Employer's Payroll Tax Expense

advertisement

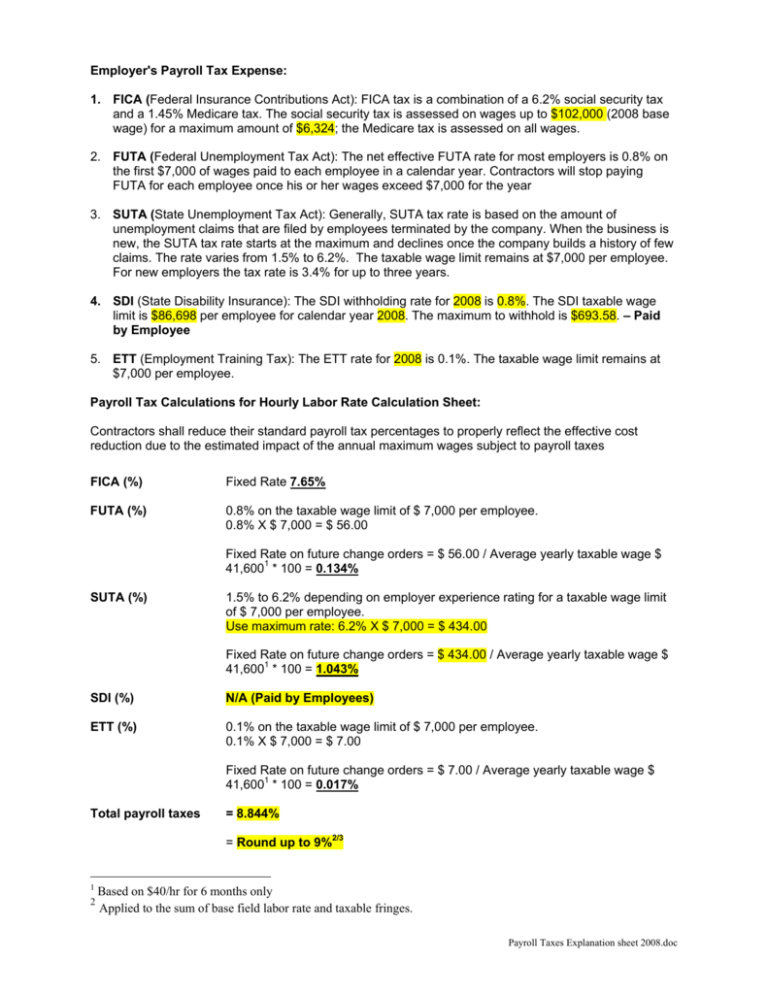

Employer's Payroll Tax Expense: 1. FICA (Federal Insurance Contributions Act): FICA tax is a combination of a 6.2% social security tax and a 1.45% Medicare tax. The social security tax is assessed on wages up to $102,000 (2008 base wage) for a maximum amount of $6,324; the Medicare tax is assessed on all wages. 2. FUTA (Federal Unemployment Tax Act): The net effective FUTA rate for most employers is 0.8% on the first $7,000 of wages paid to each employee in a calendar year. Contractors will stop paying FUTA for each employee once his or her wages exceed $7,000 for the year 3. SUTA (State Unemployment Tax Act): Generally, SUTA tax rate is based on the amount of unemployment claims that are filed by employees terminated by the company. When the business is new, the SUTA tax rate starts at the maximum and declines once the company builds a history of few claims. The rate varies from 1.5% to 6.2%. The taxable wage limit remains at $7,000 per employee. For new employers the tax rate is 3.4% for up to three years. 4. SDI (State Disability Insurance): The SDI withholding rate for 2008 is 0.8%. The SDI taxable wage limit is $86,698 per employee for calendar year 2008. The maximum to withhold is $693.58. – Paid by Employee 5. ETT (Employment Training Tax): The ETT rate for 2008 is 0.1%. The taxable wage limit remains at $7,000 per employee. Payroll Tax Calculations for Hourly Labor Rate Calculation Sheet: Contractors shall reduce their standard payroll tax percentages to properly reflect the effective cost reduction due to the estimated impact of the annual maximum wages subject to payroll taxes FICA (%) Fixed Rate 7.65% FUTA (%) 0.8% on the taxable wage limit of $ 7,000 per employee. 0.8% X $ 7,000 = $ 56.00 Fixed Rate on future change orders = $ 56.00 / Average yearly taxable wage $ 41,6001 * 100 = 0.134% SUTA (%) 1.5% to 6.2% depending on employer experience rating for a taxable wage limit of $ 7,000 per employee. Use maximum rate: 6.2% X $ 7,000 = $ 434.00 Fixed Rate on future change orders = $ 434.00 / Average yearly taxable wage $ 41,6001 * 100 = 1.043% SDI (%) N/A (Paid by Employees) ETT (%) 0.1% on the taxable wage limit of $ 7,000 per employee. 0.1% X $ 7,000 = $ 7.00 Fixed Rate on future change orders = $ 7.00 / Average yearly taxable wage $ 41,6001 * 100 = 0.017% Total payroll taxes = 8.844% = Round up to 9%2/3 1 2 Based on $40/hr for 6 months only Applied to the sum of base field labor rate and taxable fringes. Payroll Taxes Explanation sheet 2008.doc