Stephen Meier, et al. v. Checkpoint Systems Inc., et al. 15-CV

advertisement

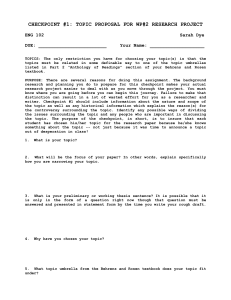

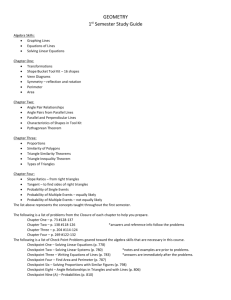

Case 1:15-cv-08007-RBK-KMW Document 1 Filed 11/11/15 Page 1 of 32 PageID: 1 Mark C. Gardy Jennifer Sarnelli GARDY & NOTIS, LLP 560 Sylvan Avenue, Suite 3085 Englewood Cliffs, NJ 07632 Tel: 201-567-7377 Fax: 207-567-7337 Counsel for Plaintiffs UNITED STATES DISTRICT COURT DISTRICT OF NEW JERSEY STEPHEN MEIER, Individually and On Behalf of All Others Similarly Situated, Plaintiff, v. No. CLASS ACTION COMPLAINT FOR VIOLATIONS OF THE FEDERAL SECURITIES LAWS JURY TRIAL DEMANDED CHECKPOINT SYSTEMS, INC., GEORGE BABICH, JR., JEFFERY O. RICHARD AND JAMES M. LUCANIA, Defendants. INTRODUCTION 1. Plaintiff, Stephen Meier, (“Plaintiff”) residing at 595 Templeton Drive Sunnyvale CA 94087, by his undersigned attorneys, alleges as follows upon personal knowledge as to his own acts, and upon information and belief as to all Case 1:15-cv-08007-RBK-KMW Document 1 Filed 11/11/15 Page 2 of 32 PageID: 2 other matters, based on the investigation conducted by and through Plaintiff’s counsel, which included, among other things, a review of Defendants’ public documents, filings made with the United States Securities and Exchange Commission (the “SEC”), announcements issued by Checkpoint Systems, Inc. (“Checkpoint” or the “Company”), wire and press releases published by and regarding the Company and other information readily obtainable in the public domain. I. NATURE OF THE ACTION 2. This is a securities class action on behalf of all investors who purchased or otherwise acquired Checkpoint securities between March 5, 2015, through November 3, 2015, inclusive (the “Class Period”). This action is brought on behalf of the Class for violations of Sections 10(b) and 20(a) of the Securities Exchange Act of 1934 (the “Exchange Act”), 15 U.S.C. §§ 78j(b) and 78t(a), and Rule 10b-5 promulgated thereunder by the SEC, 17 C.F.R. § 240.10b-5. 3. Checkpoint manufactures and markets labeling systems and solutions for a diverse customer base, providing RF source tagging, barcode labeling systems, electronic article surveillance, handheld labeling systems, and retail merchandising systems for applications within the automatic identification industry. The Company employs 4,700 people worldwide. Its stock trades on the New York Stock Exchange (“NYSE”) under the ticker ‘CKP’. 2 Case 1:15-cv-08007-RBK-KMW Document 1 Filed 11/11/15 Page 3 of 32 PageID: 3 4. After the markets closed on November 3, 2015, Checkpoint filed a Form 8-K with the SEC (“November 3 8-K”), including an Item 4.02(a), NonReliance on Previously Issued Financial Statements or a Related Audit Report or Completed Interim Review, in which it announced that it had discovered errors attributable to the accounting for the quarterly income tax provisions in its recently reported financial results. 5. Checkpoint’s common stock price plunged in reaction to this news, its closing price falling by $1.73 per share, or 22%, between November 3, 2015 and November 4, 2015. The single day drop represented an immediate loss of over $70 million in market capitalization. JURISDICTION AND VENUE 6. The claims herein arise under and pursuant to Sections 10(b) and 20(a) of the Exchange Act (15 U.S.C. § 78j(b) and 78t(a)) and Rule 10b-5 promulgated thereunder (17 C.F.R. § 240.10b-5). 7. This Court has jurisdiction over the subject matter of this action pursuant to § 27 of the Exchange Act (15 U.S.C. § 78aa) and 28 U.S.C. § 1331. 8. Venue is proper in this District pursuant to § 27 of the Exchange Act, 15 U.S.C. § 78aa and 28 U.S.C. § 1391(b), as Checkpoint has its principal executive offices located in this District and conducts substantial business therein. 3 Case 1:15-cv-08007-RBK-KMW Document 1 Filed 11/11/15 Page 4 of 32 PageID: 4 9. In connection with the acts, omissions, conduct and other wrongs alleged in this Complaint, Defendants, directly or indirectly, used the means and instrumentalities of interstate commerce including but not limited to, the United States mail, interstate telephone communications and the facilities of the national securities exchange. PARTIES 10. Plaintiff, as set forth in the attached Certification, acquired Checkpoint securities at artificially inflated prices during the Class Period and has been damaged by the revelation of Checkpoint’s material misrepresentations and material omissions. 11. Defendant Checkpoint is incorporated under the laws of Pennsylvania and its principle executive offices are located at 101 Wolf Drive, PO Box 188, Thorofare, New Jersey. The Company’s common shares trade on the NYSE and, as of October 29, 2015, Checkpoint had 41,550,175 outstanding shares of common stock. 12. Defendant George Babich, Jr. (“Babich”) is the Company’s President and Chief Executive Officer (“CEO”). Babich has been President and CEO of the Company since February 2013 and was interim President and CEO between May 2012 and February 2013. 4 Case 1:15-cv-08007-RBK-KMW Document 1 Filed 11/11/15 Page 5 of 32 PageID: 5 13. Defendant James M. Lucania (“Lucania”) is the Company’s Chief Financial Officer (“CFO”) and has been since November 10, 2015. Lucania served as Checkpoint’s acting CFO between March 23, 2015 and November 9, 2015. 14. Defendant Jeffrey O. Richard (“Richard”) was CFO of the Company until March 23, 2015. 15. The defendants referenced above in ¶¶12-14 are sometimes collectively referred to herein as the “Individual Defendants.” 