Autumn 2011

advertisement

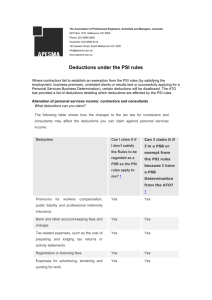

Newsletter Autumn 2011 Edition Happening at CAS We think we say this every newsletter but ‘how fast is this year going?!’ Easter eggs are now filling the supermarket shelves, Christmas is a long ago memory and the new tax year will be upon us before we know it! But before that we have the 2010 tax year lodgment deadlines in May - just six weeks away! Anyone who doesn’t have their work in will need to get a move on so we can complete the work in time. The ATO are increasingly using their discretionary powers to apply penalties for lodging tax returns late. These penalties currently range from $110.00 to $550.00 depending on the lateness of the lodgement. We don’t need to be paying the taxman any more than necessary. Proposed carbon price link to tax reforms According to the Garnaut Climate Change Review the starting price for carbon should be between $20 and $30 per tonne of carbon dioxide equivalent, rising at 4 per cent (real) per annum. Professor Garnaut said the largest element of revenue from a carbon price should be applied to reform the personal income tax system. For example, according to the paper, a large amount of revenue could be used to reduce personal income tax rates and social security withdrawal tapers at the lower end of the income distribution. The proposal by Professor Garnaut, the government’s key climate change adviser, to use the proceeds of its planned carbon tax to drive cuts to personal income tax is welcomed as it should benefit small and medium businesses (most of which are unincorporated) and taxpayers generally. CPA Australia Tax Forum to be held in October The Treasurer, the Hon. Wayne Swan, has announced the Australian Government will host a Tax Forum to discuss the nation's tax reform agenda. The Tax Forum will be held in Canberra from Tuesday 4 to Wednesday 5 October and is expected to host around 150 representatives from businesses, community groups, academics and tax practitioners. Mr Swan said he will release a discussion paper in the middle of the year 'to help foster the debate' and the Tax Forum will assist the government in prioritising its tax reform agenda. The forum is a major opportunity to incrementally advance tax reform in Australia. It should be kept in mind that the Henry tax review report, released last May, is a reference tool for a longer-term (10 or more years) agenda and there is still a significant amount that can be done and should be done. A Guide to claiming business deductions You can claim most expenses you incur in running your business as deductions to reduce your assessable income. The rules can vary depending on the business structure you operate under and the nature of each expense. Keeping good records You must keep records of your business transactions, including expense claims, for five years after they are prepared, obtained or the transactions completed, whichever occurs later. If you don’t have those records, your expense claim may be denied or reduced. Store records in either paper or electronic form. But they must be readily accessible and available in English. What you can claim and how to claim As a general rule, you can claim your day-to-day business operating expenses in full in the year you incur them, while capital items – such as buying plant and equipment – are claimed over a number of years. Motor vehicle expenses The deductions you can claim for the business use of a motor vehicle depend on the business structure you operate under, whether you use the vehicle for private use, and the type of vehicle. Business travel expenses To claim business travel expenses, you need specific, documented evidence of the expenses. Capital allowances - plant & equipment depreciation There are two sets of rules you can use to work out how much you can claim for depreciating assets, such as plant and equipment – the simpler capital allowances rules concession; and the uniform capital allowances rules. Small businesses with aggregated turnover of less than $2 million can select the set of rules preferred. Larger businesses must use the uniform capital allowance rules. Salaries, wages and super If you operate your business as a company or trust, you can claim a deduction for salary and wages paid to all employees including yourself, and for super contributions you make to a complying super fund or retirement savings account for them. If you are selfemployed, you can claim a deduction for your own super contributions in your personal tax return and you can claim a deduction for salary and wages you pay to other employees. Note: Wages to family need to be reasonable for the work performed otherwise they can be varied by the ATO. Continued on page 2 QUOTES Joking Around Money can't buy you happiness ..... but it does bring you a more pleasant form of misery. Spike Milligan Only Irish coffee provides in a single glass all four essential food groups: alcohol, caffeine, sugar and fat. Alex Levine I was married by a judge. I should have asked for a jury. Wickenby Update Groucho Marx The Cost of Power Project Wickenby is a cooperative partnership between the ATO, Australian Federal Police, Australian Crime Commission, Australian Securities and Investments Commission and the Commonwealth Director of Public Prosecutions, with support from the Australian Transaction Reports and Analysis Centre, the Australian Government Solicitor and the Attorney-General’s Department. As at 28 February 2011 the Project Wickenby taskforce results: • $1,064 million in tax liabilities have been raised • $245.44 million in tax has been collected • 62 people have been charged with serious offences • 24 criminal investigations are currently in progress • $56.25 million in assets have been restrained, and • $306.1 million gathered in improved voluntary compliance. The latest prosecution saw former co-directors of a Sydney work safety company be sentenced to 2yrs 7mths for utilising illegal ‘round-robin’ schemes where money from their company was transferred offshore and then returned ‘tax free’ to their personal accounts, which they then claimed were loans. The sentencing brings the total number of criminal convictions under Project Wickenby to 18. Tax Commissioner Michael D’Ascenzo indicated that those who are tempted to deliberately cheat the system should be warned and those who do the wrong thing will get caught. Further, that the net is closing on those who use tax secrecy jurisdictions to deliberately avoid paying their fair share of tax. The ATO suggests - “Contact us before we contact you.” Business Succession No matter how successful , eventually almost everyone will wish to sell their business. The following checklist will help to maximize the sale value. Improve the efficiency of internal systems Make sure the business can operate without your involvement. Legalise key client and supplier contracts and increase the use of longer term agreements. Boost the business’ online presence by updating the website. Consider the business structure. You may need to restructure to allow for new owners, investors or shareholders. Ensure the business is compliant with all necessary rules and regulations. Work on reducing liabilities and debt Make effective succession planning a priority. Todd and Alex have specific experience to assist here, as well as invaluable contaacts for the next step. With energy cost rising and the general push to reduce our carbon footprint it may be useful to look at which appliances are costing you the most in real terms: Appliance $Cost Per quarter Pool heater (heat pump) 434 Ducted air conditioning 268 Wall mounted air conditioning 166 Electric storage hot water unit 150 Pool pump 95 Pool heater (solar) 48 New refrigerator 500 litre 30 400 litre freezer 30 Salt water chlorinator 26 Plasma TV 20 Bar fridge 15 Large LCD TV 10 Model, age and use can influence running costs. Estimated costs are based on Energy Australia’s domestic all time tariff for 2010 - 2011 for NSW A Guide to claiming business deductions Continued from page1 Losses If you operate a business that makes a loss, you can carry forward that loss and may be able to claim a deduction for that loss in a future year. The rules differ for different business structures. If you operate as a sole trader or a partner in a partnership, you may be able to claim business losses by offsetting them against other income – for example, income you earn from salary or wages. Expenses related to your work area If you run all or some of your business from home, you may be able to claim things such as rent, rates, insurance and utilities. What you can claim depends on whether your home is your place of business and whether or not you have an area set aside exclusively for business activities. Tax-related expenses You may be eligible to claim a deduction for things such as having a bookkeeper prepare your business records and activity statements. Repairs, maintenance and replacement expenses You may be able to claim a deduction for repairs to machinery, tools or premises you use to produce business income. Remember this is generic commentary - as always the CAS team are available to answer your questions. Disclaimer: While due care is taken in preparing comment on topics this newsletter is not intended to provide advice. If any of the topics above cause concern or general interest please do not hesitate to contact our office. Page 2