise acquired Checkpoint securities between March 5, 2015, through November 3, 2015, inclusive (the “Class Period”). This action is brought on behalf of the Class for violations of Sections 10(b) and 20(a) of the Securities Exchange Act of 1934 (the “Exchange Act”), 15 U.S.C. §§ 78j(b) and 78t(a), and Rule 10b-5 promulgated thereunder by the SEC, 17 C.F.R. § 240.10b-5. 3. Checkpoint manufactures and markets labeling systems and solutions for a diverse customer base, providing RF source tagging, barcode labeling systems, electronic article surveillance, handheld labeling systems, and retail merchandising systems for applications within the automatic identification industry. The Company employs 4,700 people worldwide. Its stock trades on the New York Stock Exchange (“NYSE”) under the ticker ‘CKP’. 2 4. After the markets closed on November 3, 2015, Checkpoint filed a Form 8-K with the SEC (“November 3 8-K”), including an Item 4.02(a), NonReliance on Previously Issued Financial Statements or a Related Audit Report or Completed Interim Review, in which it announced that it had discovered errors attributable to the accounting for the quarterly income tax provisions in its recently reported financial results. 5. Checkpoint’s common stock price plunged in reaction to this news, its closing price falling by $1.73 per share, or 22%, between November 3, 2015 and November 4, 2015. The single day drop represented an immediate loss of over $70 million in market capitalization. JURISDICTION AND VENUE 6. The claims herein arise under and pursuant to Sections 10(b) and 20(a) of the Exchange Act (15 U.S.C. § 78j(b) and 78t(a)) and Rule 10b-5 promulgated thereunder (17 C.F.R. § 240.10b-5). 7. This Court has jurisdiction over the subject matter of this action pursuant to § 27 of the Exchange Act (15 U.S.C. § 78aa) and 28 U.S.C. § 1331. 8. Venue is proper in this District pursuant to § 27 of the Exchange Act, 15 U.S.C. § 78aa and 28 U.S.C. § 1391(b), as Checkpoint has its principal executive offices located in this District and conducts substantial business therein. 3 9. In connection with the acts, omissions, conduct and other wrongs alleged in this Complaint, Defendants, directly or indirectly, used the means and instrumentalities of interstate commerce including but not limited to, the United States mail, interstate telephone communications and the facilities of the national securities exchange. PARTIES 10. Plaintiff, as set forth in the attached Certification, acquired Checkpoint securities at artificially inflated prices during the Class Period and has been damaged by the revelation of Checkpoint’s material misrepresentations and material omissions. 11. Defendant Checkpoint is incorporated under the laws of Pennsylvania and its principle executive offices are located at 101 Wolf Drive, PO Box 188, Thorofare, New Jersey. The Company’s common shares trade on the NYSE and, as of October 29, 2015, Checkpoint had 41,550,175 outstanding shares of common stock. 12. Defendant George Babich, Jr. (“Babich”) is the Company’s President and Chief Executive Officer (“CEO”). Babich has been President and CEO of the Company since February 2013 and was interim President and CEO between May 2012 and February 2013. 4 13. Defendant James M. Lucania (“Lucania”) is the Company’s Chief Financial Officer (“CFO”) and has been since November 10, 2015. Lucania served as Checkpoint’s acting CFO between March 23, 2015 and November 9, 2015. 14. Defendant Jeffrey O. Richard (“Richard”) was CFO of the Company until March 23, 2015. 15. The defendants referenced above in ¶¶12-14 are sometimes collectively referred to herein as the “Individual Defendants.” 16. The Individual Defendants, because of their positions with the Company, possessed the power and authority to control the content and form of Checkpoint’s annual reports, quarterly reports, press releases and presentations to the SEC, securities analysts, money and portfolio managers and investors; i.e., the market. The Individual Defendants were provided with copies of the SEC filings alleged herein to be misleading prior to their issuance and had the ability and opportunity to prevent their issuance or to cause them to be corrected. Because of their positions with the Company and their access to material non-public information available to them but not to the public, the Individual Defendants knew that the adverse facts specified herein had not been disclosed to and were being concealed from the public and that the positive representations being made were materially false and misleading. The Individual Defendants are liable for the false statements pleaded herein. 