PAYROLL AND

INCOME TAX

McGraw-Hill/Irwin

Chapter Seven

Copyright © 2014 by The McGraw-Hill Companies, Inc. All rights reserved.

LEARNING UNIT OBJECTIVES

LU 7-1: Calculating Various Types of Employees’ Gross Pay

1.

Define, compare, and contrast weekly, biweekly, semimonthly, and

monthly pay periods.

2.

Calculate gross pay with overtime on the basis of time.

3.

Calculate gross pay for piecework, differential pay schedule, straight

commission with draw, variable commission scale, and salary plus

commission.

LU 7-2: Computing Payroll Deductions for Employees’ Pay; Employers’ Responsibilities

1. Prepare and explain the parts of a payroll register.

2. Explain and calculate federal and state unemployment taxes.

LU 7-3: Calculating Taxable Income and Tax Liability

1. Compute taxable income.

2.

Calculate tax liability.

7-2

PAYROLL CYCLES

7-3

HOURLY RATE OF PAY;

CALCULATION OF OVERTIME

Gross pay = Hours employee worked x Rate per hour

Hourly overtime pay rate = Regular hourly pay rate x 1.5

Gross pay = Earnings for 40 hours + Earnings at time-and-a-half rate

7-4

HOURLY RATE OF PAY; CALCULATION OF

OVERTIME

Employee

M

T

W

Th

F

R Valdez

13

8.5

10

8

11.25

S

10.75

Total

61.5

*Rate is $9.00 per hour.

Hourly overtime pay rate = Regular hourly pay rate x 1.5

Gross pay = Earnings for 40 hours + Earnings at time-and-a-half rate

61.5 – 40 = 21.5 overtime hours

$9 x 1.5 = 13.50 overtime rate

(40 hours x $9) + (21.5 hours x 13.5)

$360 + $290.25 = $650.25

7-5

STRAIGHT PIECE RATE PAY

Gross pay = Number of units produced x Rate per unit

Example:

Ryan Foss produced 900 dolls. He is paid $.96 per doll. Calculate his

gross pay.

900 dolls x $.96 = $864.00

7-6

DIFFERENTIAL PAY SCHEDULE

Gross pay = Number of units produced x Various rates per unit

Example:

Logan Company pays Abby Rogers on the basis of the following schedule:

Last week Abby produced 300 dolls. What is Abby’s gross pay?

(50 x $.50) +(100 x $.62)+(50 x $.75) + (100 x $1.25) = $249.50

7-7

STRAIGHT COMMISSION WITH DRAW

Commission is a certain percentage of the amount a salesperson sells.

Draw is an advance on the salesperson’s commission.

Example:

Logan Company pays Jackie Okamoto a straight commission of 15% on

her net sales (net sales are total sales less sales returns). In May, Jackie

had net sales of $56,000. Logan gave Jackie a $600 draw in May. What is

Jackie’s gross pay?

($56,000 x .15) = $8,400

-- 600

$7,800

7-8

VARIABLE COMMISSION SCALE

Different commission rates for different levels of net sales.

Example:

Up to $35,000

Last month, Jane Ring’s net sales were

$160,000. What is Jane’s gross pay

based on the schedule?

4%

Excess of $35,000 to $45,000 6%

Over $45,000

8%

($35,000 x .04) + ($10,000 x .06) + ($115,000 x .08)

= $1,400

+

$600

+

$9,200

= $11,200

7-9

SALARY PLUS COMMISSION

Gross pay = Salary + Commission

Example:

Logan Company pays Joe Roy a $3,000 monthly salary plus a 4% commission

for sales over $20,000. Last month Joe’s net sales were $50,000. Calculate

Joe’s gross pay.

$3,000 + ($30,000 x .04) = $4,200

7-10

EMPLOYEE’S W-4 FORM

• When an employee is hired, a W-4 Form is completed.

• This information is needed to calculate the federal income tax.

7-11

PAYROLL REGISTER

Rate

Base

Social Security

6.20%

$110,100

Medicare

1.45

No Base

FICA taxes fund Social Security and Medicare.

7-12

FEDERAL INCOME TAX WITHHOLDING

(FIT)

1. Percentage Method

7-13

PERCENTAGE METHOD INCOME TAX

WITHHOLDING TABLES

TABLE 7.1

TABLE 7.2

(Partial)

You can use

the

percentage

method to

calculate

federal

income tax

withholding

(FIT).

7-14

PERCENTAGE METHOD

Example: Alice Rey earns $2,250 for week 47. She is married with two allowances.

Step 1. In Table 7.1, locate the

weekly withholding for

one allowance. Multiply

this number by 2.

$73.08 x 2 = $146.16

$2,250.00

-- 146.16

$2,103.84

Step 2. Subtract Step 1 from

employee’s pay.

Step 3. In Table 7.2, locate

appropriate table and

compute income tax.

