Reporting and Analyzing Stockholders' Equity

advertisement

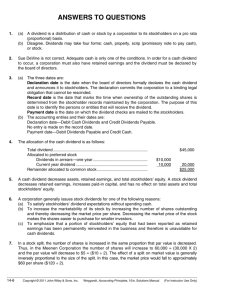

Study Study Objectives Objectives Reporting and Analyzing Stockholders’ Equity Chapter 11-1 Chapter 11-2 Reporting Stockholders Reporting and and Analyzing Analyzing Stockholders’ Stockholders’’ Equity Equity The Corporate Form of Organization Characteristics Formation Stockholder rights Stock Issue Consideration Authorized stock Issuance Par and nonopar value Accounting for common stock issues Accounting for Treasury Stock Purchase of treasury stock Preferred Stock Dividend preferences Liquidation preference Dividends and Retained Earnings Cash dividends Stock dividends Stock splits Retained earnings restrictions Financial Statement Presentation and Corporate Performance Balance sheet Statement of cash flows Dividend record Earnings performance Debt vs. equity decision Chapter 11-4 The The Corporate Corporate Form Form of of Organization Organization An entity separate and distinct from its owners. 2. Record the issuance of common stock. 3. Explain the accounting for the purchase of treasury stock. 4. Differentiate preferred stock from common stock. 5. Prepare the entries for cash dividends and understand the effect of stock dividends and stock splits. 6. Identify the items that affect retained earnings. 7. Prepare a comprehensive stockholders’ equity section. 8. Evaluate a corporation’s dividend and earnings performance from a stockholder’s perspective. 9. Prepare entries for stock dividends. The The Corporate Corporate Form Form of of Organization Organization Characteristics of a Corporation Separate Legal Existence Classified by Ownership Not-for-Profit Publicly held For Profit Privately held Limited Liability of Stockholders Transferable Ownership Rights Ability to Acquire Capital The The Corporate Corporate Form Form of of Organization Organization ¾ ¾ ¾ ¾ Nike General Motors IBM General Electric ¾ Cargill Inc. Corporate Management Government Regulations Chapter 11-6 Characteristics of a Corporation Other Forms of Business Organization Chairman and Board of Directors Treasurer Chapter 11-7 Vice President Finance/Chief Financial Officer SO 1 Identify and discuss the major characteristics of a corporation. corporation. The The Corporate Corporate Form Form of of Organization Organization Stockholders Vice President Marketing Disadvantages Additional Taxes ¾ Limited partnerships ¾ Limited liability partnerships (LLPs) President and Chief Executive Officer General Counsel and Secretary Advantages Continuous Life ¾ Salvation Army ¾ American Cancer Society ¾ Gates Foundation Chapter 11-5 Illustration 11-1 Corporation organization chart Identify and discuss the major characteristics of a corporation. Chapter 11-3 Financial Accounting, Fifth Edition Classified by Purpose 1. ¾ Limited liability companies (LLCs) Vice President Operations ¾ S Corporation Vice President Human Resources 9 no double taxation 9 cannot have more than 75 shareholders Controller SO 1 Identify and discuss the major characteristics of a corporation. corporation. Chapter 11-8 Chapter 11-9 SO 1 Identify and discuss the major characteristics of a corporation. corporation. The The Corporate Corporate Form Form of of Organization Organization The The Corporate Corporate Form Form of of Organization Organization Forming a Corporation Stockholders Rights Initial Steps: The The Corporate Corporate Form Form of of Organization Organization Illustration 11-3 Stockholders Rights 3. Keep the same percentage ownership when new shares of stock are issued (preemptive right). 1. Vote in election of board of directors and on actions that require stockholder approval. File application with the Secretary of State. State grants charter. Corporation develops by-laws. Companies generally incorporate in a state whose laws are favorable to the corporate form of business (Delaware, New Jersey). Illustration 11-3 2. Share the corporate earnings through receipt of dividends. Corporations engaged in interstate commerce must obtain a license from each state in which they do business. Chapter 11-10 SO 1 Identify and discuss the major characteristics of a corporation. corporation. The The Corporate Corporate Form Form of of Organization Organization Stockholders Rights Chapter 11-11 SO 1 Identify and discuss the major