16. The Individual Defendants, because of their positions with the Company, possessed the power and authority to control the content and form of Checkpoint’s annual reports, quarterly reports, press releases and presentations to the SEC, securities analysts, money and portfolio managers and investors; i.e., the market. The Individual Defendants were provided with copies of the SEC filings alleged herein to be misleading prior to their issuance and had the ability and opportunity to prevent their issuance or to cause them to be corrected. Because of their positions with the Company and their access to material non-public information available to them but not to the public, the Individual Defendants knew that the adverse facts specified herein had not been disclosed to and were being concealed from the public and that the positive representations being made were materially false and misleading. The Individual Defendants are liable for the false statements pleaded herein. 5 Case 1:15-cv-08007-RBK-KMW Document 1 Filed 11/11/15 Page 6 of 32 PageID: 6 SUBSTANTIVE ALLEGATIONS 17. The Class Period in this action begins on March 5, 2015. On that day, Checkpoint filed with the SEC a Form 10-K providing its financial results for the fourth quarter and year end 2014. The Company also filed with the SEC, as an attachment to a Form 8-K, a press release accompanying the March 5 filing which included a section entitled 2015 Outlook. The press release contained detailed information with regards to anticipated 2015 results and tax impact, in addition to direct quotes from Babich and Richard. It read, in relevant part, as follows: 2015 Outlook Based on an assessment of market conditions, current customers' orders and commitments, and assuming continuation of current foreign exchange rates, Checkpoint is initiating guidance for 2015. This guidance does not include the impact of acquisitions, divestitures, restructuring and one-time or unusual charges resulting from debt refinancing, litigation fees or settlements and gains or losses generated by non-routine operating matters which we may record during the year. Projected income taxes for the year can be impacted by changes in the mix of pre-tax income and losses in the countries in which we operate. The valuation allowance on U.S. deferred tax assets results in a GAAP tax rate on U.S. pre-tax income or losses of essentially 0%. When the mix of income or losses shifts from the U.S. to a country where the income tax rate is in the normal range, our effective tax rate will increase. Additionally, we continue to monitor our profitability in the U.S. to determine whether there is sufficient evidence that may result in a full or partial release of the U.S. valuation allowance. Should this occur, the 0% GAAP tax rate in the U.S. will revert to its normal range of nearly 40%, including state income taxes. The combination of these factors can have a significant impact on the amount of reported income tax expense, and therefore our earnings per share, when compared with the projections that are the basis of our outlook. 6 Case 1:15-cv-08007-RBK-KMW Document 1 Filed 11/11/15 Page 7 of 32 PageID: 7 Mr. Babich added, “Our business is significantly impacted by large-scale capital projects, the timing of which can be difficult to forecast. The roll-on and roll-off of these projects can generate large swings in revenue and profitability. While we continue to execute a number of EAS and RFID pilots and tests, retailers remain cautious about their in-store capital expenditures. While it is certainly possible that some of these tests will transition into chain-wide rollouts, our guidance assumes that none will occur during fiscal 2015. Our guidance also assumes an incremental $7-10 million total investment in R&D and SG&A to fund our growth initiatives, with primary benefits beginning in 2016." Mr. Richard added, "Like many other multinational companies, we will face tremendous currency headwinds in 2015 due to the strengthening US dollar. Over two-thirds of our revenues are denominated in foreign currencies with particular exposure to the Euro, the Japanese Yen, the British Pound and the Australian Dollar. We expect fiscal 2015 total capital expenditures in the range of $20 to $25 million. We expect our continuous working capital improvement projects will help offset the free cash flow impact of our increased capital spending." Net revenues are expected to be in the range of $575 million to $625 million. Adjusted EBITDA is expected to be in the range of $55 million to $68 million. Non-GAAP diluted net earnings per share attributable to Checkpoint Systems, Inc. is expected to be in the range of $0.40 to $0.50, assuming an effective tax rate of approximately 35%. 18. In addition to the Form 10-K and the press release, the Company also conducted a conference call with its investors on March 5, 2015, wherein it discussed the forecast for 2015 and the Company’s anticipated tax treatment for 2015. During the call, Defendant Richard stated that: Now on to guidance for fiscal year 2015, we expect net revenues in the range of $575 million to $625 million. Adjusted EBITDA in the range of $55 million to $68 million. Non-GAAP diluted net earnings per share in the range of $0.40 to $0.50. As a reminder, our guidance 7 Case 1:15-cv-08007-RBK-KMW Document 1 Filed 11/11/15 Page 8 of 32 PageID: 8 assumes a continuation of the current foreign currency exchange rate environment with over 2/3rds of our sales denominated in foreign currency, the impact of strengthening US dollar on our net revenues will be significant. We estimate that our 2015 revenue guidance would have been more than $40 million higher at constant 2014 foreign exchange rates. Our guidance also assumes that no hardware rollout are executed during fiscal 2015 which are large enough to offset the loss of revenue for our large projects executed during 2014, including our largest chain-wide EAS roll out in Checkpoint's history at Family Dollar. Our adjusted EBITDA and earnings guidance assumes $7 million to $10 million of an incremental investments in R&D, in SG&A, partially funded through savings delivered by our profit improvement plans. We were also increasing our investment in capital expenditures to drive growth and expect total CapEx to be up to $25 million for fiscal 2015. We expect the primary benefit of these investments to begin in 2016. We are currently expecting a 2015 effective tax rate of approximately 35% versus approximately 30% in 2014, after giving consideration to non-GAAP adjustments. We continue to monitor our profitability in the US and to determine whether there is sufficient evidence that all or a portion of the – of our US income tax valuation allowance should be released. If this occurs, our income tax rate on US income will increase from 0% to nearly 40%, which would significantly impact our reported earnings per share. Please note that all of these adjustments would have no impact on our cash tax obligations and we expect our effective tax income – effective income tax rate to be approximately 20% regardless of whether the valuation allowance remains in place or is released. 19. The statements identified in paragraphs 17-18 above were materially false and misleading when made, and omitted from disclosure material facts 8 Case 1:15-cv-08007-RBK-KMW Document 1 Filed 11/11/15 Page 9 of 32 PageID: 9 necessary to not make the statements made misleading as regarded the Company’s tax treatment and 2015 guidance. 20. On May 6, 2015, Checkpoint filed its Form 10-Q with the SEC (the “May 6 10-Q”) in which it falsely represented its quarterly income tax provisions and other related financial statements. 21. Specifically, in the following excerpt from the May 6 10-Q the entries for other current assets, total current assets, total assets, other current liabilities, total current liabilities, deferred income taxes, accumulated deficit, total stockholders’ equity and total liabilities and stockholders’ equity were fraudulently or recklessly disclosed to investors as an accurate reflection of the Company’s financial status when in fact they were false and misleading. 9 Case 1:15-cv-08007-RBK-KMW Document 1 Filed 11/11/15 Page 10 of 32 PageID: 10 March 29, December 28, 201S 2014 (amounts in thousands) AcE1 CURRENT ASSETS: Cash and cash equivalents $ 124,205 $ 135,537 100,696 131.720 95,579 21,245 91.860 25.928 Accounts receivable, net ofallowance of $7,917 and $8,526 Inventories Other current assets Defrred income taxes Total Current Assets REVENUE EQUIPMENT ON OPERATING LEASE net PROPERTY, PLANT, AND EQUIPMENT, net GOODWILL OTHER INTANGIBLES, net DEFERRED INCOME TAXES OTHER ASSETS 5,310 5,557 347,035 390.602 1,021 77,022 1.057 76.332 164,027 60,980 173.569 64.940 23,088 25.284 6.882 6.264 TOTAL ASSETS $ 679,437 $ 738,666 LIABILITIES AND EQUITY CURRENT LIABILiTIES: Short-tenn borrowings and current portion of long-term debt $ 224 $ 236 Accounts payable Dividend payable 36.523 21.384 48,929 Accrued compensation and related taxes Other accrued expenses 20,205 37.208 27.511 44.204 Income taxes Unearned revenues Restructuring reserve 7,208 1,278 7.663 4,324 6.255 3.999 16.058 4A72 17,504 147.133 158.051 LONG-TERM DEBT, LESS CURRENT MATURiTIES 65.138 65.161 FINANCING LIABIUTY 31,187 33,094 ACCRUED PENSIONS 96,948 108.920 OTHER LONG-TERN LIABILITIES DEFERRED INCOME TAXES 28.104 15,120 30,140 Additional capital 420.955 441.882 Accumulated deficit Common stock in treasury, at cost, 4,035.912 and 4.03 5,912 shares (13.076) (71,520) (12331) (71,520) Accumulated other comprehensive mcome. net of tax (45.152) (34.684) 295.807 327931 Accrued pensions - current Other current liabilities Total Current Liabilities TOTAL STOCKHOLDERS' EQUiTY TOTAL LIABIL1TIESAND STOCKHOLDERS' EQUITY May 6 10-Q at 3. 10 1 5,369 $ 679.437 $ 738,666 Case 1:15-cv-08007-RBK-KMW Document 1 Filed 11/11/15 Page 11 of 32 PageID: 11 22. Additionally, in the following excerpt from the May 6 10-Q the entries for income tax expense, net loss, basic loss per share and diluted loss per share were fraudulently or recklessly disclosed to investors as an accurate reflection of the Company’s financial status when in fact they were false and misleading. Quarter (13 weeks) Ended March 29. 201 (amounts in thousands. except per share d a t a ) (Loss) earnings before income taxes Income tax expense March 30. 2014 (674) 1.091 71 L220 Net loss $ (745) S (129) Net loss per common sha re: Basic loss per share $ (0.02) $ ¶ (0.02) S - D1utedIosspershare May 6 10-Q at 4. 23. In the following excerpt from the May 6 10-Q the entries for net loss and comprehensive (loss) income were also fraudulently or recklessly disclosed to investors as an accurate re flection of the Company’s financial status when in fact they were false and misleading. (13 weeks) Laded March 29. 2015 (mo*ut.n thousands) Net loss $ Other comprehensive (loss) income, net of tax: Pension liability autments. net of tax benefit of$3 and $110 Foreign currency translation adjustment Total other comprehensive (loss) income, net oftax (745) S May 6 10-Q at 5. 11 (129) 4.431 329 (14,899) 355 (10.468) 623 S (1 L213) $ Comprehensive (loss)income March 30. 