First group assignment IBUS 302 20091002

advertisement

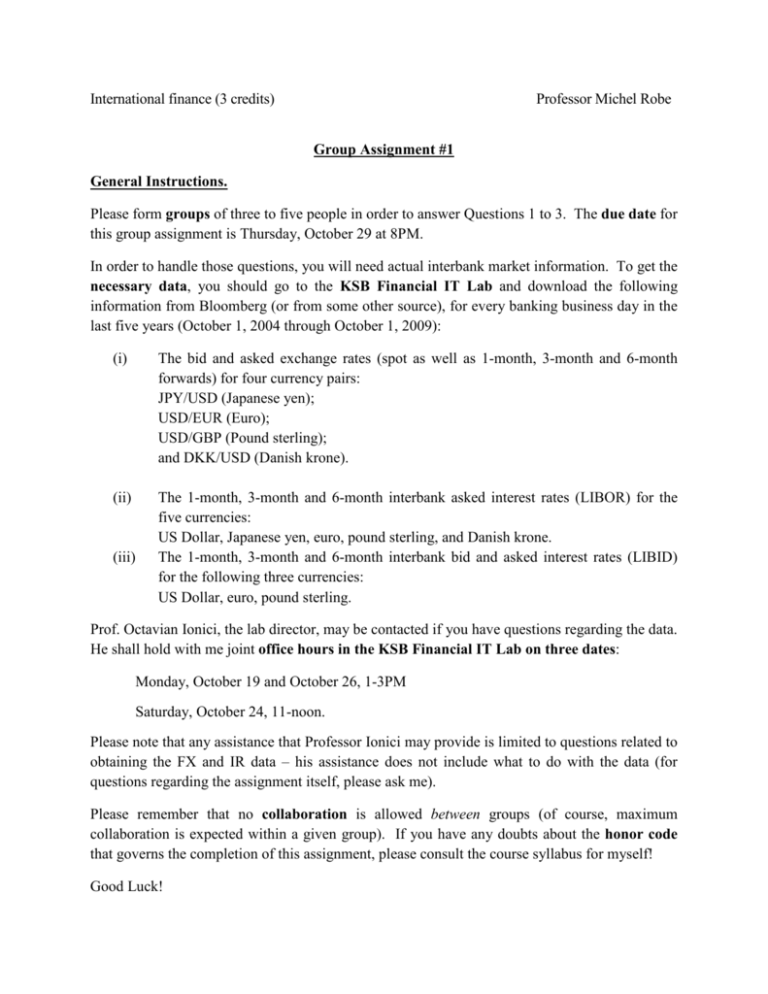

International finance (3 credits) Professor Michel Robe Group Assignment #1 General Instructions. Please form groups of three to five people in order to answer Questions 1 to 3. The due date for this group assignment is Thursday, October 29 at 8PM. In order to handle those questions, you will need actual interbank market information. To get the necessary data, you should go to the KSB Financial IT Lab and download the following information from Bloomberg (or from some other source), for every banking business day in the last five years (October 1, 2004 through October 1, 2009): (i) The bid and asked exchange rates (spot as well as 1-month, 3-month and 6-month forwards) for four currency pairs: JPY/USD (Japanese yen); USD/EUR (Euro); USD/GBP (Pound sterling); and DKK/USD (Danish krone). (ii) The 1-month, 3-month and 6-month interbank asked interest rates (LIBOR) for the five currencies: US Dollar, Japanese yen, euro, pound sterling, and Danish krone. The 1-month, 3-month and 6-month interbank bid and asked interest rates (LIBID) for the following three currencies: US Dollar, euro, pound sterling. (iii) Prof. Octavian Ionici, the lab director, may be contacted if you have questions regarding the data. He shall hold with me joint office hours in the KSB Financial IT Lab on three dates: Monday, October 19 and October 26, 1-3PM Saturday, October 24, 11-noon. Please note that any assistance that Professor Ionici may provide is limited to questions related to obtaining the FX and IR data – his assistance does not include what to do with the data (for questions regarding the assignment itself, please ask me). Please remember that no collaboration is allowed between groups (of course, maximum collaboration is expected within a given group). If you have any doubts about the honor code that governs the completion of this assignment, please consult the course syllabus for myself! Good Luck! Question 1: bid-ask spreads (10 points) a. How wide are the percentage bid-asked spreads for those four currency pairs, at various contract maturities? Hint: compare the means and/or medians of the daily percentage bid-asked spreads in a small table like the one below: MEANS spot 1-month 3-month 6-month JPY/USD USD/EUR USD/GBP DKK/USD MEDIANS spot 1-month 3-month 6-month JPY/USD USD/EUR USD/GBP DKK/USD b. Do the mean/median spreads widen with contract maturity? Are the spread generally higher for one of the currencies? Can you venture an explanation for any pattern you observe? Hint: Provide a third table with volatility estimates for the 16 exchange rates (e.g., average or median “high minus low”, or standard deviation of the daily currency rates of return) and see whether the percentage spreads are correlated with volatility. VOLATILITY spot 1-month 3-month 6-month JPY/USD USD/EUR USD/GBP DKK/USD Question 2: Covered Interest Rate Parity (10 points) Over the last five years, please check whether covered interest rate parity has held. a. Intuitively, you could use the midpoints of the forex rates and the LIBOR to check that, each day in your sample period, the forward premia/discount at which each currency is trading (for the three forward delivery dates) are approximately equal to the relevant interest rate differentials: 1+i T 360 ft,T = st * 1 +i T 360 or i - i* T ft,T - st 360 = st * 1 +i T 360 b. Formally, please check whether the EUR/USD forward rates are in line with the spot rates, after adjusting for the relevant interest rate differentials. Do not forget to take into account bid-ask spreads for exchange rates as well as interest rates. Hint: simply verify whether there is any day in your five-year sample when the following inequalities do not hold: T a ) S t (1+ ia 360 b F t ,T ≤ T ) ( 1+ i*b 360 T b ) S t (1+ i b 360 a ≥ F t ,T T ) (1+ i*a 360 Bonus Question 3: Carry trades ( 5 points) Over the last five years, could you have made money from carry trades using the yen as the funding currency (borrowing at LIBOR) and the US dollar as the target currency (depositing at LIBID)? Please show your work. Note: as this question comes for a substantial bonus, I am not providing much of a hint. If you have ideas as to how to proceed, however I would be happy to discuss them with you during office hours.