1285091906_351447

advertisement

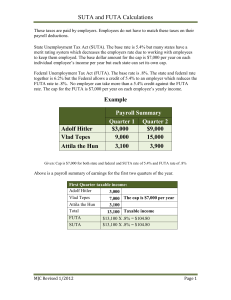

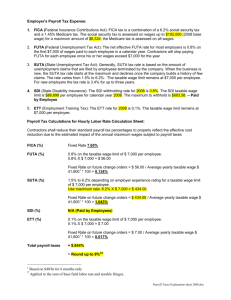

Payroll Accounting 2012 Bernard J. Bieg and Judith A. Toland CHAPTER 5 UNEMPLOYMENT COMPENSATION TAXES Developed by Lisa Swallow, CPA CMA MS Learning Objectives Describe basic requirements for classification under Federal Unemployment Tax Act (FUTA) Define taxable wages under FUTA Compute FUTA and credit against it Describe how experience-rating system is used in determining state unemployment compensation (SUTA) funds Complete reports required by FUTA Describe types of information reports required under SUTA FUTA and SUTA FUTA Federal Unemployment Tax Act Passed as part of Social Security Act of 1935 Federal law that imposes an employer tax Required for administration of federal and state unemployment insurance programs SUTA State Unemployment Tax Act Different law in each state Funds used to pay benefits and administer program at individual state’s level In current economic situation, unemployment insurance programs are being stretched very thin! LO-1 Taxable Wages for FUTA/SUTA Taxable FUTA wage base caps at $7,000/year* Taxable SUTA wage base caps at different amount in each state (Figure 5-1 on pages 5-10 and 5-11) Wages include Bonuses, advances, severance pay Stock compensation - fair market value Tips Retroactive wage increases Complete list of taxable wages found on pages 5-7 and 5.8 *Discussion as to new wage base and rate being discussed as of print time LO-2 FUTA Rates FUTA rate = 6.2% of first $7,000 of gross wages for each employee per year 5.4% credit against FUTA (allowed for SUTA taxes)* Therefore gross 6.2% less 5.4% credit = .8% net FUTA *Even if experience rating allows employer to pay a lower rate than 5.4% LO-3 Credits Against FUTA Tax To get full 5.4% SUTA credit, employer must have done the following Made SUTA contributions on timely basis - on or before due date for filing Been located in a state that is not in default on their Title XII advances Title XII of the Social Security Act lends funds to states so they may provide unemployment compensation funds from federal government Credit is reduced (.3% per year beginning the second year after the advance – for example, Michigan subject to additional rate if loans not repaid by 11/10/10) LO-3 SUTA Laws & Rates Each employer’s rate based upon experience rating (see next slide) Some states utilize reserve-ratio formula to lower contributions based on low risk of unemployment Nonprofits have option to reimburse state for actual amount of unemployment benefits paid instead of paying percentage SUTA Dumping Prevention Act mandates that states enact laws to stop businesses from lowering their unemployment rates through creating new entities LO-4 How to File Form 940 Form 940 due by January 31 of next year Or if timely deposits have been made, have until February 10 to file Need to attach Schedule A (Form 940) if multi-state employer or have SUTA credit reduced Filed with IRS District Center in which business is located – thereafter IRS will send preaddressed Form 940 Can e-file after submit electronic IRS letter of application A final return must be filed in year company ceases doing business LO-5 FUTA Deposit Overview Deposit quarterly - but only if cumulatively over $500 Due dates are as follows* 1/1 - 3/31 4/1 - 6/30 7/1 - 9/30 10/1 - 12/31 deposit by 4/30 deposit by 7/31 deposit by 10/31 deposit by 1/31 *If falls on Saturday, Sunday or legal holiday, have until following business day LO-5 How Much FUTA to Deposit If $500 or more, must deposit by last day of month following close of quarter If less, can wait and add to next quarter, then if it’s $500 or more, must deposit If never gets over $500, pay with Form 940 at yearend Use voucher 940-V LO-5 SUTA Deposit & Reporting Overview SUTA requirements vary widely by state In the states where EE also pays into SUTA, both EE and ER taxes deposited together SUTA quarterly contribution report generally shows the following Each employee’s gross wages and taxable SUTA wages (wage information) Contribution rate x taxable SUTA wages Amount of required payment Usually includes wage information report per employee LO-6