2011 554 Case 1:15-cv-08007-RBK-KMW Document 1 Filed 11/11/15 Page 12 of 32 PageID: 12 24. Furthermore, in the following excerpt from the May 6 10-Q the entries for balance/accumulated deficit and the net loss were fraudulently or recklessly disclosed to investors as an accurate reflection of the Company’s financial status when in fact they were false and misleading. (amoomts in thoaaids) Chekpeânt Sv items, Inc Stockholders Accumulated Other Coinprehr.the Total Additional Accuinu1atd Amount Capital Deficit Sbr.c Amount Intone (Lou) Equity Common Stock Shares Ba1aie, December 29, 2013 Net eI1zs Exercise ofstock-ed compensatton and awards released 45.434 S Tricurv Stork 4,542 $ 434,336 5 (23.24) 4.036 5(71520) S 356 36 1O.93 907 Tax benefit anstock-based cqci&,iiticc 943 (14) (14) Stock-based compensabon expense 5,781 Deferred cimp..t*iij11n 5.781 872 872 Pe— liability adt-ftnegis (17263) (17.263) Famp crcy translation adImmew Balance, December 28, 2014 Net loss Exerci,e of cck-based cipeibc*i aca iwu6 E.katd (19.66 484 $ 4,94 S 441,882 $ (12.331) 4.036 $(71,520) S (19,66 (34,6i) $ 327.931 (745) 156 16 Tixbrnfjt an itock-b*se4ent (745) (1,084) (1,06 (1) (1) 1,459 1.459 Stock-based compensation Deferred cnpenatplan 83 83 Di%idend ckcIared ($0.50 per share) (21.384) (21,394) Peicci Ith1Iityadjusth 4.431 Pciei cencv trandation a djustmets March 29, 2O15 2245 5 346.325 10.93 45.996 $ 4,600 S 420.55 S (13.076) 4.O3 $(7I.5O) S (45,151) S 295 807 May 6 10-Q at 6. 25. 4,431 (14.899) (14S9) In the following excerpt from the May 6 10-Q the entries for net loss, deferred taxes and other assets were fraudulently or recklessly disclosed to investors as an accurate re flection of the Company’s financial status when in fact they were false and misleading. 12 , Case 1:15-cv-08007-RBK-KMW Document 1 Filed 11/11/15 Page 13 of 32 PageID: 13 MMCh29, 2015 Quar-ter (13 weeks) ended March O14 Cash flows from operitingactivities: Net loss S (745) S (129) Adjustments to reconcile net loss to net cash (used in) provided by operating activities: 6.690 6,164 Amortization of debt issuance costs Interest on financing liability 108 492 108 Defened taxes Stock-based compensation (41) Depreciation and amoniwion 559 Provision for losses on accounts receivable 258 (93) 1,501 676 Excess tax benefit on stock-based compensation (101) (97) (186) 29 1.459 (Gain) loss on disposal of fixed assets 172 Restructuring related asset in3painnent Decrease (increase) in operating assets: Accounts receivable Inventories Other assets (Decrease) increase in operating liabilities: Accounts payable Income taxes Unearned revenues current Restructuring reserve Other liabilities 24.578 (8.312) 24,279 (11,111) 3.856 3,995 (1003) (1.084) (13,209) (2.376) 110 (1.414) 594 517) (15.381) (1 893) May 6 10-Q at 7. 26. The May 6 10-Q also falsely stated that the Company had adequate internal controls and procedures in place to ensure the accuracy of its financial results contained in its filings with the SEC and provided via other outlets to investors, falsely claiming the following: Item 4. CONTROLS AND PROCEDURES Evaluation of Disclosure Controls and Procedures Management, with the participation of the Chie f Executive Officer and Acting Chief Financial Office r, conducted an evaluation ( as required by Rule 13a-15 under the Securities Exchange Act o f 1934, as amended (the Exchange Act)) of the effe ctiveness of our disclosure controls and procedures (as define d in Rules 13a-15(e) and 15d- 1 5(e) under the Exchange Act) as of the end of the period covered by this report. Based on that 13 Case 1:15-cv-08007-RBK-KMW Document 1 Filed 11/11/15 Page 14 of 32 PageID: 14 evaluation, our Chief Executive Officer and Acting Chief Financial Officer concluded that our disclosure controls and procedures were effective as of the end of the period covered by this report. Changes in Internal Control over Financial Reporting There have been no changes in our internal control over financial reporting that occurred during our first fiscal quarter of 2015 that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting. 27. The May 6 10-Q also contained, attached to the filing as Exhibits 31.1 and 31.2, respectively, false and misleading certifications pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 (“SOX”) executed by Defendants Babich and Richard. These certifications falsely stated: 1. I have reviewed this Form 10-Q of Checkpoint Systems, Inc.; 2. Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report; 3. Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report; 4. The registrant’s other certifying officer(s) and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have: a. Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under 14 Case 1:15-cv-08007-RBK-KMW Document 1 Filed 11/11/15 Page 15 of 32 PageID: 15 our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared; b. Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles; c. Evaluated the effectiveness of the registrant's disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and d. Disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal quarter (the registrant’s fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting; 5. The registrant’s other certifying officer(s) and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the registrant’s auditors and the audit committee of the registrant’s board of directors (or persons performing the equivalent functions): a. All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information; and b. Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal control over financial reporting. 15 Case 1:15-cv-08007-RBK-KMW Document 1 Filed 11/11/15 Page 16 of 32 PageID: 16 28. The May 6 10-Q also included as Exhibit 32.1 a SOX certification executed by Babich and Lucania which falsely stated that: The undersigned executive officers of Checkpoint Systems, Inc. (the “Company”) hereby certify that this Quarterly Report on Form 10-Q for the quarter ended June 28, 2015 (the “Report”) fully complies with the requirements of Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, and the information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Company. 29. On August 4, 2015, the Company filed with the SEC its Form 10-Q (the “August 4 10-Q”) in which it falsely represented its quarterly income tax provisions and other related financial statements. 