characteristics of a corporation. corporation. Stock Stock Issue Issue Considerations Considerations Illustration 11-3 Chapter 11-12 SO 1 Identify and discuss the major characteristics of a corporation. corporation. Stock Stock Issue Issue Considerations Considerations Prenumbered Authorized Stock Charter indicates the amount of stock that a corporation is authorized to sell. 4. Share in assets upon liquidation in proportion to their holdings. This is called a residual claim. Number of authorized shares is often reported in the stockholders’ equity section. Shares Illustration 11-4 Name of corporation Stockholder’s name Signature of corporate official Chapter 11-13 SO 1 Identify and discuss the major characteristics of a corporation. corporation. Chapter 11-14 SO 1 Identify and discuss the major characteristics of a corporation. corporation. Chapter 11-15 SO 1 Identify and discuss the major characteristics of a corporation. corporation. Stock Stock Issue Issue Considerations Considerations Stock Stock Issue Issue Considerations Considerations Stock Stock Issue Issue Considerations Considerations Issuance of Stock Par and No-Par Value Stocks Review Question Corporation can issue common stock Capital stock that has been assigned a value per share. ¾ directly to investors or Years ago, par value determined the legal capital per share that a company must retain in the business for the protection of corporate creditors. ¾ indirectly through an investment banking firm. U.S. securities exchanges b. The stockholders’ equity section begins with paidin capital. No-par value stock is quite common today. ¾ American Stock Exchange c. The authorization of capital stock does not result in a formal accounting entry. In many states the board of directors assigns a stated value to no-par shares. ¾ 13 regional exchanges ¾ NASDAQ national market SO 1 Identify and discuss the major characteristics of a corporation. corporation. a. Ownership of common stock gives the owner a voting right. Today many states do not require a par value. ¾ New York Stock Exchange Chapter 11-16 Which of these statements is false? Chapter 11-17 SO 1 Identify and discuss the major characteristics of a corporation. corporation. d. Legal capital is intended to protect stockholders. Chapter 11-18 SO 1 Identify and discuss the major characteristics of a corporation. corporation. Stock Stock Issue Issue Considerations Considerations Common CommonStock Stock Account Account Paid-in Capital Paid Paid-in Capital Preferred PreferredStock Stock Stock Stock Issue Issue Considerations Considerations Common CommonStock Stock Paid-in Capital Paid Paid-in Capitalin in Excess Excessof ofPar Par Paid-in Capital Paid Paid-in Capital Account Account Preferred PreferredStock Stock Account Account Two Primary Sources of Equity Retained RetainedEarnings Earnings Account Account Paid-in capital is the total amount of cash and other assets paid in to the corporation by stockholders in exchange for capital stock. Chapter 11-19 SO 2 Record the issuance of common stock. Account Account Stock Stock Issue Issue Considerations Considerations Accounting for Common Stock Issues Additional Paid AdditionalPaidPaidin inCapital Capital Two Primary Sources of Equity Account Account Other than consideration received, the issuance of common stock affects only paid-in capital accounts. Retained earnings is net income that a corporation retains for future use. Chapter 11-20 SO 2 Record the issuance of common stock. Accounting for Common Stock Issues Accounting for Common Stock Issues Illustration: Assume that Hydro-Slide, Inc. issues 1,000 shares of $1 par value common stock at par. Prepare the journal entry. Illustration: Now assume Hydro-Slide, Inc. issues an additional 1,000 shares of the $1 par value common stock for cash at $5 per share. Prepare Hydro-Slide’s journal entry. Chapter 11-23 Stock Stock Issue Issue Considerations Considerations Identify the specific sources of paid-in capital. 2) Maintain the distinction between paid-in capital and retained earnings. Retained RetainedEarnings Earnings Stock Stock Issue Issue Considerations Considerations SO 2 Record the issuance of common stock. 