In re UBS Auction Rate Securities Litigation 08-CV

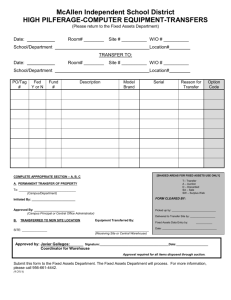

advertisement