30. Specifically, in the following chart from the August 4 10-Q, the entries for other current assets, total current assets, total assets, other current liabilities, total current liabilities, accumulated deficit, total stockholders’ equity and total liabilities and stockholders’ equity contained were fraudulently or recklessly put forth to investors as an accurate reflection of the Company’s financial status when in fact they were false and misleading. 16 Case 1:15-cv-08007-RBK-KMW Document 1 Filed 11/11/15 Page 17 of 32 PageID: 17 June 2$, December 28, (;immmouncs in thonmds) 20H 2014 99.104 5 135.537 109,643 92,462 24,733 131,720 91,860 25,928 ASSET CURRENT ASSETS: Cash and cash equivalents 5 Accounts receivable, net ofallowance of $7,642 and $8,526 Inventories Other current assets Deferred income taxes Total Current Assets REVENUE EQUIPMENT ON OPERATING LEASE, net 5.334 5.557 331276 390.602 1.060 1,057 77.336 76,332 166.083 173.569 OTHER INTANGIBLES, net 58.584 64.940 DEFERRED INCOME TAXES OTHER ASSETS 22.901 5,934 25.284 6,882 $ 663174 S 738.666 $ $ PROPERTY, PlANT, AND EQUIPMENT, net GOODWILL TOTAL ASSETS LIABILiTIES AND EQUITY CURRENT LIABILITIES: Short-term borrowings and current portion of long-term debt 186 236 Accounts payable 41,122 48.928 Accrued corripensation and related taxes 19,245 27.511 Other accrued expenses Income taxes 36,860 44,204 - 1,278 8,337 3.089 4,104 7,663 6155 Other current liabilities 16.519 17.504 Total Current Liabilities 129.462 158.051 LONG-TERM DEBT. LESS CURRENT MATURITIES FINANCING LIABILITY 65.146 31,349 65.161 33,094 ACCRUED PENSIONS 99.306 108.920 OTHER LONG-TERM LIABILITIES 28,682 30.140 DEFERRED INCOME TAXES COMMITMENTS AND CONTINGENCIES 15.163 15,369 4.612 4,584 424,067 (18,483) 441.882 (12.331) (71,520) (44,610) (71.520) (34,684) 294,066 327,931 Unearned revenues Restructurmgreserve Accrued pensions —current 4.472 STOCKHOLDERS' EQUITY: Preferred stock, no par value, 500,000 shares authorized, none issued Common stock, par value S. 10 per share. 100,000,000 shares authorized, 46.117.768 and 45,840.171 shares issued. 42,081,956 and 41,904,259 shares outstanding Additional capital Accumulated deficit Common stock in treasury, at cost. 4,03 5,912 and 4.035,912 shares Accumulated other comprehensive (loss) income, net of tax TOTAL STOCKHOLDERS EQUITY TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY August 4 10-Q at 3. 17 $ 663,174 S 738,666 Case 1:15-cv-08007-RBK-KMW Document 1 Filed 11/11/15 Page 18 of 32 PageID: 18 31. Additionally, in the following chart from the August 4 10-Q, the entries for the income tax expense, net loss, basic loss per share and diluted loss per share were fraudulently or recklessly put forth to investors as an accurate reflection of the Company’s financial status when in fact they were false and misleading. (Loss) earnings before income taxes Income tax (benefit) expense (6.105) (698) Net (loss) earnings 1L631 L777 6.779) 627) 12.722 1997 $ (54O7) S 9.854 $ 6152) $ 9.725 $ $ (0.13) $ (0.13) $ 0.23 $ 0.23 $ (0.14) $ (0.14) $ 0.23 0.23 Net (loss) earnings per commom share: Basic (loss) earnings per share Diluted (loss) earnings per thaiie August 4 10-Q at 4. 32. In the following chart from the August 4 10-Q, the entries for net loss and comprehensive (loss) income were fraudulently or recklessly disclosed to investors as an accurate re flection of the Company’s financial status when in fact they were false and misleading. Quarter &I inoithi (13 weeks) Ended (26 wtkc) Ended 23, 2015 3DM (amounts in thousands) Net (loss) eammgs Other comprehensiv (loss) income, net of tax: $ Pension liability adjustments, net of tax benefit of $432. Si 12, $435 and $222. respectively Foreign currency translation adjustment (5.407) $ (489) 1,031 Total other comprehensive income (loss). net of tax $ 542 $ Comprehensive loss) income $ (4.865) $ ( 29, 2011 1DM 9.854 $ 277 470 747 $ June 28. 2015 (6.152) S 3,942 (13,868) 555 875 1,430 10.601 S (16.078) S 11,155 Furthermore, in the following chart from the August 4 10-Q, the entries for balance/accumulated deficit and the net loss were fraudulently or 18 9.725 (9.926) $ August 4 10-Q at 5. 33. June 2. 2014 Case 1:15-cv-08007-RBK-KMW Document 1 Filed 11/11/15 Page 19 of 32 PageID: 19 recklessly disclosed to investors as an accurate reflection of the Company’s financial status when in fact they were false and misleading. (amounts in thousands) 'Common Stock Treasury Stock Additional AcimIted Shares Amount Capital Deficit Balance, December 29, 2013 Net e1r Emercue ofstock-based released 45.484 $ 4j43 $ 434336 S (23,294) k- Shares Amount Accumulated Other compreheash-C Total hieo.nr (Lc) Equity 4036 $(71.520) $ 10.953 compensation and awards 356 36 Tx beifit an stock-1sed cpsaticc 907 943 (14) (14) 5,781 Stock-bid cclrIpecIticl1 expee Deferred ccpisaticnplan 5,781 172 872 Frein currency trauslatica ausniem Balance, December 28, 2014 Net 10 Excie of stock-beed compensaizen and iwaM released 41840 5 4.584 S 441,8*2 S 278 28 4.036 S(7L520) S (19.666) (19.666) (34,694)$ 327,931 (6,52) (9) (223) 2,999 Z998 891 Divided declared ($OiOpr Aare) $91 (21.384) (21,38) 3,942 liability adjustments Foreign cry franthtim au!mrm BaInce. June 28. 2015 (17.263) (223) c,rntiii expense Deferred c..thu1pI Fewaca (12331) (17.263) (6,152) Tax beifit m stork-based cpitk Stock-bed 2,245 S 346,325 10,953 (13, 46.118 S 4.612 S 424.067 S (18.493) 4.036 5(7120) S 3,942 (13,96 (44 610)S 294.066 , August 4 10-Q at 6. 34. Finally, in the following chart from the August 4 10-Q, the entries for net loss, deferred taxes and other assets were fraudulently or recklessly disclosed to investors as an accurate re flection of the Company’s financial status when in fact they were false and misleading. 