Exacta, s.a. case study

advertisement

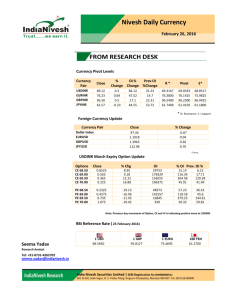

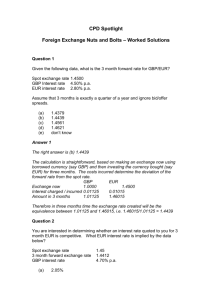

MGMT 575 Group B Case Study 2 September 16, 2012 Samantha Allison Leah Bond Lisa Cochran Louis Latimer Overview Company Background Statement of Problem Courses of Action Financial Information Analysis Recommendations Conclusion References Company Background Exacta, s.a. is major French machine tool manufacturer. Currently sells within Europe and the United States. Only 1/6th of annual U.S. exports are subject to currency risk. Interested in opening a new plant in N. Carolina, opening the door to potential new sales to Canada and Mexico. N.C. plant will be a $380 million investment with expected annual revenues of $420 million and expected annual net profits of $52 million. Statement of Problem CEO and Finance Director are concerned with currency risks between Euro and Dollar. Considering offsetting $380 million U.S. plant investment by issuing dollar bonds. What would Exacta’s exposure be from new U.S. plant? How would it change from the current exposure? What is the most effective and inexpensive approach to hedging for that exposure? Courses of Action Option 1 – Finance the new plant by a $380 million bond issue in dollars. Option 2 – Sell forward at the beginning of each year the expected revenues of the plant. Financial Information Two thirds output exported, mostly within the European Union. Net-60 invoice produces one sixth current exposure to U.S. currency risk. New plant in US expected cost $380 million. Projected revenues of $420 million and net profit of $52 million annually. Financial Information What would Exacta’s exposure be from new U.S. plant? How would it change from the current exposure? What is the most effective and inexpensive approach to hedging for that exposure? Analysis Current Exchange Rates Forward Exchange Rates Spot Rates Current Exchange Rates Current Exchange Rates Price Change %Change Day Range 52 Week Range EUR/USD 1.3128 +0.0141 +1.0865% 1.2985 1.3169 1.2090 - 1.4155 AUD/USD 1.0557 +0.0011 +0.1052% 1.0537 1.0624 0.9388 - 1.0856 GBP/USD 1.6214 +0.0062 +0.3808% 1.5808 1.6254 1.5234 - 1.6302 USD/JPY 78.4000 +0.9150 +1.1809% 77.5050 78.3850 75.8265 83.7100 EUR/JPY 102.9243 +2.2621 +2.2472% 100.7555 103.0273 94.1172 111.5114 EUR/GBP 0.8097 +0.0056 +0.6906% 0.8037 0.8116 0.7790 - 0.8788 USD/CAD 0.9711 +0.0022 +0.2229% 0.9634 0.9722 0.9634 - 1.0536 USD/CHF 0.9268 -0.0084 -0.8961% 0.9240 0.9354 0.8598 - 0.9957 Current Spot Rate Exchange Quote Day Week Month Year 14-Sep-12 13-Sep-12 7-Sep-12 15-Aug-12 15-Sep-11 Quote % Chg Quote % Chg Quote % Chg Quote % Chg Quote Forex Spot Rates - 9 Majors EUR/CHF 1.2104 EUR/JPY 100.3583 EUR/USD 0.1% 1.2094 0.4% 1.2050 0.3% 1.2014 -0.4% 1.2066 0.0% 100.4007 1.2% 99.2302 2.3% 97.0293 -8.8% 106.3526 1.2921 0.3% 1.2884 2.2% 1.2613 2.1% 1.2349 -10.8% 1.3846 GBP/EUR 1.2481 0.0% 1.2478 -1.0% 1.2607 -0.8% 1.2704 11.3% 1.1410 GBP/USD 1.6129 0.3% 1.6077 1.1% 1.5901 1.4% 1.5688 -0.7% 1.5804 USD/AUD 0.9544 -0.2% 0.9564 -2.1% 0.9767 2.6% 0.9516 -1.9% 0.9699 USD/CAD 0.9755 0.1% 0.9741 -1.4% 0.9882 -0.4% 0.9923 0.8% 0.9846 USD/CHF 0.9368 -0.2% 0.9387 -1.8% 0.9554 -1.8% 0.9729 11.6% 0.8714 USD/JPY 77.6578 -0.3% 77.9241 -1.0% 78.6736 0.1% 78.5727 2.3% 76.7700 Currency Conversion Current Currency Table Currency Last Day High Day Low % Change Bid Ask EUR/USD 1.3111 1.3128 1.3111 -0.11% 1.3111 1.3116 GBP/USD 1.6220 1.6238 1.6217 +0.04% 1.6220 1.6227 USD/JPY 78.320 78.420 78.320 -0.08% 78.320 78.370 USD/CHF 0.92600 0.92730 0.92620 -0.08% 0.92600 0.92690 USD/CAD 0.97160 0.97180 0.97030 +0.05% 0.97160 0.97220 AUD/USD 1.0533 1.0560 1.0535 -0.14% 1.0533 1.0538 Recommendations Exacta should choose Option 2: Sell forward at the beginning of each year the expected revenues of the plant Stability for Exacta and customer Exacta should NOT choose Option 1: Must comply with U.S. regs for traded bonds Must register with SEC Very long process U.S. debt-rating agencies would determine credit worthiness Conclusion Exacta concerned with currency risks between Euro and Dollar. Exacta should sell forward at beginning of each year expected revenues of the plant. References Brealey, R., Myer, S., & Allen, F. (2011). Principles of corporate finance. (10th ed.). New York, NY: McGrawHill Irwin Currency Center. (2012). Retrieved September 15, 2012 from http://finance.yahoo.com/currency-investing Currency hedging. (2011) Retrieved September 13, 2012 from http://www.theglobeandmail.com/partners/a dvedc1111/currency-hedging-essential-toprofiting-from-internationaltrade/article1355447/?page=all Derivatives to Hedge Risk. (2010). Retrieved September 13, 2012 from http://www.investopedia.com/articles/stocks/04/12220 4.asp#axzz26PIszfXh References Foreign currency hedging. (2010). Retrieved September 13, 2012 from http://www.buzzle.com/articles/foreigncurrency-hedging.html Spot Exchange Rates. (2012). Retrieved September 15, 2012 from http://www.foreign-trade.com/currencyoutlook.htm Yankee Bond. (2011). Retrieved September 13, 2012 from http://www.investopedia.com/terms/y/yankeebond.asp #axzz26PIszfXh