1) Account Account Stock Stock Issue Issue Considerations Considerations Chapter 11-22 Primary objectives: Account Account SO 2 Record the issuance of common stock. Chapter 11-21 SO 2 Record the issuance of common stock. Stock Stock Issue Issue Considerations Considerations Stockholders’ equity section assuming Hydro-Slide, Inc. has retained earnings of $27,000. Illustration 11-5 Chapter 11-24 SO 2 Record the issuance of common stock. Accounting Accounting for for Treasury Treasury Stock Stock Review Question Common CommonStock Stock ABC Corp. issues 1,000 shares of $10 par value common stock at $12 per share. When the transaction is recorded, credits are made to: Paid-in Capital Paid Paid-in Capital Preferred PreferredStock Stock Two Primary Sources of Equity b. Common Stock $12,000. c. Common Stock $10,000 and Paid-in Capital in Excess of Par Value $2,000. Account Account Retained RetainedEarnings Earnings Account Account Less: Less: Treasury TreasuryStock Stock Account Account d. Common Stock $10,000 and Retained Earnings $2,000. SO 2 Record the issuance of common stock. Paid-in Capital Paid Paid-in Capitalin in Excess Excessof ofPar Par Account Account a. Common Stock $10,000 and Paid-in Capital in Excess of Stated Value $2,000. Chapter 11-25 Account Account Chapter 11-26 Chapter 11-27 SO 3 Explain the accounting for the purchase of treasury stock. Accounting Accounting for for Treasury Treasury Stock Stock Accounting Accounting for for Treasury Treasury Stock Stock Treasury stock - corporation’s own stock that it has reacquired from shareholders, but not retired. Illustration 11-6 Purchase of Treasury Stock Generally accounted for by the cost method. Corporations purchase their outstanding stock: 1. Accounting Accounting for for Treasury Treasury Stock Stock Debit Treasury Stock for the price paid. To reissue the shares to officers and employees under bonus and stock compensation plans. Treasury stock is a contra stockholders’ equity account, not an asset. 2. To increase trading of the company’s stock in the securities market. 3. To have additional shares available for use in acquiring other companies. Purchase of treasury stock reduces stockholders’ equity. 4. To increase earnings per share. Illustration: On February 1, 2008, Mead acquires 4,000 shares of its stock at $8 per share. Prepare the entry. Another infrequent reason is to eliminate hostile shareholders. Chapter 11-28 SO 3 Explain the accounting for the purchase of treasury stock. Accounting Accounting for for Treasury Treasury Stock Stock Chapter 11-29 SO 3 Explain the accounting for the purchase of treasury stock. Chapter 11-30 SO 3 Explain the accounting for the purchase of treasury stock. Accounting Accounting for for Treasury Treasury Stock Stock Stockholders’ Equity with Treasury stock Review Question Illustration 13-7 Treasury stock may be repurchased: a. to reissue the shares to officers and employees under bonus and stock compensation plans. b. to signal to the stock market that management believes the stock is underpriced. c. to have additional shares available for use in the acquisition of other companies. d. more than one of the above. Both the number of shares issued (100,000), outstanding (96,000), and the number of shares held as treasury (4,000) are disclosed. Chapter 11-31 SO 3 Explain the accounting for the purchase of treasury stock. Preferred Preferred Stock Stock Features often associated with preferred stock. 1. Preference as to dividends. 2. Preference as to assets in liquidation. Chapter 11-32 SO 3 Explain the accounting for the purchase of treasury stock. Preferred Preferred Stock Stock Illustration: Stine Corporation issues 10,000 shares of $10 par value preferred stock for $12 cash per share. Journalize the issuance of the preferred stock. Chapter 11-33 Preferred Preferred Stock Stock Dividend Preferences Right to receive dividends before common stockholders. Per share dividend amount is stated as a percentage of the preferred stock’s par value or as a specified amount. 3. Nonvoting. Each paid-in capital account title should identify the stock to which it relates: Cumulative dividend – holders of preferred stock must be paid their annual dividend plus any dividends in arrears before common stockholders receive dividends. 