©2012 Retirement Learning Center, LLC Page 1 Distributions of

advertisement

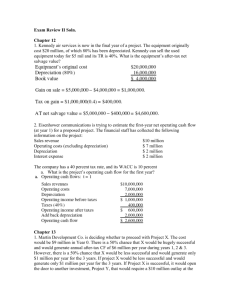

Distributions of After-Tax Assets from 401(k) Plans Introduction Much controversy has arisen around the apportioning and reporting of distributions and conversions of after-tax contributions from defined contribution plans. This paper analyzes the topic based on guidance provided by the following tax laws and IRS pronouncements: Notice 87-13 (Basis recovery rules) IRS Publication 575 (Examples of basis recovery rules) The Economic Growth and Tax Relief Reconciliation Act of 2001 (EGTRRA) Job Creation and Workers Assistance Act of 2002 The Tax Increase Prevention and Rec onciliation Act of 2005 (TIPRA) Pension Protection Act 2006 Notice 2008-30 (Rollovers from QPs to Roth IRA) Notice 2009-68 (Safe harbor IRC Sec. 402(f) rollover notices) Notice 2009-75 (Income tax consequences of rollover from QP to Roth IRA) 2012 IRS Form 1099-R Instructions Executive Summary If the plan document so permits, it may be possible for a participant to request a distribution of his or her 401(k) plan after-tax account (or contract)1 while still working.2 Since 1987, as a result of the Tax Reform Act of 1986 (TRA-86), plans have been allowed to treat employee after-tax contributions and associated earnings as made to a separate account (or contract) under the plan that is segregated from the remaining portion of the plan (IRS Notice 1987-13). If the plan had tracked the participant’s pre-1987 after-tax employee contributions and earnings thereon, the plan may treat the separate account as comprised of all employee after-tax contributions and earnings thereon (i.e., pre-1987 plus post-1986 employee contributions and earnings). TRA-86 also introduced new basis recover rules applicable to the distribution of post1986 contributions and earnings from employee after-tax accounts. A special 1 When referring to employee after-tax accounts, IRS pronouncements still use somewhat archaic language, which dates back to the day when plans were often in the form of annuity contracts. For example, in IRS Publication 575, the language regarding after-tax contributions refers to maintaining them in a separate “contract” as opposed to separate account as would be the common nomenclature today. 2 Plans may distribute after-tax accounts based on distribution triggering events written into plan documents. Separation of service is a common distribution trigger. But it is not unusual, though not always the case, for a plan sponsor to elect a provision in the governing plan document that permits in-service/nonhardship distributions of after-tax account assets at any time (regardless of the participant’s age or time of participation in the plan). ©2012 Retirement Learning Center, LLC Page 1 grandfather rule excludes pre-1987 employee after-tax contributions from the basis recovery rules (IRS Notice 1987-13, Q&A 13). Therefore, the tax consequences of a distribution from an employee’s separate after-tax account will depend on whether the distribution comes from the pre-1987 employee after-tax contributions or post1986 employee after-tax contributions and earnings. Pre-1987 after-tax contributions potentially can be recovered without associated earnings. Post -1986 after-tax contributions and earnings in the account are subject to the basis recovery rules that require the participant to treat recovered amounts as consisting of a pro rata share of after-tax contributions and earnings. If a distribution consists of post 1986 employee after-tax contributions and earnings, only a portion will be excludable from taxable income as a return of basis—that is the employee’s after-tax contributions. The portion of the distribution that is excludable is based on the same ratio as the ratio that reflects the participant’s after-tax employee contributions to the participant’s total vested after-tax account balance. Prior to 2002, the portion of a distribution that represented a return of employee after-tax contributions was not eligible for rollover. The Economic Growth and Tax Relief Reconciliation Act of 2001 (EGTRRA), changed that rule. Effective January 1, 2002, employee after-tax contributions may be included in an eligible rollover distribution, provided the receiving plan is an IRA or a defined contribution plan that separately accounts for after-tax amounts. Technical corrections to EGTRRA contained in the Job Creation and Workers Assistance Act of 2002 clarified that if a distribution to a participant includes both pre-tax and after-tax amounts, the portion that the participant rolls over is treated as consisting first of pre-tax amounts. Plan participants should consider two other law changes that affected distributions and rollovers or conversions from after-tax accounts in qualified plans: the Pension Protection Act of 2006 (PPA) and t he Tax Increase Prevention and Reconciliation Act of 2005 (TIPRA). PPA Among the many provisions