My GE S&SP - GE Healthcare

advertisement

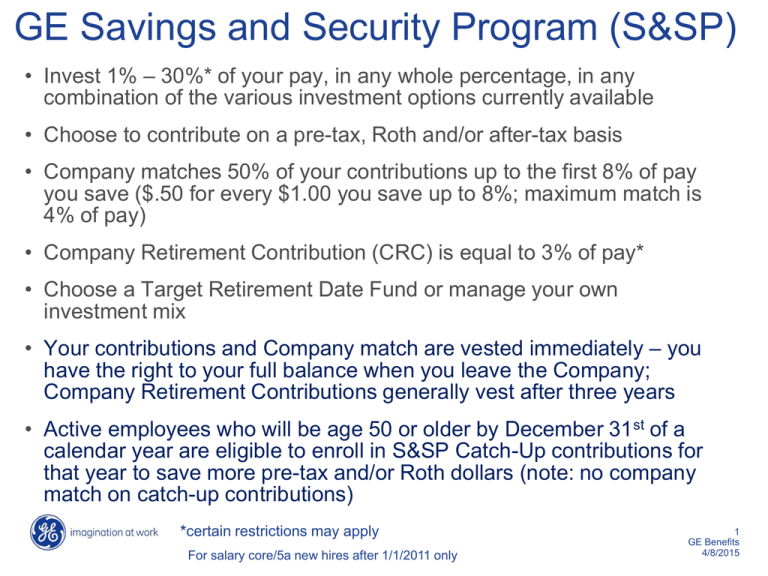

GE Savings and Security Program (S&SP) • Invest 1% – 30%* of your pay, in any whole percentage, in any combination of the various investment options currently available • Choose to contribute on a pre-tax, Roth and/or after-tax basis • Company matches 50% of your contributions up to the first 8% of pay you save ($.50 for every $1.00 you save up to 8%; maximum match is 4% of pay) • Company Retirement Contribution (CRC) is equal to 3% of pay* • Choose a Target Retirement Date Fund or manage your own investment mix • Your contributions and Company match are vested immediately – you have the right to your full balance when you leave the Company; Company Retirement Contributions generally vest after three years • Active employees who will be age 50 or older by December 31st of a calendar year are eligible to enroll in S&SP Catch-Up contributions for that year to save more pre-tax and/or Roth dollars (note: no company match on catch-up contributions) *certain restrictions may apply For salary core/5a new hires after 1/1/2011 only 1 GE Benefits 4/8/2015 S&SP Key Features • Contribution amount – flexibility to increase or decrease savings rate with each paycheck • Manage your investment mix • Change investment choices for future payroll contributions, company match and CRC at any time • Exchange your accumulated savings between investment choices – can do 12 per quarter, can’t exchange into US Savings Bonds • Rebalance your account or sign-up for Automatic Rebalancing • Access S&SP loans – Can have two outstanding at any time • Make in-service withdrawals* • CRC available for distribution from S&SP account only after you leave employment with GE; not available for loans, hardship or regular inservice withdrawals • Participate in the GE Stock Fund Dividend Cash Payout Option • View your account balance or generate an online statement at any time GE S&SP Service Center 877-554-3777 or online – benefits.ge.com – My GE S&SP For salary core/5a new hires after 1/1/2011 only *certain restrictions may apply 2 GE Benefits 4/8/2015 S&SP Investment Education and Tools • www.SoWhatsYourMix.com - Learn about Target Retirement Date Funds and all the S&SP investment options • Investment Options - Plan Information and Documents, and Investment Choices and Research • See what your retirement income might be with the Retirement Quick Check and Retirement Income Planner • Check your investment mix with Portfolio Review • Fidelity eLearning Workshops • Access Fidelity’s investment education and tools Online - Visit benefits.ge.com and click on S&SP, then My GE S&SP, then GE S&SP, then Tools and Learning Phone consultations - You can also arrange a phone consultation with a Fidelity representative to help you get started; contact the GE S&SP Service Center at 1-877-55-GESSP (1-877-554-3777) to learn more Access pre-recorded S&SP retirement planning workshops online at the MY GE S&SP Web site. Click on GE S&SP > Tools and Learning > eLearning > On-Demand Workshops For salary core/5a new hires after 1/1/2011 only 3 GE Benefits 4/8/2015