5 SUBSTANTIVE ALLEGATIONS 17. The Class Period in this action begins on March 5, 2015. On that day, Checkpoint filed with the SEC a Form 10-K providing its financial results for the fourth quarter and year end 2014. The Company also filed with the SEC, as an attachment to a Form 8-K, a press release accompanying the March 5 filing which included a section entitled 2015 Outlook. The press release contained detailed information with regards to anticipated 2015 results and tax impact, in addition to direct quotes from Babich and Richard. It read, in relevant part, as follows: 2015 Outlook Based on an assessment of market conditions, current customers' orders and commitments, and assuming continuation of current foreign exchange rates, Checkpoint is initiating guidance for 2015. This guidance does not include the impact of acquisitions, divestitures, restructuring and one-time or unusual charges resulting from debt refinancing, litigation fees or settlements and gains or losses generated by non-routine operating matters which we may record during the year. Projected income taxes for the year can be impacted by changes in the mix of pre-tax income and losses in the countries in which we operate. The valuation allowance on U.S. deferred tax assets results in a GAAP tax rate on U.S. pre-tax income or losses of essentially 0%. When the mix of income or losses shifts from the U.S. to a country where the income tax rate is in the normal range, our effective tax rate will increase. Additionally, we continue to monitor our profitability in the U.S. to determine whether there is sufficient evidence that may result in a full or partial release of the U.S. valuation allowance. Should this occur, the 0% GAAP tax rate in the U.S. will revert to its normal range of nearly 40%, including state income taxes. The combination of these factors can have a significant impact on the amount of reported income tax expense, and therefore our earnings per share, when compared with the projections that are the basis of our outlook. 6 Mr. Babich added, “Our business is significantly impacted by large-scale capital projects, the timing of which can be difficult to forecast. The roll-on and roll-off of these projects can generate large swings in revenue and profitability. While we continue to execute a number of EAS and RFID pilots and tests, retailers remain cautious about their in-store capital expenditures. While it is certainly possible that some of these tests will transition into chain-wide rollouts, our guidance assumes that none will occur during fiscal 2015. Our guidance also assumes an incremental $7-10 million total investment in R&D and SG&A to fund our growth initiatives, with primary benefits beginning in 2016." Mr. Richard added, "Like many other multinational companies, we will face tremendous currency headwinds in 2015 due to the strengthening US dollar. Over two-thirds of our revenues are denominated in foreign currencies with particular exposure to the Euro, the Japanese Yen, the British Pound and the Australian Dollar. We expect fiscal 2015 total capital expenditures in the range of $20 to $25 million. We expect our continuous working capital improvement projects will help offset the free cash flow impact of our increased capital spending." Net revenues are expected to be in the range of $575 million to $625 million. Adjusted EBITDA is expected to be in the range of $55 million to $68 million. Non-GAAP diluted net earnings per share attributable to Checkpoint Systems, Inc. is expected to be in the range of $0.40 to $0.50, assuming an effective tax rate of approximately 35%. 18. In addition to the Form 10-K and the press release, the Company also conducted a conference call with its investors on March 5, 2015, wherein it discussed the forecast for 2015 and the Company’s anticipated tax treatment for 2015. During the call, Defendant Richard stated that: Now on to guidance for fiscal year 2015, we expect net revenues in the range of $575 million to $625 million. Adjusted EBITDA in the range of $55 million to $68 million. Non-GAAP diluted net earnings per share in the range of $0.40 to $0.50. As a reminder, our guidance 7 assumes a continuation of the current foreign currency exchange rate environment with over 2/3rds of our sales denominated in foreign currency, the impact of strengthening US dollar on our net revenues will be significant. We estimate that our 2015 revenue guidance would have been more than $40 million higher at constant 2014 foreign exchange rates. Our guidance also assumes that no hardware rollout are executed during fiscal 2015 which are large enough to offset the loss of revenue for our large projects executed during 2014, including our largest chain-wide EAS roll out in Checkpoint's history at Family Dollar. Our adjusted EBITDA and earnings guidance assumes $7 million to $10 million of an incremental investments in R&D, in SG&A, partially funded through savings delivered by our profit improvement plans. We were also increasing our investment in capital expenditures to drive growth and expect total CapEx to be up to $25 million for fiscal 2015. We expect the