in this law is the ability of a participant to directly rollover (convert) qualified retirement plan assets, including after-tax amounts (presuming a distribution triggering event), to a Roth IRA without the intermediate step of rolling to a traditional IRA first as was initially required. This change took effect in 2008, resulting in plan participants having three qualified retirement plan rollover options (plan permitting): 1) rollover to a traditional IRA; 2) rollover (conversion) to a Roth IRA; or 3) rollover to another eligible employer-sponsored plan. Although a conversion is a type of rollover, it is a potentially taxable event as the individual must include any converted pre-tax assets in his or her ordinary taxable income for the year, pursuant to general Roth conversion rules. TIPRA This tax law had a provision that eliminated the income restrictions on conversions of traditional IRA and qualified plan assets to Roth-type accounts. There are now two possible ways that plan participants could convert plan assets to Roth-type accounts. One is through a rollover to a Roth IRA and the other is through an in-plan conversion to a Designated Roth contribution account within a 401(k) plan. This was ©2012 Retirement Learning Center, LLC Page 2 permitted through the Small Business Jobs Act of 2010. Although income limits remain in effect on contributions to a Roth IRA, there are no income limits on conversions to a Roth IRA. Note: There are no income limits on contributions to a Designated Roth contribution account within 401(k), 403(b) or 457 plans. Nor are there any income limits on “in-plan” conversions to those Roth accounts. The plan must meet a few conditions to permit in-plan conversions: 1) offer a Designated Roth c ontribution option and 2) include a distribution trigger to allow an in-plan conversion. Section II. Technical Summary The following examples reflect application of the after-tax account basis recovery rules pursuant to IRS Notice 87-13 and Publication 575. = separate contract or account $ 4,000 After-tax contributions $ 2,400 Earnings on after-tax contributions $ 9,600 Employer contributions and earnings (within a profit sharing account) $16,000 Total Assumptions In-service distribution triggering event $3,000 distribution Because the plan maintains a separate account for the after-tax contributions and their earnings, the distribution will represent a pro rata return of after-tax and pretax amounts (earnings) based on the separate account only. In this case, the 9,600 in the profit sharing account, which consists of employer made contributions and earnings, is not a consideration. After-tax contributions Formula: Amount of distribution X = Nontaxable portion Value of separate account $4,000 $3,000 X = $1,875 tax free ($1,125 taxable earnings) $6,400 ©2012 Retirement Learning Center, LLC Page 3 In other words, although an after-tax account within the defined contribution plan and is combined with other contribution types for certain purposes (e.g., the IRS Sec. 415 limit on overall contributions that a participant may receive annually), it is a separate account (or contract) for distribution purposes. The record keeper is required to track contributions and earnings separately. So long as the record keeper does this, and any credible record keeper does, distributions from the aftertax account are distinct, and basis recovery is determined solely on what is in the after-tax account and precludes consideration of what may be in other pretax and/or designated Roth accounts in the plan. Note: Although included in the IRC. Sec. 415 limits on annual contributions, which for 2012 is $50,000 for someone under age 50 and $55,500 for someone age 50 and above making catch-up contributions), after-tax accounts are not included in the IRC Sec. 402(g) limit on salary deferrals and designated Roth contributions, which for 2012 is a maximum of $17,000 for someone under age 50 and is $22,500 for someone age 50 and above. Therefore, based on what the plan permits, it is possible for a participant to contribute from his or her salary over the IRC Sec. 402(g) maximum limit if there is an after-tax account in the plan, subject to nondiscrimination limitations. Example 2 $ 2,000 Pre-1987 after-tax contributions independently tracked $ 2,000 Post-1986 after-tax contributions $ 2,400 Earnings on pre-1987 and post-1986 after-tax contributions $ 9,600 Employer contributions and earnings (Profit sharing plan) $16,000 Total Assumptions Distribution trigger $3,000 distribution Pursuant to the grandfather provision of the basis recovery rules of Notice 87-13, the first $2,000 is a return of the pre-1987 after-tax contributions tax free. The taxability of the remaining $1,000 of the distribution is determined using the formula. $2,000 $1,000 X = $454.55 tax free $4,400 ©2012 Retirement Learning Center, LLC Page 4 $2,000 Pre-1987 + [$1,000 x ($2,000/$4,400)] = $454.55 tax free Of the distribution, $2,454.55 is