9 Paid-in Capital in Excess of Par Value—Preferred Stock 9 Paid-in Capital in Excess of Par Value—Common Stock Chapter 11-34 SO 4 Differentiate preferred stock from common stock. Preferred stock may have a par value or no-par value. Chapter 11-35 SO 4 Differentiate preferred stock from common stock. Chapter 11-36 SO 4 Differentiate preferred stock from common stock. Preferred Preferred Stock Stock Liquidation Preference Preferred Preferred Stock Stock Review Question M-Bot Corporation has 10,000 shares of 8%, $100 par value, cumulative preferred stock outstanding at December 31, 2010. No dividends were declared in 2008 or 2009. If M-Bot wants to pay $375,000 of dividends in 2010, common stockholders will receive: Preference on corporate assets if the corporation fails. Preference may be 9 for the par value of the shares or 9 for a specified liquidating value. Dividends Dividends A distribution of cash or stock to stockholders on a pro rata (proportional to ownership) basis. Types of Dividends: a. $0. b. $295,000. c. $215,000. 1. Cash dividends. 3. Stock dividends. 2. Property dividends. 4. Scrip (promissory note) Dividends expressed: (1) as a percentage of the par or stated value, or (2) as a dollar amount per share. d. $135,000. Chapter 11-37 SO 4 Differentiate preferred stock from common stock. Dividends Dividends Chapter 11-38 SO 4 Differentiate preferred stock from common stock. Dividends Dividends Cash Dividends Chapter 11-39 SO 5 Prepare the entries for cash dividends and understand the effect of stock dividends and stock splits. Dividends Dividends Dividends require information concerning three dates: For a corporation to pay a cash dividend, it must have: 1. Retained earnings - Payment of cash dividends from retained earnings is legal in all states. Illustration: On Dec. 1, the directors of Media General declare a 50¢ per share cash dividend on 100,000 shares of $10 par value common stock. The dividend is payable on Jan. 20 to shareholders of record on Dec. 22? December 1 (Declaration Date) 2. Adequate cash. December 22 (Date of Record) 3. A declaration of dividends by the Board of Directors. SO 5 Prepare the entries for cash dividends and understand the effect of stock dividends and stock splits. Chapter 11-40 January 20 (Payment Date) Chapter 11-41 Dividends Dividends SO 5 Prepare the entries for cash dividends and understand the effect of stock dividends and stock splits. Chapter 11-42 SO 5 Prepare the entries for cash dividends and understand the effect of stock dividends and stock splits. Dividends Dividends Stock Dividends Review Question Illustration 11-10 Pro rata distribution of the corporation’s own stock. Entries for cash dividends are required on the: a. declaration date and the record date. b. record date and the payment date. c. declaration date, record date, and payment date. d. declaration date and the payment date. Results in decrease in retained earnings and increase in paid-in capital. Chapter 11-43 SO 5 Prepare the entries for cash dividends and understand the effect of stock dividends and stock splits. Chapter 11-44 Chapter 11-45 SO 5 Prepare the entries for cash dividends and understand the effect of stock dividends and stock splits. Dividends Dividends Dividends Dividends Stock Dividends Dividends Dividends Effects of Stock Dividends Reasons why corporations issue stock dividends: Changes the composition of stockholders’ equity. 1. To satisfy stockholders’ dividend expectations without spending cash. Illustration: Medland Corp. declares a 10% stock dividend on its $10 par common stock when 50,000 shares were outstanding. The market price was $15 per share. Illustration 11-9 Total stockholders’ equity remains the same. No effect on the par or stated value per share. 2. To increase the marketability of the corporation’s stock. Increases the number of shares outstanding. 3. To emphasize that a portion of stockholders’ equity has been permanently reinvested in the business. (Answers on notes page) SO 5 Prepare the entries for cash dividends and understand the effect of stock dividends and stock splits. Chapter 11-46 Dividends Dividends SO 5 Prepare the entries for cash dividends and understand the effect of stock dividends and stock splits. Chapter 11-47 Dividends Dividends Stock Split Reduces the market value of shares. Chapter 11-48 SO 5 Prepare the entries for cash dividends and understand the effect of stock dividends and stock splits. Dividends Dividends Illustration: Assuming that instead of issuing a 10% stock dividend, Medland splits its 50,000 