primary benefit of these investments to begin in 2016. We are currently expecting a 2015 effective tax rate of approximately 35% versus approximately 30% in 2014, after giving consideration to non-GAAP adjustments. We continue to monitor our profitability in the US and to determine whether there is sufficient evidence that all or a portion of the – of our US income tax valuation allowance should be released. If this occurs, our income tax rate on US income will increase from 0% to nearly 40%, which would significantly impact our reported earnings per share. Please note that all of these adjustments would have no impact on our cash tax obligations and we expect our effective tax income – effective income tax rate to be approximately 20% regardless of whether the valuation allowance remains in place or is released. 19. The statements identified in paragraphs 17-18 above were materially false and misleading when made, and omitted from disclosure material facts 8 necessary to not make the statements made misleading as regarded the Company’s tax treatment and 2015 guidance. 20. On May 6, 2015, Checkpoint filed its Form 10-Q with the SEC (the “May 6 10-Q”) in which it falsely represented its quarterly income tax provisions and other related financial statements. 21. Specifically, in the following excerpt from the May 6 10-Q the entries for other current assets, total current assets, total assets, other current liabilities, total current liabilities, deferred income taxes, accumulated deficit, total stockholders’ equity and total liabilities and stockholders’ equity were fraudulently or recklessly disclosed to investors as an accurate reflection of the Company’s financial status when in fact they were false and misleading. 9 May 6 10-Q at 3. 10 22. 2 Additionally, in i the folllowing exxcerpt from m the Maay 6 10-Q Q the entries for incomee tax expeense, net lo oss, basic lloss per shhare and ddiluted losss per share were w fraud dulently or o recklesssly disclosed to innvestors as an accuurate reflectio on of the Company’s financiaal status w when in fa fact they w were false and mislead ding. May 6 10-Q 1 at 4. 23. 2 In thee following excerpt from the M May 6 10-Q Q the entriies for net loss and com mprehensiv ve (loss) in ncome werre also frauudulently oor recklesssly discloseed to investorrs as an acccurate refl flection of the Company’s finaancial statuus when inn fact they weere false an nd misleadiing. May 6 10-Q 1 at 5. 11 24. 2 Furth hermore, in n the follow wing excerrpt from thhe May 6 10-Q the enntries for balaance/accum mulated deeficit and the t net losss were frraudulentlyy or reckleessly discloseed to invesstors as an n accurate reflection of the Coompany’s ffinancial sttatus when in n fact they were falsee and misleeading. May 6 10-Q 1 at 6. 25. 2 In thee following g excerpt from f the M May 6 10-Q Q the entriies for net loss, deferred d taxes an nd other assets weere frauduulently or recklesslyy disclosedd to investorrs as an acccurate refl flection of the Company’s finaancial statuus when inn fact they weere false an nd misleadiing. 12 May 6 10-Q at 7. 7 26. 2 The May M 6 10--Q also faalsely stateed that the Companyy had adeqquate internall controls and procedures in place p to ennsure the aaccuracy oof its finanncial results contained in its filiings with the SEC and providded via otther outletts to c th he followin ng: investorrs, falsely claiming Ittem 4. CONTROLS S AND PROCEDUR RES Evaluation E of Disclosure Contro ols and Proocedures Managemen M nt, with th he particip pation of the Chieff Executivve Officer and Acting A Chiief Financial Officerr, conductted an evaaluation (aas requiredd by Rule R 13a-15 under th he Securitiies Exchannge Act off 1934, as amended (the Exchange E Act)) of the effecctiveness of our ddisclosure controls and procedures p d in Rules 13a-15(e) and 15d-115(e) underr the Exchaange (as defined Act) A as of the end of o the perriod coverred by thiis report. Based on that 13 evaluation, our Chief Executive Officer and Acting Chief Financial Officer concluded that our disclosure controls and procedures were effective as of the end of the period covered by this report. Changes in Internal Control over Financial Reporting There have been no changes in our internal control over financial reporting that occurred during our first fiscal quarter of 2015 that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting. 27. The May 6 10-Q also contained, attached to the filing as Exhibits 31.1 and 31.2, respectively, false and misleading certifications pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 (“SOX”) executed by Defendants Babich and Richard. These certifications falsely stated: 1. I have reviewed this Form 10-Q of Checkpoint Systems, Inc.; 2. Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report; 3. Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report; 4. The registrant’s other certifying officer(s) and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have: a. Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under 14 our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared; b. Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles; c. Evaluated the effectiveness of the registrant's disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and d. Disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal quarter (the registrant’s fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting; 5. The registrant’s other certifying officer(s) and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the registrant’s auditors and the audit committee of the registrant’s board of directors (or persons performing the equivalent functions): a. All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information; and b. Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal control over financial reporting. 15 28. The May 6 10-Q also included as Exhibit 32.1 a SOX certification executed by Babich and Lucania which falsely stated that: The undersigned executive officers of Checkpoint Systems, Inc. (the “Company”) hereby certify that this Quarterly Report on Form 10-Q for the quarter ended June 28, 2015 (the “Report”) fully complies with the requirements of Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, and the information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Company. 29. On August 4, 2015, the Company filed with the SEC its Form 10-Q (the “August 4 10-Q”) in which it falsely represented its quarterly income tax provisions and other related financial statements. 30. Specifically, in the following chart from the August 4 10-Q, the entries for other current assets, total current assets, total assets, other current liabilities, total current liabilities, accumulated deficit, total stockholders’ equity and total liabilities and stockholders’ equity contained were fraudulently or recklessly put forth to investors as an accurate reflection of the Company’s financial status when in fact they were false and misleading. 16 August 4 10-Q at 3. 17 31. Additionally, in the folllowing chaart from tthe Augusst 4 10-Q,, the e net loss, baasic loss peer share annd diluted loss entries for the inccome tax expense, fr y or reckllessly put forth to iinvestors aas an accuurate per shaare were fraudulently reflectio on of the Company’s financiaal status w when in fa fact they w were false and mislead ding. August 4 10-Q at 4. 32. g chart fro om the Auggust 4 10-Q Q, the entrries for nett loss In thee following mprehensiv ve (loss) income were w frauduulently or recklesslyy discloseed to and com investorrs as an acccurate refl flection of the Company’s finaancial statuus when inn fact they weere false an nd misleadiing. August 4 10-Q at 5. 33. hermore, in n the following chaart from tthe Augusst 4 10-Q,, the Furth entries for balance/accumu ulated defiicit and thhe net losss were fr fraudulentlyy or 18 recklesssly disclossed to inv vestors as an accurrate reflecction of thhe Compaany’s financiaal status wh hen in factt they weree false and misleadingg. August 4 10-Q at 6. 34. f chart c from m the Auguust 4 10-Q, the entries for Finallly, in the following net loss, deferred taxes and other o assetts were frauudulently oor recklesssly discloseed to flection of the Company’s finaancial statuus when inn fact investorrs as an acccurate refl they weere false an nd misleadiing. 19 August 4 10-Q at 7. 35. A 4 10-Q also contained substantiaally similaar Controlss and The August Procedu ures disclosures referrenced in ¶26 ¶ and atttached to thhe filing ass Exhibits 31.1 and 31..2, respecttively, SOX certifications exeecuted by Defendannts Babich and Richard d substantiaally similaar to the ceertificationss referenceed in ¶27. The Auguust 4 10-Q allso attacheed as Exhiibit 32.1 a SOX cerrtification executed bby Defenddants Babich and Richarrd substantially simillar to the ccertificationn referenceed in ¶28. 20 The Truth Begins to Emerge 36. On November 3, 2015, after the close of trading, the Company issued an 8-K with the SEC admitting that: During the preparation of the third quarter financial statements, the Company discovered financial statement errors attributable to the accounting for its quarterly income tax provision. As a result of these errors, on November 2, 2015, the Audit Committee of the Board of Directors (the “Audit Committee”) of Checkpoint Systems, Inc. (the “Company”) concluded that the unaudited financial statements for the quarterly period ended March 29, 2015, the quarterly period ended June 28, 2015 and the year-to-date period ended June 28, 2015 contained in the Company’s Quarterly Reports on Form 10-Q for the quarterly period ended March 29, 2015 and the quarterly period ended June 28, 2015 should no longer be relied upon due to the effect of financial statement errors that