tax free and $545.45 is taxable since the pre-1987 $2,000 is tax free and a percentage of the $1,000 withdrawn from the remaining $4,400 in the account is tax free. Note: Ideally, a record keeper that is fulfilling a distribution request would cut checks based on the participant’s intent. For example, if the participant wanted to roll amounts over to IRAs but was determined to have a tax-free Roth conversion, the record keeper would cut two checks: One for the $2,000 that is the pre-1987 contributions ($2,000), which would be a tax-free conversion of $2,000 dollars because there are no pretax dollars undergoing conversion; and t he other check would be for $1,000 and would consist of the pro rata amount of post -1986 contributions and earnings (subject to basis recovery rules). That check would be made out to the traditional IRA and would consist of $454.55 in post -1986 after-tax contributions and $545.45 in earnings. But without explicit instructions from the participant, it is possible that the record keeper would cut two checks but quite differently. If not instructed otherwise, t he record keeper may cut one check that combines all the after-tax amounts (i.e., the pre-1987 contributions of $2,000 and the post -1986 contribution amount of $454.55 for a total of $2,454.55); and a separate check with just the pre-tax amounts (in this example, $545.45). The reason being, prior to 2002, this is how record keepers were required to process distributions that included after-tax amounts due to the prohibition of after-tax rollovers. It is possible that some record keepers have not adjusted their systems to reflect 1) the ability to rollover after-tax amounts and 2) the pro rata, basis recovery requirements that apply to post -1986 after-tax contributions and earnings. Therefore, it is prudent for a participant to give very explicit instructions on how distribution checks should be cut. Remember that in a conversion situation, a plan participant must report the conversion to the IRS on Form 8606 and Form 1040, and include what portion of the conversion is subject to treatment as ordinary taxable income. Example 3 $ 2,000 Pre-1987 after-tax contributions $ 1,000 Post-1986 after-tax contributions $ 1,000 Earnings on pre-1987 and post-1986 after-tax contributions $14,000 All other amounts, which are all pre-tax $18,000 Total Assumptions ©2012 Retirement Learning Center, LLC Page 5 Distribution trigger applies $5,000 distribution $2,000 Pre-1987 after-tax contributions removed tax free $2,000 subject to basis recovery rules, calculated as follows $2,000 x ($1,000/$2,000) = $1,000 tax-free withdrawal of post-1987 contributions and $1,000 of taxable earnings $1,000 taxable withdrawal from remaining pre-tax balance Once again, the participant’s intent should be the key focus for how the record keeper processes the distribution. Does the participant want to roll over the entire distribution? If so, does he or she want it all to go to a traditional IRA or all to a Roth IRA, or to divide it in some proportion between a traditional and Roth IRA? Scenario 1 Sam is retiring from Smart Solutions, LLC. His 401(k) plan account statement reads as follows. Pre-1987 after-tax contributions $20,000 Post-1987 after-tax contributions $30,000 (of which $5,000 is earnings) Employer Matching $50,000 Profit Sharing $50,000 Salary Deferrals $50,000 Total $200,000 Distribution options Sam is considering: A: 100% direct rollover to a traditional IRA (or Roth IRA) B: 100% distribution to Sam C: A direct rollover of a portion to a traditional IRA (or Roth IRA) and a portion distributed to Sam D: A direct rollover of a portion to a traditional IRA and a converison of a portion to a Roth IRA How would the record keeper report each distribution option on IRS Form 1099-R? ©2012 Retirement Learning Center, LLC Page 6 Option A 100% direct rollover to a traditional IRA (or Roth IRA) Box 1—total amount rolled over = $200,000 Box 2a—taxable amount = If rolled over to a traditional IRA = “0;” if rolled over to a Roth IRA $155,000 (i.e., $200,000-$45,000) Box 5—Employee after-tax contributions = $45,000 Box 7—Distribution code = G for a direct rollover Option B 100% distributed to Sam Box 1—total amount distributed = $200,000 Box 2a—taxable amount = $155,000 Box 5—Employee after-tax contributions = $45,000 Box 4—Withholding = $31,000 ($155,000 x .20) Box 7—Distribution code = 1 or 7 depending on Sam’s age Option C: Direct rollover of a portion to a traditional IRA (or Roth IRA) and a portion distributed to Sam Sam instructs the plan administrator to directly roll over $155,000 to a traditional IRA and distribute $45,000 to him (mistakenly thinking that this would be a totally tax-free transaction). The record keeper will complete two Forms 1099-R. Form 1099-R #1 Box 1—total amount rolled over = $155,000 Box 2a—taxable amount = if rolled to a traditional IRA “0,” if rolled to a Roth IRA “$116,250” (i.e., $155,000 - $20,000 of pre-1987 after-tax = $135,000; $135,000 x $25,000/$180,000 = $18,750 nontaxable $135,000 - $18,750 = $116,250 taxable Box 5—Employee after-tax contributions = $38,750 ($20,000 Pre-1987 + $18,750, which is .75 (i.e., $135,000/$180,000) of $25,000 Post -1986) Box 7—Distribution code = G ©2012 Retirement Learning Center, LLC Page 7 Form 1099-R #2 Box 1—total amount distributed = $45,000 Box 2a—taxable amount = $38,750 Box 5—Employee contributions = $6,250 ($25,000 x .25 (i.e., $45,000/$180,000) of Post-1986) Box 4—Withholding = $7,750 (i.e., $38,750 x .20) Box 7—Distribution code = 1 or 7 depending on age Questions: Does the participant c hoose which distribution has the $20,000 pre1987? Or—does he or she split it 50/50 between the two distributions? Option D: Direct rollover to traditional IRA and conversion to a Roth IRA Note: Currently, there is no IRS reporting guidance on how to handle this scenario specifically. The 2012 instructions to Form 1099-R address the reporting of combinations of one direct rollover and one distribution, and multiple distributions with different distribution codes, but not two direct rollovers to different accounts. Generally, the instructions state to aggregate distributions with like codes (e.g., “G”) on one Form 1099-R. One Form 1099-R (because distribution code “G” is the same for both amounts) Conflict on Box 2a—taxable amount are converted as taxable income. Form 1099-R should include pre-tax assets that Scenario #2 Sue, who also works for Smart Solutions, LLC, wants to take an in-service distribution of her after-tax dollars because she learned the plan allows for it. Her 401(k) plan account statement reads as follows. Pre-1987 after-tax $20,000 Post-1987 after-tax $30,000 ($5,000 earnings) Employer Matching $50,000 Profit Sharing $50,000 Salary Deferrals $50,000 $200,000 ©2012 Retirement Learning Center, LLC Page 8 The total amount in her after-tax account is $50,000. Sue requests a $50,000 distribution. Distribution options Sue is considering: A: 100% Direct rollover to a traditional IRA (or Roth IRA) B: 100% Distribution to Sue C: Direct rollover of a portion to a traditional IRA (or Roth IRA) and a portion distributed to Sue D: Direct rollover to a traditional IRA and direct rollover to a Roth IRA Form 1099-R Reporting Option A: $50,000 direct rollover to a traditional IRA (or Roth IRA) Box 1—total amount rolled over = $50,000 Box 2a—taxable amount = If rolled to a traditional IRA, then “0;” if rolled to a Roth IRA, then $5,000 (i.e., $20,000 pre-1987 after-tax, $25,000 post-1986 after-tax and $5,000 earnings) Box 5—Employee Contributions = $45,000 Box 7—Distribution code = G Option B $50,000 Distribution to Sue Reporting Box 1—total amount distributed = $50,000 Box 2a—taxable amount = $5,000 Box 5—Employee contributions = $45,000 Box 4—Withholding = $1,000 (i.e., $5,000 x .20) Box 7—Distribution code = 1 or 7 depending on Sue’s age Option C: $45,000 direct rollover to a traditional IRA (or Roth IRA) and $5,000 distribution to Sue Two Forms 1099-R Form 1099-R #1 Box 1—total amount rolled over = $45,000 ©2012 Retirement Learning Center, LLC Page 9 Box 2a—taxable amount = if rolled to a traditional IRA “0,” if rolled to a Roth IRA “$4,166.67” (i.e., $20,000 pre-1987 tax free, $25,000 x ($25,000/$30,000) = $20,833.33 nontaxable and $4,166.67 taxable) Box 5—Employee Contributions = $40,833.33 ($20,000 + $20,833.33) Box 7—Distribution code = G Form 1099-R #2 Box 1—total amount distributed = $5,000 Box 2a—taxable amount = $833.33 (i.e., $5,000 x $25,000/$30,000 = $4,166.67 nontaxable) Box 5—Employee contributions = $4,166.67 Box 4—Withholding = $166.67 ($833.33 x .20) Box 7—Distribution code = 1 or 7 depending on Sue’s age Option D: Direct rollover to a traditional IRA and direct rollover to a Roth IRA Note: Currently, there is no IRS reporting guidance on how to handle this scenario specifically. The 2012 instructions to Form 1099-R address the reporting of combinations of one direct rollover and one distribution, and multiple distributions with different distribution codes, but not two direct rollovers to different accounts. Generally, the instructions state to aggregate distributions with like codes (e.g., “G”) on one Form 1099-R. 1 Form 1099-R (because distribution code “G” is the same for both amounts) Conflict on Box 2a—taxable amount Because the conversion of pre-tax assets is a taxable event, an amount should be entered in Box 2a. ©2012 Retirement Learning Center, LLC Page 10 Conclusion The existence of an after-tax account in a defined contribution plan can lead to a taxefficient distribution or Roth conversion. Conservatively, only a distribution or conversion of pre-1987 employee after-tax amounts may truly be a tax-free transaction. Post-1986 employee after-tax contributions and earnings must be distributed or converted by applying the basis recovery rules of Notice 87-13 and Publication 575, resulting in a taxable transaction. ©2012 Retirement Learning Center, LLC Page 11