NCI INFORMATION SYSTEMS, INC. 401(K) PROFIT SHARING PLAN

Understanding Your Retirement Plan Contributions

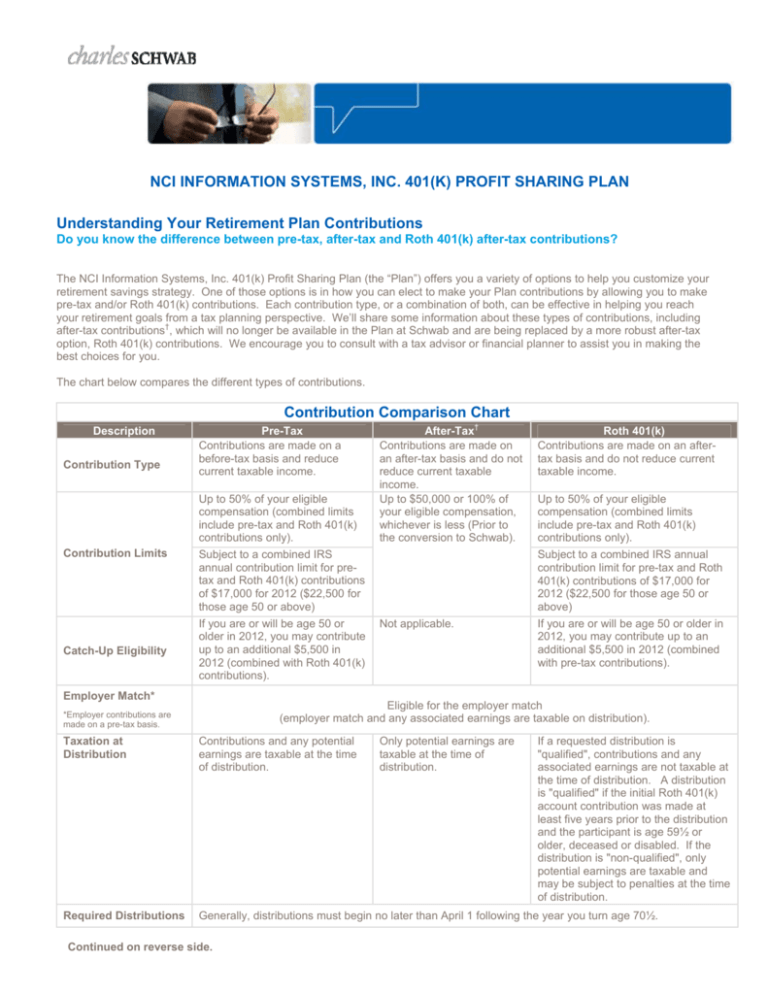

Do you know the difference between pre-tax, after-tax and Roth 401(k) after-tax contributions?

The NCI Information Systems, Inc. 401(k) Profit Sharing Plan (the “Plan”) offers you a variety of options to help you customize your

retirement savings strategy. One of those options is in how you can elect to make your Plan contributions by allowing you to make

pre-tax and/or Roth 401(k) contributions. Each contribution type, or a combination of both, can be effective in helping you reach

your retirement goals from a tax planning perspective. We’ll share some information about these types of contributions, including

†

after-tax contributions , which will no longer be available in the Plan at Schwab and are being replaced by a more robust after-tax

option, Roth 401(k) contributions. We encourage you to consult with a tax advisor or financial planner to assist you in making the

best choices for you.

