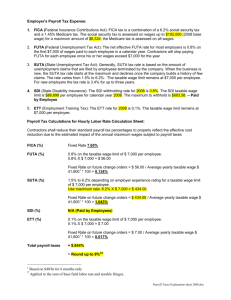

PAYROLL TAXES FOR 2007 The Social Security taxable wage base

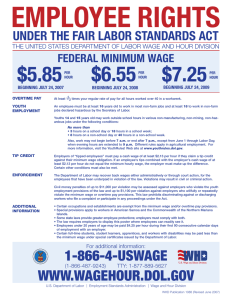

advertisement

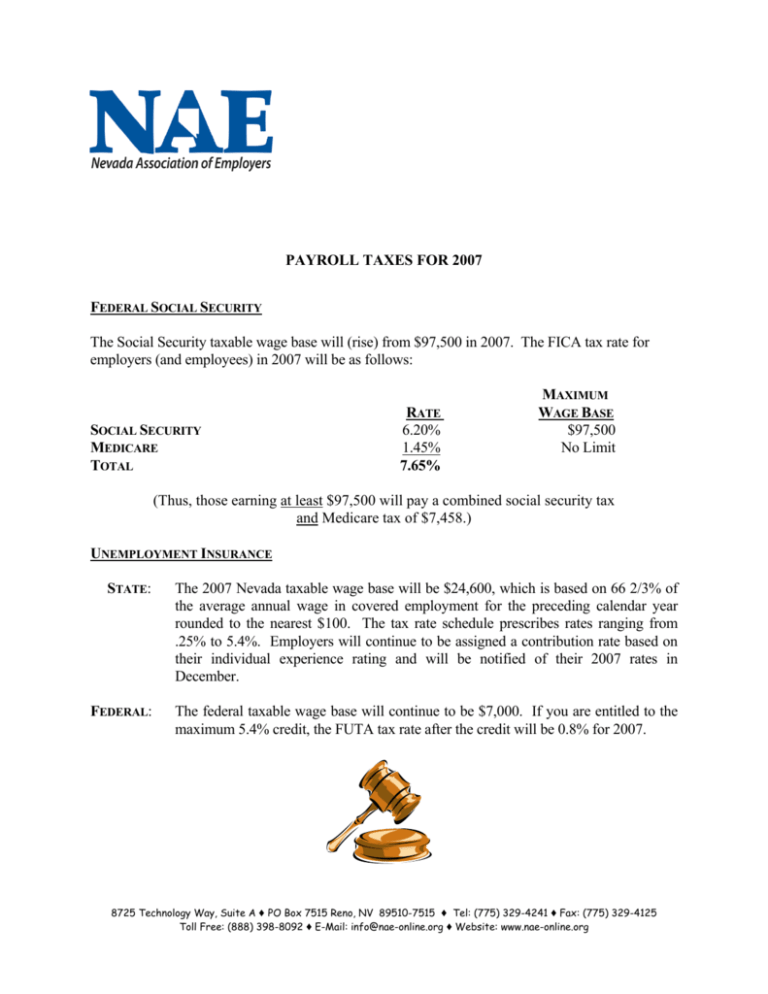

PAYROLL TAXES FOR 2007 FEDERAL SOCIAL SECURITY The Social Security taxable wage base will (rise) from $97,500 in 2007. The FICA tax rate for employers (and employees) in 2007 will be as follows: SOCIAL SECURITY MEDICARE TOTAL RATE 6.20% 1.45% 7.65% MAXIMUM WAGE BASE $97,500 No Limit (Thus, those earning at least $97,500 will pay a combined social security tax and Medicare tax of $7,458.) UNEMPLOYMENT INSURANCE STATE: The 2007 Nevada taxable wage base will be $24,600, which is based on 66 2/3% of the average annual wage in covered employment for the preceding calendar year rounded to the nearest $100. The tax rate schedule prescribes rates ranging from .25% to 5.4%. Employers will continue to be assigned a contribution rate based on their individual experience rating and will be notified of their 2007 rates in December. FEDERAL: The federal taxable wage base will continue to be $7,000. If you are entitled to the maximum 5.4% credit, the FUTA tax rate after the credit will be 0.8% for 2007. 8725 Technology Way, Suite A ♦ PO Box 7515 Reno, NV 89510-7515 ♦ Tel: (775) 329-4241 ♦ Fax: (775) 329-4125 Toll Free: (888) 398-8092 ♦ E-Mail: info@nae-online.org ♦ Website: www.nae-online.org