are attributable to an error in the accounting for the Company’s quarterly income tax provision. Accordingly, investors should no longer rely upon the Company’s previously-issued financial statements for these periods and any earnings releases or other Company communications relating to these periods. The Company intends to restate its previously-issued financial statements for the quarterly periods ended March 29, 2015 and June 28, 2015 and the six month period ended June 28, 2015 through the filing of amended Quarterly Reports on Form 10-Q/A for the quarterly periods ended March 29, 2015 and June 28, 2015. These amended Quarterly Reports on Form 10-Q/A will be filed with the Securities and Exchange Commission (“SEC”) as soon as possible.1 37. The following day, November 4, 2015, the Company filed with the SEC on Forms 10-K/A and 10-Q/A, restated financial reports for the affected time periods. 38. 1 The Company restated the May 6 10-Q as follows: November 3 8-K. Unless otherwise noted, all emphasis has been added by counsel. 21 Checkpoint Novem mber 4, 20 015 Form 10-Q/A, p eriod of reeport Marcch 29, 2015, at 10-11. 22 39. The Company restated thee August 4 10-Q as follows: 23 Checkpoint Noveember 4, 2015 Form 10-Q/A, pperiod of report Junne 28, 2015, at 10-11. 40. 4 Checckpoint’s stock s pricee plunged on Noveember 4, 22015 afterr the revelation of the accounting g errors an nd unreliabbility of thhe prior finnancial ressults, b $1.73 per p share, or o more th han 22%, aas a direct result of thhe informaation falling by disseminated in th he Novemb ber 3 8-K. 24 CLASS ACTION ALLEGATIONS 41. Plaintiff brings this action as a class action pursuant to Rule 23 of the Federal Rules of Civil Procedure on behalf of a Class of all persons and entities who purchased or otherwise acquired Checkpoint common stock between March 5, 2015, and November 3, 2015, inclusive. Excluded from the Class are Defendants, directors, and officers of Checkpoint, as well as their families and affiliates. 42. The members of the Class are so numerous that joinder of all members is impracticable. The disposition of their claims in a class action will provide substantial benefits to the parties and the Court. 40. There is a well-defined community of interest in the questions of law and fact involved in this case. Questions of law and fact common to the members of the Class which predominate over questions which may affect individual Class members include: a. Whether the Exchange Act was violated by Defendants; b. Whether Defendants omitted and/or misrepresented material c. Whether Defendants’ statements omitted material facts facts; necessary in order to make the statements made, in light of the circumstances under which they were made, not misleading; 25 d. Whether Defendants knew or recklessly disregarded that their statements were false and misleading; e. Whether the price of Checkpoint common stock was artificially inflated; and f. The extent of damage sustained by Class members and the appropriate measure of damages. 41. Plaintiff’s claims are typical of those of the Class because Plaintiff and the Class sustained damages from Defendants’ wrongful conduct alleged herein. 42. Plaintiff will adequately protect the interests of the Class and has retained counsel who are experienced in class action securities litigation. Plaintiff has no interests that conflict with those of the Class. 43. A class action is superior to other available methods for the fair and efficient adjudication of this controversy. FRAUD ON THE MARKET 44. Plaintiff will rely upon the presumption of reliance established by the fraud-on-the-market doctrine in that, among other things: a. Defendants made public misrepresentations or failed to disclose material facts during the Class Period; b. The omissions and misrepresentations were material; 26 c. The Company’s common stock traded in efficient markets; d. The misrepresentations alleged herein would tend to induce a reasonable investor to misjudge the value of the Company’s common stock; and e. Plaintiff and other members of the Class purchased Checkpoint common stock between the time Defendants misrepresented or failed to disclose material facts and the time the true facts were disclosed, without knowledge of the misrepresented or omitted facts. f. At all relevant times, the markets for Checkpoint common stock were efficient for the following reasons, among others: (i) Checkpoint filed periodic public reports with the SEC; and (ii) Checkpoint regularly communicated with public investors via established market communication mechanisms, including through regular disseminations of press releases on the major news wire services and through other wide-ranging public disclosures, such as communications with the financial press, securities analysts and other similar reporting services. Plaintiff and the Class relied on the price