UBS Wealth Management

Public

Wealth Management – The New Era

Kobi Faigenbaum

CEO, UBS Wealth Management Israel Ltd.

December 2012

This presentation is given for educational purposes only and shall not be understood as a provision

of investment advice and its content is not intended to be and shall not be construed as an invitation

or offer to purchase the securities/and or financial assets mentioned therein.

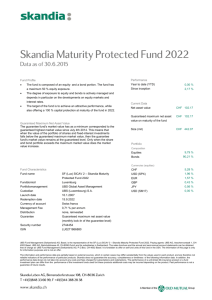

Is Israel lagging behind

global banking trends?

1

A new era in global banking

1

Shift towards Emerging Markets

3

2

Tighter regulation

Changes in client demands

2

1

Cross border flow to Emerging Markets

1999

Emerging

Markets

2009

While in 1999, the cross border flow to Emerging Markets was mainly illustrated by the red lines

[Total value of cross border investments between regions of 3-5% of world GDP], in 2009 we saw

substantial shift towards the blue lines [5-10% of world GDP], mainly from Europe region

Also illustrated, the rapid increase in the total financial domestic assets [represented by the circles,

$ trillion] within Emerging Markets countries.

Source: IMF and McKinsey Global Institute3

2

Regulation

Tightening regulation

During the last few years, regulators have introduced new guidelines at country

and client levels. The pace and complexity of regulation shows no sign of

slowing down in the foreseeable future. On a daily basis, we see media

coverage to reflect the market interest and magnitude of those changes.

“

…preparing to revamp its directadvice arm in preparation for the

RDR

Money Marketing

“ Switzerland is developing a “white”

money strategy" in response to a

crackdown on offshore financial

centers by the U.S. and European

countries eager to recoup money

from taxpayers banking abroad.

Bloomberg

“ The U.S. Treasury Department said

”

Thursday it’s talking to more than 50

countries and jurisdictions around

the world to implement a law

aimed at fighting tax avoidance

Wall Street Journal

4

”

3

Clients

Expected changes in model service

The "new customers"

Looking for

•Entrepreneurs

•Performance

•Professionals & CEOs

•Business owners

•Sophisticated solutions to their

wealth

•Single Family Offices

•Tailored made solutions

Characterized by

•Adding value for their business

as well as family

•Sophisticated

•More involvement in their

investment process

•Knowledgeable

•Younger & Faster

For illustration purposes only

5

3

Clients

So what is the difference?

Private Banking

Emphasizes the relationship as

leading indicator: "Red Carpet"

Wealth Management

Emphasizes different solutions to

the client's complex set of needs

For illustrative purposes only

For illustrative purposes only

6

3

Clients

The spectrum of Wealth Management services

•

•

•

•

•

•

•

Discretionary Mandates

Advisory Mandates

Investment Funds

Non- traditional

- traditional

Asset

Asset

Classes

Classes

Structured Products

Cash Products

Trading

•

•

•

•

•

•

•

•

Asset

Asset

Management

Management

Your client

Financial

Planner

advisor

Banking

Corporate

Services

Services

•

•

•

•

You

Client

Financial Planning

Succession Planning

Pension Planning

Life Insurance

Trusts

Foundations

Numismatics

Arts

&collectables

Philanthropy

Life

LifeCycle

Cycle

Management

Management

Corporate Finance

M&A

IPO

Networking

Liability

Liability

Management

Management

• Mortgages

• Lombard

• Financing

For illustrative purposes only

7

Can Israel catch-up with

these trends?

8

Disclaimer

UBS is a premier global financial firm offering wealth management, asset management and investment banking services from its headquarters in Switzerland and

its authorised operations in over 50 countries worldwide to individual, corporate and institutional investors. In Israel UBS AG is registered as a "Foreign Dealer"

together with UBS Wealth Management Israel Ltd. its fully owned subsidiary. UBS Wealth Management Israel Ltd. is a Portfolio Management Licensee which also

engages in Investment Marketing and is regulated by the Israel Securities Authority .

This presentation is for personal use and your information only and is not intended as an offer, or a solicitation of an offer, to buy or sell any product or other

specific service. Although all pieces of information and opinions expressed in this presentation were obtained from sources believed to be reliable and in good faith,

neither representation nor warranty, express or implied, is made as to its accuracy or completeness. All information and opinions are subject to change without

notice. UBS does not provide legal or tax advice and this presentation does not constitute such advice.

This presentation may not be reproduced or copies circulated without prior authority of UBS. UBS expressly prohibits the distribution and transfer of this

presentation to third parties for any reason. UBS will not be liable for any claims or lawsuits from any third parties arising from the use or distribution of this

presentation. This presentation is for distribution only under such circumstances as may be permitted by applicable law.

© UBS 2012. The key symbol and UBS are among the registered and unregistered trademarks of UBS. All rights reserved

9