shares of common stock on a 2-for-1 basis. Differences between the effects of stock dividends and stock splits. Illustration 11-11 No entry recorded for a stock split. Illustration 11-12 Decrease par value and increase number of shares. SO 5 Prepare the entries for cash dividends and understand the effect of stock dividends and stock splits. Chapter 11-49 Dividends Dividends SO 5 Prepare the entries for cash dividends and understand the effect of stock dividends and stock splits. Retained Retained Earnings Earnings Review Question SO 5 Prepare the entries for cash dividends and understand the effect of stock dividends and stock splits. Retained Retained Earnings Earnings Illustration 11-14 Net income increases Retained Earnings and a net loss decreases Retained Earnings. a. Stock dividends reduce a company’s cash balance. b. A stock dividend has no effect on total stockholders’ equity. Retained earnings is part of the stockholders’ claim on the total assets of the corporation. c. A stock dividend decreases total stockholders’ equity. A debit balance in Retained Earnings is identified as a deficit. d. A stock dividend ordinarily will increase total stockholders’ equity. SO 5 Prepare the entries for cash dividends and understand the effect of stock dividends and stock splits. Chapter 11-51 Retained earnings is net income that a company retains for use in the business. Which of these statements about stock dividends is true? Chapter 11-52 (Answers on notes page) (Answers on notes page) Chapter 11-50 Chapter 11-53 SO 6 Identify the items that affect retained earnings. Chapter 11-54 SO 6 Identify the items that affect retained earnings. Retained Retained Earnings Earnings Presentation Presentation of of Stockholders’ Stockholders’ Equity Equity Retained Earnings Restrictions Presentation Presentation of of Stockholders’ Stockholders’ Equity Equity Balance Sheet Presentation Balance Sheet Presentation Restrictions can result from: Two classifications of paid-in capital: 1. Legal restrictions. 1. Capital stock 2. Contractual restrictions. 2. Additional paid-in capital Illustration 11-16 3. Voluntary restrictions. Chapter 11-55 SO 6 Identify the items that affect retained earnings. Measuring Measuring Corporate Corporate Performance Performance Chapter 11-56 SO 7 Prepare a comprehensive stockholders’ equity section. Measuring Measuring Corporate Corporate Performance Performance Earnings Performance Illustration: Using the information shown below, calculate the payout ratio for Nike in 2007 and 2006. Illustration: Calculate Nike’s return on common stockholders’ equity ratios for 2007 and 2006. $357.2 $1,491.5 = 24% $304.9 $1,392.0 Debt Versus Equity Decision Illustration 11-21 Illustration 11-20 = 22% The payout ratio measures the percentage of earnings a company distributes in the form of cash dividends. Chapter 11-58 SO 7 Prepare a comprehensive stockholders’ equity section. Measuring Measuring Corporate Corporate Performance Performance Dividend Record Illustration 11-18 Chapter 11-57 SO 8 Evaluate a corporation’s dividend and earnings performance from a stockholder’s perspective. Measuring Measuring Corporate Corporate Performance Performance Debt Versus Equity Decision Illustration 11-22 This ratio shows how many dollars of net income a company earned for each dollar of common stockholders’ equity. (Answers on notes page) Chapter 11-59 SO 8 Evaluate a corporation’s dividend and earnings performance from a stockholder’s perspective. Entries Entries for for Stock Stock Dividends Dividends Chapter 11-60 SO 8 Evaluate a corporation’s dividend and earnings performance from a stockholder’s perspective. Entries Entries for for Stock Stock Dividends Dividends Illustration: Medland Corporation declares a 10% stock dividend on its 50,000 shares of $10 par value common stock. The current fair market value of its stock is $15 per share. The entry to record this transaction at the declaration date is: Illustration: When Medland issues the dividend shares, it decreases Common Stock Dividends Distributable and increases Common Stock as follows. Illustration 11A-1 Chapter 11-61 SO 8 Evaluate a corporation’s dividend and earnings performance from a stockholder’s perspective. Chapter 11-62 SO 9 Prepare entries for stock dividends. Chapter 11-63 SO 9 Prepare entries for stock dividends.