of Checkpoint common stock, which reflected all the information in the market, including the misstatements by Defendants. NO SAFE HARBOR 45. The statutory safe harbor provided for forward-looking statements under certain circumstances does not apply to any of the allegedly false statements 27 pleaded in this Complaint. The specific statements pleaded herein were not identified as forward-looking statements when made. 46. To the extent there were any forward-looking statements, there were no meaningful cautionary statements identifying important factors that could cause actual results to differ materially from those in the purportedly forward-looking statements. LOSS CAUSATION 47. On November 3, 2015, after the close of the markets, Checkpoint disclosed that its “unaudited financial statements for the quarterly period ended March 29, 2015, the quarterly period ended June 28, 2015 and the year-to-date period ended June 28, 2015 contained in the Company’s Quarterly Reports on Form 10-Q for the quarterly period ended March 29, 2015 and the quarterly period ended June 28, 2015 should no longer be relied upon due to the effect of financial statement errors.” On November 4, 2015 Checkpoint’s stock price declined by $1.73 per share, or more than 22%, on these disclosures. This decline was directly attributable to the revelations of the accounting errors and unreliability of Checkpoint’s financial reports. 28 FIRST CLAIM Violation of Section 10(b) of the Exchange Act and Rule 10b-5 Promulgated Thereunder (Against All Defendants) 48. Plaintiff repeats and realleges each and every allegation contained above as if fully set forth herein. 49. During the Class Period, Defendants disseminated or approved the false statements specified above, which they knew or deliberately disregarded were misleading in that they contained misrepresentations and failed to disclose material facts necessary in order to make the statements made, in light of the circumstances under which they were made, not misleading. 50. Defendants violated §10(b) of the Exchange Act and Rule 10b-5 in that they (i) employed devices, schemes, and artifices to defraud; (ii) made untrue statements of material fact and/or omitted to state material facts necessary to make the statements not misleading; and (iii) engaged in acts, practices, and a course of business which operated as a fraud and deceit upon those who purchased or otherwise acquired Checkpoint securities during the Class Period. 51. Plaintiff and the Class have suffered damages in that, in reliance on the integrity of the market, they paid artificially inflated prices for Checkpoint common stock. Plaintiff and the Class would not have purchased Checkpoint common stock at the price paid, or at all, if they had been aware that the market 29 prices had been artificially and falsely inflated by Defendants’ misleading statements. SECOND CLAIM Violation of Section 20(a) of the Exchange Act (Against Individual Defendants) 52. Plaintiff repeats and realleges each and every allegation contained above as if fully set forth herein. 53. The Individual Defendants acted as controlling persons of Checkpoint within the meaning of Section 20(a) of the Exchange Act as alleged herein. By virtue of their high-level positions at the Company, the Individual Defendants had the power and authority to cause or prevent Checkpoint from engaging in the wrongful conduct complained of herein. The Individual Defendants were provided with or had unlimited access to the fraudulent SEC filings and other reports alleged by Plaintiff to be misleading both prior to and immediately after their publication, and had the ability to prevent the issuance of these materials or cause them to be corrected so as not to be misleading. PRAYER FOR RELIEF WHEREFORE, Plaintiff prays for relief and judgment, as follows: 1. Determining that this action is a proper class action pursuant to Rule 23(a) and (b)(3) of the Federal Rules of Civil Procedure on behalf of the Class Classes as defined herein, and a certification of Plaintiff as class representatives 30 pursuant to Rule 23 of the Federal Rules of Civil Procedure and appointment of Plaintiff’s counsel as Lead Counsel; 1. Awarding compensatory and punitive damages in favor of Plaintiff and the other Class members against all Defendants, jointly and severally, for all damages sustained as a result of Defendants’ wrongdoing, in an amount proven at trial, including pre-judgment and post-judgment interest thereon; 2. Awarding Plaintiff and other members of the Class their costs and expenses in this litigation, including reasonable attorneys’ fees and experts’ fees and other costs and disbursements; and 3. Awarding Plaintiff and the other Class members such other relief as this Court may deem just and proper. DEMAND FOR JURY TRIAL Plaintiff hereby demands a trial by jury in this action of all issues so triable. 31