19 Case 1:15-cv-08007-RBK-KMW Document 1 Filed 11/11/15 Page 20 of 32 PageID: 20 (ammairs in thoasds) June 28 Six mouths (26 weeks) ended 201 Cash flows from operating activities: Net (loss) earnings $ (6.152) $ June 19 2014 9,725 Adjustments to reconcile net (loss) earnings to net cash (used in) provided by operating activities: Depreciation and amortization Amortization of debt issuance costs 13206 217 Interest on financing liability Defrned taxes Stock-based compensation Provision far losses on accounts receivable Excess tax benefit on stock-based compensation (Gain) loss on disposal of fixed assets Restructuring related asset impairment Decrease (increase) in operating assets: Accounts receivable Inventories Other assess (Decrease) increase in operating liabilities: Accounts payable Income taxes Unearned revenues -current Restructuring reserve Other liabilities 217 980 (39) 1.127 (194) 2,998 204 (99) 2.898 473 (79) (195) - 81 172 16,646 26,398 (4.908) 534 (16.527) 3,357 (5.419) (7.625) (1.137) 1.133 (2,341) 985 (2,742) (15,588) (2,437) (7,421) August 4 10-Q at 7. 35. The August 4 10-Q also contained substantially similar Controls and Procedures disclosures referenced in ¶26 and attached to the filing as Exhibits 31.1 and 31.2, respectively, SOX certifications executed by Defendants Babich and Richard substantially similar to the certifications referenced in ¶27. The August 4 10-Q also attached as Exhibit 32.1 a SOX certification executed by Defendants Babich and Richard substantially similar to the certification referenced in ¶28. 20 12.490 Case 1:15-cv-08007-RBK-KMW Document 1 Filed 11/11/15 Page 21 of 32 PageID: 21 The Truth Begins to Emerge 36. On November 3, 2015, after the close of trading, the Company issued an 8-K with the SEC admitting that: During the preparation of the third quarter financial statements, the Company discovered financial statement errors attributable to the accounting for its quarterly income tax provision. As a result of these errors, on November 2, 2015, the Audit Committee of the Board of Directors (the “Audit Committee”) of Checkpoint Systems, Inc. (the “Company”) concluded that the unaudited financial statements for the quarterly period ended March 29, 2015, the quarterly period ended June 28, 2015 and the year-to-date period ended June 28, 2015 contained in the Company’s Quarterly Reports on Form 10-Q for the quarterly period ended March 29, 2015 and the quarterly period ended June 28, 2015 should no longer be relied upon due to the effect of financial statement errors that are attributable to an error in the accounting for the Company’s quarterly income tax provision. Accordingly, investors should no longer rely upon the Company’s previously-issued financial statements for these periods and any earnings releases or other Company communications relating to these periods . The Company intends to restate its previously-issued financial statements for the quarterly periods ended March 29, 2015 and June 28, 2015 and the six month period ended June 28, 2015 through the filing of amended Quarterly Reports on Form 10-Q/A for the quarterly periods ended March 29, 2015 and June 28, 2015. These amended Quarterly Reports on Form 10-Q/A will be filed with the Securities and Exchange Commission (“SEC”) as soon as possible. 1 37. The following day, November 4, 2015, the Company filed with the SEC on Forms 10-K/A and 10-Q/A, restated financial reports for the affected time periods. 38. 1 The Company restated the May 6 10-Q as follows: November 3 8-K. Unless otherwise noted, all emphasis has been added by counsel. 21 Case 1:15-cv-08007-RBK-KMW Document 1 Filed 11/11/15 Page 22 of 32 PageID: 22 March N. 2015 As Priuilv Reported (amounts in thousands) Otbercunnt assets Total cunent assets Total assets Other current liabilities Total current liabilities Defined income taxes 5 Accumulated deficit Total stockholders' equity Total liabilities and stockholders' equity 21.245 347.035 679.437 Restatement .'idstluents S .s Restated 18.464 344,254 676,656 (2.781) S (2.781) (2.781) 16.058 (345) 15.713 147,133 15,120 (345) (622) 146,788 14,498 (13.076) 295,807 679A37 (1,814) (1.814) (2.781) (14,890) 293.993 676656 Quarter (13 Weeks) Ended March 29, 2015 As Presioush Reported (amounts in thousands) Income lax expense $ 71 Net loss (745) Basic loss pier share Diluted loss per share (0.02) (002) Restatement Adjustments $ As Restated 1,814 $ (1,814) 1.885 (2.559) (0.04) (004) (0.06) (006) CIIEC1PO1NT SYSTEMS, rc. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) (Unaudited) Quarter (U Weeks) Ended March 29, 2015 As Presioush (amounts in thousand;) Net loss Comprehensive loss S Restatement Reported Adjustments As Restated (745) S (1.814) S (2.559) (11.213) (1.814) (13.027) CHECKPOINT SYSTEMS, INC. CONSOLATED STATEMENTS OF EQUITY (Ijns udi ted) March 29, 201.r. As Presioush Reported (amounts in thousands) Net loss Accumulated deficit balance. March 29. 2015 $ Total equity Restatement Adjustments As Rstated (745) $ (13.076) (1.814) $ (1.814) (2559) (14.890) 295.807 (1,814) 293.993 CHECKPOLNT SYSTEMS, INC. CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited) Quarter (13 Weeks) Ended March 29, 2015 Al P,otul Reported (amounts in thousand;) Net loss $ Deferred taxes (145) $ (41) Other assets 3.856 Restatement Adjustments As Restated (1.814) S 967) 2381 Checkpoint November 4, 2015 Form 10-Q/A, period of report March 29, 2015, at 10-11. 