$2,103.84

-- 1,515.00

$ 588.84

Tax $187.15 + .25 ($588.81)

$187.15 + 147.21 = $334.36

7-15

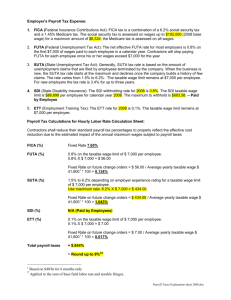

EMPLOYERS’ RESPONSIBILITIES

Federal Unemployment Tax Act (FUTA) —

6.2% tax on the first $7,000 paid to employees as

wages during the calendar year

State Unemployment Tax Act (SUTA) *–

5.4% tax on the first $7,000 paid to employees as

wages during the calendar year

6.2% FUTA

5.4% SUTA credit

.8% FUTA tax

*Can be credited against the 6.2% federal rate.

Example:

Assume a company had total wages of $19,000 in a calendar year. No employee

earned more than $7,000 during the calendar year. The FUTA tax is .8% (6.2%5.4%) . How much does the company pay in FUTA tax?

.008 x $19,000 = $152 FUTA tax due to federal government

7-16

EMPLOYERS’ RESPONSIBILITIES

Federal Unemployment Tax Act (FUTA) —

6.2% tax on the first $7,000 paid to employees as

wages during the calendar year

State Unemployment Tax Act (SUTA) *–

5.4% tax on the first $7,000 paid to employees as

wages during the calendar year

6.2% FUTA

5.4% SUTA credit

.8% FUTA tax

*Can be credited against the 6.2% federal rate.

Example:

Assume a company has total wages of $19,000 and $4,000 of the wages are

exempt from SUTA. What are the company’s SUTA and FUTA taxes if the

company’s SUTA rate is 5.8% due to a poor employment record?

$20,000 -- $4,000 (exempt wages) = $16,000

SUTA = $16,000 x .058 = $928; FUTA = $16,000 x .008 = $128

7-17

CALCULATING TAXABLE INCOME

AND TAX LIABILITY

• In the United States, the tax liability – what is owed to the

government – is based on calculated taxable income and the

IRS tax rate schedules (tax tables).

• Keep in mind a taxpayer in the 25% bracket saves 25 cents in

federal income tax for each dollar spent on a deductible

expense.

• Knowing what is a deductible expense can go a long way

toward effective tax planning.

7-18

CALCULATING TAXABLE INCOME

Step 1. Total all income.

Step 2. Subtract from Step 1 any adjustments to income to

calculate adjusted gross income.

Step 3. Subtract from Step 2 the standard deduction (see

Figure 7.2) or the total of itemized deductions --whichever is greater.

Step 4. Subtract from Step 3 the exemption allowance,

found by multiplying the total number of

exemptions claimed by the exemption amount.

See Figure 7.2.

Taxable Income = Adjusted gross income

— Standard or itemized

deductions

— Exemption allowance

7-19

2012 STANDARD DEDUCTION AND

EXEMPTION AMOUNT – FIGURE 7.2

7-20

CALCULATING TAXABLE INCOME

Example: Calculate taxable income for Bree Langemo who files as

head of household and claims two exemptions. She earned

$95,720; sold stock with a capital gain totaling $2,500; earned a

$1,750 bonus, had a capital loss of $7,000; contributed $2,000 to

her IRA; had moving expenses of $15,500, mortgage interest of

$12,500, and charitable contributions of $450.

Step 1. $95,720 + $2.500 = $1.750 - $7,000 = $92,970.

Step 2. $92,970 - $2,000 = $90,970.

Step 3. Choose the greater of the two: standard deduction of

$8,700 (from Figure 7.2) or itemized deductions of $28,450

($15,500+$12,500+$450). Itemized deductions are greater, so

$90,970 - $28,450 = $62,520.

Step 4. $62,520 – ($3,800 x 2) = $54,920 taxable income

7-21

DETERMINING INCOME TAX LIABILIT Y

Example 1: Mary Frey files head of household and has taxable income

of $86,500. Calculate her tax liability.

Step 1. Locate the filing status in Figure 7.2.

Her filing status is Head of Household.

7-22

DETERMINING INCOME TAX LIABILIT Y

Example 1: Mary Frey files head of household and has taxable income

of $86,500. Calculate her tax liability.

Step 2. Find the taxable income bracket in Table 7.3.

Her taxable income lies within the over $47,350 but

not over $122,300.

7-23

DETERMINING INCOME TAX LIABILIT Y

Example 1: Mary Frey files head of household and has taxable income

of $86,500. Calculate her tax liability.

Step 3. Calculate the tax owed for each bracket.

10% on taxable income from $0 to $12,400: $12,400 x .10 = $1.240

15% on taxable income over $12,400 to $47,350: $47,350 - $12,400

= $34,950 x .15 = $5,242.50

25% on taxable income over $47,350 to $122,300: $86,500 - $47,350

= $39,150 x .25 = $9,787.50

7-24

DETERMINING INCOME TAX LIABILIT Y

Example 1: Mary Frey files head of household and has taxable income

of $86,500. Calculate her tax liability.

Step 4. Total the taxes owed for each bracket to find the tax liability.

$1,240 + $5,242.50 + $9,787.50 = $16,270 tax liability

7-25