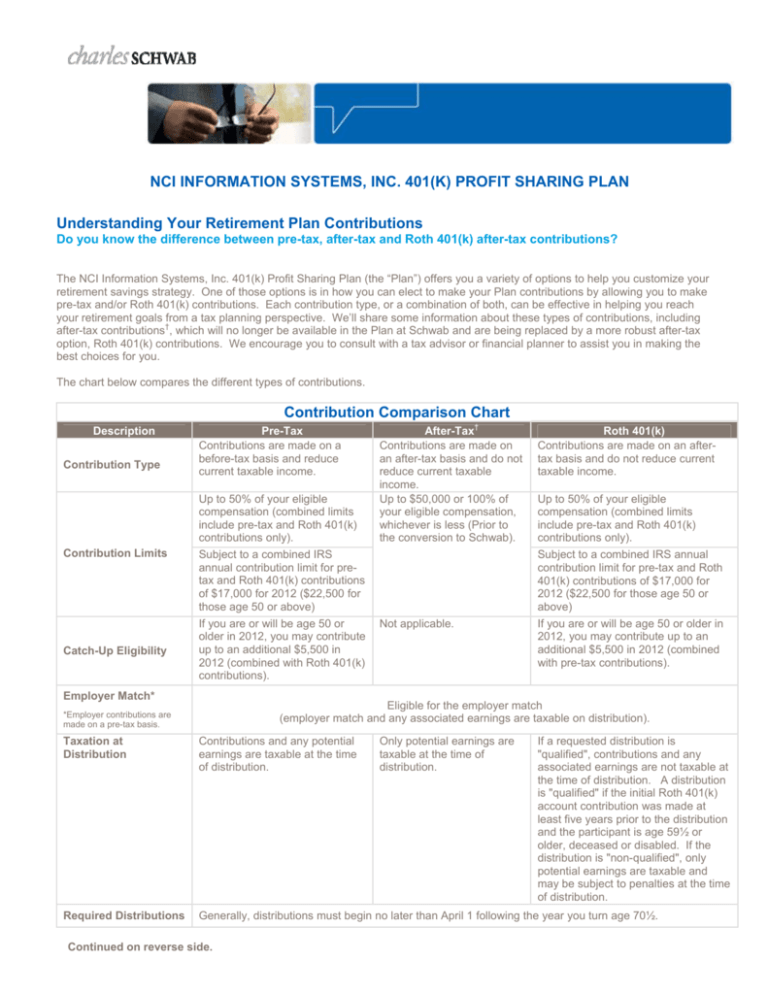

The chart below compares the different types of contributions.

Contribution Comparison Chart

Description

Contribution Type

Pre-Tax

Contributions are made on a

before-tax basis and reduce

current taxable income.

Up to 50% of your eligible

compensation (combined limits

include pre-tax and Roth 401(k)

contributions only).

Contribution Limits

Catch-Up Eligibility

After-Tax†

Contributions are made on

an after-tax basis and do not

reduce current taxable

income.

Up to $50,000 or 100% of

your eligible compensation,

whichever is less (Prior to

the conversion to Schwab).

Subject to a combined IRS

annual contribution limit for pretax and Roth 401(k) contributions

of $17,000 for 2012 ($22,500 for

those age 50 or above)

If you are or will be age 50 or

older in 2012, you may contribute

up to an additional $5,500 in

2012 (combined with Roth 401(k)

contributions).

Employer Match*

Roth 401(k)

Contributions are made on an aftertax basis and do not reduce current

taxable income.

Up to 50% of your eligible

compensation (combined limits

include pre-tax and Roth 401(k)

contributions only).

Subject to a combined IRS annual

contribution limit for pre-tax and Roth

401(k) contributions of $17,000 for

2012 ($22,500 for those age 50 or

above)

Not applicable.

If you are or will be age 50 or older in

2012, you may contribute up to an

additional $5,500 in 2012 (combined

with pre-tax contributions).

Eligible for the employer match

(employer match and any associated earnings are taxable on distribution).

*Employer contributions are

made on a pre-tax basis.

Taxation at

Distribution

Contributions and any potential

earnings are taxable at the time

of distribution.

Required Distributions

Generally, distributions must begin no later than April 1 following the year you turn age 70½.

Continued on reverse side.

Only potential earnings are

taxable at the time of

distribution.

If a requested distribution is

"qualified", contributions and any

associated earnings are not taxable at

the time of distribution. A distribution

is "qualified" if the initial Roth 401(k)

account contribution was made at

least five years prior to the distribution

and the participant is age 59½ or

older, deceased or disabled. If the

distribution is "non-qualified", only

potential earnings are taxable and

may be subject to penalties at the time

of distribution.

What is the difference between after-tax contributions which had been available in the Plan and Roth 401(k)

contributions?

Roth 401(k) contributions and after-tax contributions are similar in tax treatment initially and during the years before retirement.

Both Roth 401(k) and after-tax contributions are subject to federal, state and Social Security tax before it is contributed, and they

both can grow tax-deferred until distribution.

Roth 401(k) and after-tax contributions differ with regard to tax treatment at the time of distribution. Withdrawals of your after-tax

contributions will have taxes due if you experienced any earnings. If qualified as noted above, a distribution of contributions and

any earnings from a Roth 401(K) will not be subject to federal and, in most cases, state tax.

Another difference between Roth and after-tax is the liquidity of these contributions. After-tax contributions are not subject to the

same distribution restrictions as Roth 401(k) elective deferrals. Roth 401(k) contributions are only available at death, disability,

separation of service, attainment of age 59½ or hardship.

Whether you choose to make pre-tax or Roth 401(k) contributions - or a combination of them - participating in the Plan and saving

for your retirement can be the key in reaching your retirement goals.

Questions?

Contact a Schwab Participant Services Representative at 800-724-7526 or log onto www.nci.schwabplan.com

to review all of the information communicated to you up to this point regarding the transition.

†

The after-tax contribution option is being frozen to future contributions in the Plan at Schwab.

* The employer contribution is paid on a pre-tax basis and may be taxable at withdrawal.

This information is not intended to be a substitute for specific individualized tax, legal or investment planning advice. Where specific advice is

necessary or appropriate, Schwab recommends consultation with a qualified tax advisor, CPA, Financial Planner or Investment Manager.

Schwab Retirement Plan Services, Inc. provides recordkeeping and related services with respect to retirement plans.

© 2012 Schwab Retirement Plan Services, Inc. All rights reserved. (0812-5333) PLC69266NIS-00 (08/12)