22 (2559) (1.008) 6.637 Case 1:15-cv-08007-RBK-KMW Document 1 Filed 11/11/15 Page 23 of 32 PageID: 23 39. The Company restated the August 4 10-Q as follows: June 29, 201 5 M Pttuh Reported (amounts in tiou.d) Othercunnt assets $ 24.733 S Restatement Adjustments (6.866) $ As Restated 17867 Total cuirent assets 331,276 (6.866) 324.410 Total assets Other cunent liabilities 663.174 16.519 (6,866) (345) 65630 Total cunnt liabilities Defened income taxes 129.462 15,163 (345) (622) Accumulated deficii (18.483) (5 1899) (24.382) Total stockholders 'equity 294.066 (5.899) 288.167 Total liabilities and sockbo1deis' equity 663174 6.966) 656.308 23 16374 129,117 14,541 Case 1:15-cv-08007-RBK-KMW Document 1 Filed 11/11/15 Page 24 of 32 PageID: 24 Quarter (13 Weeks) Ended Six Months (26 Weeks) Ended June 28, 2015 (amounts in thousands) Income tax benefit)expense As Presicustv Reported 698) S $ Net loss Basic loss per share Diluted loss per share Restatement Adjustments June 28, 2015 As Restated 4.085 S As Presiouclv Reported 3387 S (627) $ Restatement Adjustments As Rusted 5899 $ (5.407) (4.085) (9492) (6.152) (5.899) 5.272 (12,051) (013) (0.13) (0.09) (0.09) (022) (0.22) (014) (0.14) (014) (0.14) (028) (028) CHECKPOINT SYSTEMS, INC. CONSOL]DATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) (Unaudited) Quarter (13 Weeks) Ended Six Months (26 Weeks) Ended June 28, 2015 (amounts in thousands) Net loss Comprehensive loss As Pre'sicnclv Reported $ Restatement Adjustment; June 28, 2015 As Restated As Previously Reporte.à (5.407) S 4.085) S (9.492) S (4.865) (4.085) (8.950) (6,152) $ (16.078) Restatement Adjustments As Restated (5.899) S (12.051) (5.899) (21.977) CHECKPOINT SYSTEMS, INC. CONSOLIDATED STATEMENTS OF EQUITY (Unaudited) June 28, 2015 (amounts in thousands) Net loss Accumulated deficit balance, June 28. 2015 As Presiousl't Restatement Reported Adjustments S Total equity (6.152) $ (18,483) (5.899) 5 (5,899) 294.066 (5.899) As Restated (12.051) (24382) 288.167 CHECKPOINT SYSTEMS, INC. CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited) Six Months (26 Weeks) Ended June 28, 2015 As Previously Reported (amounts in thousands) Net loss Defend taxes $ (6,152) $ (39) 534 Other assets Restatement Adjustments (5,899) S (967) 6.866 As Resisted (12,051) (1,006) 7,400 Checkpoint November 4, 2015 Form 10-Q/A, period of report June 28, 2015, at 10-11. 40. Checkpoint’s stock price plunged on November 4, 2015 after the revelation of the accounting errors and unreliability of the prior financial results, falling by $1.73 per share, or more than 22%, as a direct result of the information disseminated in the November 3 8-K. 24 Case 1:15-cv-08007-RBK-KMW Document 1 Filed 11/11/15 Page 25 of 32 PageID: 25 CLASS ACTION ALLEGATIONS 41. Plaintiff brings this action as a class action pursuant to Rule 23 of the Federal Rules of Civil Procedure on behalf of a Class of all persons and entities who purchased or otherwise acquired Checkpoint common stock between March 5, 2015, and November 3, 2015, inclusive. Excluded from the Class are Defendants, directors, and officers of Checkpoint, as well as their families and affiliates. 42. The members of the Class are so numerous that joinder of all members is impracticable. The disposition of their claims in a class action will provide substantial benefits to the parties and the Court. 40. There is a well-defined community of interest in the questions of law and fact involved in this case. Questions of law and fact common to the members of the Class which predominate over questions which may affect individual Class members include: a. Whether the Exchange Act was violated by Defendants; b. Whether Defendants omitted and/or misrepresented material c. Whether Defendants’ statements omitted material facts facts; necessary in order to make the statements made, in light of the circumstances under which they were made, not misleading; 25 Case 1:15-cv-08007-RBK-KMW Document 1 Filed 11/11/15 Page 26 of 32 PageID: 26 d. Whether Defendants knew or recklessly disregarded that their statements were false and misleading; e. Whether the price of Checkpoint common stock was artificially inflated; and f. The extent of damage sustained by Class members and the appropriate measure of damages. 41. Plaintiff’s claims are typical of those of the Class because Plaintiff and the Class sustained damages from Defendants’ wrongful conduct alleged herein. 42. Plaintiff will adequately protect the interests of the Class and has retained counsel who are experienced in class action securities litigation. Plaintiff has no interests that conflict with those of the Class. 43. A class action is superior to other available methods for the fair and efficient adjudication of this controversy. FRAUD ON THE MARKET 44. Plaintiff will rely upon the presumption of reliance established by the fraud-on-the-market doctrine in that, among other things: a. Defendants made public misrepresentations or failed to disclose material facts during the Class Period; b. The omissions and misrepresentations were material; 26 Case 1:15-cv-08007-RBK-KMW Document 1 Filed 11/11/15 Page 27 of 32 PageID: 27 c. The Company’s common stock traded in efficient markets; d. The misrepresentations alleged herein would tend to induce a reasonable investor to misjudge the value of the Company’s common stock; and e. Plaintiff and other members of the Class purchased Checkpoint common stock between the time Defendants misrepresented or failed to disclose material facts and the time the true facts were disclosed, without knowledge of the misrepresented or omitted facts. f. At all relevant times, the markets for Checkpoint common stock were efficient for the following reasons, among others: (i) Checkpoint filed periodic public reports with the SEC; and (ii) Checkpoint regularly communicated with public investors via established market communication mechanisms, including through regular disseminations of press releases on the major news wire services and through other wide-ranging public disclosures, such as communications with the financial press, securities analysts and other similar reporting services. Plaintiff and the Class relied on the price of Checkpoint common stock, which reflected all the information in the market, including the misstatements by Defendants. NO SAFE HARBOR 45. The statutory safe harbor provided for forward-looking statements under certain circumstances does not apply to any of the allegedly false statements 27 Case 1:15-cv-08007-RBK-KMW Document 1 Filed 11/11/15 Page 28 of 32 PageID: 28 pleaded in this Complaint. The specific statements pleaded herein were not identified as forward-looking statements when made. 46. To the extent there were any forward-looking statements, there were no meaningful cautionary statements identifying important factors that could cause actual results to differ materially from those in the purportedly forward-looking statements. LOSS CAUSATION 47. On November 3, 2015, after the close of the markets, Checkpoint disclosed that its “unaudited financial statements for the quarterly period ended March 29, 2015, the quarterly period ended June 28, 2015 and the year-to-date period ended June 28, 2015 contained in the Company’s Quarterly Reports on Form 10-Q for the quarterly period ended March 29, 2015 and the quarterly period ended June 28, 2015 should no longer be relied upon due to the effect of financial statement errors.” On November 4, 2015 Checkpoint’s stock price declined by $1.73 per share, or more than 22%, on these disclosures. This decline was directly attributable to the revelations of the accounting errors and unreliability of Checkpoint’s financial reports. 28 Case 1:15-cv-08007-RBK-KMW Document 1 Filed 11/11/15 Page 29 of 32 PageID: 29 FIRST CLAIM Violation of Section 10(b) of the Exchange Act and Rule 10b-5 Promulgated Thereunder (Against All Defendants) 48. Plaintiff repeats and realleges each and every allegation contained above as if fully set forth herein. 49. During the Class Period, Defendants disseminated or approved the false statements specified above, which they knew or deliberately disregarded were misleading in that they contained misrepresentations and failed to disclose material facts necessary in order to make the statements made, in light of the circumstances under which they were made, not misleading. 50. Defendants violated §10(b) of the Exchange Act and Rule 10b-5 in that they (i) employed devices, schemes, and artifices to defraud; (ii) made untrue statements of material fact and/or omitted to state material facts necessary to make the statements not misleading; and (iii) engaged in acts, practices, and a course of business which operated as a fraud and deceit upon those who purchased or otherwise acquired Checkpoint securities during the Class Period. 51. Plaintiff and the Class have suffered damages in that, in reliance on the integrity of the market, they paid artificially inflated prices for Checkpoint common stock. Plaintiff and the Class would not have purchased Checkpoint common stock at the price paid, or at all, if they had been aware that the market 29 Case 1:15-cv-08007-RBK-KMW Document 1 Filed 11/11/15 Page 30 of 32 PageID: 30 prices had been artificially and falsely inflated by Defendants’ misleading statements. SECOND CLAIM Violation of Section 20(a) of the Exchange Act (Against Individual Defendants) 52. Plaintiff repeats and realleges each and every allegation contained above as if fully set forth herein. 53. The Individual Defendants acted as controlling persons of Checkpoint within the meaning of Section 20(a) of the Exchange Act as alleged herein. By virtue of their high-level positions at the Company, the Individual Defendants had the power and authority to cause or prevent Checkpoint from engaging in the wrongful conduct complained of herein. The Individual Defendants were provided with or had unlimited access to the fraudulent SEC filings and other reports alleged by Plaintiff to be misleading both prior to and immediately after their publication, and had the ability to prevent the issuance of these materials or cause them to be corrected so as not to be misleading. PRAYER FOR RELIEF WHEREFORE , Plaintiff prays for relief and judgment, as follows: 1. Determining that this action is a proper class action pursuant to Rule 23(a) and (b)(3) of the Federal Rules of Civil Procedure on behalf of the Class Classes as defined herein, and a certification of Plaintiff as class representatives 30 Case 1:15-cv-08007-RBK-KMW Document 1 Filed 11/11/15 Page 31 of 32 PageID: 31 pursuant to Rule 23 of the Federal Rules of Civil Procedure and appointment of Plaintiff’s counsel as Lead Counsel; 1. Awarding compensatory and punitive damages in favor of Plaintiff and the other Class members against all Defendants, jointly and severally, for all damages sustained as a result of Defendants’ wrongdoing, in an amount proven at trial, including pre-judgment and post-judgment interest thereon; 2. Awarding Plaintiff and other members of the Class their costs and expenses in this litigation, including reasonable attorneys’ fees and experts’ fees and other costs and disbursements; and 3. Awarding Plaintiff and the other Class members such other relief as this Court may deem just and proper. 31 Case 1:15-cv-08007-RBK-KMW Document 1 Filed 11/11/15 Page 32 of 32 PageID: 32 DEMAND FOR JURY TRIAL Plaintiff hereby demands a trial by jury in this action of all issues so triable. DATED: November 11, 2015 GARDY & NOTIS, LLP By: /s/ Jennifer Sarnelli Mark C. Gardy Jennifer Sarnelli 560 Sylvan Avenue, Suite 3085 Englewood Cliffs, New Jersey 07632 (201) 567-7377 phone (201) 567-7337 fax mgardy@gardylaw.com jsarnelli@gardylaw.com BLOCK & LEVITON LLP Jeffrey C. Block Steven P. Harte Bradley J. Vettraino 155 Federal Street, Suite 400 Boston, Massachusetts 02110 Tel: (617) 398-5600 Fax: (617) 507-6020 Jeff@blockesq.com Steven@blockesq.com Brad@blockesq.com Counsel for Plaintiff 32